U.S. Manufacturers Deliver 367 Aircraft in First Quarter – Up 52 Units from Q1 2018

by J. Kasper Oestergaard, European Correspondent, Forecast International.

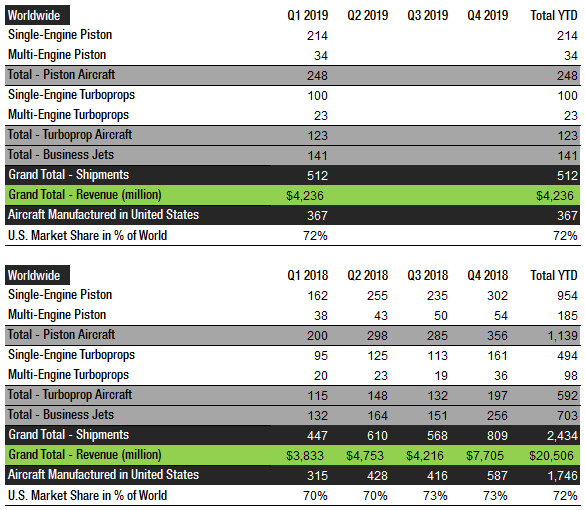

According to the General Aviation Manufacturers Association (GAMA), in the first quarter of 2019, manufacturers reported very strong results. Fixed-wing general aviation aircraft manufacturers delivered 512 aircraft worldwide in Q1 2019, up 14.5 percent from 447 in Q1 2018. Revenues (billings) at the same time increased 10.5 percent to $4.2 billion, mainly due to a surge in Gulfstream revenues year-over-year following the commencement of G500 deliveries in September 2018. The piston airplane market led the increase in deliveries with 248 units in Q1 2019, a 24.0 percent increase from the same period in 2018. Turboprop and business jet shipments also increased year-over-year at 7.0 percent and 6.8 percent, respectively.

U.S. manufacturers delivered 367 aircraft in Q1 2019, up from 315 in Q4 2018 – an impressive 16.5 percent increase. U.S. manufacturers accounted for 72 percent of worldwide shipments in the first quarter, up from 70 percent in Q1 last year.

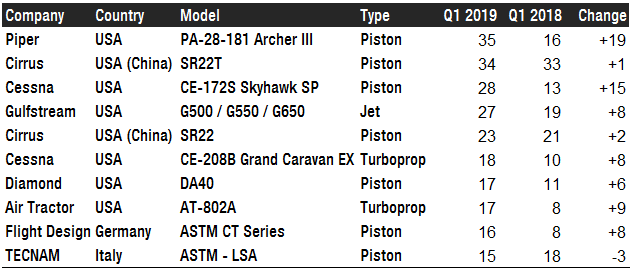

Surprisingly, in Q1 2019, the Piper PA-28-181 Archer III (piston) was the most popular fixed-wing general aviation aircraft with 35 units delivered (+19 from Q1 2018). The Cirrus SR22T (piston) took second place with 34 shipments – up from 33 in Q1 2018 – followed by the Cessna CE-172S Skyhawk SP (piston) with 28 shipments, up 15 units from last year. In fourth place is Gulfstream’s G500 / G550 / G650 large-cabin business jet variants with 27 units delivered, ahead of Cessna’s CE-208B Grand Caravan EX (turboprop), the Diamond DA40 (piston), Air Tractor’s AT-802A (turboprop), Flight Design’s ASTM CT Series (piston), and TECNAM’s ASTM – LSA (piston).

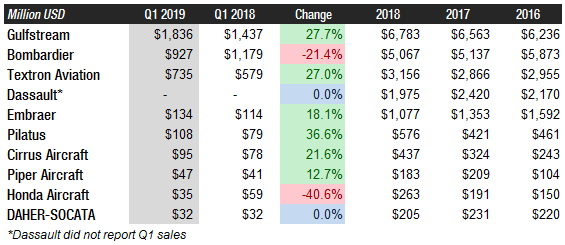

When general aviation aircraft manufacturers are ranked by revenues, the business jet manufacturers take the lead. Gulfstream boasted the highest revenues of all fixed-wing aircraft manufacturers in Q1 2019 with total sales of $1.8 billion, up an impressive 27.7 percent from the same period last year. The increase is mainly due to the introduction of the G500. Gulfstream has been the world’s largest general aviation aircraft manufacturer by revenues since 2013. In second place is Bombardier with Q1 2019 sales of $927 million, down 21.4 percent from Q1 2018. Textron Aviation (Cessna + Beechcraft) is the overall leader by units sold but only ranks third by revenue with $735 million in Q1 2019, up 27.0 percent from $579 million in the first quarter last year. In fourth place, Embraer reported billings of $134 million, up 18.1 percent. It is worth mentioning that Pilatus Aircraft had yet another very strong quarter, with year-over-year billings up 36.6 percent after the company delivered five units of its new PC-24 business jets (deliveries commenced in Q1 2018). Cirrus and Piper Aircraft also reported strong results, with billings up 22 percent and 13 percent, respectively. In Q1 2019, Honda Aircraft disappointed and only delivered seven HA-420 HondaJets vs. 12 units shipped during the same quarter last year.

Upcoming Product Launches and Key Events

At a special ceremony at its Montreal headquarters, Bombardier delivered the first Global 7500 business jet on December 20, 2018 to Stonebriar Commercial Finance. The first delivery of the Global 8000, which is smaller but has a 200-nautical-mile range advantage over the Global 7500, is expected to follow later in 2019. Bombardier has stated that it remains committed to the Global 8000 despite many claiming that the aircraft was made redundant when the Global 7500’s range was increased by 300 nautical miles in early 2018. With these product launches, Bombardier aims to take market share from Gulfstream’s successful G650 and G650ER. The Global 7500 and Global 8000 boast maximum ranges of 7,700 nautical miles and 7,900 nautical miles, respectively. This compares to 7,500 nautical miles for the G650ER. On March 4, a Global 7500 logged an impressive 8,152-nautical-mile flight, setting a new business jet range record. However, on March 29, a Gulfstream G650ER completed an even more impressive 8,379-nautical-mile flight to reclaim the record. Bombardier expects to deliver a handful of Global 7500s in the first half of 2019, with 10-15 deliveries following in the second half. In 2020, the company expects to deliver 35-40 aircraft. Bombardier also expects to deliver two new longer-range variants of its Global 6500 and 5500 large-cabin jets by the end of 2019.

In July 2018, the G500 received both its type certification and production certificate from the U.S. Federal Aviation Administration (FAA). Having amassed 5,000 flight hours with five G500 flight-test aircraft, Gulfstream delivered its first production G500 on September 27, 2018. The Gulfstream G600 was expected to be approved by the FAA by year-end 2018; however, due to the recent U.S. government shutdown, the expected approval date was pushed back. Gulfstream recently announced that it expects G600 FAA approval in June, with deliveries following in the second half of the year. Thanks to the G500 and G600 product launches, Gulfstream expects growth in both orders and deliveries in 2019.

At NBAA-BACE in Orlando in October 2018, Embraer announced the 2019 launch of two Praetor models in the company’s midsized Legacy line. The aircraft will join a highly competitive market segment that includes Bombardier’s Challenger 350 and Gulfstream’s G280, along with Textron’s upcoming super-midsize Cessna Citation Longitude.

On February 5, 2019, Boeing announced that it had signed an agreement with Reno, Nevada-based Aerion to become a partner in the development of the Aerion AS2 supersonic business jet. Boeing states that it has “made a significant investment in Aerion to accelerate technology development and aircraft design, and unlock supersonic air travel for new markets.” As part of the agreement, Boeing will provide financial, engineering and industrial resources. Aerion introduced the 12-passenger AS2 business jet design in 2014 and unveiled the AS2’s GE Affinity engine design in 2018. The first flight of the AS2 prototype is targeted for June 2023, the 20th anniversary of the retirement of the Concorde.

Recent History & Market Dynamics

The recession from December 2007 to June 2009 had a massive impact on the general aviation aircraft manufacturing industry as the sale of business jets and piston-engine aircraft collapsed and were, as of 2017, not even close to their 2007 peak levels. From 2007-2010, the global production of general aviation aircraft dropped a staggering 52.8 percent from 4,276 aircraft in 2007 to 2,020 in 2010. In the United States, manufacturers experienced a 59.3 percent drop in production, from 3,279 to 1,334 units, over the same period.

An important reason why deliveries of general aviation aircraft are still way below their 2007 peak levels, both worldwide and in the U.S., is that the price per aircraft has doubled. From 2007 to 2018, the average price of a piston-engine aircraft, which is the most common type, soared from $328,000 to 665,000. That increase is keeping many would-be buyers out of the market. Also, the average price of a business jet was up from $12.5 million to $25.4 million over the same period. At the same time, the average price of turboprops declined from $3.5 million to $3.0 million, resulting in a surge in shipments of this type of aircraft.

The market for general aviation aircraft is highly cyclical, and in particular the small business jet and piston-engine aircraft segments suffer in a down economy. Perhaps a surprise to some, the large business jet segment emerged unscathed from the 2007-09 recession.

2019 Business Jet Forecast

Forecast International’s Platinum Forecast System® is a breakthrough in forecasting technology which – among many other features – provides 15-year production forecasts. The author has used the Platinum Forecast System® to retrieve the latest delivery forecasts. Forecast International’s analysts expect aircraft manufacturers to deliver 721 business jets in 2019 as well as 1,751 other fixed-wing general aviation / utility aircraft.

Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

References:

- http://www.fi-aeroweb.com/General-Aviation.html

- https://gama.aero/news-and-events/press-releases/gama-publishes-first-quarter-aircraft-shipment-data/

- https://gama.aero/facts-and-statistics/quarterly-shipments-and-billings/

- https://www.ainonline.com/aviation-news/business-aviation/2019-04-24/gulfstream-deliveries-sales-soar-first-quarter

- https://www.ainonline.com/aviation-news/business-aviation/2019-03-04/global-7500-sets-bizjet-range-record

- https://www.ainonline.com/aviation-news/business-aviation/2019-04-08/gulfstream-sets-longest-business-jet-flight-record

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.