Airbus delivers first A321XLR and reiterates target for 770 jets for the year

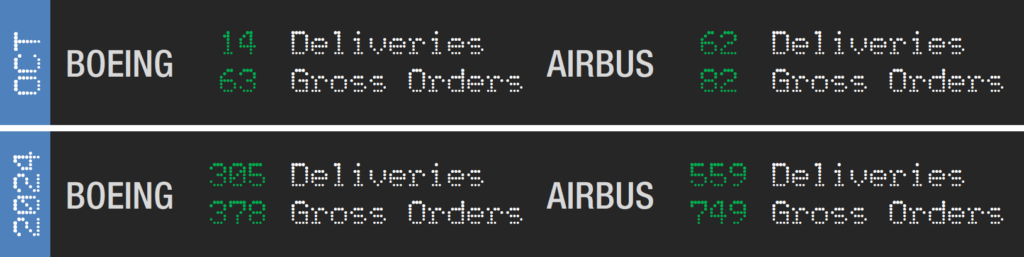

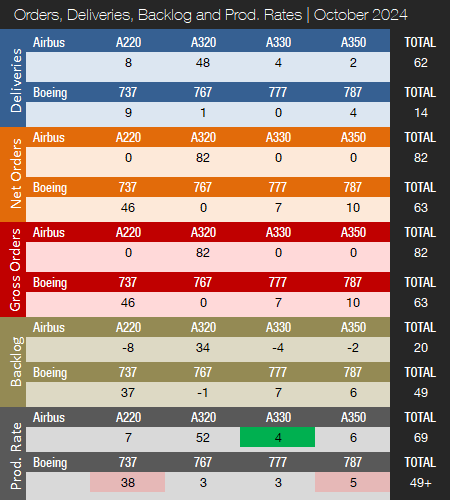

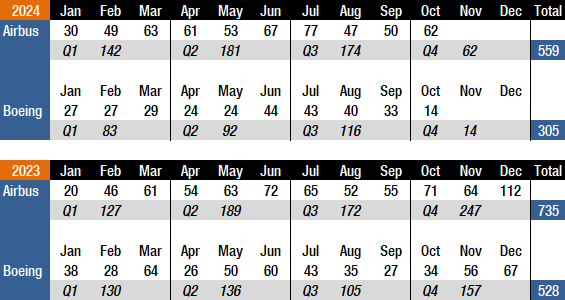

In October, deliveries were on the low side for Airbus and very low for Boeing, while orders were solid for both manufacturers. For the second consecutive month, Airbus set a new all-time backlog record for the commercial aircraft industry and delivered the first A321XLR to launch customer Iberia. On the deliveries front, due to the strike, Boeing handed over just 14 commercial jets, compared to 33 in September, while Airbus delivered 62 units, up from 50 last month. This compares to 34 deliveries for Boeing and 71 for Airbus in October of last year. For seven weeks, Boeing’s deliveries have been affected by a major strike involving 33,000 of its unionized workers. However, the strike by the International Association of Machinists and Aerospace Workers (IAM) finally came to a close in early November after union members voted 59% in favor of a new contract offer.

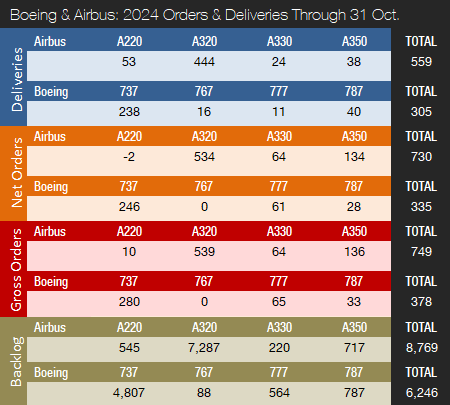

Year-to-date, Boeing and Airbus have delivered 305 and 559 aircraft compared to 405 and 559, respectively, during the first ten months of 2023. As of October, Boeing is 100 deliveries behind compared to last year’s totals to date, while Airbus is at exactly the same level. In 2023, in total, Boeing and Airbus delivered 528 and 735 aircraft compared to 480 and 663, respectively, in 2022. In 2023, Airbus won the deliveries crown for the fifth consecutive year.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021-23 were recovery years for the two largest commercial plane makers. For Airbus, 2024 is expected to be another year of recovery on the deliveries front, however, the company is currently struggling to push out aircraft fast enough to keep up with demand, and it appears an insufficient supply of engines is mainly at fault. To reach its revised target of 770 units delivered this year (down from a target of 800 at the beginning of the year), Airbus will have to push out 106 jets, on average, per month in November and December. While Airbus has traditionally finished the year on a very high note, churning out 212 aircraft in just two months would be quite a feat. Airbus in fact reiterated its guidance for 770 units at their third quarter earnings call in October, which means we can expect an impressive end-of-year surge. Last year, Airbus delivered 176 units in the last two months compared to 216 in both 2018 and 2019 in the pre-COVID years. Turning our attention to 2025, despite the company’s deliveries woes during 2024, we continue to expect a new all-time delivery record from Airbus. Boeing will take a big step back on the deliveries front this year as it is focusing on safety and working to fix its quality system. But we can expect a surge in Boeing shipments in 2025. However, Boeing still has quite a way to go before setting new all-time company deliveries records. In 2018, before COVID-19 and the first 737 MAX grounding, Boeing delivered 806 jets, a level that will likely not be recaptured before 2027. Airbus’ record high of 863 shipments was set in 2019, a level that should be surpassed in 2025. Also, Airbus is expected to retain their deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Before 2019, Boeing had out-delivered Airbus every year since 2012.

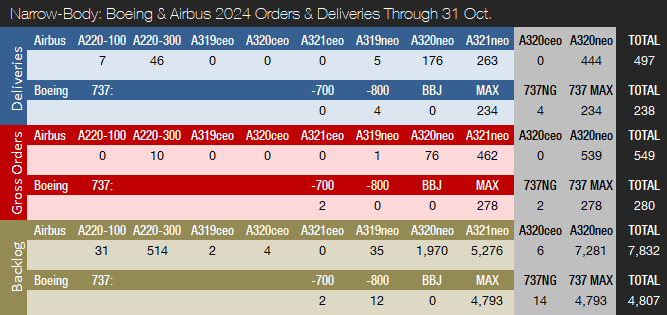

As indicated above, in October, Boeing delivered only 14 jets, including nine 737s (all MAXs), one 767, and four 787s. For most of last year, the 737 program was producing aircraft at an official rate of 31 per month. At the end of 2023, the program completed its transition to 38 aircraft per month. However, increased quality checks and audits by regulators in the aftermath of the Alaska Airlines Flight 1282 incident mean that Boeing is currently producing 737 MAXs at a lower rate. In March, Boeing Chief Financial Officer, Brian West, stated: “We are the ones who made the decision to constrain rates on the 737 program below 38 per month until we feel like we’re ready.” Before the strike, Boeing expected to return to its official production rate by the end of the year. However, a return to the official rate may now not happen before early next year. Boeing’s plans to increase production to approximately 50 737 MAX jets per month in the 2025/26 timeframe are still in effect. The target of 50 per month compares to the pre-crash/pre-pandemic rate of 52 737s per month in 2018. The company is still producing 737 NGs but now only has 12 737-800s remaining in backlog – of which 10 are P-8 Poseidons for the U.S. Navy and allies – as well as an additional two 737-700s that will be converted into E-7A Airborne Early Warning and Control (AEW&C) aircraft for the U.S. Air Force.

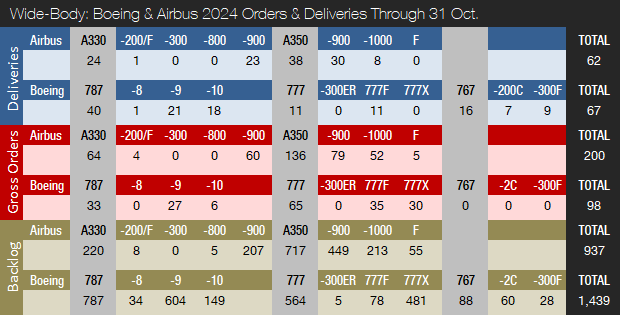

The 787 program will be ramping up production next year. In January of this year, the 787 production rate was raised to five per month with a target of 10 per month by 2025/26. However, Boeing has for now reduced the 787 rate to four before returning to five by the end of the year.

The 767 program is currently producing jets at a rate of three units per month, a mix of KC-46 tankers (based on the 767-2C) and 767-300F freighters. Boeing has just announced plans to end production of the 767-300F in 2027, after which the 767-2C is to be the sole 767 version in production. The company indicated that production of the 767 freighter will end once current orders are fulfilled. At the end of October 2024, Boeing had unfilled orders for 28 767-300Fs, including 17 for UPS and 11 for FedEx.

The 777 program is currently pushing out aircraft at a rate of three per month. Most aircraft in backlog are 777 freighters, with only five 777-300ERs left. By the 2025/26 timeframe, Boeing expects to be delivering four 777s per month. The 777 program was expected to get a new addition in late 2023 with the delivery of the first 777X (777-9), however, the 777X’s entry into service was postponed to 2025. Recently, the service entry was pushed out once more, this time to 2026. Boeing will also launch a 777X-based freighter (777-8F) with initial delivery in 2028 – recently postponed by one year just like the 777-9.

In October, Airbus delivered 62 jets, including eight A220s, 48 A320s (all NEO), four A330s, and two A350s. On average, the company delivered 48 A320s per month in 2023 compared to 43 in 2022 and 44 year-to-date. Production is currently being increased, however, Airbus is no longer releasing their production rate changes and prefers to announce in what year they will reach a certain rate. At this time, despite slow shipments in the August-October timeframe, we consider the unofficial A320 production rate to be 52 per month with further increases expected in the fourth quarter (perhaps not before early next year). Airbus is working with its supply chain to increase A320 production to 75 aircraft per month by 2027. Previously, the target of 75 was expected to be reached in 2026, however, in June of this year, Airbus pushed the target out by a year as suppliers are unable to keep up with demand. Also, Airbus has reduced its 2024 deliveries target from 800 to 770. The A320 program was expected to reach a monthly rate of 65 by late 2024, however, while Airbus has not specified whether this target has also been pushed out, we would now not expect this level of production to be reached before well into 2025. In late October, the commercial aircraft fleet got a new addition with the first delivery of the A321XLR. On 30 October, Spanish flag carrier Iberia took delivery of the first Airbus A321XLR, becoming the launch operator for the type. The aircraft will be operated on a number of flights across the airline’s European network before its first transatlantic mission from Madrid to Boston later in November. In Iberia service, the jet seats 182 passengers in a two-class layout with lie-flat business class seats with direct aisle access. According to Airbus, the A321XLR’s large overhead bins provide 60% more luggage capacity. The A321XLR delivers ranges of up to 4,700nm (5,400 miles/8,700 kms) – 15% more than the A321LR.

The A220, meanwhile, is being produced at an unofficial rate of seven aircraft per month, with a monthly production rate of 14 expected by 2026 (reiterated at the third quarter earnings call in October). Airbus is reportedly considering to introduce a stretch version of the A220.

The A330 production rate was increased from two aircraft per month to three at the end of 2022. In October, the rate was increased to four per month in line with previous announcements. The A350 production rate was raised to six per month at the end of 2023 in line with Airbus’ announcements. Airbus expects to produce 10 A350s per month by 2026 and 12 by 2028 (reiterated at the third quarter earnings call in October).

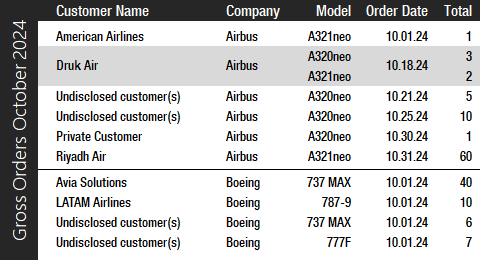

Turning to the October orders review, in terms of reported bookings, Boeing had a solid month and reported 63 gross orders from four different customers. Boeing had no cancellations in October. Avia Solutions, the world’s largest Aircraft, Crew, Maintenance and Insurance (ACMI) provider, placed an order for 40 737 MAX jets (all 737-8s). Also, LATAM booked a total of 10 787-9s, while undisclosed customers ordered seven 777Fs and six 737 MAXs. Year-to-date, Boeing has accumulated 335 net new orders (378 gross orders), compared to 841 net new orders (971 gross orders) after the first ten months of last year. Last year’s figures include Paris Air Show held in June 2023, where the general ordering activity was much stronger than at Farnborough this year. In 2023, Boeing booked a total of 1,314 net new orders (1,456 gross orders) – before ASC 606 changes – compared to 774 net new orders (935 gross orders) in 2022. Please note that for comparison reasons, we do not include Boeing’s so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

In October, Airbus had a strong month in terms of new orders and booked orders from six customers for a total of 82 jets (gross orders) and reported no cancellations. The largest order (by # of aircraft) was placed by Saudi Arabia’s Riyadh Air, which booked 60 A321neos. The remaining orders were all relatively small and mainly feature A320neos. Year-to-date, Airbus has accumulated 749 gross orders (19 cancellations => 730 net new orders), compared to 1,334 net new orders (1,394 gross orders) after the first ten months of last year. In 2023, Airbus won the orders crown for the fifth consecutive year booking an astounding 2,094 net new orders (2,319 gross orders), compared to 820 net new orders (1,078 gross orders) in 2022.

At the end of October, following a strong orders haul, Airbus set yet another all-time backlog record for the commercial aircraft industry. The company reported a backlog of a staggering 8,769 jets, of which 7,832, or 89 percent, were A220 and A320 family narrowbodies. Airbus’ old all-time backlog record of 8,749 jets was set in September. By the end of last month, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 6,246 aircraft, of which 4,770, or 77 percent, were 737 family narrowbody jets. Boeing’s all-time backlog record of 6,259 aircraft was set in March 2024. The number of Airbus aircraft to be built and delivered represents 10.2 years of shipments at the 2019 production level (the pre-pandemic level), or 11.9 years based on the 2023 total. In comparison, Boeing’s backlog would “only” last 7.7 years at the 2018 level (the most recent “normal” year for Boeing), or 11.8 years based on 2023 deliveries. Boeing’s book-to-bill ratio year-to-date, calculated as net new orders divided by deliveries, is 1.10 with Airbus coming in higher at 1.31. This means that both companies are currently adding to their backlog with Airbus receiving around 1.3 new orders for every aircraft it delivers. Boeing’s book-to-bill ratio last year was 2.49 with Airbus coming in even higher at 2.85. This means that both companies received well over two new firm orders for every aircraft delivered.

2024 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2024, Forecast International’s analysts currently expect Boeing and Airbus to deliver 343 and 764 commercial jets, respectively. Please note that these figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon maritime patrol aircraft and KC-46 Pegasus tanker and Airbus’ A330 MRTT tanker.

In its current year guidance, despite sluggish deliveries these past few months, Airbus still expects to deliver 770 planes in 2024 (target reduced in July from 800), compared to 735 delivered in the previous year. Airbus reiterated their guidance in late October at the company’s third quarter earnings call. Meanwhile, Boeing decided to forgo issuing a 2024 production forecast as it focuses on safety and quality improvements in the aftermath of the Alaska Airlines incident in January. Boeing reported third quarter results on 23 October.

Note: Green means the rate was just increased. Light red color means the program is temporarily producing at a lower rate than what is indicated in the table.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://boeing.mediaroom.com/2024-10-23-Boeing-Reports-Third-Quarter-Results

- https://boeing.mediaroom.com/2024-10-08-Boeing-Announces-Third-Quarter-Deliveries

- https://boeing.mediaroom.com/2024-10-28-LATAM-Orders-10-787-Dreamliners-to-Grow-Boeing-Widebody-Fleet

- https://s2.q4cdn.com/661678649/files/doc_financials/2024/q3/3Q24-Boeing-Earnings-Call-Transcript.pdf

- https://flightplan.forecastinternational.com/2024/11/05/boeing-strike-ends-after-workers-approve-new-contract/

- https://flightplan.forecastinternational.com/2024/10/16/boeing-to-end-767-300f-production-in-2027-postpones-777x-delivery-start/

- https://www.airbus.com/en/newsroom/press-releases/2024-10-riyadh-air-places-firm-order-for-60-airbus-a321neo-family-aircraft

- https://www.airbus.com/en/newsroom/press-releases/2024-10-airbus-delivers-first-a321xlr-to-iberia

- https://www.airbus.com/en/newsroom/press-releases/2024-10-airbus-reports-nine-month-9m-2024-results

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.