A soon-to-be-published Regional Transport Aircraft market analysis from Forecast International projects that a total of 2,399 regional aircraft will be produced during the 10-year period from 2023 through 2032. The value of this production is estimated at $98.4 billion, as calculated in constant 2023 U.S. dollars.

The world’s manufacturers built 152 regional jets and turboprops in 2022, representing a 10 percent increase compared to the 138 aircraft built in 2021. This was the first annual increase in regional aircraft production since 2019.

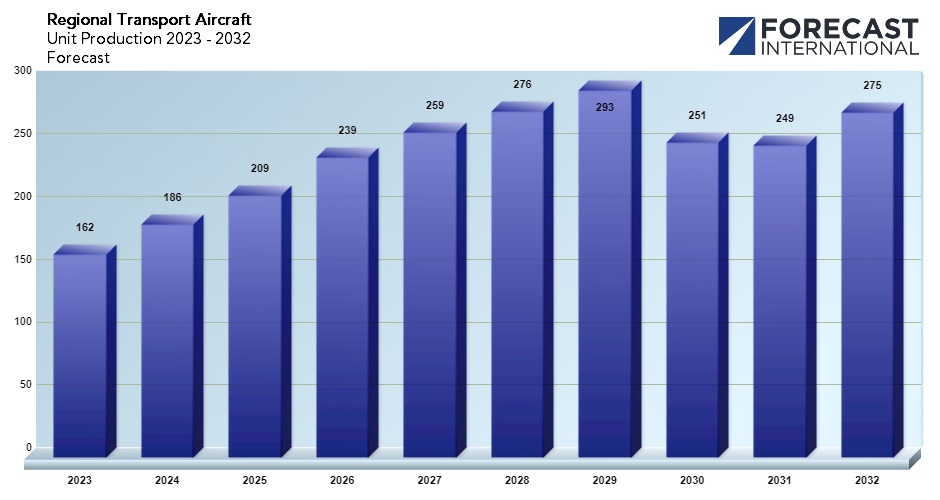

According to Forecast International, annual production is projected to increase to 162 aircraft in 2022, and continue rising until reaching a peak of 293 aircraft in 2029. Due to an anticipated cyclical downturn, production is forecast to decline to 251 units in 2030 and 249 in 2031, before rebounding to 275 units in 2032.

The forecasts include production of both jet-powered and turboprop-powered regional aircraft. During the 2023-2032 forecast period, jets will account for 54.9 percent of regional aircraft unit production and 78.4 percent of production value.

The Forecast International projections encompass a wide range of aircraft – from 19-seat turboprops to 90+ seat regional jets. The wide capacity range covered by regional aircraft types results in a market that is quite stratified from top to bottom.

The regional aircraft manufacturing industry has undergone considerable restructuring in recent years. Leading contenders Bombardier and Mitsubishi have exited the market, at least as regional aircraft OEMs. The result of this consolidation and restructuring is the existence at present of one dominant manufacturer in the regional jet segment (Embraer) and one dominant manufacturer in the turboprop sector (ATR). Embraer’s dominance of the regional jet market might not receive a serious challenge during, or even somewhat beyond, the forecast period. ATR, however, could see its dominance in the turboprop market eventually challenged by none other than Embraer. The Brazilian company had once been a major manufacturer of turboprop aircraft, and is mulling a possible launch of a new family of 70- to 90-passenger turboprop airliners for service entry in the early 2030s.

In terms of unit production, Embraer is expected to lead the regional transport market on production of 754 regional jetliners, a 31.4 percent market share. ATR is second with production of 661 aircraft, for a 27.6 percent share of the market. The Chinese firm COMAC takes third place on production of 354 ARJ21 regional jets for a 14.8 percent share. Textron Aviation subsidiary Cessna takes fourth place with production of 161 SkyCourier turboprops, representing a 6.7 percent share of the market.

In terms of the monetary value of production, Embraer takes the number one position on production worth $49.4 billion, a 50.2 percent share of the market. ATR is second with production worth an estimated $17.6 billion, a 17.9 percent share. COMAC is third with production worth $13.5 billion, a market share of 13.8 percent. Airbus Canada is fourth with A220-100 production worth $8.2 billion, for a market share of 8.3 percent.

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes more than 70 individual reports, most with a 10-year unit production forecast. Product comes complete with four Market Segment Analyses, covering the markets for: Large Commercial Jet Transports; Regional Transport Aircraft; Business Jet Aircraft; and General Aviation/Utility Aircraft.

Click here to learn more.

Raymond Jaworowski currently co-authors three of Forecast International's best-selling products: Civil Aircraft Forecast, Military Aircraft Forecast, and Rotorcraft Forecast. As a contributor to Aviation Week & Space Technology's Aerospace Source Book, he has authored Aircraft Outlooks, and provided input for the publication's Aircraft Specifications tables. Raymond has represented Forecast International at numerous conferences and trade shows, often as a featured speaker. He is a member of the American Helicopter Society.