U.S. Manufacturers Deliver 587 Aircraft in Fourth Quarter – Up 55 Units from Q4 2017

by J. Kasper Oestergaard, European Correspondent, Forecast International.

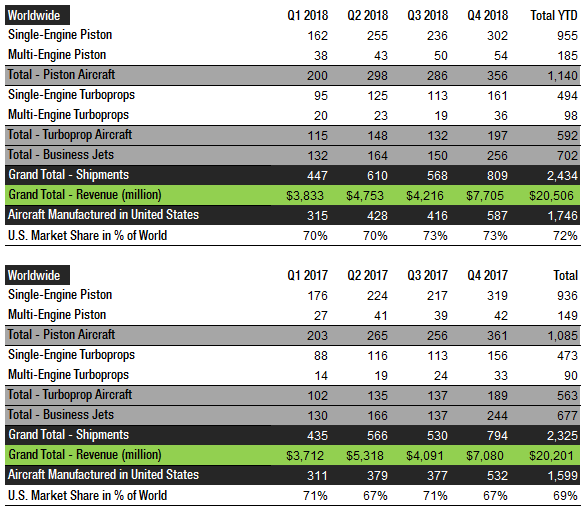

According to the General Aviation Manufacturers Association (GAMA), in the fourth quarter of 2018, manufacturers reported both higher deliveries and higher revenues. Fixed-wing general aviation aircraft manufacturers delivered 809 aircraft worldwide in Q4 2018, up 1.9 percent from 794 in Q4 2017. At the same time, revenues (billings) increased 8.8 percent to $7.7 billion due to a surge in Gulfstream revenues following the commencement of G500 deliveries in late September 2018.

U.S. manufacturers delivered 587 aircraft in Q4 2018, up from 532 in Q4 2017 – an impressive 10.3 percent increase. U.S. manufacturers accounted for 73 percent of worldwide shipments in the fourth quarter, up from 67 percent in Q4 last year.

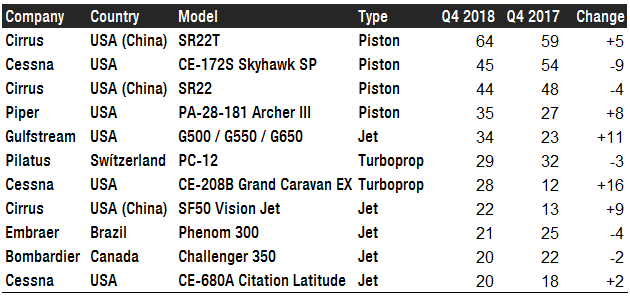

In Q4 2018, the Cirrus SR22T (piston) was the most popular fixed-wing general aviation aircraft with 64 units delivered (+5 from Q4 2017). The Cessna CE-172S Skyhawk SP (piston) took second place with 45 shipments – down from 54 in Q4 2017, followed by the Cirrus SR22 (piston) with 44 shipments, down four from last year. In fourth place is Piper’s PA-28-181 Archer III (piston) with 35 units delivered, ahead of Gulfstream’s G500 / G550 / G650 large business jet variants, the Pilatus PC-12 (turboprop), Cessna’s CE-208B Grand Caravan EX (turboprop), the Cirrus SF50 Vision Jet, Embraer’s Phenom 300 (jet), the Bombardier Challenger 350 (jet), and the Cessna CE-680A Citation Latitude (jet).

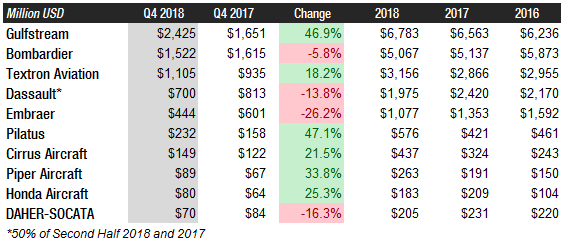

When general aviation aircraft manufacturers are ranked by revenues, the business jet manufacturers take the lead. Gulfstream boasted the highest revenues of all fixed-wing aircraft manufacturers in Q4 2018 with total sales of $2.4 billion, up a whopping 47 percent from the same period last year. The increase is mainly due to the commencement of G500 deliveries. Gulfstream has been the world’s largest general aviation aircraft manufacturer by revenues since 2013. In second place is Bombardier, with Q4 2018 sales of $1.5 billion, down 5.8 percent from Q4 2017. Textron Aviation (Cessna + Beechcraft) is the overall leader by units sold, but only ranks third by revenue with $1.1 billion in Q4 2018, up 18.2 percent from $935 million in the fourth quarter of last year. Embraer reported billings of $444 million, down 26.6 percent due to a sharp drop in shipments to 36 in Q4 2018 from 50 in the same quarter in 2017. It is worth mentioning that Pilatus Aircraft had yet another very strong quarter with year-over-year billings up 47 percent after the company delivered nine units of its new PC-24 business jet (deliveries commenced in Q1 2018). Piper Aircraft, Honda, and Cirrus also reported strong results, with billings up 34 percent, 25 percent and 22 percent, respectively. Piper reported a sharp increase in shipments to 77, from 56 in Q4 2017, while Honda shipped 16 HondaJets, up from 13 in Q4 last year. Cirrus Aircraft’s revenues were up almost 22 percent, compared to just 13 a year ago – benefiting from 22 deliveries of the company’s SF50 Vision Jet.

Upcoming Product Launches and Key Events

At a special ceremony at its Montreal headquarters, Bombardier delivered the first Global 7500 business jet on December 20, 2018, to Stonebriar Commercial Finance. The first delivery of the Global 8000, which is smaller than the Global 7500 but has a 200-nautical-mile range advantage, is expected to follow later in 2019. Bombardier has stated that it remains committed to the Global 8000 despite many claiming that the aircraft was made redundant when the Global 7500’s range was increased by 300 nautical miles in early 2018. With these product launches, Bombardier aims to take market share from Gulfstream’s successful G650 and G650ER. The Global 7500 and Global 8000 boast maximum ranges of 7,700 nautical miles and 7,900 nautical miles, respectively. These compare to 7,500 nautical miles for the G650ER. Bombardier expects to deliver a handful of Global 7500s in the first half of 2019, with 10-15 deliveries following in the second half. In 2020, the company expects to deliver 35-40 aircraft. Bombardier also expects to deliver two new longer-range variants of its Global 6500 and 5500 large-cabin jets by the end of 2019.

In July 2018, the G500 received both its type certification and production certificate from the U.S. Federal Aviation Administration. Having amassed 5,000 flight hours with five G500 flight-test aircraft, Gulfstream delivered its first production G500 on September 27, 2018. The Gulfstream G600 was expected to be approved by the FAA by year-end 2018, but due to the recent U.S. government shutdown, the approval date was pushed back. On February 20, Gulfstream announced that it expects FAA approval for the G600 to come during the first half of the year, with deliveries following soon after. By February 3, 2019, the five G600 flight-test aircraft had accumulated nearly 2,900 hours across 760 sorties. Thanks to these product launches, Gulfstream expects growth in both orders and deliveries in 2019.

At NBAA-BACE in Orlando in October 2018, Embraer announced the 2019 launch of two Praetor models in the company’s midsize Legacy line. The aircraft will join a highly competitive market segment that includes Bombardier’s Challenger 350 and Gulfstream’s G280, along with Textron’s upcoming super-midsize Cessna Citation Longitude.

On February 5, 2019, Boeing announced that it has signed an agreement with Reno, Nevada-based Aerion to become a partner in the development of the Aerion AS2 supersonic business jet. Boeing states that it has “made a significant investment in Aerion to accelerate technology development and aircraft design, and unlock supersonic air travel for new markets.” As part of the agreement, Boeing will provide financial, engineering and industrial resources. Aerion introduced the 12-passenger AS2 business jet design in 2014 and unveiled the AS2’s GE Affinity engine design in 2018. The first flight of the AS2 prototype is targeted for June 2023, the 20th anniversary of the retirement of the Concorde.

Recent History & Market Dynamics

The recession from December 2007 to June 2009 had a massive impact on the general aviation aircraft manufacturing industry, as the sale of business jets and piston-engine aircraft collapsed and were, as of 2017, not even close to their 2007 peak levels. From 2007-2010, the global production of general aviation aircraft dropped a staggering 52.8 percent – from 4,276 aircraft in 2007 to 2,020 in 2010. In the United States, manufacturers experienced a 59.3 percent drop in production – from 3,279 to 1,334 units over the same period.

A major reason why deliveries of general aviation aircraft are still way below their 2007 peak levels, both worldwide and in the U.S., is that the price per aircraft has doubled. From 2007 to 2017, the average price of a piston-engine aircraft, which is the most common type, soared from $328,000 to $662,000. That increase is keeping many would-be buyers out of the market. Also, the average price of a business jet was up from $12.5 million to $26.6 million over the same period. At the same time, the average price of turboprops declined from $3.5 million to $2.6 million, resulting in a surge in shipments of this type of aircraft.

The market for general aviation aircraft is highly cyclical, and the small business jet and piston-engine aircraft segments in particular suffer in a down economy. Perhaps a surprise to some, the large business jet segment emerged unscathed from the 2007-09 recession.

2019 Business Jet Forecast

Forecast International’s Platinum Forecast System® is a breakthrough in forecasting technology. Among many other features, Platinum provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecasts. Forecast International’s analysts expect aircraft manufacturers to deliver 729 business jets in 2019, plus 1,749 other fixed-wing general aviation/utility aircraft.

References:

- http://www.fi-aeroweb.com/General-Aviation.html

- https://gama.aero/news-and-events/press-releases/gama-presents-2018-year-end-aircraft-shipment-and-billing-numbers/

- https://gama.aero/facts-and-statistics/quarterly-shipments-and-billings/

- https://www.flightglobal.com/news/articles/bombardier-insists-it-will-still-build-global-8000-b-455631/?cmpid=NLC|FGFG|FGBAD-2019-0218-GLOB&sfid=70120000000taAl

- https://www.reuters.com/article/us-bombardier-business-jets/bombardier-to-deliver-handful-of-global-7500-jets-in-first-half-2019-idUSKCN1Q926V

- https://corporatejetinvestor.com/articles/exclusive-stonebriar-commercial-takes-delivery-of-bombardiers-first-global-7500-587/

- https://www.reuters.com/article/us-aerospace-gulfstream/gulfstream-intends-to-deliver-first-g600-business-jet-in-first-half-of-2019-idUSKCN1Q92MG

- https://www.flightglobal.com/news/articles/g600-certification-slips-on-back-of-us-government-sh-455501/?cmpid=NLC|FGFG|FGBAD-2019-0218-GLOB&sfid=70120000000taAl

- https://www.reuters.com/article/us-bombardier-outlook/bombardier-expects-increased-business-jet-deliveries-to-fuel-turnaround-idUSKBN1O515X

- https://boeing.mediaroom.com/2019-02-05-Boeing-Partners-with-Aerion-to-Accelerate-Supersonic-Travel

A military history enthusiast, Richard began his career at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet became central to defense research, he helped design the company’s Forecast Intelligence Center and now coordinates the FI Market Recap newsletters for clients. He also manages two blogs: Defense & Security Monitor, which covers defense systems and international security issues, and Flight Plan, focused on commercial aviation and space systems.

For more than 30 years, Richard has authored Defense & Aerospace Companies, Volume I (North America) and Volume II (International), providing detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database tracking all companies involved in programs covered by the FI library. Richard currently serves as Manager of the Information Services Group (ISG), which develops outbound content for both Forecast International and Military Periscope.