Orders Drought: Only One Jet Ordered in Unusually Weak Month

by J. Kasper Oestergaard, European Correspondent, Forecast International.

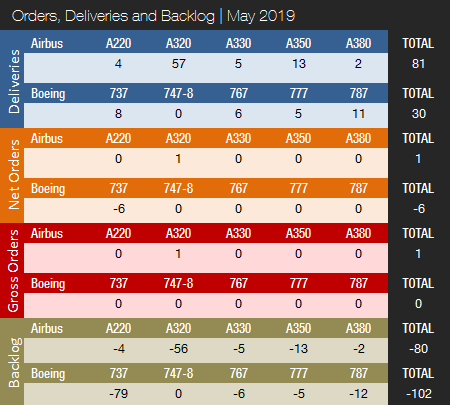

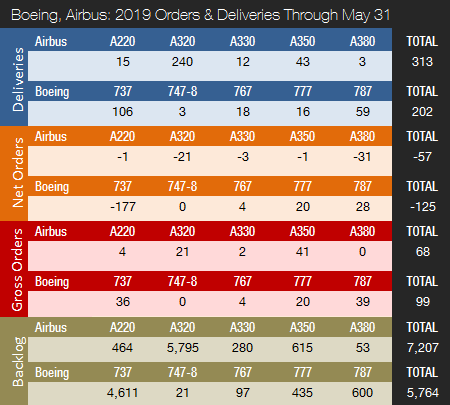

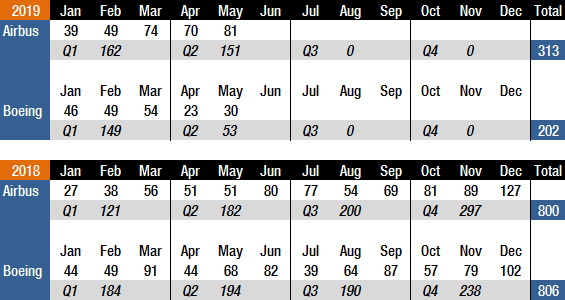

Boeing and Airbus delivered 30 and 81 commercial jets in May 2019 compared to 68 and 51 deliveries, respectively, in the same month last year. Boeing’s deliveries have taken a severe hit since the March 10 crash of Ethiopian Airlines Flight 302, a 737 MAX, and the subsequent deliveries halt and grounding of the fleet. Boeing decided on March 14 to suspend all deliveries of 737 MAX jets. The crashes were with a high degree of certainty caused by the aircraft’s Maneuvering Characteristics Augmentation System (MCAS), which suddenly activated in response to erroneous angle of attack information. In 2018, Boeing delivered 806 jets (763 in 2017), with Airbus handing over 800 (718 in 2017). With 202 deliveries this year to date, Boeing is 94 shipments behind last year’s total for the first five months of the year. Airbus has delivered a total of 313 jets from January to May compared to just 223 during the same period last year.

In May 2019, Boeing delivered eight 737s (all were 737 NG). Boeing is still producing 737 MAX jets at a reduced rate, thereby building up an inventory of aircraft ready to be shipped. During 2018, Boeing raised its 737 production rate to 52 and was planning for a further increase to 57 per month from early June this year. In the aftermath of the 737 MAX crashes, Boeing has decided to temporarily reduce its 737 production rate to 42 per month from April 15. This will allow the company to prioritize additional resources to focus on software certification and returning the 737 MAX to flight. On May 16, Boeing announced that it had completed development of the updated software for the 737 MAX and that it had flown the aircraft with updated MCAS software for more than 360 hours on 207 flights. The company now awaits regulatory approval for its software fix. The FAA has established a Boeing 737 MAX Joint Authorities Technical Review (JATR) comprising a team of experts from the FAA, NASA, and international aviation authorities. The review sessions commenced on April 29 and the JATR’s work is expected to take until the end of July; however, an exact date has not been announced. More recently, on May 23, the FAA held a full-day meeting with representatives from 33 global regulatory bodies to discuss the process for bringing the 737 MAX back into service. To date, Boeing has delivered 387 737 MAXs, of which 57 were delivered in Q1 2019; 256 737 MAX jets were delivered in 2018, up from 74 in 2017. During May 2019, Boeing also delivered six 767s, five 777s, and 11 787s. Boeing is currently in the process of raising the monthly Dreamliner production rate to 14 aircraft. Boeing delivered 145 787s in 2018, up from 136 in 2017.

In May 2019, Airbus delivered four A220s, 57 A320s (10 CEO / 47 NEO), five A330s, 13 A350s, and two A380s. A total of 386 A320neo family aircraft were delivered in 2018, up from 181 and 68 in 2017 and 2016, respectively. By mid-2019, Airbus expects to be delivering 60 A320 jets per month on average. The company has internally been debating rates above 60 aircraft. Airbus delivered 93 A350s in 2018, up from 78 in 2017, and recently increased the monthly production rate to 10. Airbus is considering a further increase up to 13 A350s per month but no date has yet been announced. With the ramp up of A350 XWB deliveries combined with a higher A320 production rate, Airbus has nearly eliminated Boeing’s deliveries lead in recent years. Following the tragic 737 MAX events in 2019, Airbus is looking set to deliver more aircraft than Boeing.

With six 737 cancellations and not a single order in May, Boeing had a terrible month in the orders race. Year to date, Boeing reports 99 gross orders (224 cancellations => -125 net new orders). On May 26, Boeing announced that Air New Zealand plans to buy eight 787-10 Dreamliners but no firm order has yet been placed. For the full year 2018, Boeing booked 893 net new orders (1,008 gross orders).

In the orders race, Airbus is not faring much better than Boeing. In May, Airbus booked just one gross order while no cancellations were reported. An undisclosed customer ordered a single A320neo. For 2019 to date, Airbus reports 68 gross orders (125 cancellations => net of -57). Of the cancellations, 31 were due to Emirates’ decision to reduce its A380 order book. This decision subsequently forced Airbus to announce that it will cease A380 production in 2021. In 2018, Airbus landed a total of 747 net new orders (831 gross orders), thereby losing the 2018 orders race as Boeing had accumulated 893 net new orders. Airbus had retained an orders lead over its rival every year since 2012.

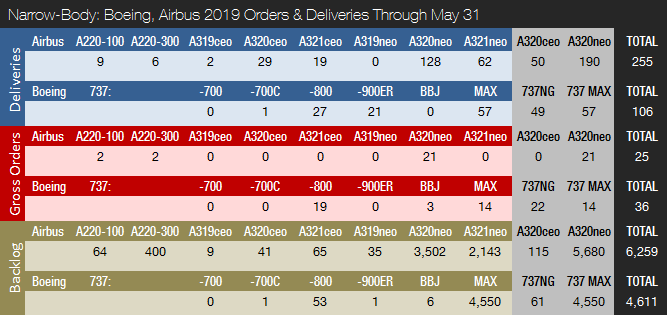

On May 31, 2019, Airbus backlog was 7,207 jets, of which 6,259 (87 percent) are A220 and A320ceo/neo family narrowbodies, not far below the company’s all-time backlog record high of 7,577 jets set in December 2018. By the end of May 2019, Boeing’s backlog (total unfilled orders after ASC 606 adjustments) was 5,764 aircraft (of which 4,611, or 80 percent, are 737 NG/MAX narrowbody jets). Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 9.0 years of shipments at the 2018 production level. In comparison, Boeing’s backlog would “only” last 7.2 years. In 2018, Boeing boasted a book-to-bill ratio of 1.11, with Airbus at 0.93. In 2017, Boeing booked 912 net new orders for a book-to-bill ratio of 1.20. That same year, Airbus booked 1,109 net new orders for a book-to-bill ratio of 1.54.

2019 Forecast

Forecast International’s Platinum Forecast System® is a breakthrough in forecasting technology which – among many other features – provides 15-year production forecasts. The author has used the Platinum Forecast System® to retrieve the latest delivery forecasts and for 2019, Forecast International’s analysts expect Boeing and Airbus to deliver 811 and 875 large commercial jets, respectively. The forecast 2019 total for Boeing was 904 prior to the second 737 MAX crash and the subsequent grounding of the fleet and temporary cut in the production rate. These are the latest “live” forecast figures (adjusted frequently by FI analysts as new information comes in). These figures are excluding militarized variants of commercial platforms such as Boeing’s P-8 Poseidon, KC-46 and KC-767 tankers, the C-40, and Airbus’ A330 MRTT tanker.

Prior to the second 737 MAX crash, Boeing announced in connection with the release of its 2018 earnings report in late January that it was targeting between 895 and 905 commercial jet deliveries in 2019, a 12-13 percent increase from 2018. Boeing will likely provide an updated guidance later this year. On February 14, Airbus announced that it aims for 880 to 890 commercial aircraft deliveries in 2019, equal to a 10-11 percent increase from 2018.

Note: Boeing 777-300ER category includes one 777-200LR order placed in October 2018.

Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

References:

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.faa.gov/news/updates/?newsId=93206

- https://www.boeing.com/commercial/737max/737-max-update.page

- https://boeing.mediaroom.com/2019-05-26-Air-New-Zealand-Selects-Boeing-787-10-Dreamliner-for-Future-Growth

- https://boeing.mediaroom.com/news-releases-statements?item=130434

- https://www.airbus.com/newsroom/press-releases/en/2019/05/airbus-celebrates-delivery-of-its-12000th-aircraft–an-a220100-to-delta-air-lines.html

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.