777X first delivery postponed; pushed out another two years. Airbus targets 75 A320neos per month by 2025.

by J. Kasper Oestergaard, European Correspondent, Forecast International.

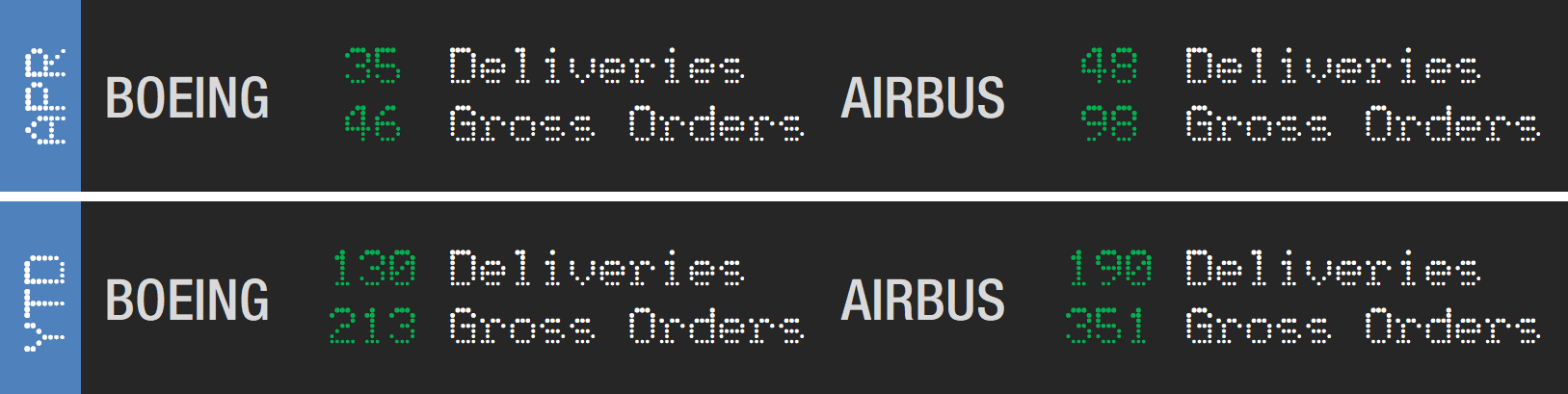

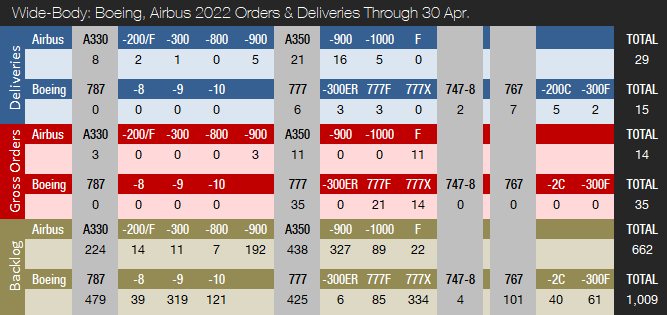

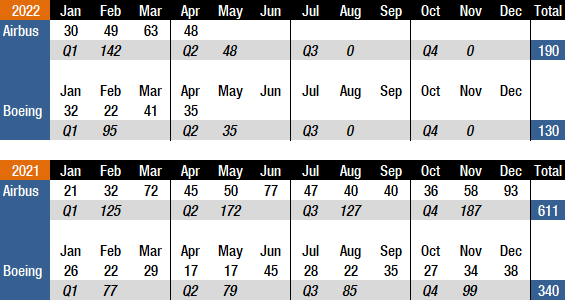

Boeing and Airbus delivered 35 and 48 commercial jets in April 2022, compared to 17 and 45 deliveries, respectively, in the same month last year. Year-to-date, Boeing and Airbus have delivered 130 and 190 aircraft, compared to 94 and 170, respectively, in the first four months of 2021. So far this year, Boeing and Airbus are 36 and 20 deliveries ahead of last year’s totals to date.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021 was a year of recovery for the two largest commercial plane makers. 2022 is well underway and is expected to be another year of recovery for the commercial aircraft manufacturing industry, despite events currently unfolding in Ukraine. Boeing and Airbus still have a long way to go before deliveries are back to pre-pandemic levels, though.

For the full year 2021, Boeing delivered 340 aircraft, compared to 157 in 2020 and 380 in 2019. Boeing’s last “normal” year was 2018 – before COVID-19 and the 737 MAX grounding – when it delivered 806 jets, a level that will likely not be recaptured before 2024 or 2025. The past three years have been extremely challenging for Boeing but, despite ongoing Dreamliner quality issues and 777X delays, the outlook is now looking brighter than at any time since March 2019, when the second 737 MAX crash occurred. Orders are strong and deliveries have surged from the 2020 lows, with another sharp increase expected this year.

The 737 MAX is approved to fly in nearly every country, and since late 2020, the fleet has flown more than one million flight hours. The aircraft, however, has not yet returned to commercial service in China despite the fact that the Civil Aviation Administration of China (CAAC) ungrounded the 737 MAX in December of last year. For example, China Eastern Airlines recently announced that aircraft modifications and further pilot training are needed before it can resume commercial service with the aircraft. The top reason for the 737 MAX’s absence in the skies over China is most likely the nation’s zero-COVID approach, which continues to wreak havoc on domestic air travel.

In 2021, Airbus delivered 611 aircraft and won the deliveries crown for the third year in a row. Deliveries were up from 566 in 2020 but remain well below the company’s all-time record high of 863 shipments in 2019. Airbus is expected to retain the deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Prior to 2019, Boeing had out-delivered Airbus every year since 2012.

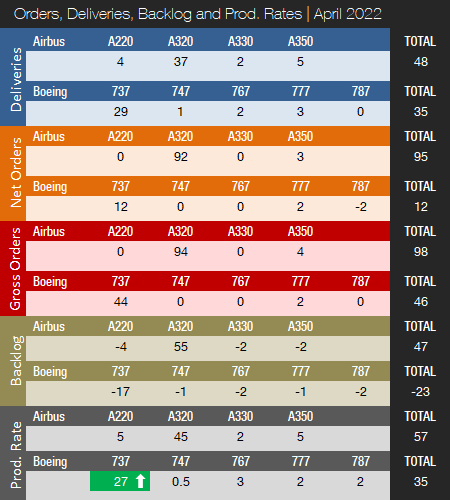

As indicated above, in April 2022, Boeing delivered 35 jets, including 29 737s (28 MAX / 1 NG), one 747, two 767s, and three 777s. The 737 program is currently officially producing at a rate of 27 per month, up from 19 as of the end of October 2021, and will reach the company’s near-term target of 31 per month in the second quarter. According to Reuters, Boeing has preliminary plans to boost 737 production to 38 jets per month in the first half of 2023, followed by an increase to 47 jets per month by the end of 2023.

Dreamliner deliveries have now been suspended for nearly a year, and it is unknown when shipments will resume. Boeing suspended Dreamliner deliveries in May 2021 for the second time in less than a year. The FAA is reviewing Boeing’s method for inspecting and evaluating the aircraft to ensure it meets federal safety regulations. In February, the head of the FAA, Steve Dickson, stated that the agency needs a “systemic fix” from Boeing to address Dreamliner production issues and would not allow the company to self-certify individual new jets when deliveries resume. However, the FAA has acknowledged that Boeing is heading in the right direction.

The FAA wants Boeing to ensure it has a robust plan for the rework that it performs on a large number of new 787s in storage and demonstrate that its delivery processes are stable. According to Boeing, the company is continuing to complete comprehensive inspections across the 787 production system and within the supply chain, while holding detailed, transparent discussions with the FAA, suppliers, and customers. The company continues to perform rework on 787 airplanes in inventory and is engaged in detailed discussions with the FAA.

In late April, Dave Calhoun, Boeing’s president and CEO, announced that rework has been completed on the initial 787s and that the company continues to work closely with the FAA on timing of resuming deliveries. Other important progress on the 787 was made when Boeing recently submitted its certification plan to the FAA. At the end of last year, Boeing had 110 Dreamliners in storage (manufactured but not yet certified). The current 787 production rate is approximately two aircraft per month, and Boeing expects to continue at this rate until deliveries resume and then return to five per month over time. In March, it was reported that the company is currently testing the ability of suppliers to meet output scenarios as high as seven per month by the end of 2023.

The 777 program was expected to get a new addition in late 2023 with the first delivery of the 777X, but in April Boeing announced this will now not happen before 2025. This reflects an updated assessment of the time required to meet certification requirements. According to Boeing, the 777-9 production rate ramp-up is being adjusted to minimize inventory and the number of airplanes requiring “change incorporation,” including a temporary pause through 2023. However, Boeing is taking advantage of the adjustment to the 777-9 production schedule by adding 777 freighter capacity starting in late 2023. In January of this year, Boeing launched a new 777X-based freighter, thereby expanding its 777X and cargo portfolio. Qatar Airways will be the 777-8F launch customer.

In April 2022, Airbus delivered 48 jets, including four A220s, 37 A320s (all NEO), two A330s, and five A350s. During 2021, Airbus steadily increased A320 production from 40 per month to 43 in Q3 2021 before finishing the year at a rate of 45 per month. Production will continue to be increased until reaching a monthly rate of 65 by the summer of 2023. Airbus has also discussed a scenario with a rate of 70 by Q1 2024. On May 4, Guillaume Faury, the CEO of Airbus, announced that the company continues to see strong growth in commercial aircraft demand driven by the A320 family. As a result, Airbus is now working with its supply chain to increase the A320 production rate to 75 aircraft per month in 2025. On the A321XLR program, Airbus continues to work toward a first flight by the end of Q2 2022. The entry-into-service, initially planned for the end of 2023, is now expected to take place in early 2024.

The A220, meanwhile, is being produced at a rate of five aircraft per month. The rate will be increased to six in the coming months – with a monthly production rate of 14 envisioned by the middle of the decade. The A350 production rate currently averages five per month and will be increased to six by early 2023. Airbus is currently producing two A330s per month, a rate that will be increased to nearly three aircraft by the end of 2022.

In 2021, Airbus launched the new A350 freighter, or A350F, which is a major and much-needed boost to the company’s competitiveness in the cargo segment. Boeing has long dominated the cargo space with its 737-800BCF, 767-300BCF, 767-300F, 777F, 777-8F and 747-8F offerings. Until now, Airbus has only offered the A330-200F, which has not performed well in competition against Boeing’s popular 767-300F. With the launch of the A350F, it appears Airbus is getting serious about capturing more of the cargo aircraft market. The A350F, which carries up to 120 tons (109 metric tons) of cargo, received its first order in November and will predominantly compete with the 777F. In comparison, the 777F has a cargo capacity of up to 112 tons (102 metric tons).

Recently, Airbus urged European leaders to not impose sanctions on titanium imports from Russia. Airbus argues that sanctions on the metal would damage aerospace in Europe while barely hurting the Russian economy. Airbus relies on Russia for half its titanium needs, compared to one-third for Boeing. In early March, Boeing said it had suspended Russian titanium purchases. Despite this challenge, Airbus has announced that its titanium sourcing needs are covered in the short and medium terms and recently reaffirmed its 2022 guidance. However, the company is accelerating its search for non-Russian supplies. Both Airbus and Boeing have been stockpiling titanium in recent months.

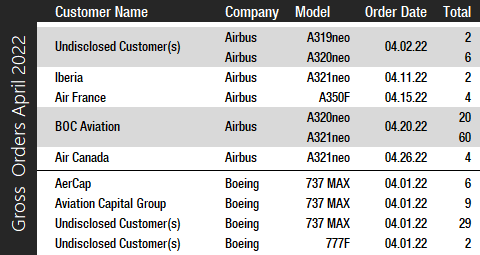

Turning to the April orders review, Boeing had a satisfactory month and booked four orders for a total of 46 jets. The company, however, also reported 34 cancellations (32 737 MAXs and two 787s), resulting in only 12 net new orders in total. The largest order was for 29 737 MAXs for an undisclosed customer, followed by an order from Aviation Capital Group for nine 737 MAX jets. Finally, AerCap ordered six 737 MAXs and an undisclosed customer booked two 777Fs. Year-to-date, Boeing has accumulated 157 net new orders (213 gross orders). In 2021, Boeing booked 909 gross orders and received 430 cancellations, for a total of 479 net new orders (before ASC 606 changes). In 2020, Boeing accumulated a total of 184 gross orders and received 655 cancellations, for a total of -471 net new orders.

Due to events unfolding in Ukraine and sanctions on aircraft deliveries to Russia, Boeing expects that up to 141 jets it has on order – 90 of which are 737 MAX aircraft – could be affected and eventually removed from its books. Please note that for comparison reasons, we do not include these so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

Airbus reported a strong order haul in April and booked five orders for a total of 98 jets. The company only reported three cancellations (two A321neos and one A350-1000), resulting in an impressive 95 net new orders. In April, Singapore-based aircraft leasing company BOC Aviation ordered 80 Airbus A320neo family aircraft, comprising 10 A321XLRs, 50 A321neos, and 20 A320neos. Also of note were Air France’s order for four A350 freighters and an order for two A319neos and six A320neos placed by an undisclosed customer.

Year-to-date, Airbus has accumulated 178 net new orders (351 gross orders). In 2021, Airbus booked a total of 771 gross orders and received 264 cancellations, for a total of 507 net new orders – enough to win the orders crown for the third year in a row. It should be noted, however, that if Boeing’s 2021 ASC 606 adjustments are included, Boeing comes out ahead with 535 net new orders. In 2020, Airbus accumulated 383 gross orders and received 115 cancellations, for a total of 268 net new orders.

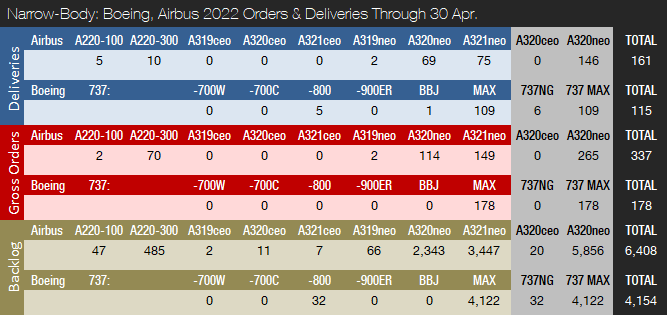

At the end of April 2022, Airbus reported a backlog of 7,070 jets, of which 6,408, or 91 percent, were A220 and A320ceo/neo family narrowbodies. This is 655 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of April, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,163 aircraft, of which 4,154, or 80 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.2 years of shipments at the 2019 production level (the pre-pandemic level), or 11.6 years based on the 2021 total. In comparison, Boeing’s backlog would “only” last 6.4 years at the 2018 level (the most recent “normal” year for Boeing), or 15.2 years based on 2021 deliveries. In 2022 to date, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, is 1.21. Airbus’ book-to-bill ratio is 0.94. In 2021, Boeing’s book-to-bill ratio was 1.41, while Airbus reported a book-to-bill of 0.81.

2022 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2022, Forecast International’s analysts currently expect Boeing and Airbus to deliver 450 and 702 commercial jets, respectively. Compared to the 2021 level, this is a 32.4 percent increase for Boeing and a 14.9 percent increase for Airbus.

In January, Boeing reported Q4 and full-year 2021 earnings and operating results but did not provide any guidance on expected 2022 deliveries. The company released first quarter 2022 results on April 27 but did not provide any updated guidance on deliveries. Airbus reported 2021 earnings on February 17 and expects to deliver 720 commercial aircraft in 2022. As the basis for its 2022 guidance, Airbus assumes no further disruptions to the world economy, air traffic, and its own internal operations. The company released Q1 2022 earnings on May 4 and reaffirmed its 2022 guidance.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://boeing.mediaroom.com/2022-04-27-Boeing-Reports-First-Quarter-Results

- https://boeing.mediaroom.com/news-releases-statements?item=131041

- https://www.airbus.com/en/newsroom/press-releases/2022-05-airbus-reports-first-quarter-q1-2022-results

- https://www.airbus.com/en/newsroom/press-releases/2022-04-boc-aviation-orders-80-a320neo-family-aircraft

- https://www.bocaviation.com/en/Aircraft

- https://www.reuters.com/business/aerospace-defense/exclusive-boeing-tests-suppliers-787-output-hikes-sources-2022-03-11/

- https://www.reuters.com/business/aerospace-defense/airbus-accelerates-hunt-alternative-titanium-supplies-2022-04-12/

- https://www.reuters.com/business/aerospace-defense/boeing-suspends-part-its-business-russia-wsj-2022-03-07/

- https://www.barrons.com/articles/boeing-737-max-china-51648726661

- https://apnews.com/article/technology-business-china-8848390bcb40e14ef8a177fb99ec100b

- https://www.scmp.com/business/article/3178627/china-eastern-airlines-lists-steps-needed-return-boeings-737-max-aircraft

- https://www.reuters.com/business/aerospace-defense/exclusive-boeing-aims-nearly-double-737-max-production-by-end-2023-sources-2022-03-05/

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes 75 individual reports, most with a 10-year unit production forecast. Click here to learn more.

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.