Ball Corp is investigating the divestiture of its aerospace operation, Ball Aerospace & Technologies Corp.

According to a Reuters report in mid-June, the sale was being explored with a price tag of around $5 billion. Named suitors included BAE Systems, General Dynamics, and Textron, as well as private equity firms.

(Note: In August 2023, BAE Systems agreed to buy the unit for $5.6 billion in cash. The transaction, which is subject to regulatory approvals and customary closing conditions and adjustments, is projected to close in the first half of 2024.)

In response to the report speculating on the sale, Ball officials said that “it is considering options that could better position its aerospace business to provide value to shareholders and customers. There is no certainty that any formal decision will be made. If and when appropriate, a further announcement will be made.”

For 2022, the unit reported sales of $1.98 billion, compared to sales of $1.91 billion in 2021. Operating income for the division was $170 million for the year, compared to $169 million in 2021. The federal government accounted for 98 percent of the division sales for 2022. Backlog at the unit jumped 20 percent during 2022 to almost $3 billion from $2.5 billion in 2021. The unit’s success can be attributed to its position in key funding priorities for space systems hardware.

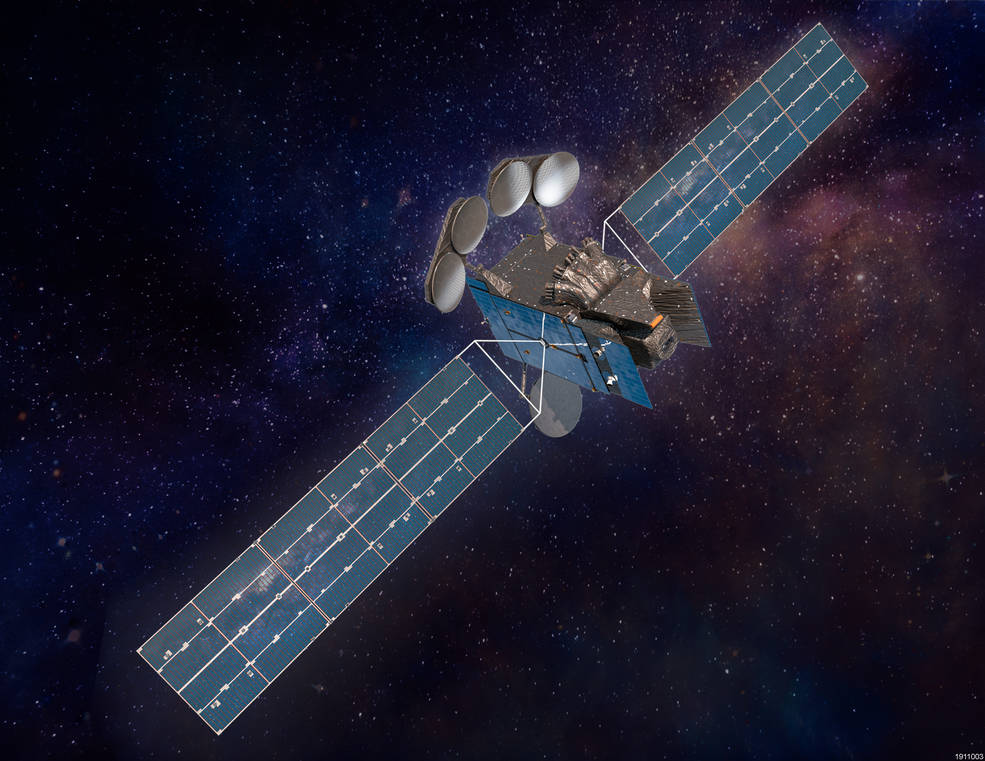

Ball Aerospace & Technologies designs, develops, and manufactures systems for intelligence surveillance and reconnaissance (ISR); civil and commercial; and national security aerospace markets. It produces spacecraft, instruments and sensors; radio frequency systems and components; data exploitation solutions; and a variety of advanced technologies and products that enable weather prediction and climate change monitoring as well as deep space missions.

Key products include full satellite systems and space mission equipment; instruments and sensors; radio frequency systems; and antennas, tactical camera systems, and components. Other products include target identification systems; warning and attitude control systems and components; cryogenic systems for reactant storage, and associated sensor cooling devices; star trackers, which are general-purpose stellar attitude sensors; and fast-steering mirrors. Additionally, the aerospace and technologies segment provides diversified technical services and products to government agencies, prime contractors, and commercial organizations for a broad range of information warfare, electronic warfare, avionics, intelligence, training, and space system needs.

The operation employs about 4,800 and has facilities in Broomfield, Colorado, Albuquerque, New Mexico, and Chantilly, Virginia.

For many years Ball has stated emphatically that it did not intend to divest this operation, as it provides very strong returns. It appears that perhaps the time has arrived to divest what many saw as an odd fit for a packaging manufacturer. Space is currently a fast-growing market, with a high degree of recent merger and acquisition activity underway, such as the L3Harris move to buy Aerojet Rocketdyne and the sale of Maxar Technologies to Advent International. Current speculation is that private equity may be the front-runner for this operation, as industry primes may be a bit wary of adding such a specialized unit to their portfolios.

Forecast International’s Defense & Aerospace Companies series consists of two volumes. Volume One includes coverage of over 100 key U.S. and Canadian primes and their subsidiaries. Volume Two covers over 90 top companies and subsidiaries outside North America, with a focus on key players in Europe and Asia. The services’ reports contain detailed data on recent programs, mergers, competitions, and joint ventures, along with financial data and contract awards. Click here to learn more.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.