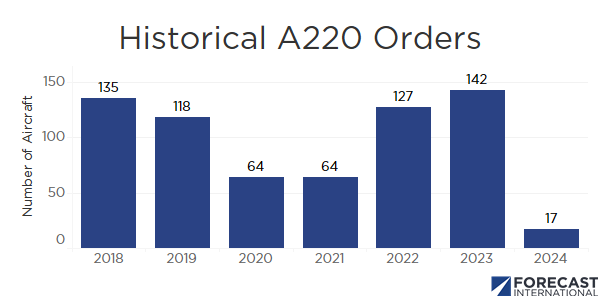

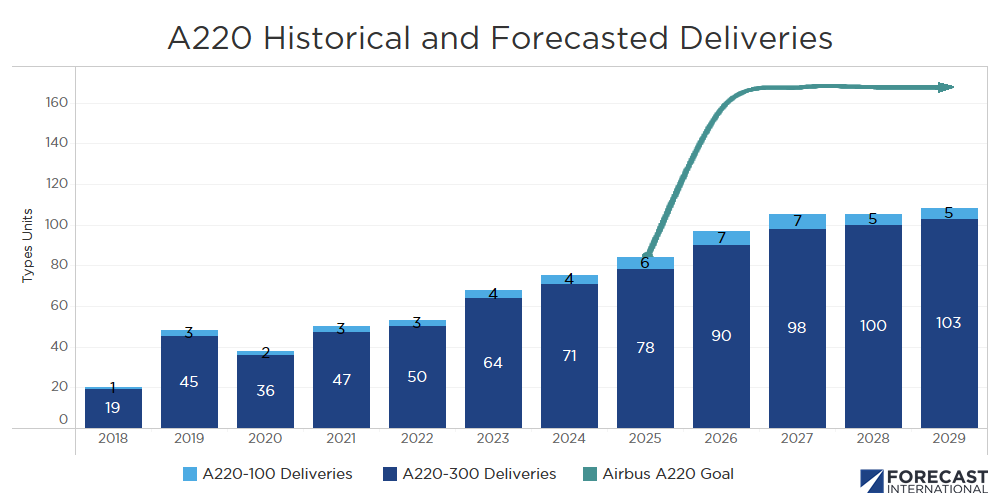

The year 2024 was a challenging one for A220 orders, with Airbus securing only 17 new commitments for the aircraft. As of March 31, 2025, no new orders have been recorded for the current year. Despite this, Airbus remains confident in the A220’s long-term prospects and is proceeding with plans to ramp up production to 14 aircraft per month by 2026, contingent on supply chain capacity. However, Forecast International views this target as overly ambitious, and one that even if achieved, is unlikely to be sustained for long due to several key factors.

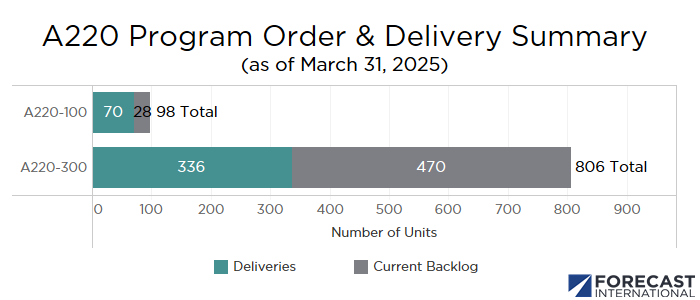

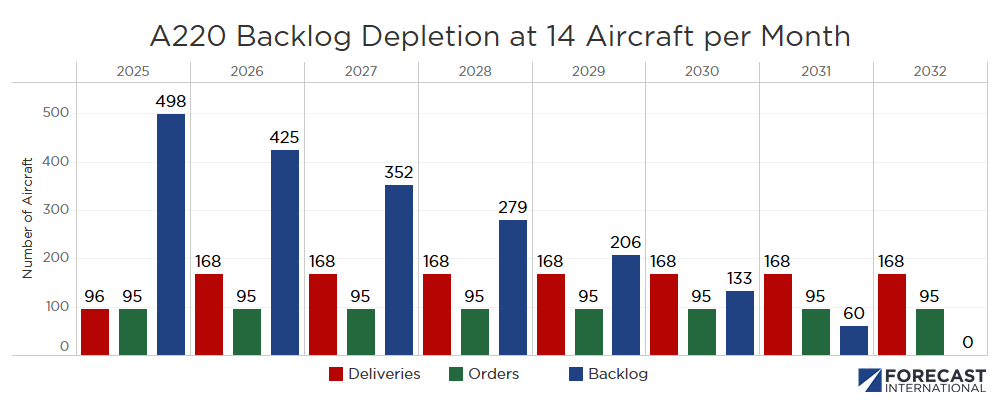

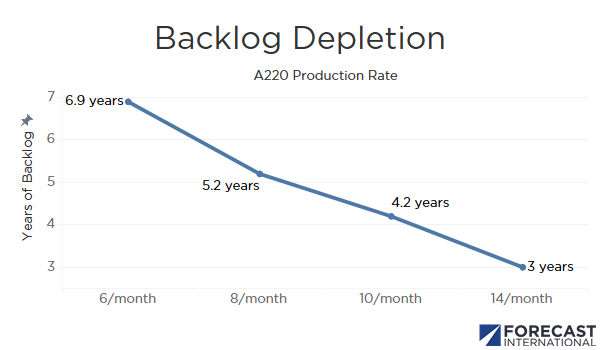

First, as of the end of March 2025 the A220 backlog stood at 498 aircraft. At the current maximum production rate of eight aircraft per month, this equates to approximately 5.2 years of output. If production settles at six aircraft per month, the backlog would extend to roughly 6.9 years. This means Airbus has between five and seven years of secured production at current rates, even without additional orders. If production increases to 14 aircraft per month, however, the existing backlog would be exhausted in just three years. This ramp up might be achievable in the short term since a three-year backlog is typically considered standard from order to delivery. However, there are serious concerns about maintaining this pace in the years that follow, considering that going back to 2018 Airbus has averaged only 95 A220 orders per year. If this trend continues and production stays at 14 aircraft per month, the backlog would be fully depleted by the end of 2032. This raises concerns about the long-term sustainability of the 14 aircraft per month production rate. Unless Airbus sees a substantial increase in new orders or the annual average rises well above the historical 95 aircraft per year in the near-term, the company will likely need to reduce production after reaching the 2026 target.

Another issue affecting long-term output is the weak demand for the A220-100. Although a small number of deliveries is expected each year, the backlog for this model will likely be exhausted, further limiting the overall potential of the A220 program. Airbus had previously announced plans to develop a stretched version of the A220-300, known as the A220-500, which would compete with the 737 MAX 8. However, this project has been placed on hold so the company can focus on increasing production of the existing A220 variants. Without a larger model to draw in new customers and expand the program’s appeal, Airbus will face an added challenge in meeting and maintaining its production targets beyond 2026. That said, if Airbus proceeds with the A220-500 and the aircraft proves popular, it could generate the additional demand needed to support production at 14 aircraft per month over a longer period.

Even with the potential addition of the A220-500, Airbus still faces the broader challenge of securing more A220 orders to justify higher production levels over an extended period. Without a significant increase in demand, the planned production ramp-up may need to be reconsidered, or at the very least revised to a more realistic rate. For these reasons, Forecast International does not share Airbus’ optimistic outlook as we do not believe there is sufficient market demand to support a sustained production rate of 14 A220s per month over the long term. While a short-term increase to 14 aircraft per month may be achievable, we also believe it will be short-lived and will likely result in lower production rates in the future, as the existing backlog would be depleted more quickly.

Our forecast anticipates a gradual ramp-up in A220 production through the end of the decade, with approximately 84 aircraft expected to be produced in 2025, rising to around 110 units by 2029. The outlook for production beyond that point will largely depend on the volume of new orders. Without a significant expansion of the backlog, we do not expect annual A220 production to exceed 120 units.

Meet Us at the Paris Air Show

Join Forecast International at the Paris Air Show and gain firsthand insight into the trends shaping the global aerospace market. From navigating supply chain challenges to analyzing the Airbus-Boeing rivalry and the rise of new regional players, our team delivers the industry’s most trusted intelligence and long-range forecasts. Whether you’re focused on commercial, business, or general aviation, stop by Hall 3 Booth C164 to discover how our expert analysis can elevate your strategic planning. 👉 Book time with Grant in Paris: https://lnkd.in/ekijrXhE

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.