Bombardier Takes Top Spot as Cirrus and SR22T Lead Unit Sales /// Honeywell Predicts 8,500 Business Jet Deliveries over Next 10 Years in New Forecast

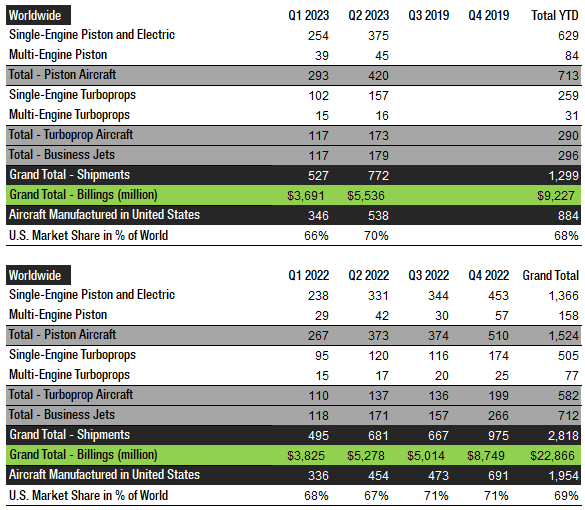

With NBAA-BACE 2023 well underway in Las Vegas, now is a good time to check up on the performance and health of the business aviation industry. According to figures released by the General Aviation Manufacturers Association (GAMA), in the second quarter of 2023, manufacturers reported very strong results. Fixed-wing business aviation aircraft manufacturers delivered 772 aircraft worldwide in Q2 2023, up 18.5% from 681 in Q2 2022. In Q1 2023, shipments were up 6.5% year-over-year. In Q2 2023, sales (billings) at the same time increased 4.9% to $5.5 billion year-over-year, mainly due to a strong quarter by Embraer, increased Gulfstream sales compared to Q2 2022, and very strong results by smaller manufacturers such as Cirrus Aircraft, Air Tractor and Daher. The turboprop segment led the increase in deliveries with 173 units in Q2 2023, a 26.3% increase from the same period in 2022. Piston airplane shipments increased 12.6% year-over-year, while business jet deliveries were up 4.7%.

U.S. manufacturers delivered 538 aircraft in Q2 2023 up from 454 in Q2 2022 equal to an 18.5% decrease. Manufacturers in the U.S. accounted for 70% of worldwide shipments in the second quarter up from 67% in Q2 last year. Meanwhile, European manufacturers shipped 210 aircraft in Q2 2023 up from 206 in Q2 2018 equal to a 1.9% decrease. The U.S. and Europe clearly dominate world business aviation aircraft production with a combined 97% market share. Even Embraer has much of its business jet production in the U.S. at its facility in Melbourne, Florida.

In Q2 2023, the Cirrus SR22T (piston) was the most popular fixed-wing general aviation aircraft with 84 units delivered (+31 from Q2 2022). The Cessna CE-172S Skyhawk SP (piston) took second place with 54 shipments – up from 42 in Q2 2022, followed by the Cirrus SR22 with 39 shipments, up six units from last year. In fourth place, we have the Piper PA-28-181 (piston) with 38 units delivered, ahead of the Diamond DA42 (piston – 33 delivered), the Cirrus SR20 (piston – 28), Pilatus’ PC-12 (turboprop – 28), the Cirrus SF50 Vision Jet (business jet – 26), TECNAM’s P-Mentor (piston – 20), and Cessna’s Grand Caravan EX (turboprop – 19).

In the second quarter of 2023, Cirrus delivered more aircraft than any other manufacturer. The company had a strong quarter and shipped 177 aircraft compared to 132 in Q2 2022. Textron Aviation (Cessna + Beechcraft) also had a good quarter and delivered 158 aircraft, up from 144 in Q2 last year. In third place, we have Diamond Aircraft with 71 shipments, down from 76 in Q2 2022, followed by TECNAM, Air Tractor, Piper Aircraft, Pilatus, Embraer, Bombardier, Gulfstream, and CubCrafters.

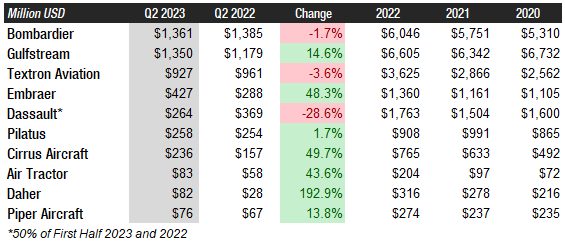

When business aviation aircraft manufacturers are ranked by sales (billings), the business jet manufacturers take the lead. Bombardier boasted the highest sales of all fixed-wing business aircraft manufactures in Q2 2023 with total sales of $1.36 billion, down 1.7% from the same period last year. Already delivering more business jets, Bombardier has nearly closed the sales gap to its American rival and could this year, for the first time since 2012, surpass Gulfstream’s annual billings. However, this will likely only occur if meaningful G700 deliveries slip into 2024. The G700 flight test program is nearing completion and certification and service entry by the U.S. Federal Aviation Administration (FAA) are planned for Q4 2023. Initially planned to occur in the fourth quarter of 2022, certification of the aircraft has been delayed due to a number of issues. Gulfstream has been the world’s largest general aviation aircraft manufacturer by annual sales revenues since 2013. The company reported Q2 2023 sales of $1.35 billion, up 14.6% from Q2 2022. Textron Aviation (Cessna + Beechcraft) reported sales of $927 million in Q2 2023, down 3.6% from $961 million in the second quarter last year. In fourth place, Embraer had a banner quarter and reported billings of $427 million, up a whopping 48.3%. Dassault reported sales of $264 million, down 28.6% from Q2 2022 slightly ahead of Pilatus with $258 million, up 1.7% year-over-year. Cirrus Aircraft reported sales of $236 million and up nearly 50% due to strong SR22/T and SF50 shipments. Air Tractor has been on a tear these past few years and the company’s Q2 2023 sales were up 43.6% year-over-year. In fact, Air Tractor just exceeded its total 2020 annual sales in just one quarter. Daher’s sales were up nearly 200%, however, Q2 2022 was very weak and therefore not representative for a normal quarter for the French manufacturer. Daher has been growing well in recent years and the company’s success depends on their TBM 960 turboprop flagship model. At a press conference at NBAA-BACE 2023 yesterday, Daher celebrated the 500th delivery of a TBM 900-series aircraft. In tenth place, Piper Aircraft reported sales of $76 million, up nearly 14% compared to Q2 2022.

Honeywell Global Business Aviation Outlook

In their 32nd Global Business Aviation Outlook released on October 15, Honeywell predicts strong demand for new business jets and an increased focus on reducing emissions. The company forecasts up to 8,500 new business jet deliveries worth $278 billion from 2024 to 2033, which is in line with the same 10-year forecast a year ago.

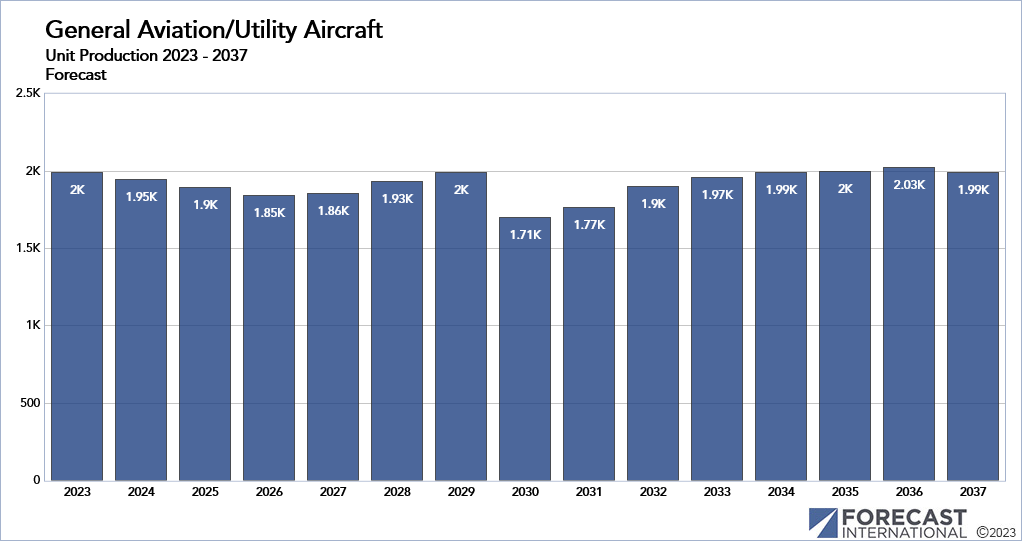

Forecast International’s Business Aviation Forecasts

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology which – among many other features – provides 15-year production forecasts. All results are displayed as bar graphs, pie charts and unit and value of production charts — presented as line items by manufacturer — for instant analysis. All forecast data are complemented by full market reports, Forecast Rationales, Excel spreadsheets, and more. The author has used the Platinum Forecast System’s Civil Aircraft module to retrieve the latest Business Jet Aircraft and General Aviation/Utility Aircraft forecast data. Example 15-year unit production forecasts, as presented in the Platinum Forecast System, for these two markets are presented below. For a full demonstration please sign up here.

References:

- https://gama.aero/facts-and-statistics/quarterly-shipments-and-billings/

- https://www.globalair.com/articles/daher-celebrates-500th-tbm-900-series-delivery?id=6514

- https://www.honeywell.com/us/en/press/2023/10/honeywell-forecast-shows-strong-demand-for-new-business-jets-increased-focus-on-reducing-emissions

- https://flightplan.forecastinternational.com/2023/09/11/gulfstream-reveals-range-increase-for-new-g700-business-jet/

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.