Despite a challenging economic environment, Honeywell delivered a solid year in 2022 with sales up 3 percent to $35.5 billion from $34.4 billion in 2021.

The key to its success through these troubling times has been its nimbleness in responding to the recent crisis. The company quickly took action to mitigate supply chain challenges and inflation by bringing on alternate suppliers, redesigning parts, and implementing pricing actions. The result is a solid backlog and good momentum moving into 2023, during which it forecasts sales of $36.0 billion to $37.0 billion, representing year-over-year growth of 2 percent up to 5 percent on the high end of the range.

Helping to drive this improvement is a rosy forecast in the business aviation sector, which has bounced back with a vengeance from the pandemic.

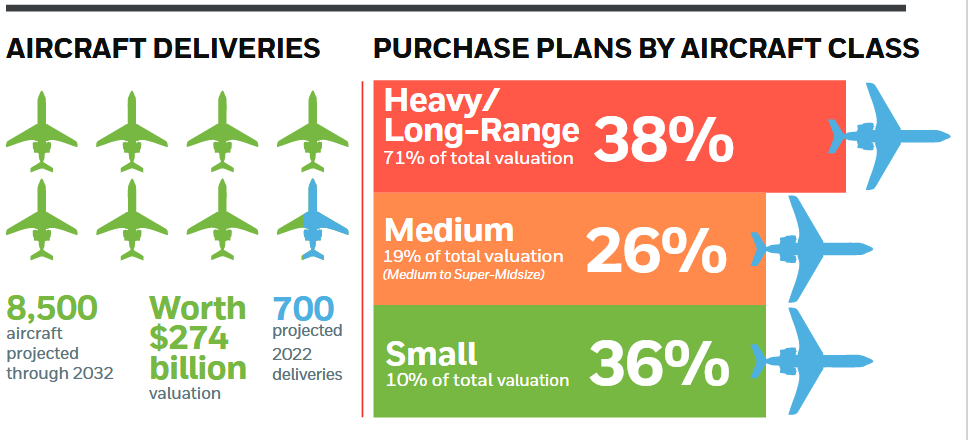

In the company’s latest Global Business Aviation Outlook (released in October 2022), Honeywell sees business aviation maintaining its surge. The company has hiked its forecast by 1,100 units, to a projected 8,500 new business jets worth $274 billion over the next decade – a 15 percent increase from the 2021 forecast.

According to the company’s survey, fleet addition rates doubled from last year’s reported intentions. This accelerated recovery has led to industry reports of sold-out business jet production lines for the next several years. The business aviation industry is benefiting from waves of first-time private aviation users and buyers, a development that likely can be attributed to COVID-19. At the current rate of recovery, the company expects the business aviation sector to recover to 2019 delivery and expenditure levels by 2023, sooner than previously expected.

The outlook for large commercial jet transports is also beginning to show signs of improvement. According to Forecast International’s Civil Aircraft Forecast, domestic air travel, especially in the U.S., has been strong, as evidenced in part by snarled airports and packed flights this past summer.

International travel, meanwhile, has only recently started to ramp up, with carriers now reporting increased ticket sales and seat bookings – a trend that anticipates subsequent improvement in air passenger traffic.

At the same time, though, near-term optimism concerning air traffic recovery must be tempered, at least in some markets, by rising inflation and increased geopolitical tensions (such as those resulting from Russia’s invasion of Ukraine). Nevertheless, if the present trajectory can hold, global air passenger traffic is forecast to return to pre-pandemic levels no later than 2024 and perhaps even sooner as markets reopen, especially in China.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.