by Bill Ostrove, Space Systems Analyst, Forecast International.

After dominating the commercial launch market for years – along with the Ariane 5 – the Proton is seeing a loss in appeal to commercial operators, along with a decline in sales. As a result, ILS has reduced staff and expenses to support only two to three launches per year, rather than its typical seven or eight.

Once considered a reliable choice for carrying satellites into orbit, the Proton has experienced a number of failures in recent years. Since December 2010, six Proton rockets have failed to place their payload into the correct orbit, generating a loss of revenue for the satellite operators. Some customers, questioning the Proton’s dependability, have turned away from the launch vehicle. Those still willing to buy Proton launches will pay higher insurance rates, further reducing its competitiveness in the market.

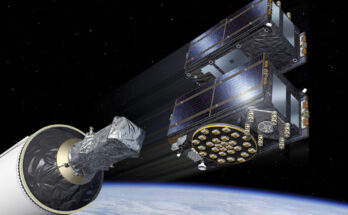

The launch market has also changed recently. Satellite operators have been purchasing smaller satellites that can be carried into orbit on Falcon 9 and Ariane 5 vehicles. This trend is taking away opportunities for the Proton, which is more competitive in the large satellite market. Additionally, new players in the industry, such as SpaceX, are increasing the competitive pressure on the Proton in the commercial market.

Another threat facing the Proton is the Russian government’s development of a new heavy launch vehicle called Angara. The heaviest version of this modular launch vehicle family, the Angara 5, will eventually replace the Proton for Russian government launches.

ILS has introduced plans to address these challenges. First, it will lower the price of Proton launches and offer flexible launch dates. Second, and more important for the long term, ILS will offer light and medium variants of the Proton launch vehicle, enabling it to compete in a broader segment of the market. These changes will allow the Proton to be competitive with new launch vehicles, such as the Falcon 9, at lower price points to carry smaller satellites. They will also increase its competitiveness in the commercial market – even without Russian government launches. With these changes to pricing and lineup, Forecast International expects Proton production to continue during the forecast period.

Please feel free to use this content with Forecast International and analyst attributions, along with a link to the article. Contact Ray Peterson at +1 (203) 426-0800 or via email at ray.peterson@forecast1.com for additional analysis.

Forecast International offers two Space Systems Forecast products: Launch Vehicles & Manned Platforms, with reports on manned spacecraft, expendable launch vehicles and more, and Satellites & Spacecraft, with coverage ranging from microsatellites to large COMSATs – all complete with technical specifications and forecast details.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.