by Bill Ostrove, Space Systems Analyst, Forecast International.

Annual deliveries of remote sensing satellites are increasing at high rates. Only 18 remote sensing satellites launched in 2013, but 177 were launched in 2017.

This trend can be expected to continue. During the 2018-2032 forecast period, civil and commercial satellite operators will take delivery of 3,979 satellites, representing an estimated $39 billion in value of production.

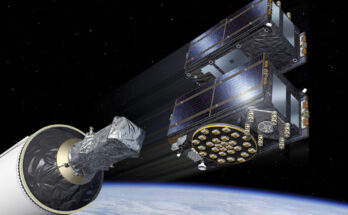

This rise in value and delivery rates is being driven by the growth in the market for small satellites. Companies such as Planet are selling services based on the use of satellites as small as a loaf of bread. These small satellites, which are significantly cheaper to build and launch than their larger relatives, are typically operated in large networks numbering in the dozens or even hundreds of spacecraft.

The average launch mass of remote sensing satellites has steadily declined since 2013, when it reached a high of 1,507 kilograms (3,322 lb). By 2016, the average launch mass had declined to 282 kilograms (622 lb), and by 2017, to 90 kilograms (198 lb).

This is not to say that there has been a lack of opportunities for large satellites. For example, China’s Fengyun-4A and the United States’ GOES-R both had launch masses above 5,000 kilograms (11,000 lb) at launch. The decline in average launch mass is due to an increased number of small satellites, not a decreased number of large satellites.

Another trend in the remote sensing satellite market is the widespread use of commercial satellites. Between 2013 and 2017, 363 commercial satellites and 92 civil government satellites were launched. While governments have historically been the main buyers of remote sensing satellites, commercial satellites have increased in importance as commercial companies have readily adopted the small satellite form. During the last five years, the number of civil satellites launched steadily increased. At the same time, the number of commercial satellites built grew substantially. Since 2014, commercial satellite launches have dramatically outnumbered civil satellite launches.

Remote sensing satellites are used for a variety of purposes, including civil planning, weather forecasting, climate change monitoring, and military reconnaissance. In addition to these traditional uses, commercial satellites are increasingly being used to provide remote sensing imagery, for applications including oil and gas exploration, damage assessment for insurance claims, real estate appraising, building site selection and development, utility and communications infrastructure planning, and even financial analysis. The scope of services now being provided by small satellites is attracting new players to the market, such as Planet and Satellogic, which are building large networks of small satellites.

The top five manufacturers in the civil and commercial remote sensing satellite industry between 2018 and 2032 will be Airbus Defence and Space, Thales Alenia Space, Lavochkin, Mitsubishi Electric, and Maxar Technologies. Maxar is a new entrant on Forecast International’s top five list. The company, which owns the old MacDonald Dettwiler and Associates and Space Systems Loral, has moved aggressively into the remote sensing market, winning contracts to build satellites for Planet and DigitalGlobe alongside RadarSat.

For more information on the remote sensing market, check out Forecast International’s “The Market for Civil & Commercial Remote Sensing Satellites” analysis.

And be sure to come visit us during the Farnborough International Airshow at Hall 1, Booth #1046.

Bill Ostrove is the author of Forecast International’s two Space Systems Market Intelligence Services, one covering launch vehicles and the other, satellites and spacecraft. The Launch Vehicles product features programs on reusable and expendable launch vehicles, and human spaceflight vehicles. The Satellites & Spacecraft service covers systems ranging from microsatellites to large COMSATs. Both volumes provide global coverage on the major players and market trends.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.