The return of the Boeing 737 MAX draws close while Airbus reports highest delivery figures since before the pandemic, delivers first A330-800 and mulls A320 rate hike

by J. Kasper Oestergaard, European Correspondent, Forecast International.

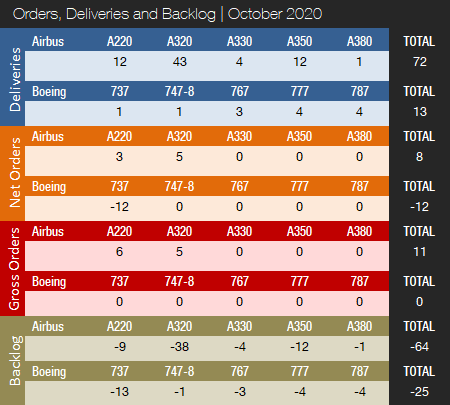

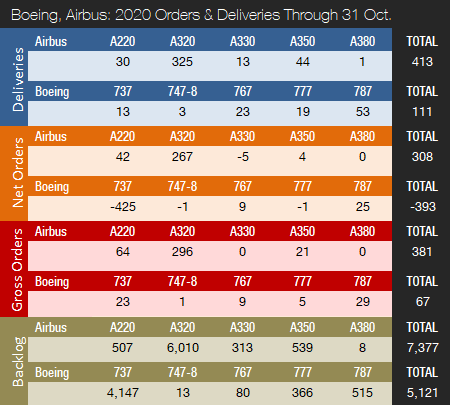

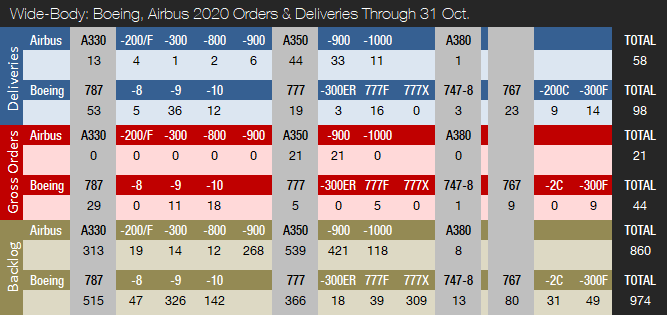

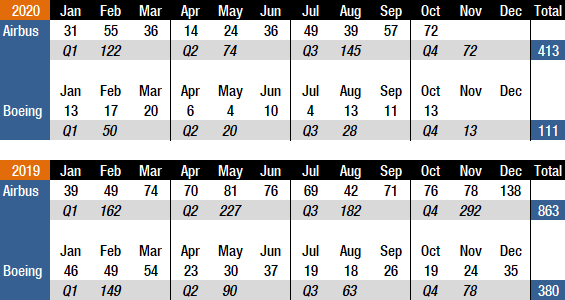

Boeing and Airbus delivered 13 and 72 commercial jets in October 2020, compared to 19 and 76 deliveries, respectively, in the same month last year. For Airbus, the month of October was the strongest since the COVID-19 pandemic began. With just 111 deliveries this year to date, Boeing is 210 shipments behind last year’s total for the first 10 months of the year. Airbus delivered a total of 413 jets from January to October, compared to 647 during the same period last year. Boeing’s deliveries have suffered for many months in the aftermath of two 737 MAX crashes and the subsequent suspension of deliveries and grounding of the fleet. Deliveries of 737 MAX aircraft have been on hold since March 2019. Due to COVID-19, both manufacturers were forced to temporarily close down production facilities and have laid off thousands of employees and announced significant production rate cuts on most programs. For the full year 2019, Boeing delivered 380 aircraft, while Airbus set a new all-time annual record, handing over 863 jets. Prior to this, Boeing had retained a deliveries lead over Airbus since 2012. In 2018, Boeing delivered 806 jets (763 in 2017), with Airbus handing over 800 (718 in 2017).

In October, Boeing’s 13 aircraft shipments included one 737NG, one 747-8, three 767s, four 777s and four 787s. Production of the 737 MAX was suspended from January of this year until the end of May, when Boeing announced it had commenced low-rate production of the aircraft. Boeing expects the 737 MAX production rate to gradually increase to 31 per month by early 2022, with further increases as market demand allows. Boeing has also announced that the 787 production rate is being reduced from 14 per month (rate at the start of the year) to just six per month during 2021. On October 1, Boeing announced it will be moving all 787 production to South Carolina by mid-2021. The combined 777/777X production rate will be reduced to 2 per month in 2021. Production rate assumptions have not changed for the 747 and 767 programs. Prior to the 737 MAX production suspension, Boeing was manufacturing the jet at a reduced rate of 42 per month. The company has built about 450 737 MAX jets during the grounding and is targeting delivery of more than half of those in the first 12 months following recertification. While the U.S. Federal Aviation Administration (FAA) has repeatedly stated that it has no timetable for the aircraft’s return to service, the 737 MAX had been expected to remain grounded at least until November. In any case, it will be several years before Boeing is able to hit the originally planned monthly production rate of 57 aircraft. Prior to the suspension of deliveries in March 2019, Boeing had produced and shipped 387 737 MAX jets.

According to statements made by Patrick Ky, executive director of the European Union Aviation Safety Agency (EASA), the 737 MAX could receive regulatory approval to return to flying in November and re-enter service by the end of the year. On October 6, the FAA posted the draft Flight Standardization Board (FSB) report on the proposed pilot training for the 737 MAX, which incorporates the recommendations from the Joint Operations Evaluation Board (JOEB). Several key milestones remain: Final Design Documentation and the Technical Advisory Board (TAB) report, the issuance of a Continued Airworthiness Notification to the International Community (CANIC) and AD, the rescission of the Grounding Order by the FAA and issuance by the FAA of airworthiness certificates and export certificates, and review and approval of operator training programs. On November 10, Reuters reported that the FAA was in the final stages of reviewing proposed changes to the 737 MAX and expected to complete the process shortly.

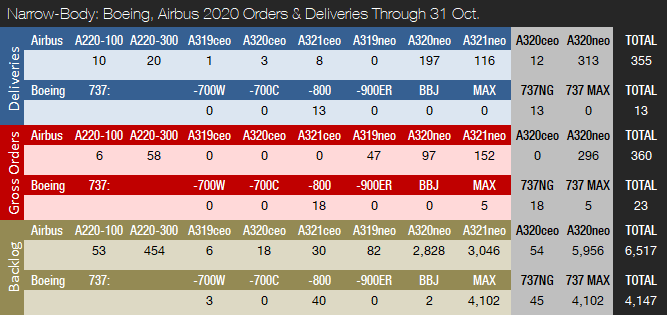

In October, Airbus delivered 72 jets, including 12 A220s, 43 A320s (2 CEO / 41 NEO), four A330s, 12 A350s and one A380. For the full year 2019, Airbus handed over 642 A320 family aircraft, of which 551 were NEOs, while also delivering a record 112 A350s. Prior to the COVID-19 pandemic, Airbus was targeting a 5 percent A320 rate increase to 63 jets per month from 2021, and was also discussing a further ramp-up with its supply chain that could have brought the production rate up to as high as 67 aircraft per month, or 804 per year, by 2023. This would have put the company within reach of a total of 1,000 jet deliveries per year. These plans have now been shelved. Due to COVID-19, Airbus has cut production on several programs and is looking to hold underlying jet output at 40 percent below pre-pandemic plans for two years. The A320 production rate has been reduced to 40 aircraft per month, down from an average of over 53 aircraft per month in 2019. Recently, however, Airbus confirmed that the company is considering an increase to 47 A320neo jets per month in the second half of 2021. The A330 and A350 programs have been reduced to a rate of two and six aircraft per month, respectively. No rate cut has been announced for the A220 or A380.

Turning to the orders race, in October, Boeing booked no new orders but reported 12 737 MAX cancellations. Year to date, Boeing has accumulated 67 gross orders (460 cancellations => -393 net new orders). For the full year 2019, Boeing booked 243 gross orders (330 cancellations => -87 net new orders). For the full year 2018, Boeing booked 893 net new orders and 1,008 gross orders.

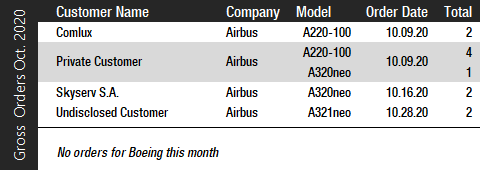

In October, Airbus reported orders for 11 aircraft as well as three A220 cancellations. Orders included two A220-100s for Comlux, four A220-100s and one A320neo for a private customer, two A320neos for Skyserv, and two A321neos for an undisclosed customer. For 2020 to date, Airbus has accumulated 381 gross orders (73 cancellations => net of 308). For the full year 2019, Airbus landed 1,131 gross orders (363 cancellations => net of 768), thereby retaking the orders crown from Boeing. In 2018, Airbus booked a total of 747 net new orders and 831 gross orders, thereby losing the 2018 orders race. Prior to this, Airbus had retained an orders lead over its rival every year since 2012.

At the end of October, Airbus’ reported a backlog of 7,377 jets, of which 6,564, or 88 percent, were A220 and A320ceo/neo family narrowbodies. This is 348 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of October 2020, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,121 aircraft, of which 4,160, or 81 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.6 years of shipments at the 2019 production level. In comparison, Boeing’s backlog would “only” last 6.4 years at the 2018 level, which we use as a proxy for 2019 due to the severe drop in 737 MAX deliveries. This year to date, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, is negative due to cancellations exceeding gross orders. Airbus’ book-to-bill ratio is 0.75. In 2019, Boeing’s book-to-bill ratio was negative, while Airbus reported a book-to-bill of 0.89.

Q3 2020 Earnings

As expected, the third quarter earnings reports of Airbus and Boeing were grim reading – however, with some signs of improvement. Boeing reported Q3 revenues of $14.1 billion, compared to $20.0 billion in the same quarter last year. Over the same period, Boeing’s net loss was $466 million, compared to a profit of $1.2 billion last year. Boeing’s free cash flow (FCF) was negative $5.1 billion in Q3. Revenues from the Commercial Airplanes segment were down by 56 percent to $3.6 billion in the third quarter.

Airbus reported Q3 revenues of EUR11.2 billion, compared to $15.3 billion in the same quarter last year. Airbus lost EUR767 million during the third quarter (EUR989 million profit in Q3 2019) and reported positive FCF in the amount of EUR600 million. This compares to FCF of negative EUR12.9 billion for the first six months of 2020 – a major improvement. In the third quarter, revenues from Airbus (commercial jets) were down by 33 percent to EUR7.7 billion.

2020 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecasts and, for 2020, Forecast International’s analysts currently expect Boeing and Airbus to deliver 219 and 513 commercial jets, respectively.

Note: The 777-300ER backlog includes one 777-200LR.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.faa.gov/news/updates/?newsId=93206

- https://www.boeing.com/commercial/737max/737-max-update.page

- https://www.airbus.com/newsroom/press-releases/en/2020/10/kuwait-airways-takes-delivery-of-its-first-two-a330neos.html

- https://boeing.mediaroom.com/2020-10-28-Boeing-Reports-Third-Quarter-Results

- https://www.airbus.com/newsroom/press-releases/en/2020/10/airbus-reports-nine-month-9m-2020-results.html

- https://www.bnnbloomberg.ca/airbus-sets-plan-to-gear-up-production-in-show-of-confidence-1.1511858

- https://www.reuters.com/article/us-boeing-737max-exclusive-idUSKBN27Q00H

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service, are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes 75 individual reports, most with a 10-year unit production forecast. Pricing begins at $2,295, with discounted full-library subscriptions available. Click here to learn more.

Based in Denmark, Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

A military history enthusiast, Richard began his career at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet became central to defense research, he helped design the company’s Forecast Intelligence Center and now coordinates the FI Market Recap newsletters for clients. He also manages two blogs: Defense & Security Monitor, which covers defense systems and international security issues, and Flight Plan, focused on commercial aviation and space systems.

For more than 30 years, Richard has authored Defense & Aerospace Companies, Volume I (North America) and Volume II (International), providing detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database tracking all companies involved in programs covered by the FI library. Richard currently serves as Manager of the Information Services Group (ISG), which develops outbound content for both Forecast International and Military Periscope.