Thanks to ongoing strong cargo demand and a resurgence in passenger air travel, Korean Air posted an exceptional year in 2022. Sales rose to a record KRW14.1 trillion, up 56 percent from sales of KRW9.0 trillion in 2021. Net income followed suit – reaching KRW1,729 billion, compared to KRW579 billion in 2021. The sales trend is expected to continue through 2023, though rising fuel prices will cut into income.

As it plans for the future, Korean Air is looking to solidify its position as South Korea’s preeminent air carrier. Toward the end of 2020, the company moved to acquire rival air carrier Asiana in a deal valued at around $1.62 billion. The goal is to consolidate South Korea’s two major airlines under Korean Air much the same way as other countries have moved to form a single major airline. The merger is moving slowly forward. In early 2022 it crossed a major hurdle when conditional approval of the deal was achieved in South Korea. However, regulators in the USA and Europe were less enamored with the deal, fearing it will cut competition for routes to South Korea in both the passenger and cargo markets. It remains to be seen if these concerns will be allayed; if not, the deal will likely be scuttled.

Among major airlines, Korean Air is unique in that the firm possesses its own manufacturing and maintenance operations thanks to its Korean Air Aerospace Division (KAL-ASD).

KAL-ASD puts Korean Air in the unique position of being not only a major customer to industry primes Airbus and Boeing but also a supplier to these companies. At the moment, however, the reduced production of aircraft at both Airbus and Boeing is affecting the operation. In addition, KAL-ASD supplies components to Embraer. As of this writing, work is slowly returning to pre-pandemic levels and may reach that goal in the 2024-2025 timeframe. However, the pandemic-related supply chain crisis is taking some time to sort out, hampering a faster recovery.

Military production has provided some respite, as it is expected to remain steady for some time to come thanks to saber-rattling from North Korea and the ongoing war in Ukraine. South Korea is looking to increase its defense budget in the years ahead. Force modernization is high on the list, with three separate aircraft procurements worth nearly $3 billion underway. While Korea Aerospace Industries will get the lion’s share of such procurements, Korean Air will no doubt be assisting. Further, Korean Air should get a fair share of force maintenance contracts under such increases.

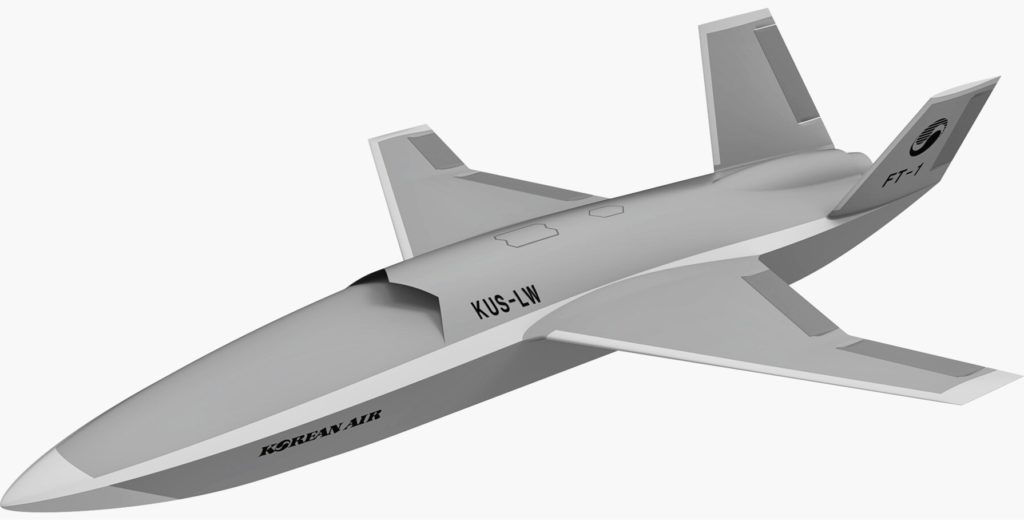

The division has a long and proud history of being one of the first indigenous aircraft producers in South Korea, and it is expected to weather this crisis. It has produced a variety of aircraft for the country’s military, including 500MD helicopters, F-5E/F fighters, and UH-60 midsize helicopters. The company moved into UAV production with a South Korean contract to produce the KUS-7. In addition, Boeing and Korean Air partnered to jointly produce an unmanned 500MD helicopter.

With South Korea’s selection of the F-35 for its KF-X program, KAL-ASD is set to gain a share of some offset work. While Korea Aerospace Industries (KAI) has been selected as the preferred bidder on the program, KAL-ASD will likely produce some subcomponents for KAI as part of the F-35 program. For example, a consortium of companies, including KAL-ASD, was selected to perform select MRO work on the F-35.

More recently, the unit was selected for the Korean Agency for Defense Development’s (ADD) “stealth UAV squadron development” project. Korean Air will develop a loyal wingman concept that envisions a manned-unmanned teaming system in which one manned aircraft and three to four stealth UCAVs can carry out missions simultaneously. These new UCAVs will serve alongside the KAI KF-21 Boramae fighter.

With broad support from its home government and a management team that responded decisively to the recent crisis, Korean Air is so far emerging as a much stronger operation as the recovery begins in earnest.

Forecast International’s Defense & Aerospace Companies series consists of two volumes. Volume One includes coverage of over 100 key U.S. and Canadian primes and their subsidiaries. Volume Two covers over 90 top companies and subsidiaries outside North America, with a focus on key players in Europe and Asia. The services’ reports contain detailed data on recent programs, mergers, competitions, and joint ventures, along with financial data and contract awards. Click here to learn more.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.