by Bill Ostrove, Space Systems Analyst, Forecast International.

Alta Devices, founded in 2007 in Sunnyvale, California, manufactures single-junction solar cell technology. The company’s largest market is the UAV market, and it also has a presence in the automotive, Internet of Things (IoT), and consumer device markets. With the market for small satellites rapidly expanding, the need for solar panels to power these spacecraft has emerged as a growing market for many companies, including Alta. Forecast International recently had a chance to talk to Alta about its work in the satellite market. Aarohi Vijh, Alta’s head of Product, and Rich Kapusta, chief marketing officer, provided answers.

Please explain in layman’s terms how your technology works.

Solar cells use semiconductor materials to convert light into electricity. Not all of the light energy that falls on the cell is converted to electricity, though; in other words, the efficiency of solar cells is not a hundred percent. Although most solar cells are made from silicon, the most efficient solar cells are made from a family of semiconductor crystals called gallium arsenide. Traditionally, gallium arsenide solar cells have been expensive, but Alta has developed a method that grows thin films of gallium arsenide crystal on a template, and then lifts them off into thin, flexible solar cells. The template itself is reused over and over, which reduces production costs of these cells. And, the thin cells are actually more efficient than thick cells because Alta has developed a way to bounce the light around in the thin crystals, increasing its intensity and leading to improved efficiency. In fact, the U.S. Department of Energy’s National Renewable Energy Laboratory in Golden, Colorado, has certified that Alta holds the world record for solar cell efficiency in the most simple and practical category of solar cells called single-junction solar cells.

How are Alta’s solar panels different from panels offered by other companies, like SolAero?

In summary, our solar technology for space enables designs that are not possible with other technologies. Alta Devices lightweight, thin, flexible, and tough gallium arsenide solar cells enable a new level of mechanical and design flexibility for the small satellite industry. Our product is ideally suited for innovative players in the market.

Relative to other cell producers, our production process allows our solar cells to be produced at a scale unique in the industry. Our equipment and tooling has been proprietary designed to enable large and efficient throughput and production. We can produce hundreds of watts of solar power per hour. We can therefore quickly and economically produce gallium arsenide solar material per customer needs.

Secondly, our modular cell design and proprietary cell-to-cell interconnection system allows us to quickly build customized solar modules according to customer power needs and space constraints. Other solar companies have limited size panels available, and end users would need to modify the cells to meet their needs, which leads to damage and wastage.

Thirdly, our cells are very flexible, easy to handle, and easy to integrate into a variety of form factors. The encapsulation of our cells is also done by us rather than the customer. Many competitor cells are very stiff and brittle, and break easily.

Lastly, our efficiency is record-breaking and provides 2-3 times the power output of other thin and flexible alternatives.

Do you serve any markets besides satellites? If so, what markets do you serve besides the satellite market?

Yes, our largest market currently is the UAV, or unmanned aerial vehicle, market.

We also have customers in the IoT, wearables, consumer devices, and automotive markets.

Within the satellite market, what segment do you focus on to sell your product?

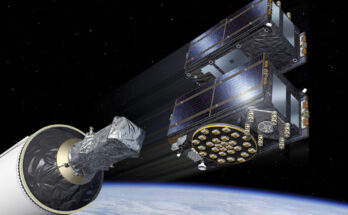

We are most interested in developing a product that will be well suited for the low-Earth orbiting satellite constellations that are being developed to provide global data and imaging coverage. These can drive significant volume from a small number of designs. For the moment, we are selling into the CubeSat market. This is a segment that is currently overpaying for solar cells and really appreciates Alta’s cost and form factor advantages. It’s a win-win because we get to gain experience on different types of projects and mission types, which is something our larger future customers are encouraging us to do anyway.

In the future, the scale and cost of Alta’s solar technology would be well suited for power-hungry space applications such as solar electric propulsion and space habitats.

Can you tell me some details about those larger future customers?

The type of disruption that we are seeing in the low-Earth orbit satellite market is largely driven by commercial entities. We believe that the two major applications will be communications and imaging. The physical size of these platforms will likely be smaller than traditional satellites, but deployed in much larger quantities.

The market for smallsats is fragmented now, with many operators and manufacturers – and even some operators that manufacture their own satellites. How do you develop sales in that market environment?

Our overall strategy is to focus on making the best cells and work with panel and component manufacturers to develop complete solutions for satellite designers. These panel and component manufacturers are well set up to sell into the small satellite market. We are building relationships with other parts of the landscape as well, including operators, launch companies, and suppliers.

Have you started production yet?

Yes, we are currently selling our solar cells to the market and are manufacturing at our Sunnyvale, California, headquarters.

What is your production capacity?

Alta already [has] solar cells in production today and has plans to ramp up to multiple 10s of megawatts of annual production in one or more overseas facilities. This scaling is enabled by Alta’s unique process that reduces material consumption and reuses the growth templates. The gallium arsenide material family is otherwise too expensive for such scale.

What is your manufacturing process?

We grow a thin layer of GaAs solar on top of a single crystal GaAs wafer using a process called metal organic vapor deposition. We then release the thin solar layer via a process called epitaxial lift-off. Then we use an automated machine of our own invention, called the matrix tool, to shingle together the finished cells into modules according to customer power requirements.

http://www.altadevices.com/technology/

China’s Hanergy acquired Alta in 2014. Can you tell me a bit about that acquisition?

Hanergy is the largest privately owned cleantech company in the world with over 20 years of experience providing clean energy using water, wind, and the sun. Alta Devices was Hanergy’s fourth solar cell technology acquisition. Hanergy’s vision for solar in the future is to produce the world’s most efficient cells in a thin and flexible form factor to be used on every surface available, including rooftops, automobiles, aircraft, and many more.

What was Alta’s rationale for agreeing to the acquisition?

Hanergy is focused on being the leader in solar technology. Alta’s technology was a clear choice to enable this vision.

Were there any other bidders?

Details of the acquisition were not disclosed.

How did you connect with Hanergy, and why did you ultimately decide it was the best buyer?

Hanergy was and remains very active in investigating every solar cell technology company in existence. Since Alta Devices holds the world record in efficiency, it was a no-brainer for Hanergy to acquire us.

Are there any downsides of working with a Chinese company?

None at all. Since the acquisition by Hanergy, Alta Devices has grown significantly in head count, revenue, production capacity, technology, and brand equity. Hanergy’s vision for the future is completely aligned with Alta’s technology roadmap and capabilities.

Please feel free to use this content with Forecast International and analyst attributions, along with a link to the article. Contact Ray Peterson at +1 (203) 426-0800 or via email at ray.peterson@forecast1.com for additional analysis.

Forecast International offers two Space Systems Forecast products: Launch Vehicles & Manned Platforms, with reports on manned spacecraft, expendable launch vehicles and more, and Satellites & Spacecraft, with coverage ranging from microsatellites to large COMSATs – all complete with technical specifications and forecast details.

Forecast International offers two Space Systems Forecast products: Launch Vehicles & Manned Platforms, with reports on manned spacecraft, expendable launch vehicles and more, and Satellites & Spacecraft, with coverage ranging from microsatellites to large COMSATs – all complete with technical specifications and forecast details.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.