The overall market for civil aircraft retrofit and modernization is, of course, directly tied to capacity. The COVID-19 pandemic has challenged the airline industry in ways it has never been before, with some airlines reporting capacity drops of more than 70 percent year-over-year. At the time of the last release of FI’s Civil Fixed-Wing Retrofit & Modernization Analysis, it appeared that there was no real end in sight. As of press time, with vaccination efforts continuing in earnest, capacity slowly returning, and a minor economic boom period expected following a return to some degree of normalcy, the airline industry appears to have avoided full-scale disaster.

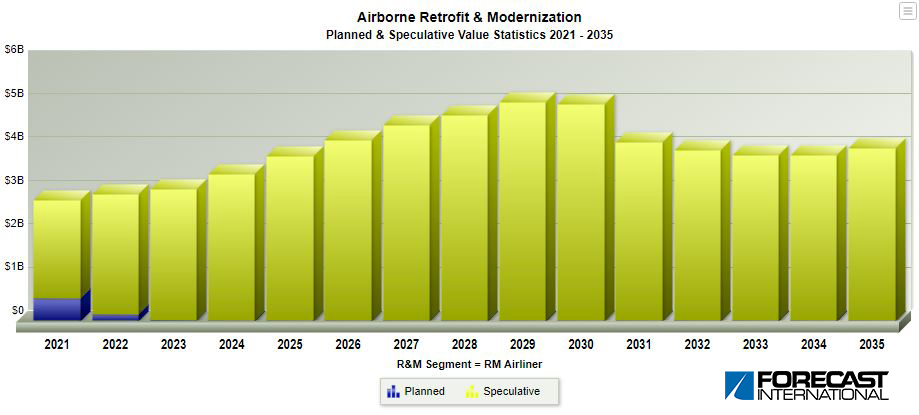

While COVID-19 will surely have a lasting impact on the airline industry as a whole, the U-shaped recovery predicted to begin in late 2020 or early 2021 has started, and it will continue to gather strength as the general population is vaccinated and activities begin to re-emerge. A significant portion of the market’s overall value – likely in the realm of 5-8 percent – will not be recovered through the forecast period. Many nonessential upgrades, such as IFE, Wi-Fi, or premium seating reconfigurations, will be pushed back or canceled altogether in favor of saving valuable dollars.

Cargo conversions will remain a strong market through the forecast period, as the boom in e-commerce caused by global lockdowns has necessitated extensive air transport of cargo, often with small delivery windows. Aircraft with large conversion feedstocks, such as the Airbus A320 and Boeing 737 families, will see extensive conversion through the forecast period as airlines look to capitalize on the growing market. Conversion activity across the widebody fleet will likely gain traction as well, perhaps best evidenced by the emergence of a 777 P2F program from GECAS and IAI.

On the whole, the economic recession long predicted by analysts at Forecast International arrived – unfortunately, in spectacular fashion. COVID-19 is a black swan event, providing a market outlook that is murky at best and almost entirely convoluted at worst. As the market and its value are intrinsically connected to consumer tendencies – with an overriding question in this case being, is it safe enough to get on an airplane with other humans? – the outlook will remain unclear for the next several years, with a recovery expected in full by 2024-2026. Forecast International will continue to add aircraft R&M program reports to its R&M product in the meantime and will provide updated information on the market’s outlook as information becomes available.

Forecast International’s Airborne Retrofit & Modernization Forecast provides comprehensive coverage of airborne retrofit and modernization activities for a portfolio of more than 60 global aircraft programs. Through extensive research and expert analysis, clients are provided with an unprecedented window into the R&M market. Each report features complete data on fleet sizes, average fleet ages, key operator nations, and a litany of ongoing and speculative retrofit programs in four key segments: Electronics, Airframe, Propulsion and Armament.

Reports include in-depth coverage of military fixed-wing aircraft, large commercial transports, business jets, regional aircraft, and a variety of military and civilian rotorcraft. From Service Life Extension Programs for the Lockheed Martin C-130H to seat replacement efforts for the Airbus A320, the Airborne R&M product covers it all. An annual subscription includes 60+ individual reports, plus three Market Analyses covering the R&M markets for: Military Fixed-Wing Aircraft Retrofit & Modernization; Civil Fixed Wing Aircraft Retrofit & Modernization; and Rotorcraft Retrofit & Modernization. Pricing begins at $2,295, with discounted full-library subscriptions available. Click here to learn more.