What to expect from the Middle East’s largest aerospace event /// First major orders announced with more – perhaps much bigger – likely to follow in the coming days

Dubai Airshow 2023, the largest aerospace event in the Middle East, opened Monday morning. The event takes place in the UAE, which is a federation of seven sheikhdoms (emirates). The venue is Al Maktoum International Airport, also known as Dubai World Central (DWC), the city’s newest airport, which is gearing up for major expansion in the coming decades. The event ends on Friday and more than 1,400 exhibitors are in attendance with over 180 aircraft on flying and static display. Dubai Airshow also features nine industry conference tracks led by more than 300 speakers. The event is organized by Tarsus Aerospace under the patronage of Sheikh Mohammed bin Rashid Al Maktoum, Ruler of Dubai and Vice President and Prime Minister of the UAE, in cooperation with the Dubai Civil Aviation Authority (DCAA), Dubai Airports, DWC, and the United Arab Emirates Armed Forces.

The biennial event traces its roots back to 1986 when a small trade show called Arab Air was held at Dubai World Trade Center. The first Dubai Air Show took place in 1989 with just 200 exhibitors and 25 aircraft. At the Dubai Airshow 2021, 40% of visitors were from the business and general aviation sector, 28% from the commercial aviation side, 20% from defense, and 12% from space. Two years ago, as many as 68% of attendees were from the Middle East and North Africa followed by 10% from Europe, 7% from the Americas, with other regions accounting for the remaining 15%.

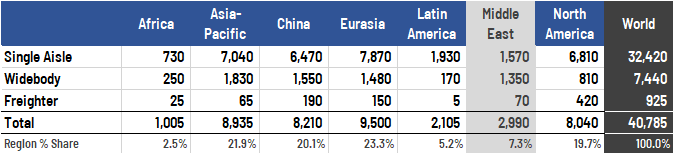

The Middle East is not surprisingly an important region for the aerospace industry. In the company’s annual Commercial Market Outlook (CMO), Boeing is forecasting 2.8% average annual economic growth (GDP) in the region out to 2042, annual passenger growth of 6.0%, and fleet growth of 4.5%. Over the coming 20 years, 2,990 large commercial jets will be delivered in the Middle East or 7.3% of all large commercial aircraft shipments worldwide. This will result in an increase in the fleet from 1,365 aircraft today to 3,310 aircraft by 2042. According to Boeing, airlines in the Middle East have increasingly expanded their influence and reach, transforming the region into an international air transit hub. The unique thing about Middle East commercial aircraft demand is the dominance of widebody aircraft for long-haul flights. Boeing forecasts that 45% of the 2,990 aircraft to be delivered in the region over the next two decades will be wide-body jets. No region in the world has a higher percentage of widebodies entering the fleet. This also means that the Middle East’s value share will be significantly higher than the 7.3% share of commercial jet deliveries.

Boeing Commercial Market Outlook: World Large Commercial Jet Deliveries 2023-42

Source: The Boeing Co.

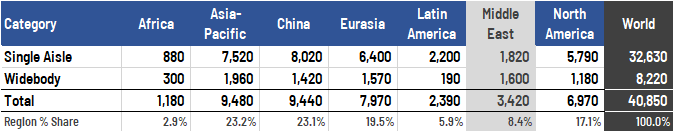

Out to 2042, in their Global Market Forecast (GMF), Airbus predicts that 3,420 large commercial passenger and cargo aircraft (>100 passengers) will be delivered to airlines based in the Middle East, of which 46.8% are wide-body jets. According to Airbus, the Middle East will account for 8.4% of world deliveries out to 2042.

Airbus Global Market Forecast: World Large Commercial Jet Deliveries 2023-42

Source: Airbus SAS

According to the International Air Transport Association (IATA), airlines in the Middle East, experienced a 27% increase in traffic during the month of September compared to the same month last year. Air travel has come back strong following COVID and will set new records this year and beyond, which translates into strong demand for new efficient aircraft in the Middle East and elsewhere.

Shifting our focus back to Dubai, air traffic is expected to grow rapidly out to 2050. The city’s two main airports have come back strong after COVID and are set for colossal expansion in the coming decades. With 66.1 million passengers handled in 2022, Dubai International Airport (DXB) was the fifth largest in the world. In the first half of 2023, the airport handled 41.6 million passengers, surpassing 2019 levels for the same period. According to industry experts, the annual figure will likely reach 85 million. It is expected that the airport will be able to accommodate up to 120 million annual passengers within 15 years. Dubai’s newest airport, Al Maktoum International Airport / Dubai World Central (DWC), only handled 1.6 million passengers last year (cargo focus), but the Emiratis are aspiring for much more and hope that it could grow to 260 million by 2050. The first stage of the DWC expansion project will increase the airport’s capacity to around 130 million passengers annually, followed by another 20 million during the second stage. According to analysis firm OAG Aviation, DXB is the world’s busiest international airport by number of departing aircraft seats – and well ahead of London Heathrow (LHR) in second place. By total seats (domestic and international), Hartsfield-Jackson Atlanta International Airport remains the world’s largest. Much is happening in aerospace all over the Middle East and in Dubai, where the first orders have already been announced.

Already before the official opening of the event, the first major orders hit the wire. Emirates placed a massive order for 90 777X jets comprised of 35 777-8s and 55 777-9s. At list prices (before discounts), the order is valued at $52 billion. With their newest order, Emirates is expanding its 777X backlog to 205 jets. The airline is also adding five more 787 Dreamliners, while converting 30 787-9s to 20 787-8s and 10 787-10s. “Emirates is the biggest operator of Boeing 777 aircraft, and today’s order cements that position,” said Sheikh Ahmed bin Saeed Al Maktoum, Chairman and Chief Executive, Emirates Airline and Group. “This order is an incredible vote of confidence in Boeing’s highly efficient widebody family and the versatility of our 777X and 787 airplanes to meet Emirates’ needs for global long-haul travel,” said Stan Deal, President and CEO of Boeing Commercial Airplanes. The 777-9 seats 426 passengers in a typical two-class configuration, with a range of 7,295 nm (13,510 km). The 777-8 seats 395 passengers with a range capability of up to 8,745 nm (16,190 km). In Dubai, Boeing has the 787-9 and 777X on display.

Also on day 1, Emirati low-cost airline, FlyDubai, announced an order for 30 Boeing 787-9 Dreamliners valued at $11 billion. SunExpress, a joint venture between Turkish Airlines and Lufthansa, placed a large order for 45 737 MAX single aisle jets with options for 45 additional aircraft. The deal comprises 28 737-8 and 17 737-10 models. Finally, Royal Air Maroc and Royal Jordanian announced orders for four and two 787-9 Dreamliners.

Airbus is making a big splash in Dubai and has the following aircraft on display: A321-211 P2F, A321neo, A330-800, A400M Atlas CMk1, A400M Atlas, C295M, and ACJ TwoTwenty. Meanwhile, Airbus today announced that airBaltic, the flag carrier of Latvia, will become the largest A220 customer in Europe after confirming a new order for an additional 30 A220-300s, taking the airline’s total firm orderbook to 80 aircraft. The airline was the launch customer for the A220-300 and currently operates a fleet of 44 aircraft of this type and is the largest operator in the world. An A350 order from Emirates appears to be on hold. According to industry sources, last-minute negotiations focused on the terms of an engine deal with Rolls-Royce. Also, Turkish Airlines could make a huge purchase of 355 aircraft from Airbus, including 250 A321neo aircraft, according to the Turkish state-run Anadolu news agency. According to Reuters, an Airbus spokesperson said on Monday that Turkish Airlines and Airbus had reached an agreement in principle for a “significant commercial aircraft order.” Turkish Airlines have reportedly discussed the purchase of 75 A350-900s, 15 A350-1000s, five A350 freighters as well as 250 A321neos, in addition to 10 A350-900s for which terms have already been agreed upon. The order has been on the drawing board for many months and some had expected it to be announced at this year’s Paris Air Show.

Also in the market for aircraft is Riyadh Air, a planned second flag carrier of Saudi Arabia. In March, the airline announced an order for up to 72 Boeing 787-9 Dreamliners and has plans to expand much further.

Business aviation players are also flocking to Dubai. Embraer is bringing their Praetor 600 and Phenom 100EV business jets, while the company’s commercial and military businesses are putting the E195-E2, A-29 Super Tucano and C-390 Millenium on display. Gulfstream, notably missing from last month’s BACE in Las Vegas, is showcasing the G500 and G700, while archrival Bombardier will present their Challenger 3500 and Global 7500 business jets. Dassault has the Falcon 10X mock-up and Falcon 2000LXS on display, while Pilatus is showcasing their PC-24 Super Versatile Jet. Also, many military aircraft will be on display at Dubai Airshow, including the Eurofighter Typhoon and Dassault Rafale fighter jets.

Get ready for an exciting week ahead at Dubai Airshow. At Forecast International, we are covering the event throughout the week and will report on major orders and provide insight into the latest industry trends, new product launches, and much more.

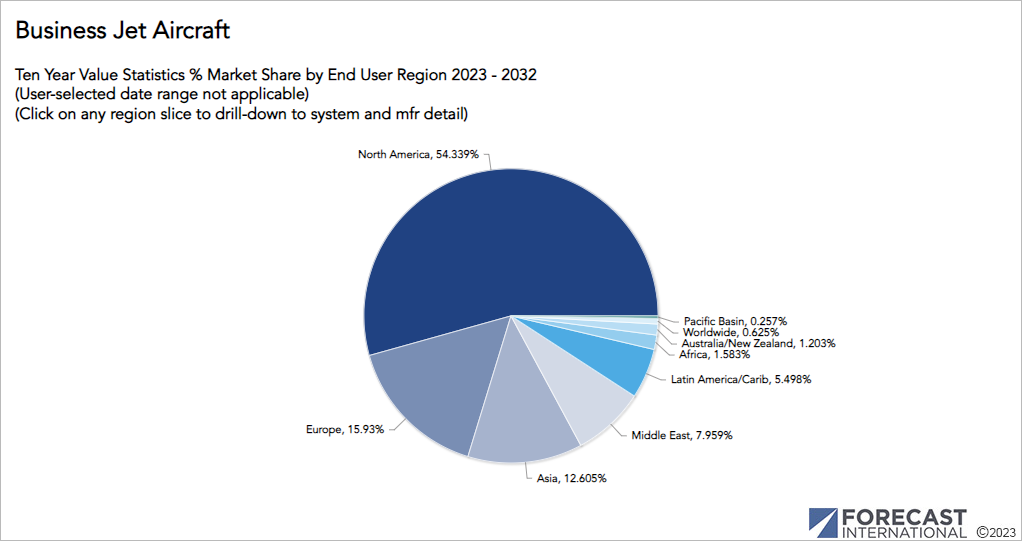

Taking a deep dive into our Civil Aircraft Forecast product, we currently predict that airlines in the Middle East will account for 13.2% of the value of world large commercial jet transport deliveries worldwide from 2023 to 2032. As we mentioned earlier in the article, while only accounting for some 7-9% of world deliveries, 45-47% of jets purchased in the Middle East over the next two decades are expected to be widebodies. It is therefore no surprise that aircraft such as the 777X, 787 and A350 will continue to be in high demand in the region in the future.

Turning to the market for business jet aircraft, over the next 10 years, the Middle East accounts for nearly 8% of the market (value share) and is the fourth most important world region.

References:

- https://www.dubaiairshow.aero/

- https://www.boeing.com/commercial/market/commercial-market-outlook/

- https://boeing.mediaroom.com/2023-11-11-Boeing-Middle-East-fleet-to-more-than-double-by-2042-with-new-technology-widebodies-leading-the-way

- https://boeing.mediaroom.com/2023-11-13-Emirates-Orders-Nearly-100-More-Boeing-Widebody-Airplanes

- https://boeing.mediaroom.com/2023-11-13-SunExpress-to-Buy-up-to-90-Boeing-737-MAX-Jets-to-Fuel-Robust-Growth

- https://boeing.mediaroom.com/2023-11-13-flydubai-Orders-30-Boeing-787-Dreamliners,-Its-First-Widebody-Airplanes

- https://boeing.mediaroom.com/2023-11-13-Royal-Jordanian-Grows-its-Long-Haul-Fleet-With-Order-for-Boeing-787-9-Dreamliners

- https://boeing.mediaroom.com/2023-11-13-Royal-Air-Maroc-Confirms-Order-for-Two-Boeing-787-Dreamliners

- https://www.airbus.com/en/products-services/commercial-aircraft/market/global-market-forecast

- https://www.airbus.com/en/newsroom/press-releases/2023-11-airbaltic-to-become-largest-airbus-a220-customer-in-europe

- https://www.reuters.com/business/aerospace-defense/airbus-agreement-reached-principle-turkish-airlines-order-2023-11-13/

- https://www.aerotime.aero/articles/turkish-airlines-eyes-355-aircraft-in-new-airbus-order

- https://www.aa.com.tr/tr/ekonomi/thy-tarihindeki-en-buyuk-ucak-alimi-icin-airbus-ile-gorusuyor/3050974

- https://www.dubaiairshow.aero/flying-display-programme

- https://www.dubaiairshow.aero/aircraft-list

- https://www.dubaiairshow.aero/exhibitor-list-exhibitor

- https://airwaysmag.com/history-dubai-airshow/

- https://apnews.com/article/dubai-air-show-israel-hamas-russia-ukraine-d2ca068f0c88592c60eb9f11737baa46

- https://www.euronews.com/travel/2023/08/29/dubai-airports-set-for-colossal-expansion-how-much-will-plans-cost-the-county-and-climate

- https://aci.aero/2023/07/19/aci-world-confirms-top-20-busiest-airports-worldwide/

- https://daep.gov.ae/our-airports/al-maktoum-international-dwc/dwc-the-ultimate-airport/

- https://gulfnews.com/business/aviation/dubai-airshow-2023-takes-off-live-updates-from-day-1-at-one-of-worlds-biggest-airshows-1.1699809819184

- https://www.oag.com/en/busiest-airports-world

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.