Airbus wins orders race at 53rd Paris Air Show, Boeing secures major 737 MAX vote of confidence

by J. Kasper Oestergaard, European Correspondent, Forecast International.

At the 53rd Paris Air Show in June, a total of 866 firm orders and commitments for commercial aircraft were announced – of which Airbus captured 363 ahead of Boeing’s 282 with the remainder going to Embraer, ATR and others. Photo Courtesy: Airbus S.A.S.

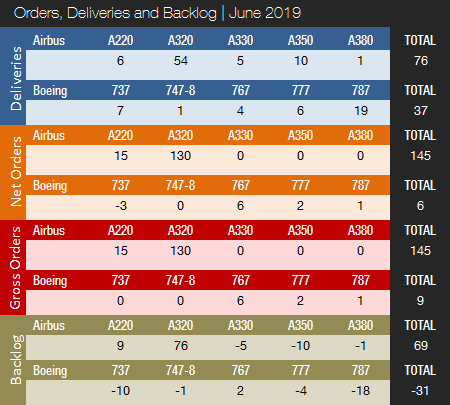

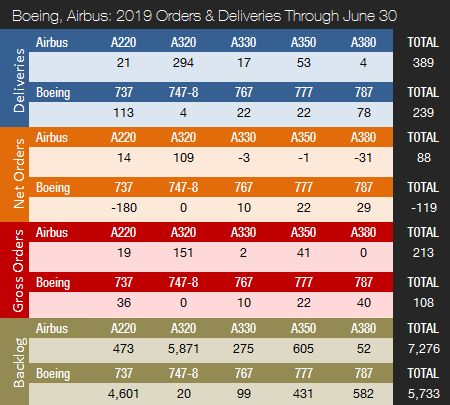

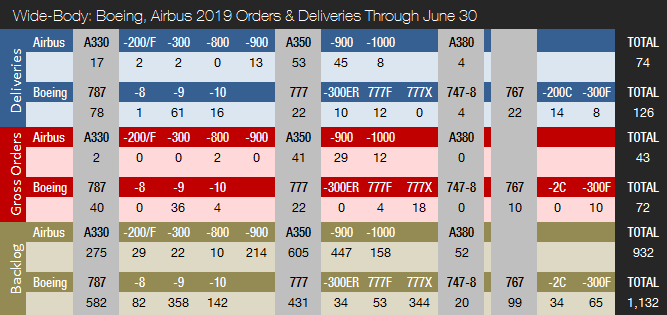

Boeing and Airbus delivered 39 and 76 commercial jets in June 2019, compared to 82 and 80 deliveries, respectively, in the same month last year. Boeing’s deliveries have taken a severe hit since the March 10 crash of Ethiopian Airlines Flight 302, a 737 MAX, and the subsequent deliveries halt and grounding of the fleet. Boeing decided on March 14 to suspend all deliveries of 737 MAX jets. The crashes were with a high degree of certainty caused by the aircraft’s Maneuvering Characteristics Augmentation System (MCAS), which suddenly activated in response to erroneous angle of attack information. In 2018, Boeing delivered 806 jets (763 in 2017), with Airbus handing over 800 (718 in 2017). With 239 deliveries this year to date, Boeing is 139 shipments behind last year’s total for the first half of the year. Airbus delivered a total of 389 jets from January to June, compared to just 303 during the same period last year.

Deliveries

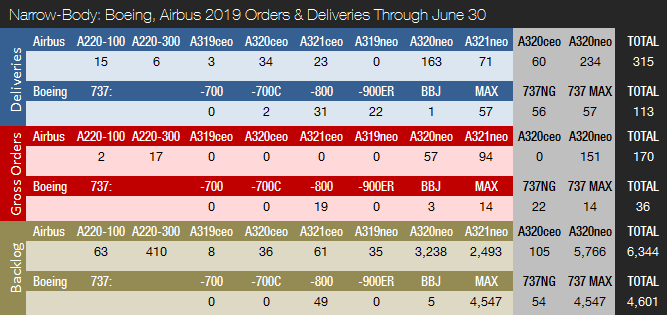

In June 2019, Boeing delivered seven 737s (all were 737 NGs). Boeing is still producing 737 MAX jets at a reduced rate of 42 aircraft per month, and thereby building up an inventory of aircraft ready to be shipped. During 2018, Boeing raised its 737 production rate to 52 and was planning for a further increase to 57 per month from June this year. Producing the 737 MAX at a reduced rate will allow the company to prioritize additional resources to focus on returning the 737 MAX to flight. The Federal Aviation Administration (FAA) has established a Boeing 737 MAX Joint Authorities Technical Review (JATR) comprising a team of experts from the FAA, NASA, and international aviation authorities. The review sessions commenced on April 29, and the JATR team’s work is expected to take until the end of July; however, an exact date has not been announced. On May 16, Boeing announced that it had completed development of the updated software for the 737 MAX and that it had flown the aircraft with updated MCAS software for more than 360 hours on 207 flights. On May 23, the FAA held a full-day meeting with representatives from 33 global regulatory bodies to discuss the process for bringing the 737 MAX back into service. On June 26, Boeing announced that the FAA has identified an additional requirement that it has asked the company to address as it updates the software, and Boeing is now working to implement this. To date, Boeing has delivered 387 737 MAXs, of which 57 were delivered in Q1 2019. A total of 256 737 MAX jets were delivered in 2018, up from 74 in 2017. In June 2019, Boeing also delivered one 747-8, four 767s, six 777s, and an impressive 19 787s, which is a new all-time record high for that model in a single month. Boeing recently raised the monthly Dreamliner production rate to 14 aircraft. Boeing delivered 145 787s in 2018, up from 136 in 2017.

In June 2019, Airbus delivered six A220s, 54 A320s (10 CEO / 44 NEO), five A330s, 10 A350s, and one A380. A total of 386 A320neo family aircraft were delivered in 2018, up from 181 and 68 in 2017 and 2016, respectively. Later this year, Airbus expects to increase the A320 production rate to 60 aircraft per month. The company is targeting a raise to 63 jets per month from 2021. Airbus delivered 93 A350s in 2018, up from 78 in 2017, and recently increased the monthly production rate to 10. Airbus is considering a further increase up to 13 A350s per month, but no date has yet been announced. With the ramp-up of A350 XWB deliveries combined with a higher A320 production rate, Airbus has nearly eliminated Boeing’s deliveries lead in recent years. Following the tragic 737 MAX events, in 2019 Airbus is almost certain to deliver more aircraft than Boeing.

Orders

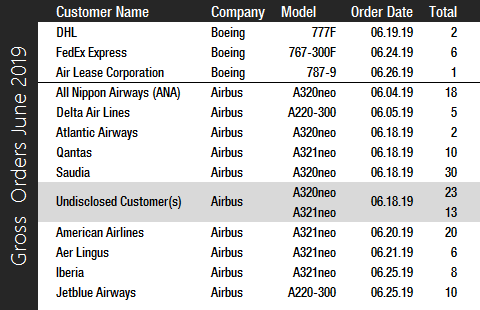

Turning to the orders race, Boeing had another quiet month in June. Boeing logged nine gross orders excluding three 737 MAX cancellations, resulting in six net new orders. Boeing’s June bookings included six 767-300 freighters for FedEx, two 777 freighters for DHL, and a single 787-9 Dreamliner for Air Lease Corporation. Year to date, Boeing has accumulated 108 gross orders (227 cancellations => -119 net new orders). For full-year 2018, Boeing booked 893 net new orders (1,008 gross orders).

In the orders race Airbus had a very strong month and booked 145 gross orders, while no cancellations were reported. All Airbus’ June orders were for narrowbody A220/A320s. The largest orders were for a mix of 36 A320/A321neos for an undisclosed customer and 30 A320neos for Jeddah-based Saudia, or Saudi Arabian Airlines, the national carrier of Saudi Arabia, followed by 20 A321neos for American Airlines and 18 A320neos for Japan’s ANA. For 2019 to date, Airbus reports 213 gross orders (125 cancellations => net of 88). Of the cancellations, 31 were due to Emirates’ decision to reduce its A380 order book. This decision subsequently forced Airbus to announce that it will cease A380 production in 2021. In 2018, Airbus landed a total of 747 net new orders (831 gross orders), thereby losing the 2018 orders race, as Boeing had accumulated 893 net new orders. Airbus had retained an orders lead over its rival every year since 2012.

On June 30, 2019, Airbus’ backlog was 7,276 jets (of which 6,344, or 87%, are A220 and A320ceo/neo family narrowbodies), not far below the company’s all-time backlog record high of 7,577 jets set in December 2018. By the end of June 2019, Boeing’s backlog (total unfilled orders after ASC 606 adjustments) was 5,733 aircraft (of which 4,601, or 80%, are 737 NG/MAX narrowbody jets). Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 9.1 years of shipments at the 2018 production level. In comparison, Boeing’s backlog would “only” last 7.1 years. This year to date, Boeing’s book-to-bill ratio, calculated as orders divided by deliveries, is negative. Airbus’ book-to-bill ratio is 0.23. In 2018, Boeing boasted a book-to-bill ratio of 1.11, with Airbus at 0.93. In 2017, Boeing booked 912 net new orders, for a book-to-bill ratio of 1.20. That same year, Airbus booked 1,109 net new orders, for a book-to-bill ratio of 1.54.

Special Coverage: Paris Air Show 2019

At the 53rd Paris Air Show held at Le Bourget, June 17-23, Airbus and Boeing reported a combined 645 firm orders and commitments (MoUs, LOIs, options, etc.) for commercial aircraft – of which Airbus captured 363, ahead of Boeing’s 282. Including ATR, Embraer, and other manufacturers, the grand total was approximately 900 orders and commitments. This compares to 1,464 orders and commitments signed at Farnborough last year and 1,226 at the Paris Air Show in 2016.

Airbus won the orders race in Paris with 363 orders and commitments (149 firm orders and 214 commitments). In addition, airlines and lessors converted 352 existing aircraft orders – mostly A320neos converted to the larger A321neo variant or A321neos converted to the new A321XLR, an “Xtra Long Range” variant of the A321neo. The launch of the A321XLR was announced on the opening day in Paris and boasts a range of 4,700 nautical miles (5,400 miles), or 15 percent more than the A321LR. Malaysia’s AirAsia Group converted 253 existing A320neo orders to larger A321neos and is now the world’s largest customer for this type. Los Angeles-based aircraft leasing company Air Lease Corporation (ALC) signed a letter of intent (LOI) for 100 aircraft, including 50 A220-300s and 27 A321XLRs, plus an incremental order for 23 A321neos.

In other air show activity, American Airlines will acquire 20 firm Airbus A321XLR aircraft and convert 30 A321neos already on order to A321XLRs. Also, Indigo Partners committed to buying 32 A321XLRs and converting 18 existing A320neo family orders to A321XLRs (20 will be allocated to Wizz Air, 18 to Frontier, and 12 to JetSmart). JetBlue Airways converted 13 existing A321neo orders to A321XLRs and firmed up an order for 10 A220-300 aircraft from existing options. Nordic Aviation Capital (NAC), the industry’s largest regional aircraft lessor, signed a Memorandum of Understanding (MoU) for 20 A220 jets, while International Airlines Group (IAG) ordered 14 Airbus A321XLRs (eight for Iberia and six for Aer Lingus, plus 14 options). Cebu Pacific, a low-cost carrier based in the Philippines, signed an MoU for 16 A330-900s, 10 A321XLRs, and five A320neos. Also, Qantas converted 26 A320neo orders to A321XLRs and added a new firm order for 10 A321XLR aircraft, while China Airlines signed an MoU for 11 A321neos. Flynas, a Saudi Arabian low-cost carrier, signed an MoU for 10 A321XLR jets and upgraded 10 A320neos it has on order to the A321neo. Furthermore, Virgin Atlantic ordered eight firm A330-900s, Delta Air Lines placed an order for five firm A220-100s, and Lebanon’s national carrier, Middle East Airlines (MEA), signed a firm order for four A321XLRs. Finally, Dublin-based leasing company Accipiter Holdings ordered 20 A320neo jets (already booked by Airbus in March 2019), Saudia ordered 15 A320neos – all the new A321XLR version (plus 35 A320 family options), and Atlantic Airways, the Faroe Islands flag carrier, ordered two aircraft.

Boeing also secured a solid order haul in Paris, signing a total of 282 orders and commitments, of which 20 were firm orders. IAG and Boeing surprised many by signing an LOI for 200 737 MAX aircraft, which is a major vote of confidence in the aircraft that could not have come at a better time. IAG is the parent company of Aer Lingus, British Airways, Iberia, Vueling and LEVEL. While IAG used to operate 737 Classics, its narrowbody fleet today is almost exclusively Airbus A320 family aircraft. IAG plans to acquire a mix of 737 MAX 8 and 10 jets for delivery between 2023 and 2027 and powered by CFM LEAP engines. Boeing also announced two deals for the 737-800 Boeing Converted Freighter (BCF), including 20 firm orders and 25 commitments. These orders were placed by ASL Aviation Holdings DAC (10 firm / 10 options) and GE Capital Aviation Services (10 firm / 15 options). Boeing also received 20 commitments from Korean Air for 787-9/10 Dreamliner variants, five commitments for the 787-9 from ALC, and 11 commitments for the 777F from China Airlines (six) and Qatar Airways (five). Finally, Turkmenistan Airlines announced its intent to purchase a single 777-200LR.

2019 Forecast

Forecast International’s Platinum Forecast System® is a breakthrough in forecasting technology. Among many other features, Platinum provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecasts and, for 2019, Forecast International’s analysts expect Airbus to deliver 724 large commercial jets. The 2019 forecast for Boeing was 904 prior to the second 737 MAX crash and the subsequent grounding of the fleet and temporary cut in the production rate. These are the latest “live” forecast figures (adjusted frequently by FI analysts as new information comes in). These figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon, KC-46 and KC-767 tankers, the C-40, and Airbus’ A330 MRTT tanker.

Prior to the second 737 MAX crash, in connection with the release of its 2018 earnings report in late January, Boeing announced it was targeting between 895 and 905 commercial jet deliveries in 2019, a 12-13 percent increase from 2018. Boeing has yet to announce a revised figure and is likely awaiting the 737 MAX’s return to service before providing updated guidance. On February 14, Airbus announced that it aims for 880 to 890 commercial aircraft deliveries in 2019, equal to a 10-11 percent increase from 2018.

Note: Boeing 777-300ER category includes one 777-200LR order placed in October 2018.

Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

References:

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.faa.gov/news/updates/?newsId=93206

- https://www.boeing.com/commercial/737max/737-max-update.page

- https://boeing.mediaroom.com/2019-06-26-Boeing-Statement-on-737-MAX-software

- https://www.airbus.com/newsroom/press-releases/en/2019/06/airbus-launches-longest-range-singleaisle-airliner-the-a321xlr.html

- https://www.airbus.com/newsroom/press-releases/en/2019/06/airbus-sees-strong-demand-for-its-new-commercial-aircraft-products-at-paris-air-show-2019.html

- https://www.airbus.com/newsroom/press-releases/en/2019/06/air-lease-corporation-to-order-100-aircraft-including-the-new-a321xlr.html

- https://airleasecorp.com/press/air-lease-corporation-to-order-100-aircraft-including-the-new-a321xlr

- https://www.reuters.com/article/us-france-airshow-airasia/airasia-to-convert-253-orders-for-airbus-a320neo-planes-to-larger-a321neo-idUSKCN1TJ11W

- https://www.iairgroup.com/en/newsroom/press-releases/newsroom-listing/2019/iag-signs-letter-of-intent-for-200-boeing-737-8-and-737-10

- https://boeing.mediaroom.com/2019-06-18-International-Airlines-Group-Announces-Intent-to-Buy-200-Boeing-737-MAX-Airplanes

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.