Airbus takes deliveries and orders crowns in 2022 despite a Boeing orders surge in December /// 2023 expected to be another year of recovery. Industry not to surpass pre-COVID shipment levels before 2024-25.

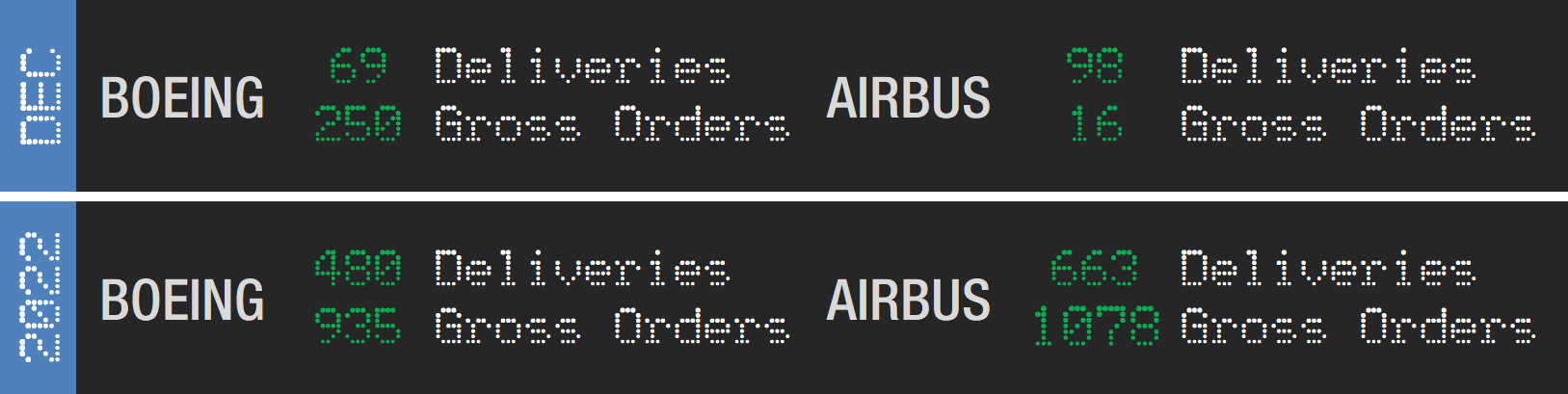

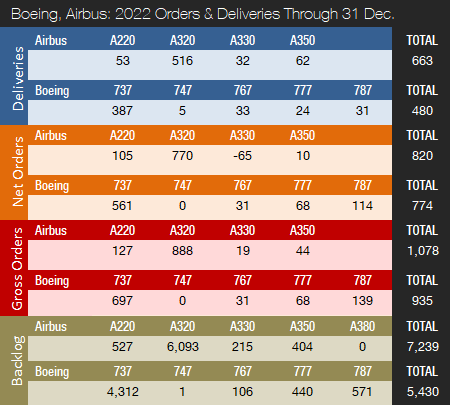

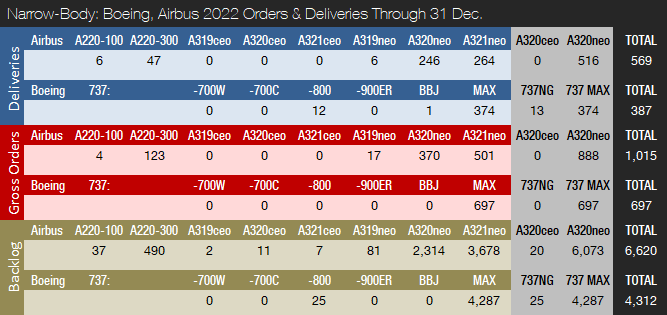

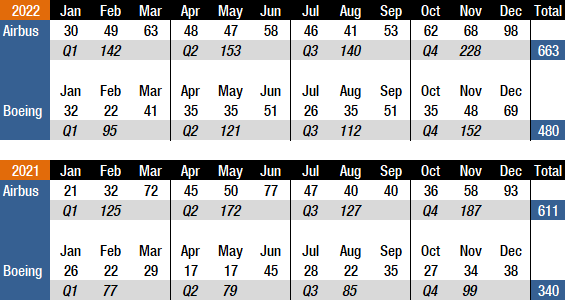

Boeing and Airbus delivered 69 and 98 commercial jets in December 2022, compared to 38 and 93 deliveries, respectively, in the same month last year. For the full year, Boeing and Airbus delivered 480 and 663 aircraft, compared to 340 (+41.2%) and 611 (+8.5%), respectively, in 2021. In 2022, Airbus won the deliveries crown for the fourth year in a row. With 69 shipments in December, Boeing delivered more aircraft in a single month than at any other time since December 2018.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021 was a year of recovery for the two largest commercial plane makers. As we predicted a year ago, 2022 indeed proved to be another year of recovery for the commercial aircraft manufacturing industry despite supply chain challenges, inflation, macro-economic weakness, labor shortages, and the war in Ukraine. For the commercial aircraft manufacturing industry, 2023 is expected to be yet another year of recovery, however, Boeing and Airbus still have quite a way to go before deliveries are back to pre-pandemic levels. In 2018, before COVID-19 and the 737 MAX grounding, Boeing delivered 806 jets, a level that will most likely not be recaptured before 2025. Airbus’ all-time record high of 863 shipments was set in 2019, a level that will likely be surpassed in 2024. Also, Airbus is expected to retain the deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Prior to 2019, Boeing had out-delivered Airbus every year since 2012.

The past 3-4 years have been extremely challenging for Boeing but, despite recent Dreamliner quality issues and 777X delays, the outlook is mostly bright. Dreamliner deliveries have resumed, and a few days ago, a 737 MAX took off in China for the first time since 2019. The flight was operated by China Southern Airlines and marked the aircraft’s return to commercial service with Chinese airlines.

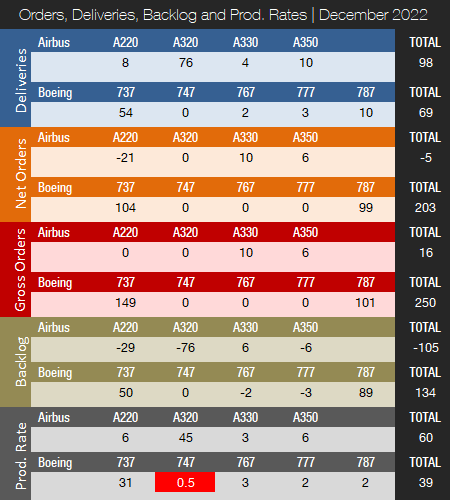

As indicated above, in December 2022, Boeing delivered 69 jets, including 54 737s (53 MAX / 1 NG), two 767s, three 777, and 10 787s. Since June of this year, the 737 program has been producing aircraft at an official rate of 31 per month, up from 27. The rate of 27 per month was maintained between November 2021 and May 2022; prior to that, the monthly rate was just 19. Boeing had been considering a boost in 737 production to 38 jets per month in the first half of 2023, followed by another increase to 47 jets per month by the end of 2023, but these plans have now been postponed due to supply chain issues. In connection with the release of Boeing’s third quarter 2022 earnings, the company announced that the monthly delivery trend is expected to remain in the low-30s into 2023. Boeing ended the third quarter with 270 737 MAX jets in inventory, down 20 from Q2 2022. At present, Boeing’s main supply chain headache is its engine supply, however, the situation improved somewhat during the third quarter. It has been reported that a shortage of structural castings used in the CFM LEAP engine is the main bottleneck. Boeing expects that supply chain constraints will remain a significant challenge in 2023. The company is still producing 737 NGs but only has 25 737-800s remaining in backlog.

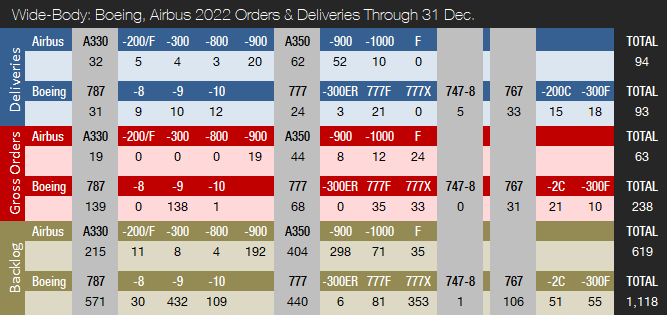

In August last year, deliveries of the Boeing 787 Dreamliner were resumed following a suspension of shipments that lasted nearly 16 months. Boeing had suspended Dreamliner deliveries in May 2021 for the second time in less than a year. The current 787 production rate is two aircraft per month. Boeing expects to continue at this rate for the time being, but will likely return to five per month over time. Boeing ended the third quarter with 115 Dreamliners in inventory, down five from Q2 2022.

The 747 program will close down production when the last aircraft is delivered to Atlas Air in early 2023. The 767 program is currently producing at a rate of three units per month, a mix of KC-46 tankers (based on the 767-2C) and 767-300 freighters. The 777 program is currently pushing out aircraft at a rate of two per month. Most aircraft in backlog are 777 freighters with only very few 777-300ERs left. The 777 program was expected to get a new addition in late 2023 with the first delivery of the 777X, but in April last year Boeing announced this will now not happen before 2025. This reflects an updated assessment of the time required to meet certification requirements. In January 2022, Boeing launched a new 777X-based freighter, thereby expanding its 777X and cargo portfolio.

In December 2022, Airbus delivered 98 jets, including eight A220s, 76 A320s (all NEO), four A330s, and 10 A350s. During 2021, Airbus steadily increased A320 production from 40 per month to 43 in Q3 2021 before finishing the year at the current official rate of 45 per month. Production will continue to be increased until reaching a monthly rate of 65 by early 2024 (pushed back from mid-2023 due to supply chain challenges). Also, Airbus is working with its supply chain to increase A320 production to 75 aircraft per month in 2025.

The A220, meanwhile, is being produced at a rate of six aircraft per month, with a monthly production rate of 14 envisioned by the middle of the decade. The A350 production rate currently averages five per month and was expected to be increased to six by early 2023. However, the rate increase will likely be delayed until the end of 2023. Based on past announcements from Airbus and deliveries figures during the past few months, it is believed that the A330 production rate was increased from two to three aircraft per month at the end of 2022.

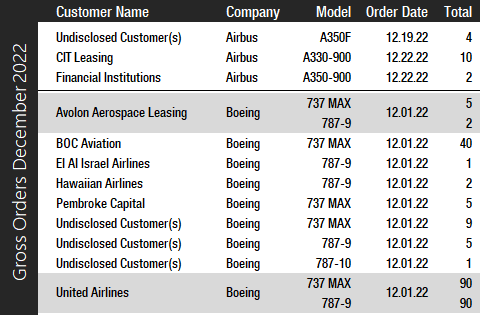

Turning to the December orders review, Boeing had a banner month and booked orders from nine customers for a total of 250 jets (gross orders). The company reported 47 cancellations, including 45 737 MAXs and two 787s, resulting in 203 net new orders. The largest order was placed by United Airlines for a whopping 90 787-9 Dreamliners and 90 737 MAXs. The airline’s current orders with Boeing have surpassed 530 aircraft, of which more than 430 are for the 737 MAX. Also in December, Singapore-based leasing company, BOC Aviation, announced it will add another 40 737-8 MAX jets to the 40 aircraft of this type it has ordered in the past. The remaining December orders were for smaller quantities of 737 MAXs and 787s. Boeing finished the year with 774 net new orders (935 gross orders). This compares to 2021, where Boeing booked 909 gross orders and received 430 cancellations, for a total of 479 net new orders (before ASC 606 changes). Please note that for comparison reasons, we do not include Boeing’s so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

In December, Airbus booked 16 orders from three different customers and reported 21 cancellations (all A220s) for a total of -5 net new orders. CIT Leasing ordered 10 A330-900s followed by an undisclosed customer who ordered four A350 freighters. Airbus finished the year with 820 net new orders (1,078 gross orders), surpassing both 2021 gross orders and net new orders. In 2022, Airbus won the orders crown for the fourth consecutive year by a fairly slim margin of just 46 aircraft compared to Boeing. In 2021, Airbus booked a total of 771 gross orders and received 264 cancellations, for a total of 507 net new orders. It should be noted, however, that if Boeing’s 2021 ASC 606 adjustments were included, Boeing would have come out ahead with 535 net new orders.

At the end of December 2022, Airbus reported a backlog of 7,239 jets, of which 6,620, or 91 percent, were A220 and A320ceo/neo family narrowbodies. This is 486 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of the year, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,430 aircraft, of which 4,312, or 79 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.4 years of shipments at the 2019 production level (the pre-pandemic level), or 10.9 years based on the 2022 total. In comparison, Boeing’s backlog would “only” last 6.7 years at the 2018 level (the most recent “normal” year for Boeing), or 11.3 years based on 2022 deliveries. In 2022, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, was a very strong 1.61. Airbus’ book-to-bill ratio was a solid 1.24. In 2021, Boeing’s book-to-bill ratio was 1.41, while Airbus reported a book-to-bill of 0.81.

2023 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2023, Forecast International’s analysts currently expect Boeing and Airbus to deliver 494 and 790 commercial jets, respectively. Please note that these figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon maritime patrol aircraft and KC-46 Pegasus tanker and Airbus’ A330 MRTT tanker.

Boeing will release its Q4 and full-year 2022 results on January 25 and will most likely provide guidance on how many 737 MAXs it expects to deliver in 2023. Airbus will announce fourth quarter and full-year 2022 results on February 16 and can be expected to provide guidance on total 2023 deliveries.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.airbus.com/en/newsroom/press-releases/2023-01-airbus-reports-2022-commercial-aircraft-orders-and-deliveries

- https://boeing.mediaroom.com/2023-01-10-Boeing-Reports-Commercial-Orders-and-Deliveries-for-2022

- https://boeing.mediaroom.com/2022-12-13-Boeing,-United-Airlines-Finalize-737-MAX-and-787-Order,-Including-Record-Purchase-for-100-Dreamliners

- https://boeing.mediaroom.com/2022-12-27-BOC-Aviation-Announces-Order-for-40-Additional-Boeing-737-8-Jets

- https://boeing.mediaroom.com/2023-01-04-Boeing-to-Release-Fourth-Quarter-Results-on-January-25th

- https://edition.cnn.com/2023/01/13/business/boeing-737-max-8-china-hnk-intl/index.html

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes 75 individual reports, most with a 10-year unit production forecast. Click here to learn more.

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.