Bombardier Takes Top Spot by Shipment Values as Cirrus and SR22T Lead Unit Sales

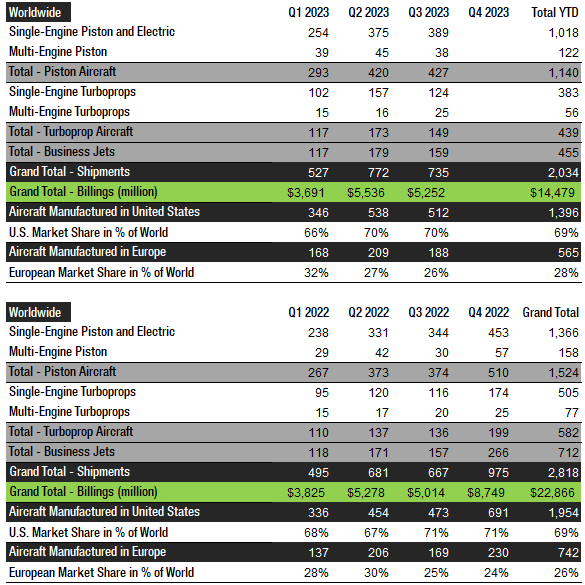

According to figures released by the General Aviation Manufacturers Association (GAMA), in the third quarter of 2023, business aviation aircraft manufacturers reported solid results. Fixed-wing business aviation aircraft manufacturers delivered 735 aircraft worldwide in Q3 2023, up 10.2% from 667 in Q3 2022. In Q2 2023, shipments were up 13.4% year-over-year. In Q3 2023, the value of shipments (billings) at the same time increased 4.8% to $5.3 billion year-over-year, mainly due to a strong quarter by Bombardier (billings up 25.1%). Gulfstream, which had a very strong Q3 last year, on the other hand, experienced a 23.3% drop in shipment values. Also, Pilatus, Embraer, Textron, Cirrus and Piper experienced substantial increases in shipment values compared to Q3 2022. The piston airplane segment led an increase in deliveries with 427 units in Q3 2023, equal to a 14.2% increase from the same period in 2022. Turboprop shipments were up 9.6% year-over-year, while business jet deliveries increased 1.3%.

U.S. manufacturers delivered 512 aircraft in Q3 2023 up from 473 in the third quarter, equal to an 8.2% increase. U.S. manufacturers accounted for 70% of worldwide shipments in the third quarter, down one point from 71% in Q3 last year. Meanwhile, European manufacturers shipped 188 aircraft, up 11.2% from 169 units in Q3 2022. Europe’s share of deliveries was up 1 percentage point to 26% in Q3 2023. The U.S. and Europe clearly dominate world business aviation aircraft production with a combined 96% market share in the third quarter. Even Embraer has placed much of its business jet production in the U.S. at its facility in Melbourne, Florida.

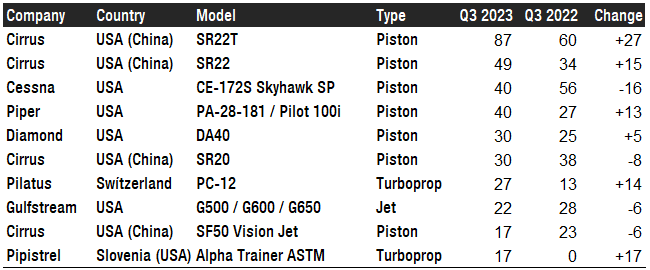

In Q3 2023, the Cirrus SR22T (piston) was yet again the most popular fixed-wing general aviation aircraft with 87 units delivered (+27 from Q3 2022). Cirrus also took second place with the SR22 with 54 shipments – up from 34 in Q3 2022, followed by Cessna’s CE-172S Skyhawk SP (piston) with 40 shipments, down 16 units from last year. In fourth place, we have the Piper PA-28-181 and Pilot 100i (piston) with 40 units delivered, ahead of the Diamond DA40 (piston – 30 delivered), the Cirrus SR20 (piston – 30), Pilatus’ PC-12 (turboprop – 27), Gulfstream’s G500 / G600 / G650 (business jets – 22), the Cirrus SF50 Vision Jet (business jet – 17), and Textron-owned Slovenian manufacturer, Pipistrel’s Alpha Trainer (piston – 17).

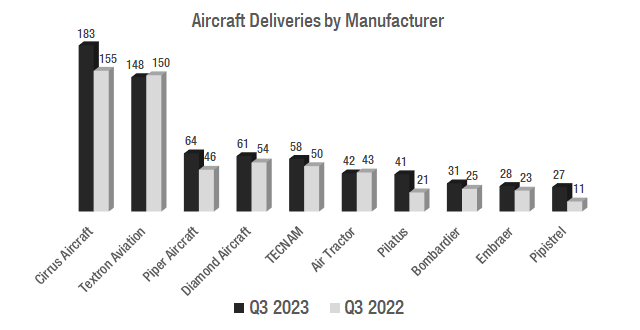

In the third quarter of 2023, Cirrus had a very strong quarter and delivered more aircraft than any other manufacturer. The company shipped 183 aircraft compared to 155 in Q3 2022. Textron Aviation (Cessna + Beechcraft) delivered 148 aircraft, down from 150 in Q3 last year. In third place, we have Piper Aircraft with 64 shipments, up from 46 in Q3 2022, followed by Diamond Aircraft, TECNAM, Air Tractor, Pilatus, Bombardier, Embraer, and Pipistrel.

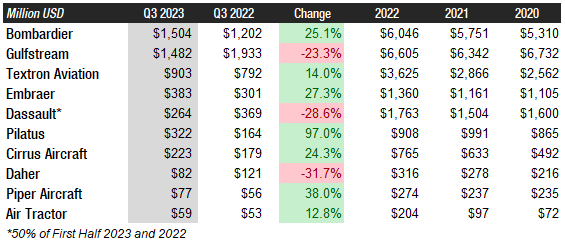

When business aviation aircraft manufacturers are ranked by shipment values (billings), the business jet manufacturers are in the lead. Bombardier boasted the highest sales of all fixed-wing business aircraft manufacturers in Q3 2023 with total sales of $1.50 billion, up 25.1% from the same period last year. Already delivering more business jets (units), Bombardier has now closed the sales gap to its American rival and is now ahead year-to-date. This year, for the first time since 2012, Bombardier could surpass Gulfstream’s annual shipment values. As it seems the first G700 deliveries might slip into 2024, Bombardier would at this point appear as the most likely winner of the 2023 sales crown. Initially planned to occur in the fourth quarter of 2022, G700 certification and service entry has been delayed due to a number of issues but could be announced any day now. Gulfstream has been the world’s largest general aviation aircraft manufacturer by annual sales revenues since 2013. The company reported Q3 2023 shipment values of $1.48 billion, down 23.3% from Q3 2022. In third place, Textron Aviation (Cessna + Beechcraft) reported sales of $903 million, up 14.0% from $792 million in the third quarter last year. In fourth place, Embraer had a very strong quarter and reported billings of $383 million, up 27.3%. Dassault reported sales of $264 million (please note as Dassault only reports half-year sales figures, the $264 million is equal to the first half of 2023 divided by two), down 28.6% from the same period last year. Pilatus had a very strong quarter – and the strongest third quarter in recent company history – and reported shipment values of $322 million, up 97% year-over-year. Please note that Pilatus’ Q3 2022 was also relatively weak resulting in a big percentage increase. Cirrus Aircraft reported sales of $223 million, up 24.3% mainly due to strong SR22/T and SF50 shipments. In eighth place, Daher had a poor quarter with shipment values down nearly 32%. However, Daher has been growing well in recent years and the company’s success depends on their best-selling TBM 960 turboprop flagship model. Piper Aircraft reported strong sales of $77 million, up 38% compared to Q3 2022. In tenth place, we have Air Tractor which has been on a tear these past few years. However, the company’s growth slowed a bit in Q3 as it reported sales of $59 million, up 12.8% compared to the same quarter last year.

In our next article, we will report on fourth-quarter aircraft shipments. Q4 is traditionally the strongest quarter of the year by far, ahead of Q2 and Q3 with Q1 as the weakest. In both 2022 and 2021, 38% of annual shipment values were in the fourth quarter, and Q4 shipments (units) accounted for 35% of the year’s total.

Business Aviation at Dubai Airshow

The major business aviation players flocked to the Middle East for last month’s Dubai Airshow. Gulfstream, notably missing from BACE in Las Vegas in October, put their G500 and G700 business jet models on display, while archrival Bombardier presented the Challenger 3500 and Global 7500. Dassault brought along their Falcon 10X mock-up and Falcon 2000LXS, while Pilatus showcased the PC-24 Super Versatile Jet. Embraer had their Praetor 600 and Phenom 100EV business jets on display.

Honeywell Global Business Aviation Outlook

In their 32nd Global Business Aviation Outlook released in October this year, Honeywell predicts strong demand for new business jets and an increased focus on reducing emissions. The company forecasts up to 8,500 new business jet deliveries worth $278 billion from 2024 to 2033, which is in line with the same 10-year forecast a year ago.

Forecast International’s Business Aviation Forecasts

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology which – among many other features – provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest Business Jet Aircraft and General Aviation/Utility Aircraft forecast data. Forecast International’s analysts expect aircraft manufacturers to deliver 684 business jets in 2023 as well as 2,001 other fixed-wing general aviation/utility aircraft.

References:

- https://gama.aero/facts-and-statistics/quarterly-shipments-and-billings/

- https://www.honeywell.com/us/en/press/2023/10/honeywell-forecast-shows-strong-demand-for-new-business-jets-increased-focus-on-reducing-emissions

- https://flightplan.forecastinternational.com/2023/11/21/dubai-air-show-2023-recap/

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.