Deliveries Continue to Suffer in May as Airbus Inaugurates New A220 Facility and Boeing Secures New Orders for Cargo Jets

by J. Kasper Oestergaard, European Correspondent, Forecast International.

Boeing and Airbus delivered 4 and 24 commercial jets in May 2020 compared to 30 and 81 deliveries, respectively, in the same month last year. With just 60 deliveries this year to date, Boeing is 142 shipments behind last year’s total for the first five months of the year. Airbus delivered a total of 160 jets from January to May, compared to 313 during the same period last year. Boeing’s deliveries have suffered for many months in the aftermath of two 737 MAX crashes and the subsequent suspension of deliveries and grounding of the fleet. Deliveries of 737 MAX aircraft have been on hold since March 2019. And due to COVID-19, both manufacturers have been forced to temporarily close down production facilities and have announced significant production rate cuts. For the full year 2019, Boeing delivered 380 aircraft, while Airbus set a new all-time annual record, handing over 863 jets. Prior to this, Boeing had retained a deliveries lead over Airbus since 2012. In 2018, Boeing delivered 806 jets (763 in 2017), with Airbus handing over 800 (718 in 2017).

In May, Boeing delivered just four aircraft, including one 737NG (P-8A Poseidon) to the U.S. Navy, a 767-300F to UPS, and two 777Fs to China Southern Airlines. It is of note that Boeing did not deliver any 787s in May.

Production of the 737 MAX has been suspended since January of this year. Prior to this, Boeing had been producing 737 MAX jets at a reduced rate of 42 aircraft per month. The 737 MAX jet is expected to remain grounded until at least August as software issues persist. Boeing hopes to win regulatory approval in August for the jet’s return to service, although that could be pushed back until fall. In the meantime, test flights and software changes continue. Meanwhile, the Federal Aviation Administration (FAA) has repeatedly stated that it has no timetable for the aircraft’s return to service. In any case, it will be a few years before Boeing is able to hit the planned monthly production rate of 57 aircraft. On June 17, FAA chief Steve Dickson will testify at a Senate hearing on the 737 MAX. Prior to the suspension of deliveries in March 2019, Boeing had delivered 387 737 MAX jets. In connection with Boeing’s first quarter 2020 earnings report on April 29, the company announced that 737 MAX aircraft production will resume at low rates later in 2020, as timing and conditions of return to service are better understood. The rate will gradually increase to 31 per month during 2021, with further gradual increases as market demand allows. Boeing also announced that the 787 production rate will be reduced from 14 per month to 10 per month this year, and gradually reduced to seven per month by 2022. The 777/777X combined production rate will be reduced to three per month in 2021. Production rate assumptions on the 747 and 767 programs have not been changed at this time. In April, Boeing terminated its Joint Venture agreement with Embraer. The companies had planned to create a joint venture comprising Embraer’s commercial aviation business and a second joint venture to develop new markets for the C-390 Millennium military transport aircraft.

In May, Airbus delivered two A220s, 18 A320s (1 CEO + 17 NEO), and four A350s. Prior to COVID-19, Airbus was targeting a 5 percent A320 rate increase to 63 jets per month from 2021, and was also discussing a further ramp-up with its supply chain that could have brought the production rate up to as high as 67 aircraft per month, or 804 per year, by 2023. This would have put the company within reach of a total of 1,000 jet deliveries per year. Those plans have now been shelved. For the full year 2019, Airbus handed over 642 A320 family aircraft, of which 551 were A320neos. This compares to deliveries of a total of 386 A320neo family aircraft in 2018, up from 181 and 68 in 2017 and 2016, respectively. Airbus delivered a record 112 A350s in 2019, up from 93 and 78 in 2018 and 2017, respectively. Airbus increased the monthly A350 production rate to 10 during 2019.

Due to the COVID-19 pandemic, Airbus has cut production on several programs and is looking to hold underlying jet output at 40 percent below pre-pandemic plans for two years. The A320 production rate has been reduced to 40 aircraft per month, down from an average of over 53 aircraft per month in 2019. The A330 and A350 programs are reduced to a rate of two and six aircraft per month, respectively. No rate cut has been announced for the A220 or A380, but Airbus has delayed a planned A220 production ramp-up at its Mirabel facility near Montreal, where the company has been producing four A220s per month. On April 27, Airbus announced that it is furloughing more than 6,000 employees in Europe, including 3,200 production workers at its wing manufacturing site in Broughton, Wales, and another 3,000 workers in France. In addition, Airbus is furloughing 3,163 workers in Spain. Airbus’ CEO Guillaume Faury has told the company’s 135,000 employees to brace for potentially deep job cuts and warned that Airbus’ survival was at stake without immediate action. At the same time, Boeing has laid off 6,770 employees in a bid to cut costs. Thousands of other employees will be let go over the next few months and 5,520 employees have been approved for voluntary separations. On May 19, Airbus announced the completion of its new A220 final assembly facility in Mobile, Alabama. The 270,000-square-foot facility will produce both the A220-100 and A220-300 versions and houses five primary assembly stations.

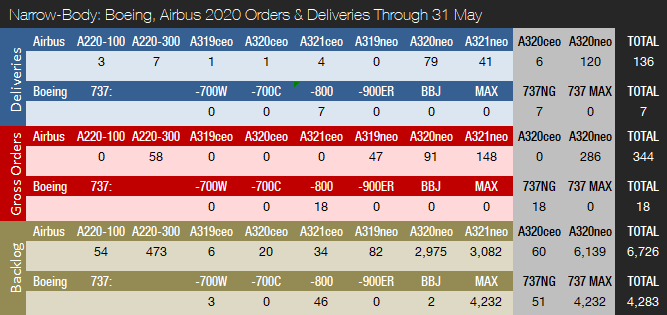

Turning to the orders race, Boeing booked nine gross orders in May and reported 18 cancellations for a total of -9 net new orders. Of the cancellations, 14 were for the 737 MAX. All the May orders were for 767 and 777 freighters. Undisclosed customers ordered five 767-300Fs and two 777Fs, while UPS and FedEx ordered a 747-8F and a 767-300F, respectively. Year-to-date, Boeing has accumulated 58 gross orders (322 cancellations => -264 net new orders). For the full year 2019, Boeing accumulated 243 gross orders (330 cancellations => -87 net new orders). For the full year 2018, Boeing booked 893 net new orders and 1,008 gross orders.

In May, Airbus reported no new orders or cancellations. For 2020 to date, Airbus has accumulated 365 gross orders (66 cancellations => net of 299). For the full year 2019, Airbus landed 1,131 gross orders (363 cancellations => net of 768), thereby retaking the orders crown from Boeing. In 2018, Airbus booked a total of 747 net new orders and 831 gross orders, thereby losing the 2018 orders race. Prior to this, Airbus had retained an orders lead over its rival every year since 2012.

At the end of May, Airbus reported a backlog of 7,621 jets, of which 6,726, or 88 percent, were A220 and A320ceo/neo family narrowbodies. This is 104 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of May 2020, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,301 aircraft, of which 4,283, or 81 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.8 years of shipments at the 2019 production level. In comparison, Boeing’s backlog would “only” last 6.6 years at the 2018 level, which we use as a proxy for 2019 due to the severe drop in 737 MAX deliveries. This year to date, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, is negative due to cancellations exceeding gross orders. Airbus’ book-to-bill ratio is 1.87, thanks mainly to very strong order bookings in January. In 2019, Boeing’s book-to-bill ratio was negative, while Airbus reported a book-to-bill ratio of 0.89.

2020 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology which, among many other features, provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecasts and, for 2020, Forecast International’s analysts expect Boeing and Airbus to deliver 301 and 507 commercial jets, respectively.

Note: Boeing 777-300ER orders include one 777-200LR. The 777-300ER backlog includes two 777-200LRs.

References:

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.boeing.com/commercial/737max/737-max-update.page

- https://boeing.mediaroom.com/news-releases-statements?item=130685

- https://boeing.mediaroom.com/news-releases-statements?item=130673

- https://boeing.mediaroom.com/2020-04-29-Boeing-Reports-First-Quarter-Results

- https://boeing.mediaroom.com/2020-04-25-Boeing-Terminates-Agreement-to-Establish-Joint-Ventures-with-Embraer

- https://www.reuters.com/article/us-boeing-737max/boeing-737-max-expected-to-remain-grounded-until-at-least-august-sources-idUSKCN22A35G

- https://edition.cnn.com/2020/04/27/business/airbus-furloughs/index.html

- https://www.bbc.com/news/business-52436741

- https://www.airbus.com/newsroom/news/en/2020/05/airbus-mobile-alabama-us-a220-fal-inauguration.html

- https://www.cnbc.com/2020/05/27/boeing-to-begin-laying-off-thousands-of-employees-this-week.html

- https://www.reuters.com/article/us-boeing-737max/u-s-faa-chief-to-testify-at-senate-hearing-on-boeing-737-max-idUSKBN2392YZ

- https://www.reuters.com/article/us-airbus-restructuring/airbus-jobs-on-wire-as-underlying-output-falls-40-sources-idUSKBN23A29F

- https://www.bloomberg.com/news/articles/2020-05-15/airbus-furloughs-in-spain-take-idled-workers-above-10-000

Based in Denmark, Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.