It’s been a rough couple of years for General Electric, but in 2020 its turnaround efforts should take solid root. For the past few years, the company has been trying to pull itself out of a financial black hole caused by poor acquisitions and mismanagement.

Over this period, a new management team has been working to reshape the company’s portfolio primarily through divestitures as it concentrates on its industrial manufacturing businesses.

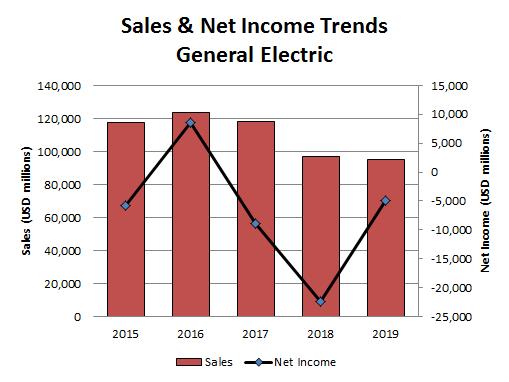

General Electric’s revenues for 2019 were $95.2 billion, down almost 2 percent from $97.0 billion in 2018. The company posted a loss of $4.9 billion in 2019, compared to a loss of $22.4 billion in 2018. The loss in 2019 is primarily attributed to a pre-tax charge of $8.7 billion related to the deconsolidation of Baker Hughes, which composed the company’s Oil & Gas segment.

Many of the company’s refocusing efforts revolve around the power industry, which led GE to acquire Alstom’s energy operations in 2015. The $10 billion acquisition – the largest in the company’s history – significantly expanded GE’s power footprint in Europe. However, things went south from there.

Struggles at the Power division have continued, and the company now plans to split the operation in two. One unit, GE Gas Power, will focus on gas; the other, GE Power Portfolio, will focus on steam, grid solutions, nuclear energy, and power conversion. Speculation is that GE may hold onto the gas operations and divest the other.

During the course of 2019, GE dramatically reshaped its operations through a series of divestitures. The first big move was the sale of its Transportation unit to Wabtec in an $11 billion deal. Up next was the divestiture of its BioPharma business to Danaher Corp for $21 billion – the sale of which should wrap up in 2020. This was followed later in the year with the deconsolidation of the company’s stake in Baker Hughes in a $2.7 billion transaction. As it stands now, GE is composed of healthcare (albeit a smaller operation following the aforementioned sale), power, aviation, and renewable energy, mostly wind turbines.

GE Aviation a Crown Jewel

The one bright spot at the company throughout these travails has been GE Aviation. The unit reported that revenue rose 7.6 percent to $32.9 billion while operating income rose 5 percent to $6.8 billion in 2019. The solid performance is due to strong demand for single-aisle jetliners. The desire for more efficient aircraft led to record orders for the Airbus A320neo and the new Boeing 737 MAX, a program facing its annus horribilis following two crashes that resulted in the fleet being grounded and a subsequent deliveries halt.

Powering both of these aircraft is the new LEAP engine, developed by the GE-Safran joint venture CFM International. Boeing suspended production of the 737 MAX family in January 2020 as it continues to work on implementing changes to the aircraft’s systems to make it safe to fly. The current forecast is for the aircraft to return to service in mid-2020, with production ramping up later in the year.

The LEAP program accounts for roughly 40 percent of the engines GE Aviation produces, and the slowdown is expected to cause some short-term pain for the unit. However, production for the Airbus A320neo continues unabated. Over the long term, demand for the 737 MAX family is not expected to overly suffer. As of December 2019, CFM was reporting that orders and commitments had risen to about 19,000 LEAP engines across all three variants, up from 17,275 in 2018.

Other major engine programs for GE Aviation include the GEnx and GE90 families.

The GEnx powers Boeing 787 and 747 widebodies. While production of the 787 continues, 747 production is slowing down. With production steady, attention has turned to the lucrative maintenance market. Here, GE formed a joint venture with Evergreen Aviation Technologies Corp in Taiwan to open an overhaul and repair center for GEnx engines. Another venture, with SIA Engineering called GE Aviation, Overhaul Services, will provide MRO services for the GE90 and GE9X engines.

The GE90 engine program focuses solely on the Boeing 777. Here production is shifting from the current 777 Classic models to the new 777X versions. The new GE9X ran into an issue with its high-pressure compressor that delayed the first flight of the 777X from mid-2019 to January 2020. Manufacturing will ramp up to meet Boeing’s production of the new aircraft and should remain stable over the long term.

The desire to replace aging aircraft with more fuel-efficient models has been driving the recent demand. According to Forecast International’s Platinum Forecast System®, Civil Aircraft Forecast, the market for large jet transports and regional commuter aircraft through 2034 and beyond represents what is probably the largest re-equipment cycle the world has ever seen, with a projected 29,900 of these airliners valued at $4.86 trillion at prediscounted prices to be built over the next 15 years. GE Aviation’s turbofan share of this market (including its participation in CFM International) is projected at about 40 percent.

It has been a wild few years for one of America’s most storied conglomerates. The changes implemented have been painful, but the results should begin to bear fruit in the years ahead.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.