Both Companies Report Weak Orders as Airbus Decides to Cease A380 Production

by J. Kasper Oestergaard, European Correspondent, Forecast International.

A special note: Due to popular demand, our decision to reduce this monthly article series to quarterly issues has been withdrawn and we are, as of this article, reverting to monthly issues.

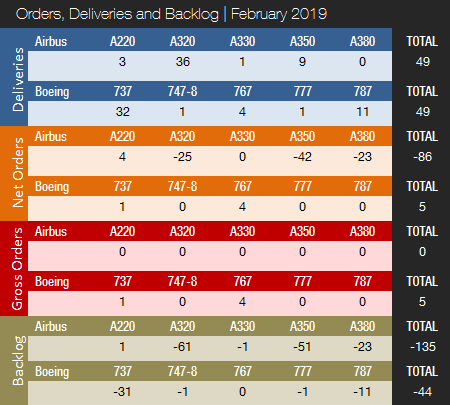

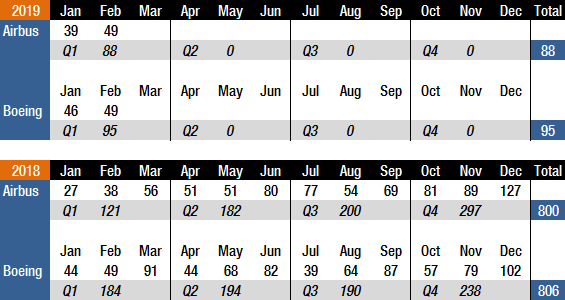

Boeing and Airbus each delivered 49 commercial jets in February 2019 compared to 49 and 38 deliveries, respectively, in the same month last year. In 2018, Boeing delivered 806 jets (763 in 2017), with Airbus handing over 800 (718 in 2017). With 95 deliveries this year to date, Boeing is two shipments ahead of last year’s total for the first two months of the year. Airbus delivered a total of 88 jets in January and February, compared to just 65 for the same period last year.

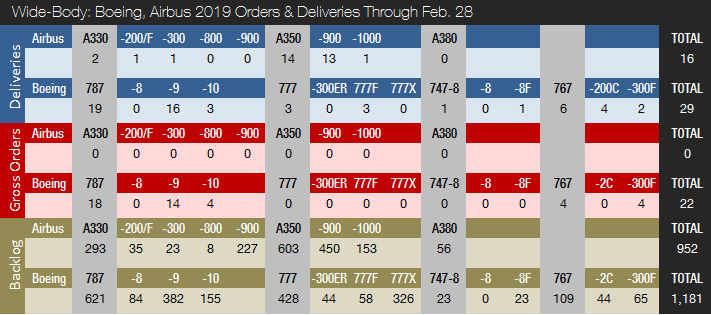

In February 2019, Boeing delivered 32 737s (of which 26 were 737 MAXs), well below the current monthly rate of 52 jets. The company also delivered a single 747-8F, four 767s, one 777, and 11 787s. On December 13, Boeing celebrated the 787th 787 Dreamliner delivery and is currently in the process of raising the monthly production rate to 14 aircraft. Boeing’s CEO Dennis Muilenburg commented on January 30: “We have started transitioning to 14 a month in our factories and supply chains as we prepare to begin delivering at this higher rate.” Boeing delivered 145 787s in 2018, up from 136 in 2017. During 2018, Boeing raised its 737 production rate to 52 and plans a further increase to 57 per month from early June. When asked about the potential for a 2020 production hike, Boeing stated in September 2018 that the market can support a production rate higher than 57 per month. A total of 256 737 MAX jets were delivered in 2018, up from 74 in 2017. On another note, following the crash of Ethiopian Airlines Flight 302, a 737 MAX 8, Boeing decided on March 14 to suspend all deliveries of 737 MAX jets. We will be covering the impact of this development further in the March Orders & Deliveries article, which will be published in April.

In February 2019, Airbus delivered three A220s, 36 A320s (9 CEO / 27 NEO), one A330 and nine A350s. A total of 386 A320neo family aircraft were delivered in 2018, up from 181 and 68 in 2017 and 2016, respectively. By mid-2019, Airbus expects to be delivering 60 A320 jets per month on average. The company has internally been debating rates above 60 aircraft. Airbus delivered 93 A350s in 2018, up from 78 in 2017, and recently increased the monthly production rate to 10. Airbus is considering a further increase to 13 A350s per month in 2019. The ramp-up of A350 XWB deliveries combined with a higher A320 production rate means that the company has almost closed Boeing’s deliveries lead and could surpass its top rival already this year.

With just five net new orders in February, Boeing had a very slow month in the orders race. Boeing logged five gross orders (no cancellations => net of five). The company booked an order for four 767-300F widebody cargo planes for an undisclosed customer as well as an order for a single 737 MAX for a business jet customer. For the full-year 2018, Boeing managed to book 893 net new orders (1,008 gross orders).

In the orders race, Airbus has so far had an awful start to 2019. While Air Vanuatu ordered four A220s, Airbus also reported as many as 90 cancellations => net of -86). This comes on top of 13 cancellations in January. Of the 99 cancellations this year to date, 31 are A380s – connected to Emirates’ decision to reduce its A380 order book. This decision subsequently forced Airbus to announce it will cease A380 production in 2021. In 2018, Airbus landed a total of 747 net new orders (831 gross orders), thereby losing the 2018 orders race as Boeing had accumulated 893 net new orders. Airbus had retained an orders lead over its rival every year since 2012.

On February 28, 2019, Airbus’ backlog was 7,390 jets, of which 6,438, or 87 percent, are A220 and A320ceo/neo family narrowbodies, not far below the company’s all-time record-high backlog of 7,577 jets set in December 2018. By the end of February 2019, Boeing’s backlog was 5,904 aircraft (of which 4,723, or 80%, are 737 NG/MAX narrowbody jets). Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 9.2 years of shipments at the 2018 production level. In comparison, Boeing’s backlog would “only” last 7.3 years. This year to date, Boeing’s book-to-bill ratio is 0.51. Airbus’ book-to-bill ratio is negative. In 2018, Boeing boasted a book-to-bill ratio of 1.11, with Airbus at 0.93. In 2017, Boeing booked 912 net new orders for a book-to-bill ratio of 1.20. That same year Airbus booked 1,109 net new orders for a book-to-bill ratio of 1.54.

2019 Forecast

Forecast International’s Platinum Forecast System® is a breakthrough in forecasting technology. Among many other features, Platinum provides 15-year production forecasts. The author has used the Platinum Forecast System® to retrieve the latest delivery forecasts. For 2019, Forecast International’s analysts expect Boeing and Airbus to deliver 904 and 875 large commercial jets, respectively. These are the latest “live” forecast figures (adjusted frequently by our analysts as new information comes in). These figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon, KC-46 and KC-767 tankers, the C-40, and Airbus’ A330 MRTT tanker.

In connection with the release of its 2018 earnings report on January 30, Boeing announced that it expects to deliver between 895 and 905 commercial jets in 2019, which is a 12-13 percent increase over the 806 aircraft the company delivered in 2018. On February 14, Airbus announced that it is aiming for 880 to 890 commercial aircraft deliveries in 2019, equal to a 10-11 percent increase from 2018.

Please feel free to use this content with Forecast International and analyst attributions, along with a link to the article. Contact Ray Peterson at +1 (203) 426-0800 or via email at ray.peterson@forecast1.com for additional analysis.

Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

References:

References:

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.reuters.com/article/us-boeing-production-737-exclusive/exclusive-boeing-aims-to-speed-737-jet-production-in-early-june-sources-idUSKCN1PU00P

- https://www.reuters.com/article/us-boeing-results-787-exclusive/boeing-speeds-787-line-to-prepare-for-output-of-14-jets-a-month-idUSKCN1PO249

- https://boeing.mediaroom.com/2019-01-30-Boeing-Reports-Record-2018-Results-and-Provides-2019-Guidance

- https://www.airbus.com/newsroom/press-releases/en/2019/02/airbus-reports-strong-fullyear-2018-results-delivers-on-guidance.html

- https://dsm.forecastinternational.com/wordpress/2019/03/15/faa-grounds-737-max/

- https://finance.yahoo.com/news/boeing-pauses-737-max-deliveries-wake-deadly-crash-204533688–finance.html

- https://www.airbus.com/newsroom/press-releases/en/2019/02/airbus-and-emirates-reach-agreement-on-a380-fleet–sign-new-widebody-orders.html

- https://dsm.forecastinternational.com/wordpress/2019/03/15/boeing-suspends-deliveries-of-737-max-family/

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.