NBAA-BACE 2025 and Industry Overview

NBAA-BACE Aircraft Connection – Image – NBAA

Industry sentiment at the NBAA-BACE Annual Conference in Las Vegas was largely positive, though signs of bifurcation emerged within the market. High-net-worth individuals continue purchasing both new and pre-owned business jets, supported by strong stock market gains, while smaller operators are increasingly pressured by rising costs and broader economic headwinds. Brokers reported that higher interest rates and inflation have not dampened transactions as previously expected. Despite supply chain challenges, optimism persists, with new models and sustained demand fueling confidence. But does all this optimism truly reflect the reality of the business jet market, particularly when it comes to new aircraft deliveries?

Short-Term Deliveries Outlook

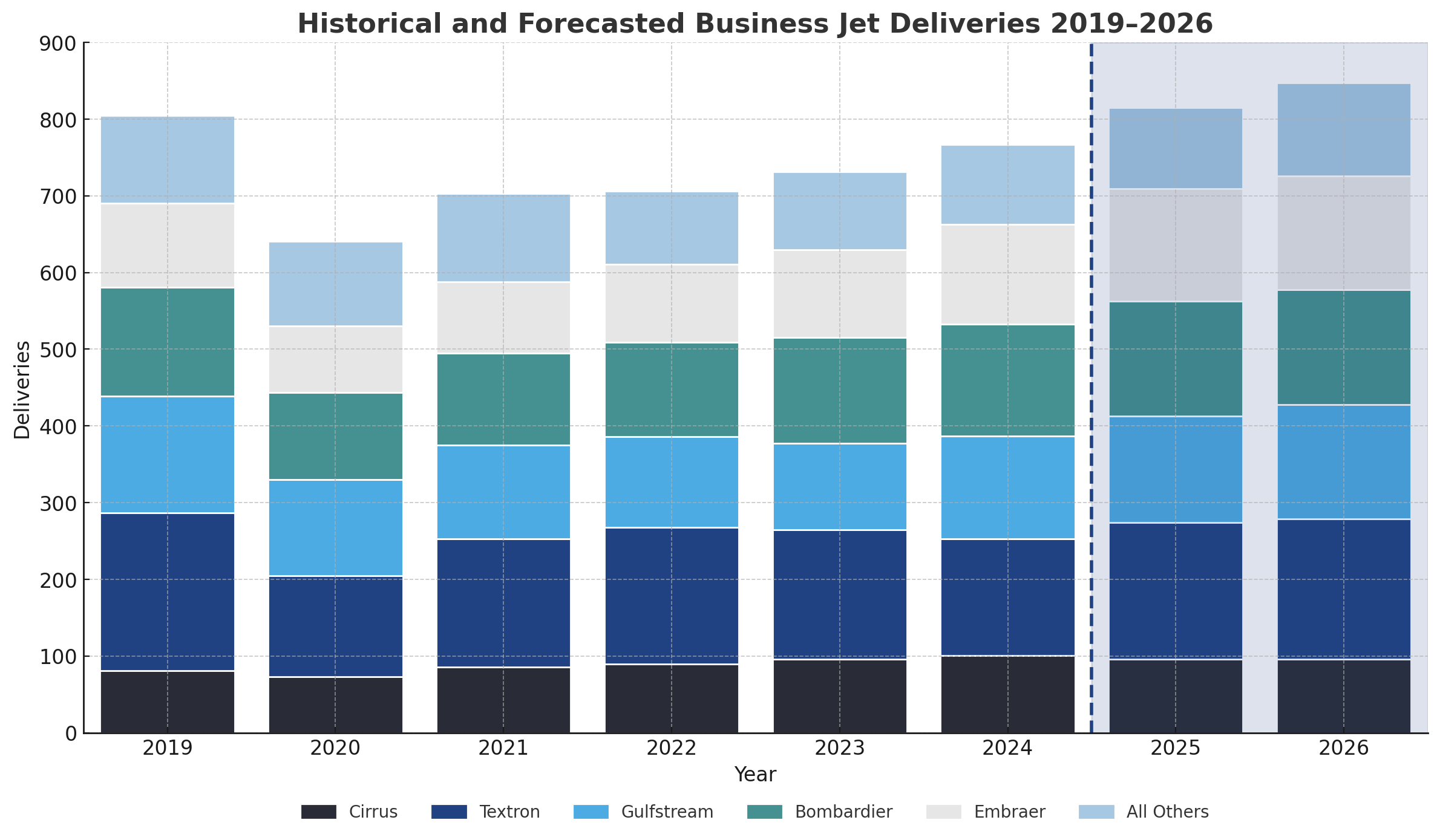

Despite demand that remains stronger than before the pandemic, business jet deliveries have not yet returned to the pre-pandemic level of 805 units recorded in 2019. Our forecast for 2025 projects approximately 815 deliveries, which would mark the first year in which output surpasses pre-pandemic levels, following 764 deliveries in 2024.

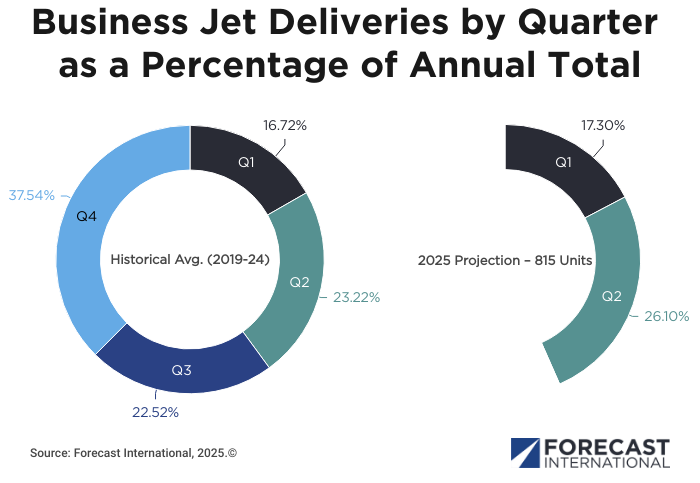

The most recent GAMA shipment data indicates a total of 354 business jet deliveries in the first half of 2025, comprising 141 aircraft in the first quarter and 213 aircraft in the second. The percentage distribution for these two quarters (17.3 percent for 1Q and 26.1 for 2Q), based on Forecast International’s projection of 815 total deliveries, aligns closely with the historical average between 2019 and 2024 of 16.7 percent for 1Q and 23.2 percent for 2Q.

The first half of 2025 also represents 43.4 percent of our full-year forecast, exceeding the five-year historical average of 39.9 percent for this period. These results suggest that deliveries are either trending slightly ahead of the historical pace or could potentially outpace our current forecast. Regardless, it appears increasingly clear that the milestone of surpassing pre-pandemic delivery levels is likely to be achieved in 2025. It is also important to note that demand for new business jets remains well above pre-pandemic levels, resulting in a continued imbalance between supply and demand, though not as pronounced as what is currently being experienced in the commercial sector.

Long-Term Deliveries Outlook

Honeywell also released its latest 10-year business jet forecast at the NBAA-BACE conference, projecting a record-breaking 8,500 deliveries through 2035, with a compound annual growth rate (CAGR) of 3.0 percent. In comparison, Forecast International projects 7,880 business jet deliveries between 2026-2035, with a lower CAGR of 1.4 percent. Our forecast also projects that Gulfstream will lead in terms of deliveries over the forecast period, representing 24.3 percent of total deliveries.

This variance from Honeywell’s upbeat forecast reflects our assumption of cyclical fluctuations and an eventual market downturn within the forecast window. My next article will take a closer look at Forecast International’s business jet production forecast methodology and provide a deeper analysis of the historical trends and assumptions that shape our outlook.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.