Weak Order Haul in May. Airbus A321XLR Successfully Completes First Flight

by J. Kasper Oestergaard, European Correspondent, Forecast International.

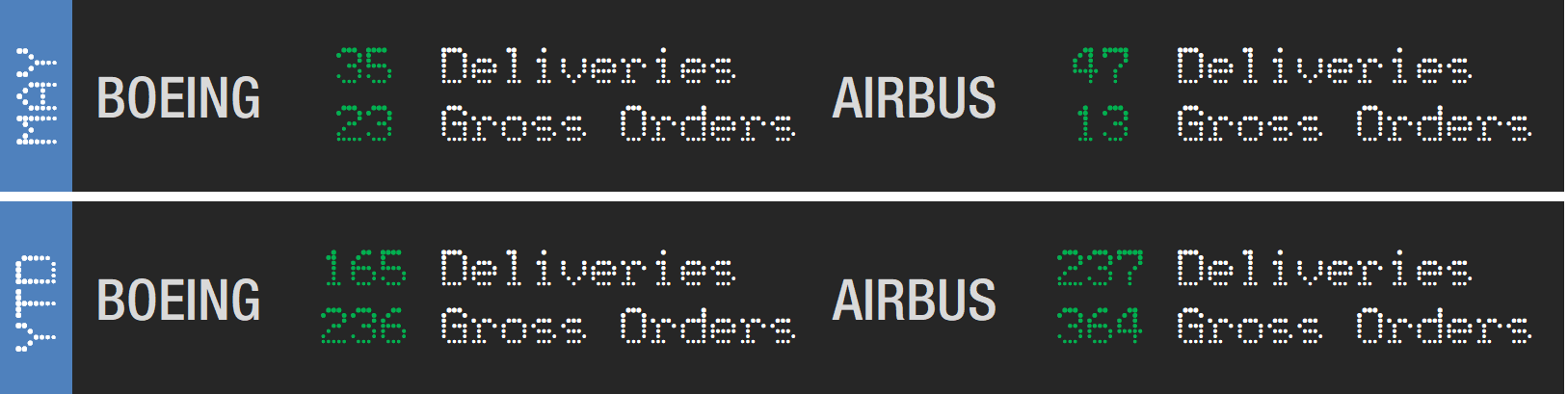

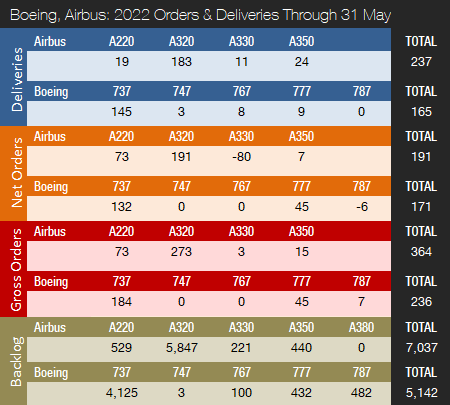

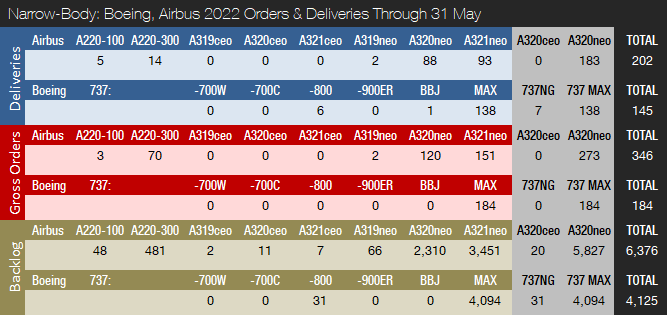

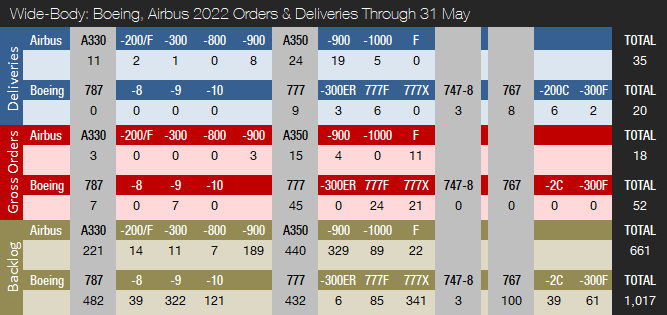

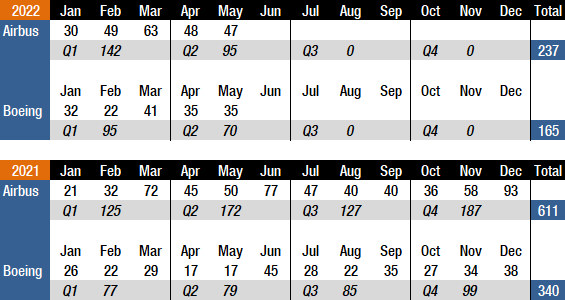

Boeing and Airbus delivered 35 and 47 commercial jets in May 2022, compared to 17 and 50 deliveries, respectively, in the same month last year. Year-to-date, Boeing and Airbus have delivered 165 and 237 aircraft, compared to 111 and 220, respectively, in the first five months of 2021. So far this year, Boeing and Airbus are 54 and 17 deliveries ahead of last year’s totals.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021 was a year of recovery for the two largest commercial plane makers. 2022 is well underway and is expected to be another year of recovery for the commercial aircraft manufacturing industry, despite events currently unfolding in Ukraine. Boeing and Airbus still have a long way to go before deliveries are back to pre-pandemic levels, though.

For the full year 2021, Boeing delivered 340 aircraft, compared to 157 in 2020 and 380 in 2019. Boeing’s last “normal” year was 2018 – before COVID-19 and the 737 MAX grounding – when it delivered 806 jets, a level that will likely not be recaptured before 2024 or 2025. The past three years have been extremely challenging for Boeing but, despite ongoing Dreamliner quality issues and 777X delays, the outlook is bright.

The 737 MAX is approved to fly in nearly every country, and since late 2020, the fleet has flown more than one million flight hours. The aircraft, however, has not yet returned to commercial service in China despite the fact that the Civil Aviation Administration of China (CAAC) ungrounded the 737 MAX in December of last year. For example, China Eastern Airlines recently announced that aircraft modifications and further pilot training are needed before it can resume commercial service with the aircraft. The top reason for the 737 MAX’s absence in the skies over China is most likely the nation’s zero-COVID approach, which has wreaked havoc on domestic air travel; hence, there has been no need to add the 737 MAX capacity. In mid-June it was reported that China Southern Airlines is making test flights, as domestic demand is now looking to pick up again.

In 2021, Airbus delivered 611 aircraft and won the deliveries crown for the third year in a row. Deliveries were up from 566 in 2020 but remain well below the company’s all-time record high of 863 shipments in 2019. Airbus is expected to retain the deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Prior to 2019, Boeing had out-delivered Airbus every year since 2012.

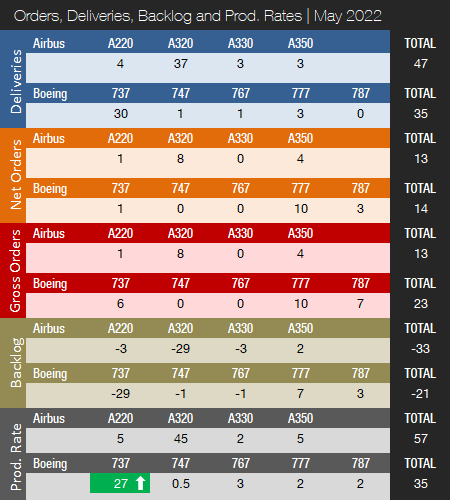

As indicated above, in May 2022, Boeing delivered 35 jets, including 30 737s (29 MAX / 1 NG), one 747, one 767, and three 777s. The 737 program is currently producing at an official rate of 27 per month, up from 19 as of the end of October 2021, and was aiming to reach a near-term target of 31 per month in the second quarter. However, according to The Seattle Times, delays in the supply of parts have resulted in a slowdown in production. Instead of rolling unfinished planes through the build line and out onto the field for later installation of missing parts, which is the company’s normal approach, Boeing is pausing planes on the moving line. Production work proceeds on various sections of the jets during these pauses and did not come to a complete halt. It is unknown if the 737 rate target of 31 will be postponed due to these issues. According to Reuters, Boeing has preliminary plans to boost 737 production to 38 jets per month in the first half of 2023, followed by another increase to 47 jets per month by the end of 2023.

Dreamliner deliveries have now been suspended for more than a year, and it is unknown when shipments will resume. Boeing suspended Dreamliner deliveries in May 2021 for the second time in less than a year. The U.S. Federal Aviation Administration is reviewing Boeing’s method for inspecting and evaluating the aircraft to ensure it meets federal safety regulations. In February, the head of the FAA, Steve Dickson, stated that the agency needs a “systemic fix” from Boeing to address Dreamliner production issues and would not allow the company to self-certify individual new jets when deliveries resume. However, the FAA has acknowledged that Boeing is heading in the right direction.

The FAA wants Boeing to ensure it has a robust plan for the rework that it performs on a large number of new 787s in storage and demonstrate that its delivery processes are stable. According to Boeing, the company is continuing to complete comprehensive inspections across the 787 production system and within the supply chain, while holding detailed, transparent discussions with the FAA, suppliers, and customers. The company continues to perform rework on 787 airplanes in inventory and is engaged in detailed discussions with the FAA.

In late April, Dave Calhoun, Boeing’s president and CEO, announced that rework has been completed on the initial 787s and that the company continues to work closely with the FAA on the timing of a resumption of deliveries. Boeing has advised key airlines and parts suppliers that Dreamliner deliveries would resume in the second half of 2022. At the end of last year, Boeing had 110 Dreamliners in storage (manufactured but not yet certified). The current 787 production rate is approximately two aircraft per month, and Boeing expects to continue at this rate until deliveries resume and then return to five per month over time. In March this year it was reported that the company is currently testing the ability of suppliers to meet output scenarios as high as seven per month by the end of 2023.

The 777 program was expected to get a new addition in late 2023 with the first delivery of the 777X, but in April Boeing announced this will now not happen before 2025. This reflects an updated assessment of the time required to meet certification requirements. According to Boeing, the 777-9 production rate ramp-up is being adjusted to minimize inventory and the number of planes requiring “change incorporation,” including a temporary pause through 2023. However, Boeing is taking advantage of the adjustment to the 777-9 production schedule by adding 777 freighter capacity starting in late 2023. In January of this year, Boeing launched a new 777X-based freighter, thereby expanding its 777X and cargo portfolio. Qatar Airways will be the 777-8F launch customer.

In May 2022, Airbus delivered 47 jets, including four A220s, 37 A320s (all NEO), three A330s, and three A350s. During 2021, Airbus steadily increased A320 production from 40 per month to 43 in Q3 2021 before finishing the year at a rate of 45 per month. Production will continue to be increased until reaching a monthly rate of 65 by the summer of 2023. Airbus has also discussed a scenario with a rate of 70 by Q1 2024. On May 4, Guillaume Faury, the CEO of Airbus, announced that the company continues to see strong growth in commercial aircraft demand driven by the A320 family. As a result, Airbus is now working with its supply chain to increase the A320 production rate to 75 aircraft per month in 2025. The A321XLR successfully accomplished its first flight on June 15, 2022. Entry into service, initially planned for the end of 2023, is now expected to take place in early 2024.

The A220, meanwhile, is being produced at a rate of five aircraft per month. The rate will be increased to six in the coming months – with a monthly production rate of 14 envisioned by the middle of the decade. The A350 production rate currently averages five per month and will be increased to six by early 2023. Airbus is currently producing two A330s per month, a rate that will be increased to nearly three aircraft by the end of 2022.

In 2021, Airbus launched the new A350 freighter, or A350F, which is a major and much-needed boost to the company’s competitiveness in the cargo segment. Boeing has long dominated the cargo space with its 737-800BCF, 767-300BCF, 767-300F, 777F, 777-8F and 747-8F offerings. Until now, Airbus has only offered the A330-200F, which has not performed well in competition against Boeing’s popular 767-300F. With the launch of the A350F, it appears Airbus is getting serious about capturing more of the cargo aircraft market. The A350F, which carries up to 120 tons (109 metric tons) of cargo, received its first order in November and will predominantly compete with the 777F. In comparison, the 777F has a cargo capacity of up to 112 tons (102 metric tons).

Recently, Airbus urged European leaders to not impose sanctions on titanium imports from Russia. Airbus argues that sanctions on the metal would damage aerospace in Europe while barely hurting the Russian economy. Airbus relies on Russia for half its titanium needs, compared to one-third for Boeing. In early March, Boeing said it had suspended Russian titanium purchases. Despite this challenge, Airbus has announced that its titanium sourcing needs are covered in the short and medium terms and recently reaffirmed its 2022 guidance. However, the company is accelerating its search for non-Russian supplies. Both Airbus and Boeing have been stockpiling titanium in recent months.

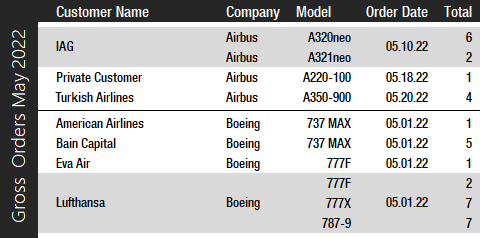

Turning to the May orders review, both companies had a weak month. Boeing booked orders from four customers for a total of 23 jets. The company also reported nine cancellations (five 737 MAXs and four 787s), resulting in 14 net new orders in total. The largest order was placed by Lufthansa and included seven 777Xs, seven 787-9s, and two 777Fs. Also, Bain Capital ordered five 737 MAXs, while American Airlines ordered a single 737 MAX. Finally, Eva Air ordered one 777 freighter. Year-to-date, Boeing has accumulated 171 net new orders (236 gross orders). In 2021, Boeing booked 909 gross orders and received 430 cancellations, for a total of 479 net new orders (before ASC 606 changes). In 2020, Boeing accumulated a total of 184 gross orders and received 655 cancellations, for a total of -471 net new orders.

Due to events unfolding in Ukraine and sanctions on aircraft deliveries to Russia, Boeing expects that up to 141 jets it has on order – 90 of which are 737 MAX aircraft – could be affected and potentially removed from its books. Please note that for comparison reasons, we do not include these so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

In May, Airbus booked orders from three customers for a total of 13 jets and reported no cancellations. Anglo-Spanish airline holding company International Airlines Group (IAG) ordered six A320neos and two A321neos. Also, Turkish Airlines ordered four A350-900s, followed by an order for a single A220-100 placed by a private customer.

Year-to-date, Airbus has accumulated 191 net new orders (364 gross orders). In 2021, Airbus booked a total of 771 gross orders and received 264 cancellations, for a total of 507 net new orders – enough to win the orders crown for the third year in a row. It should be noted, however, that if Boeing’s 2021 ASC 606 adjustments are included, Boeing comes out ahead with 535 net new orders. In 2020, Airbus accumulated 383 gross orders and received 115 cancellations, for a total of 268 net new orders.

At the end of May 2022, Airbus reported a backlog of 7,037 jets, of which 6,376, or 91 percent, were A220 and A320ceo/neo family narrowbodies. This is 688 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of May, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,142 aircraft, of which 4,125, or 80 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.2 years of shipments at the 2019 production level (the pre-pandemic level), or 11.5 years based on the 2021 total. In comparison, Boeing’s backlog would “only” last 6.4 years at the 2018 level (the most recent “normal” year for Boeing), or 15.1 years based on 2021 deliveries. In 2022 to date, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, is 1.04. Airbus’ book-to-bill ratio is 0.81. In 2021, Boeing’s book-to-bill ratio was 1.41, while Airbus reported a book-to-bill of 0.81.

2022 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2022, Forecast International’s analysts currently expect Boeing and Airbus to deliver 450 and 702 commercial jets, respectively. Compared to the 2021 level, this is a 32.4 percent increase for Boeing and a 14.9 percent increase for Airbus.

Boeing released first quarter 2022 results on April 27 but did not provide any updated guidance on deliveries. Airbus expects to deliver 720 commercial aircraft in 2022 and, as the basis for its 2022 guidance, the company assumes no further disruptions to the world economy, air traffic, and its own internal operations. The company released Q1 2022 earnings on May 4 and reaffirmed its 2022 guidance.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://boeing.mediaroom.com/2022-04-27-Boeing-Reports-First-Quarter-Results

- https://boeing.mediaroom.com/news-releases-statements?item=131041

- https://boeing.mediaroom.com/2022-05-09-Lufthansa-Group-Selects-New-777-8-Freighter,-Orders-Additional-787s

- https://www.airbus.com/en/newsroom/press-releases/2022-06-airbus-a321xlr-takes-off-for-the-first-time

- https://www.airbus.com/en/a321xlr-first-flight

- https://www.airbus.com/en/newsroom/press-releases/2022-05-airbus-reports-first-quarter-q1-2022-results

- https://www.seattletimes.com/business/boeing-aerospace/supply-chain-issues-slowing-boeing-737-max-production/

- https://www.reuters.com/business/aerospace-defense/exclusive-boeing-tells-airlines-787-deliveries-restart-second-half-2022-sources-2022-04-20/

- https://www.reuters.com/business/aerospace-defense/exclusive-boeing-tests-suppliers-787-output-hikes-sources-2022-03-11/

- https://www.reuters.com/business/aerospace-defense/airbus-accelerates-hunt-alternative-titanium-supplies-2022-04-12/

- https://www.reuters.com/business/aerospace-defense/china-southern-boeing-737-max-makes-test-flights-domestic-demand-picks-up-2022-06-15/

- https://www.reuters.com/business/aerospace-defense/boeing-suspends-part-its-business-russia-wsj-2022-03-07/

- https://www.barrons.com/articles/boeing-737-max-china-51648726661

- https://apnews.com/article/technology-business-china-8848390bcb40e14ef8a177fb99ec100b

- https://www.reuters.com/business/aerospace-defense/exclusive-boeing-aims-nearly-double-737-max-production-by-end-2023-sources-2022-03-05/

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes 75 individual reports, most with a 10-year unit production forecast. Click here to learn more.

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.