Weak ordering activity /// Boeing announces temporary Dreamliner rate cut

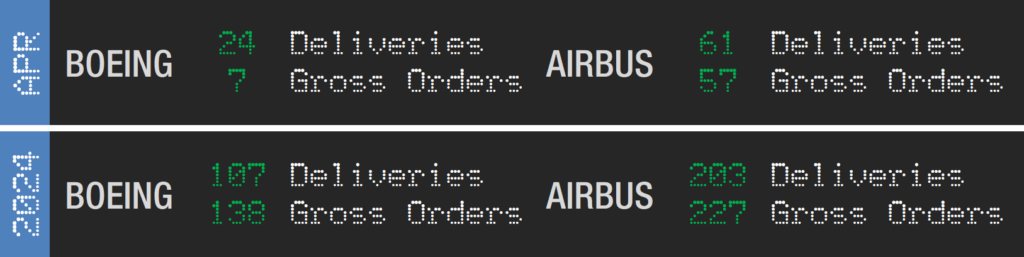

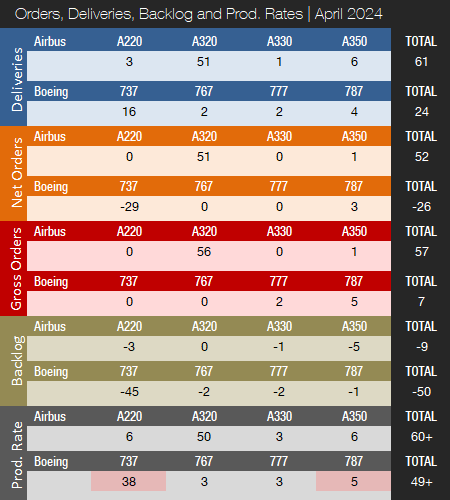

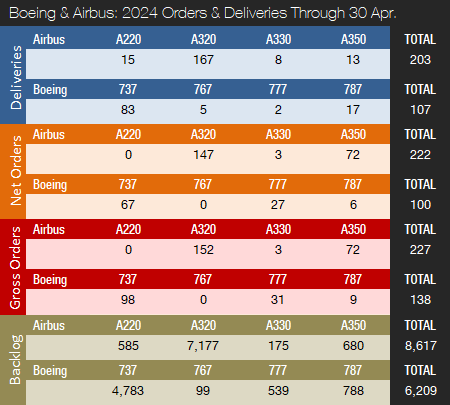

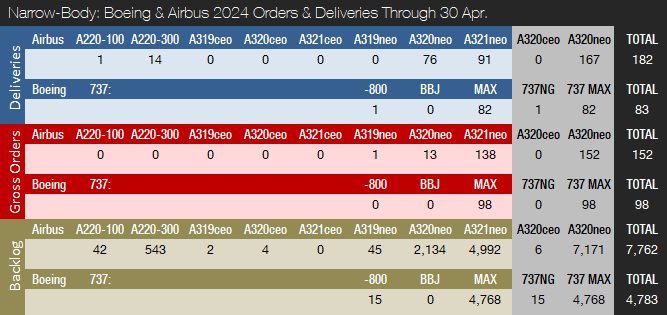

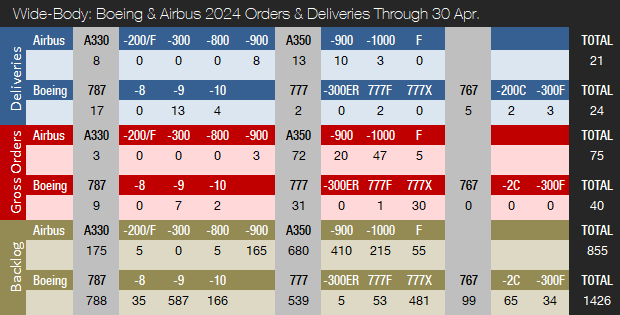

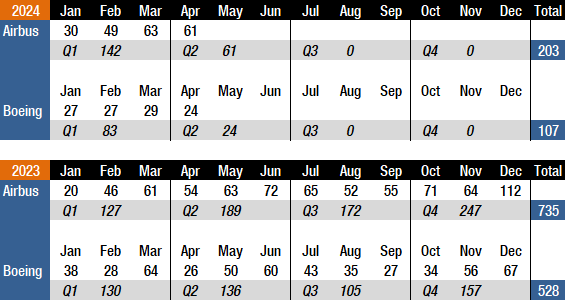

The month of April was a rather uneventful month for orders and deliveries. On the deliveries front, Boeing handed over 24 commercial jets compared to Airbus with 61 units. This compares to 26 deliveries for Boeing and 54 for Airbus in April of last year. Increased quality checks and audits by regulators were the reason for the slip in Boeing’s March and April deliveries. Boeing is busy incorporating improvements to its quality management system and is implementing a comprehensive action plan to address feedback from the FAA 737 production audit. Boeing has opted to slow its production of the 737 MAX until it feels ready to return to the official production rate of 38 jets per month. Year-to-date, Boeing and Airbus have delivered 107 and 203 aircraft compared to 156 and 181, respectively, during the first four months of 2023. As of April, Boeing is 49 deliveries behind compared to last year’s totals to date, while Airbus is 22 deliveries ahead. In 2023, in total, Boeing and Airbus delivered 528 and 735 aircraft compared to 480 and 663, respectively, in 2022. In 2023, Airbus won the deliveries crown for the fifth consecutive year.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021-23 were recovery years for the two largest commercial plane makers. Most likely, 2024 will be another year of recovery on the deliveries front followed by new records in 2025 and beyond. Boeing still has quite a way to go before setting new all-time company deliveries records, whereas Airbus will likely finish the year just below the pre-pandemic level. In 2018, before COVID-19 and the first 737 MAX grounding, Boeing delivered 806 jets, a level that will likely not be recaptured before the 2025-26 timeframe. Airbus’ record high of 863 shipments was set in 2019, a level that will likely be surpassed in 2025. Also, Airbus is expected to retain their deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Before 2019, Boeing had out-delivered Airbus every year since 2012.

As indicated above, in April, Boeing delivered 24 jets, including 16 737s (all MAXs), two 767s, two 777s, and four 787s. Last year, the 737 program was producing aircraft at an official rate of 31 per month. At the end of 2023, the program completed the transition to 38 aircraft per month. However, increased quality checks and audits by regulators in the aftermath of the Alaska Airlines Flight 1282 incident mean that Boeing is currently producing 737 MAXs at a lower rate. In March, Boeing Chief Financial Officer, Brian West, stated: “We are the ones who made the decision to constrain rates on the 737 program below 38 per month until we feel like we’re ready.” Boeing hopes to return to its official production rate in the second half of this year. Boeing’s plans to increase production to approximately 50 737 MAX jets per month in the 2025/26 timeframe are still in effect. The target of 50 per month compares to the pre-crash/pre-pandemic rate of 52 737s per month in 2018. Last year, it was reported that the company is planning to boost production to 52 jets per month by January 2025. Boeing will open a new 737 MAX production line in Everett in the second half of 2024. The new line is in addition to the three lines currently in place at Renton. For now, in the aftermath of the Alaska Airlines Flight 1282 incident, the program will remain at 38 aircraft per month. Boeing ended the year with 205 737 MAX jets in inventory, up five from Q4 2023. Boeing expects most of the inventoried jets to be delivered by the end of 2024. The company is still producing 737 NGs but now only has 15 737-800s remaining in backlog.

The 787 program is currently ramping up production. In January of this year, the 787 production rate was raised to five per month, and more increases will follow until the program reaches the current target of 10 aircraft per month by 2025/26. However, Boeing is for now reducing the 787 rate to four before returning to five later this year. Boeing ended the year with 60 Dreamliners in inventory, unchanged from Q4 2023.

The 767 program is currently producing jets at a rate of three units per month, a mix of KC-46 tankers (based on the 767-2C) and 767-300 freighters. The 777 program is currently pushing out aircraft at a rate of three per month. Most aircraft in backlog are 777 freighters, with only five 777-300ERs left. The 777 program was expected to get a new addition in late 2023 with the delivery of the first 777X, however, the 777X’s entry into service was postponed to 2025. Boeing recently reaffirmed the first delivery of the 777X will happen next year as planned. Boeing will also launch a new 777X-based freighter, thereby expanding its 777X and cargo portfolio. By the 2025/26 timeframe, Boeing expects to be delivering four 777s per month.

In April, Airbus delivered 61 jets, including three A220s, 51 A320s (all NEO), one A330, and six A350s. On average, the company delivered 48 A320s per month in 2023 compared to 43 in 2022. Production is currently being increased, however, Airbus is no longer releasing their production rate changes and prefers to announce in what year they will reach a certain rate. At this time, we consider the unofficial A320 production rate to be 50 per month. The A320 program is expected to reach a monthly rate of 65 by late 2024. We can therefore expect a series of monthly production increases this year. Also, Airbus is working with its supply chain to increase A320 production to 75 aircraft per month in 2026. The commercial aircraft fleet is getting a new addition this year with the entry-into-service of the A321XLR. The first production aircraft entered into the final assembly line in December 2023 with entry-into-service expected to take place in Q3 2024.

The A220, meanwhile, is being produced at a rate of six aircraft per month, with a monthly production rate of 14 expected by 2026. Airbus is reportedly considering to introduce a stretch version of the A220.

The A330 production rate was increased from two aircraft per month to three at the end of 2022, with an increase to four per month expected this year. The A350 production rate was raised to six per month at the end of 2023 in line with Airbus’ announcements. Airbus expects to produce 10 A350s per month by 2026 and 12 by 2028.

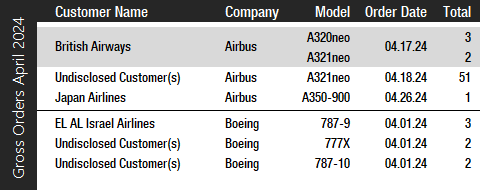

Turning to the April orders review, in terms of reported bookings, Boeing had a very quiet month and reported just seven gross orders from three different customers. Israel’s national carrier, EL AL, ordered three 787-9s while two undisclosed customers ordered two 777Xs and two 787-10s, respectively. Boeing reported 29 737 MAX cancellations in April as well as two 777 and two 787 cancellations, resulting in -26 net new orders. Year-to-date, Boeing has accumulated 100 net new orders (138 gross orders), compared to 69 net new orders (154 gross orders) in the first four months of last year. In 2023, Boeing booked a total of 1,314 net new orders (1,456 gross orders) – before ASC 606 changes – compared to 774 net new orders (935 gross orders) in 2022. Please note that for comparison reasons, we do not include Boeing’s so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

In April, Airbus booked orders from three customers for a total of 57 jets (gross orders) and reported five A320neo Family cancellations. The largest order for 51 A321neos was placed by an undisclosed customer. Meanwhile, British airways booked three A320neos and two A321neos, followed by a single A350-900 for Japan Airlines. Year-to-date, Airbus has accumulated 227 gross orders (five cancellations => 222 net new orders), compared to 144 net new orders (161 gross orders) in the first four months of last year. In 2023, Airbus won the orders crown for the fifth consecutive year booking an astounding 2,094 net new orders (2,319 gross orders), compared to 820 net new orders (1,078 gross orders) in 2022.

At the end of April, Airbus reported a backlog of 8,617 jets, of which 7,762, or 90 percent, were A220 and A320ceo/neo family narrowbodies. Airbus’ all-time backlog record was set in March 2024 when the company reported a backlog of 8,626 jets. Both manufacturers will likely set additional backlog records this year. By the end of last month, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 6,209 aircraft, of which 4,828, or 77 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog record of 6,259 aircraft was set in March 2024. The number of Airbus aircraft to be built and delivered represents 10 years of shipments at the 2019 production level (the pre-pandemic level), or 11.7 years based on the 2023 total. In comparison, Boeing’s backlog would “only” last 7.7 years at the 2018 level (the most recent “normal” year for Boeing), or 11.8 years based on 2023 deliveries. Boeing’s book-to-bill ratio year-to-date, calculated as net new orders divided by deliveries, is 0.93 with Airbus coming in a bit higher at 1.09. Boeing’s book-to-bill ratio last year was 2.49 with Airbus coming in even higher at 2.85. This means that both companies received well over two new firm orders for every aircraft delivered.

2024 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2024, Forecast International’s analysts currently expect Boeing and Airbus to deliver 573 and 797 commercial jets, respectively. Please note that these figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon maritime patrol aircraft and KC-46 Pegasus tanker and Airbus’ A330 MRTT tanker.

In its current year guidance, Airbus expects to deliver 800 planes in 2024, compared to 735 delivered in the previous year. Meanwhile, Boeing decided to forgo issuing their 2024 production forecast as it focuses on safety and quality improvements in the aftermath of the Alaska Airlines incident. Boeing reported first-quarter results on April 24 and reiterated the focus on safety and fixing its quality management system. Airbus reported Q1 2024 results on April 25 and reiterated its previous guidance.

Note: Light red color for production rates means the program is temporarily producing at a lower rate than what is indicated in the table.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://boeing.mediaroom.com/2024-04-24-Boeing-Reports-First-Quarter-Results

- https://s2.q4cdn.com/661678649/files/doc_financials/2024/q1/1Q24-Earnings-Call-Transcript.pdf

- https://www.airbus.com/en/newsroom/press-releases/2024-04-airbus-reports-first-quarter-q1-2024-results-6r5vg

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.