Strong demand across its operations saw General Dynamics post sales of $42.3 billion for 2023, up 7.3 percent from $39.4 billion in 2022. Net income for the year was $3.3 billion compared to $3.4 billion in 2022. The success drove the company’s backlog to a record high of $93.6 billion primarily on demand for aircraft and weapon systems, especially ammunition.

The trend is set to continue in 2024, though it may be slowed by nagging supply chain issues and labor shortages. For the year ahead, the company is forecasting revenue to rise some 9 percent to around $46 billion.

Fueled by unwavering demand for Gulfstream aircraft and thriving MRO activity, General Dynamics’ Aerospace sector sustained its positive momentum throughout 2023, with only a temporary stumble in Q4 due to the G700’s certification hurdles. Analysts anticipate a swift rebound in 2024 once the jet enters the market.

For the full year, the segment saw sales hold steady at $8.6 billion. According to the company’s 2023 results earnings call, the delay in certification deprived the segment of around $1 billion in revenue and $250 million in earnings. Backlog remained robust, rising almost 5 percent to $20.5 billion for the year, reflecting the ongoing strong, post-pandemic demand for business jets.

However, lingering pandemic-related supply chain issues have continued to hamper delivery of aircraft. For 2023, the company delivered 111 aircraft, far less than its original forecast of 145 units for the year. Adding to the lower figure were some 15 G700 aircraft that a ready to be delivered once final approvals are received. The company anticipates that G700 deliveries should begin in the first quarter of 2024.

Looking to 2024, Gulfstream is anticipating that it will deliver around 160 aircraft for the year, down from an earlier target of 170 jets. Leading the mix will be some 50 G700 aircraft, which should be certified shortly. Due to the conflict in Gaza, the forecast was dampened for G280 deliveries, which are produced in conjunction with Israel Aerospace Industries. Again, the ramp-up is being slowed by supply chain challenges that are doggedly hard to dispel.

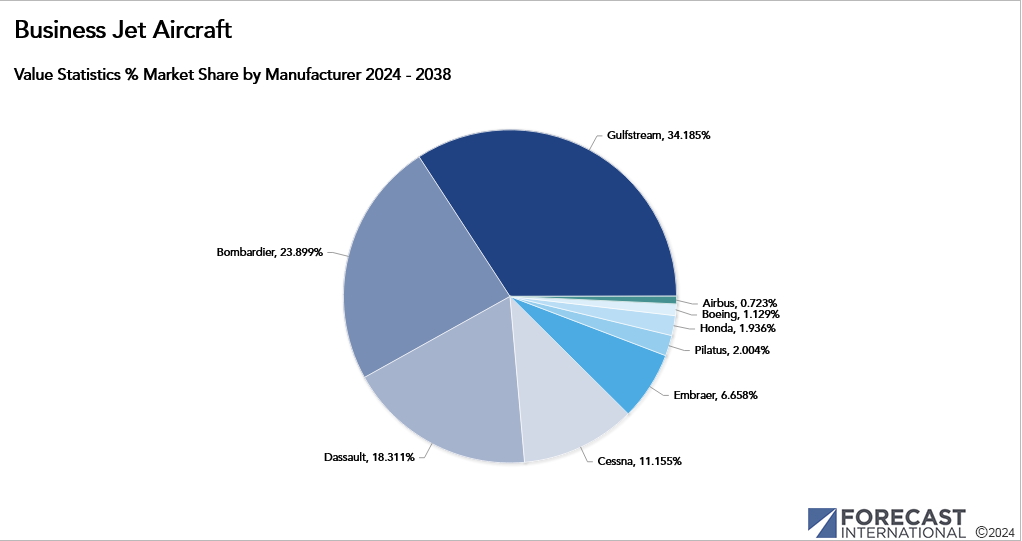

In terms of market share, Forecast International’s Civil Aircraft Forecast reports that Gulfstream is expected to rank second, behind Cessna (with Bombardier third), in unit production in the years ahead. However, due to the larger, higher-priced business jet models Gulfstream produces, the company will rank at the top in terms of dollar value.

Data for the above chart was pulled from Forecast International’s Platinum Forecast System. The Platinum Forecast System is a breakthrough in forecasting technology that enables you to select your own unique criteria to create distinct market segments. All results are displayed as bar graphs, pie charts and unit and value of production charts — presented as line items by manufacturer — for instant analysis. Schedule a Platinum demo here.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.