by Bill Ostrove, Space Systems Analyst, Forecast International.

America’s preeminent space agency is proposing a major change in focus for FY19. Along with the rest of the federal government, NASA released its fiscal year 2019 budget request on February 13. While NASA’s budget faced few changes in President Donald Trump’s FY18 budget request, for FY19 NASA is looking to shift its priorities and thereby change how its funding is spent.

NASA will need to make these changes with a budget that is largely similar to those of previous years. The $19.9 billion FY19 budget request represents a 1.9 percent increase compared to FY18 enacted levels, which were 0.7 percent below FY17 spending levels. Still, NASA could consider itself lucky to be granted a budget increase. The budget request calls for overall non-defense spending for 2019 of $57 billion below spending caps set by Congress in a recent budget deal.

In its FY19 budget request, NASA shows an increasing focus on deep space exploration and planetary science at the expense of programs devoted to low-Earth orbit operations and Earth science, among others.

NASA offered the first clue that it will change its focus by changing theme names. For example, the Exploration Systems theme was renamed Deep Space Exploration Systems, and now finds itself at the top of the list of programs in NASA’s budget. It bumps the Science theme on the list, which had resided at the top for years.

And the changes go deeper than changes in name. Deep space exploration will define NASA in FY19 and likely for the remainder of President Trump’s time in office.

Funding will continue to support development of the Space Launch System (SLS) and the Orion crew capsule. These systems will be used to carry human explorers and equipment to deep space locations, such as lunar orbit or Mars. Still, the Exploration Systems Development program, which funds SLS and Orion development, will see a 6.6 percent decline in funding between FY17 and FY19. The money will be redirected to the Advanced Exploration Systems program, which will receive $889 million under the president’s plan, an increase from $97.8 million in FY17. The program will fund the study of cislunar capabilities, including the habitation modules, crew mobility systems, vehicle systems, and autonomous and robotic technology needed to support exploration. NASA wants to utilize public-private partnerships to advance its cislunar goals, taking advantage of developments in commercial space. SpaceX’s recent launch of its Falcon Heavy rocket demonstrates the type of growing commercial capabilities that NASA wants to tap into.

In order to support human exploration goals, NASA’s budget request calls for increased planetary science funding. Planetary science funding will increase 22.3 percent between FY17 and FY19. Funding will be used to continue development of the Mars 2020 rover and the Europa Clipper mission. The increases will be used to start a robotic lunar exploration mission as well as a planetary defense initiative.

Even as exploration and planetary science experience gains, other NASA missions will receive fewer funds in FY19 as money is shifted in order to achieve the new goals. Funding for LEO and Spaceflight Operations, formerly known as Space Operations, will decline by 6.4 percent between FY17 and FY19. NASA’s Space Transportation program, which funds development of commercial crew and commercial transport vehicles, will see a decline of 18.6 percent from FY17-FY19. NASA has said that it wants to encourage commercial development of LEO. Companies like SpaceX, Boeing, NanoRacks, and Bigelow Aerospace have ambitious plans in LEO. However, there is a chance that funding from NASA is being lowered before these companies have a chance to develop sustainable businesses.

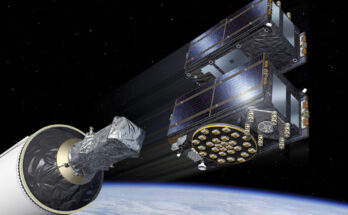

The Earth Science program also receives less funding in the FY19 budget – 6.5 percent less than in FY17. Spending cuts will force NASA to terminate Earth science missions PACE, OCO-3, DSCOVR, and CLARREO Pathfinder. There will also be less funding available for Earth science research grants. NASA had already suggested in its FY18 budget request that these missions may need to be terminated in FY19. New for FY19 is an increased focus on CubeSats. CubeSats, as well as other SmallSat form factors, may enable NASA to continue some missions with a reduced budget in the future.

Finally, the Astrophysics program will receive 12.3 percent less funding in FY19 than in FY17. In addition, the James Webb Space Telescope, which long had its own funding line, has been rolled back into the Astrophysics program – further evidence of NASA’s shifting focus away from science missions to exploration missions. Funding declines come as the JWST nears completion. NASA has also proposed terminating the WFIRST (Wide Field Infrared Survey Telescope) mission, which was planned to be the successor to the JWST. Under NASA’s new direction, the agency does not have enough funds to pay for WFIRST construction as well as exploration missions. While a halt in WFIRST development would not be noticed early on, once Hubble and the JWST reach the end of their useful lives, NASA may find it has a gap in space-based astronomical observation capabilities.

As NASA focuses on a clear mission under its FY19 budget, tradeoffs will be made. In the past, NASA has been faulted for trying to do too much. Without a clear focus, few efforts were successful. Project Constellation was canceled, and NASA’s flagship program, the JWST, suffered major delays and cost overruns. The new NASA budget seems to be an attempt to avoid the problems of the past. Still, the decision to go in a new direction has resulted in the proposed termination of some popular programs, the WFIRST in particular.

Going forward, these controversial decisions have yet to be vetted by Congress, which historically has made it difficult for NASA to terminate programs. For example, when Project Constellation was canceled, Congress forced NASA to continue development of a heavy-lift launch vehicle and a crew capsule. However, many months could pass before the proposed changes begin to be reviewed by lawmakers.

Please feel free to use this content with Forecast International and analyst attributions, along with a link to the article. Contact Ray Peterson at +1 (203) 426-0800 or via email at ray.peterson@forecast1.com for additional analysis.

Forecast International offers two Space Systems Forecast products: Launch Vehicles & Manned Platforms, with reports on manned spacecraft, expendable launch vehicles and more, and Satellites & Spacecraft, with coverage ranging from microsatellites to large COMSATs – all complete with technical specifications and forecast details.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.