After several years of tumult precipitated by a one-two punch of black swan events – the grounding of the MAX fleet in 2020 and the outbreak of the COVID-19 pandemic – the Boeing 737 series is beginning to steadily recover position as one of the world’s preeminent narrowbody passenger aircraft. Boeing’s long-established market and industrial largess, the rejuvenation of the passenger market’s demand trajectory, and easing regulatory pressure on the MAX have all contributed to the company’s ability to secure a rising slate of new orders and progressively restore production rates for the series through 2023. Although nagging supply chain complications and lingering industry skepticism continue to modestly inhibit new-build production, the company has nevertheless increased MAX outputs from 25 planes per month in 2022 to nearly 40. Boeing anticipates that monthly MAX production will attain its pre-pandemic target by 2025. Despite the series’ recent travails, Forecast International’s projections indicate that Boeing will build more than 6,400 new-build 737 aircraft over the coming decade alone, a monumental feedstock that is certain to generate a similarly vast pool of R&M requirements for decades to come.

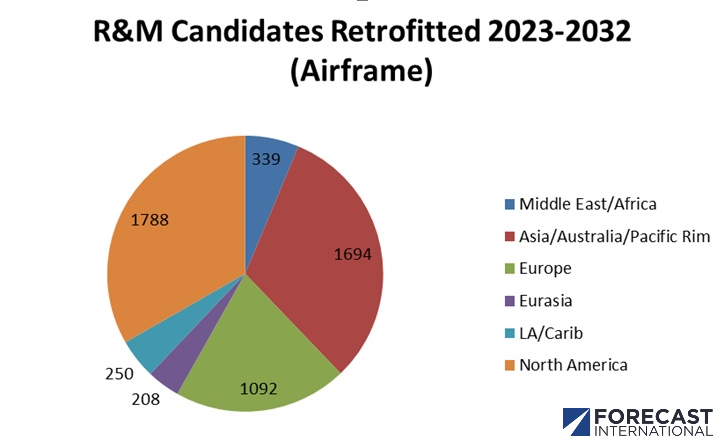

In the near to intermediate term, the slower-than-anticipated rollout of the MAX has incentivized operators to invest in the retrofit of their legacy 737 fleets. There are over 8,000 737 aircraft operating today, making the series one of the world’s most important commercial airline platforms. In response to the mounting cost pressures introduced in the wake of the pandemic, many passenger carriers around the globe downsized their fleets and paused costly initiatives. Now, the need to lure back customers amidst the ongoing recovery of passenger traffic and the relative stabilization of corporate finances after several years of painful retrenchment have placed a renewed emphasis on seating reconfigurations and creature comfort modifications over the next decade.

The 737 receives roughly the same level of R&M activity as the other large commercial transports in operation around the globe. In-flight entertainment, seating, Wi-Fi connectivity, and various cabin retrofits (lighting, lavatories, etc.) dominate the market. Electronics upgrades to instrumentation and sensors are available, though largely dwarfed by creature comfort modifications. Although identifying best practices and building consensus on how best to retain client interest and profitability in a much transformed aviation landscape remain a long-term process, the market for cabin- and seating-oriented retrofits appears to be settling into a new equilibrium as carriers emerge from the post-pandemic interregnum with a better understanding of how recent events have reshaped customer demands, expectations, and overall travel flows. Passenger traffic is expected to return to pre-pandemic levels by 2024, with a number of operators hoping to complete planned cabin refresh initiatives by 2025 at the latest in order to better leverage this nascent moment of market enthusiasm. Still, nagging supply chain constraints and inflationary pressures will continue to modestly inhibit the pace at which many carriers can respond to this warming climate.

The need to balance the monetary benefits of maximizing per-flight profitability via seat densification modifications against the risk of driving an increasingly vocal and demanding customer base into the arms of more luxury-oriented competitors has driven many passenger carriers to adopt a mixed approach. This approach seeks to capture multiple market segments while reconciling the seemingly contradictory pressures of the present environment. Revenue-maximizing densification appears to be entering a nascent renewal across the market, where need often trumps choice, but burgeoning premium economy options offer an alluring safety valve for passengers who are willing to splurge in exchange for a more comfortable flying experience. Across all class offerings, the integration of enhanced Wi-Fi suites, allowing customers to interface more easily with the capabilities of now-ubiquitous personal electronic devices, is liable to be a significant locus of R&M activity through the 2023-2032 forecast period, as evinced by Southwest’s recent $2.0 billion initiative.

In the regulatory domain, the prospective institution of a mandate for the integration of an additional angle of attack (AOA) monitoring system for the MAX series emerging from the European Union Aviation Safety Agency (EASA) could precipitate a rush of retrofit requirements within the forecast period. The 2023 decision by Boeing to begin pre-wiring all new-build MAX aircraft to be able to accommodate such a retrofit speaks to the rising likelihood that such a mandate will be realized and that the new AOA monitoring system will become a standard feature of the MAX in the future. The ultimate fallout from the fatal 737-800 nacelle incident in 2018 remains more ambiguous, with national aviation authorities continuing to debate and assess potential reforms to the NG’s maintenance requirements and the necessity of structural alterations.

The passenger-to-freight (P2F) conversion market experienced explosive and unprecedented growth over 2021 and 2022, has remained robust through 2023, and is expected to remain a long-term growth area given the centrality of e-commerce and diversified supply chains to the globalized economic landscape. Boeing’s own projections indicate that the aviation sector could demand in excess of 1,300 narrowbody P2F conversions through 2040. Still, the modest cooling of macroeconomic growth across the APAC region and the relative stabilization of e-commerce demand flows relative to the post-pandemic boom are liable to result in a gentle consolidation of the market environment through the latter half of the forecast period. As a result, opportunities for new entrants could become increasingly circumscribed as more established P2F providers such as Boeing, AEI and IAI leverage the capabilities of their newly expanded conversion lines to better accommodate the majority of anticipated demand. Over the longer term, passenger carriers’ steady accumulation of new-build MAX aircraft will eventually create a fecund feedstock of surplus NG models ready for conversion into freighters, with major providers such as AEI already beginning to prepare for this eventuality.

The advent of an additional black swan event in the form of the Russian Federation’s invasion of Ukraine remains an unwelcome development for the 737 retrofit segment. With no legible end to the war in sight, Eurasia’s single largest market remains effectively closed off to many external retrofit providers for the foreseeable future. Russian commercial operators have been barred from utilizing the airspace of the European Union and North America, and the imposition of sanctions largely precludes future business with Russian aviation contractors and operators. Worse still, the Russian government subsequently encouraged Russian commercial operators not to return hundreds of leased commercial aircraft to their predominantly Western European lessors. Although some Russian carriers, such as S7, nevertheless took steps to return their leased aircraft through 2022, many other airframes will remain stranded indefinitely. Additionally, Reuters and other sources reported that Russian operator Aeroflot had begun resorting to the cannibalization of its 737 stocks amidst an intensifying shortage of maintenance components. This situation has also imposed financial losses on contractors that had previously been contributing to Russian 737 retrofit projects, such as Aeroflot’s cabin refurbishment campaign and Pobeda’s anti-condensation improvements.

Forecast International’s Airborne Retrofit & Modernization Forecast provides comprehensive coverage of airborne retrofit and modernization activities for a portfolio of more than 60 global aircraft programs. Through extensive research and expert analysis, clients are provided with an unprecedented window into the R&M market. Each report features complete data on fleet sizes, average fleet ages, key operator nations, and a litany of ongoing and speculative retrofit programs in four key segments: Electronics, Airframe, Propulsion and Armament. Reports include in-depth coverage of military fixed-wing aircraft, large commercial transports, business jets, regional aircraft, and a variety of military and civil rotorcraft. From Service Life Extension Programs for the Lockheed Martin C-130H to seat replacement efforts for the Airbus A320, the Airborne R&M product covers it all.