Recent U.S. DoT Data Reveals Fleet of 7,356 Aircraft Flying as of Year-End 2018

by J. Kasper Oestergaard, European Correspondent, Forecast International.

Recently, the U.S. Department of Transportation (DoT) released its annual Schedule B-43 Inventory database, which contains all commercial aircraft in the U.S. inventory as of year-end 2018. Some inaccuracies and inconsistencies in the raw data were identified and fixed by Forecast International by cross-checking with airline fleet data.

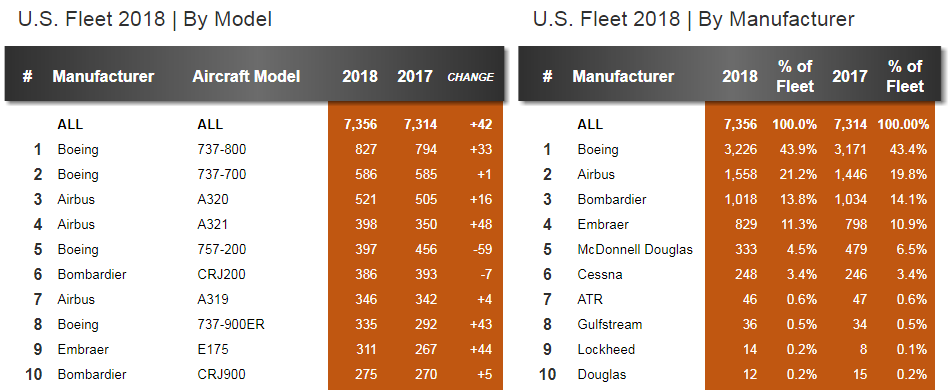

As of the end of 2018, the U.S. commercial aircraft fleet consisted of 7,356 aircraft, compared to 7,314 in 2017 (+42 units, or +0.7%). The inventory was made up of 3,971 narrowbody jets (54%), 1,760 regional jets (24%), and 1,146 widebody jets (16%). The remaining 479 aircraft were turboprops, business jets, and piston-engine aircraft.

Of the 7,356 aircraft in the U.S. commercial inventory, 3,226, or 44 percent, were manufactured by Boeing, followed by 1,558, or 21 percent, by Airbus; 1,018, or 14 percent, by Bombardier; 829, or 11 percent, by Embraer; and 333, or 5 percent, by McDonnell Douglas (now Boeing). The remaining 392 aircraft were manufactured by 13 different companies.

The most popular aircraft in the inventory remains the Boeing 737-800 with 827 units (794 in 2017), ahead of the Boeing 737-700 (586 units vs. 585 in 2017) and the Airbus A320ceo (521 units vs. 505 in 2017). In fourth place is the Airbus A321ceo (398 vs. 350 in 2017), an aircraft that has moved rapidly up the ranks in recent years. The A321 (both CEO and NEO) is also widely used as a replacement model for aging Boeing 757s. The Boeing 757-200 (397 vs. 456) takes fifth place ahead of the Bombardier CRJ200, Airbus A319ceo, Boeing 737-900ER, Embraer E175, and Bombardier CRJ900.

In 2018, a number of new aircraft types entered the U.S. fleet, including four Airbus A220-100s (all Delta Air Lines). The A220-100 was previously known as the Bombardier CS100. Other new aircraft in the U.S. fleet were the Boeing 737 MAX 9 (10 units – all United Airlines) and Boeing 787-10 (three units – all United Airlines).

Aircraft types currently being retired from the U.S. fleet in greater numbers are the McDonnell Douglas MD-80 series (MD-82, MD-83, MD-88 and MD-90) and Boeing 757-200s in passenger service. In the U.S. market, MD-80 series aircraft are generally being replaced by Boeing 737-700s, 737-800s, 737 MAX 8s and Airbus A319s and A320s. In 2018, there were 196 MD-80 series jets in the U.S. commercial inventory, down from 312 in 2017 and 346 in 2016. The larger Boeing 757-200s are being replaced by Boeing 737-900ERs and Airbus A321ceo/neos. There were 397 757-200s in the fleet in 2018, down from 456 in 2017 and 484 in 2016. In 2018, Southwest retired its last Boeing 737-300. At the end of 2017, the airline had 54 737-300s in its fleet (last flight in fall of 2017), down from 87 at the end of 2016. Southwest’s 737-300s were replaced by 737-700s, 737-800s, and 737 MAX 8s. At the end of 2018, nine 737-300s remain in the U.S. fleet, operated by Aloha Air Cargo, Kalitta Charters, National Air Cargo, and Swift Air.

Many older aircraft are still active, mainly as cargo haulers. For example, FedEx and UPS operate a combined fleet of 130 Airbus A300s and A310s. Also in the fleet are 108 McDonnell Douglas MD-11Fs. The MD-11F is a very efficient freighter and thus is coveted by the major cargo airlines. Furthermore, FedEx operates a fleet of 35 MD-10s with an age of 30-47 years, but the airline did retire three DC-10s in 2017 and another four in 2018 (an MD-10 is a DC-10 upgraded with the more modern glass cockpit featured on the MD-11). It is of note that a number of small carriers still operate aircraft from the pre-jet era. The oldest aircraft in the U.S. commercial inventory is a 75-year-old 1942-built Curtiss CW-20 / C-46, a late 1930s design. Everts Air, based in Fairbanks, Alaska, operates two aircraft of this type, as well as 12 Douglas DC-6s and a number of other aircraft. Other very old aircraft still in limited U.S. commercial service are the Convair CV-580 / CV-5800, the McDonnell Douglas DC-9, the Boeing 727-200, the Boeing 737-200, and the Lockheed L-382G Hercules.

Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

References:

- https://www.transtats.bts.gov/databases.asp?Mode_ID=1&Mode_Desc=Aviation&Subject_ID2=0

- http://www.fi-aeroweb.com/US-Commercial-Aircraft-Fleet.html

- https://hub.united.com/united-737-max-9-routes-2536795795.html

- https://airwaysmag.com/special-flights/onboard-southwests-last-boeing-737-300-flight-welcome-max-era/

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.