by J. Kasper Oestergaard, European Correspondent, Forecast International.

Summary:

- Revenues and cash flow greatly Improved in third quarter

- Sharp increase in deliveries in Q3 vs. Q2

- Cash burn has stopped, Q3 free cash flow of €600 million

- Worst of the COVID-19 fallout has already occurred

- Slow path to recovery has begun.

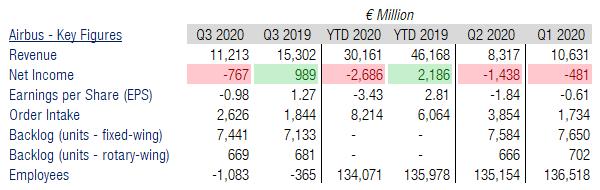

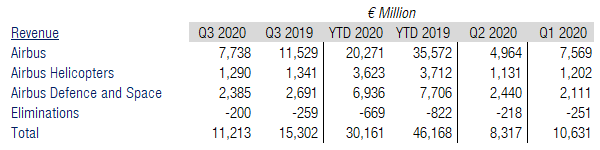

Airbus Group’s revenues and cash flow greatly improved in the third quarter of 2020 due to higher production and a sharp increase in deliveries. Airbus reported Q3 revenues of €11.2 billion down 26.7% from €15.3 billion in the same quarter last year. However, business activity increased sharply in the third quarter with revenues up €2.9 billion or 34.8% from the second quarter, where the company had been forced to temporarily close down facilities due to COVID-19. For the first nine months of the year, Airbus’ revenues were down 34.7% from €46.2 billion in 2019 to €30.2 billion in 2020.

After losing €1.4 billion in Q2 2020, Airbus reported a net loss of €767 million for the third quarter which compares to a €989 million profit in Q3 2019. The company reported Earnings per Share (EPS) of €-0.98 compared to €1.27 in Q3 2019 and €-1.84 in Q2 2020. Airbus’ employee count declined by 1,083 in the third quarter to 134,071 by 30 September.

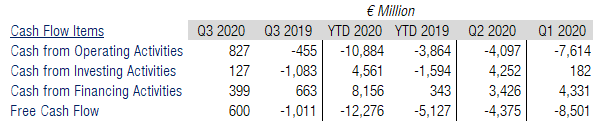

Airbus reported positive free cash flow (FCF) in the amount of €600 million for the third quarter. This compares to FCF of €-12.9 billion for the first six months of 2020 – a major improvement. Airbus has raised €8.2 billion from financing activities so far this year to ensure that the company has enough cash on hand to weather the pandemic.

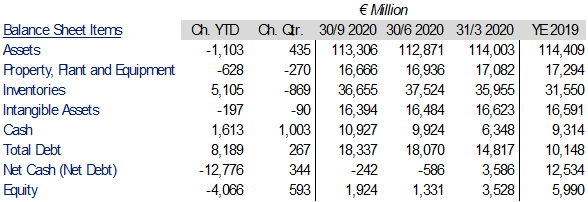

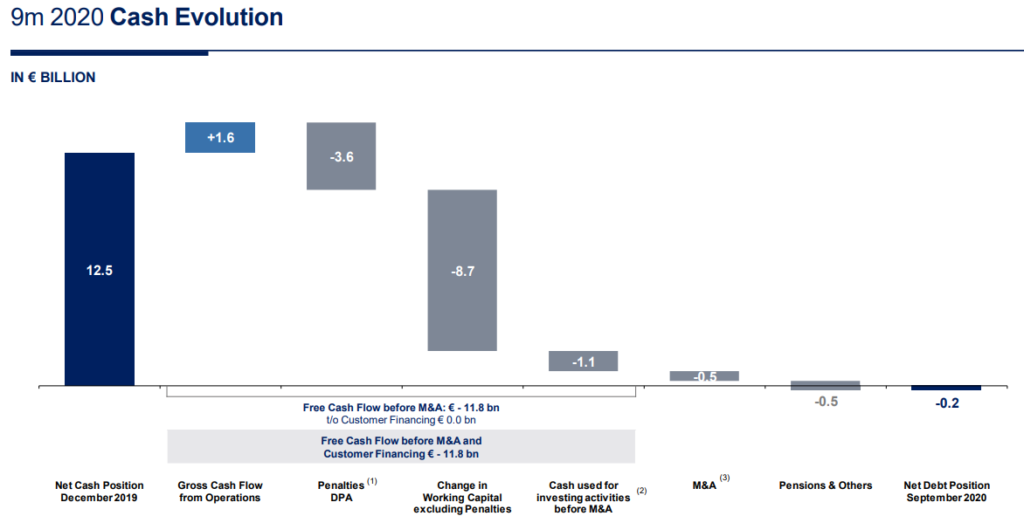

Looking at Airbus’ balance sheet figures, we see that the company entered 2020 with 9.3 billion in cash and cash equivalents and €10.1 billion in debt. When including securities held by the company, the company’s net cash position was an impressive €12.5 million.

Airbus was clearly in a strong financial position prior to the pandemic. As of 30 September, the company’s net cash position is €-242 million. This means that the company has burned through €12.8 billion in cash this year. As the chart below shows, the majority of the cash burn is due to changes in working capital (paying employees while facilities were closed down, paying suppliers, and building up inventory). The second-largest item is a €3.6 billion ($3.9 billion) penalty (from a settlement to resolve foreign bribery charges with authorities in the United States, France, and the United Kingdom).

Total debt is now €18.3 billion, up €8.2 billion from year-end 2019. Shareholder’s equity has declined from €6.0 billion by the end of last year to €1.9 billion as of 30 September. In the third quarter, the cash burn stopped and Airbus’ financial position improved significantly.

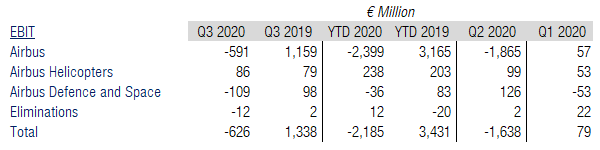

Looking at segment-level results, we see that revenues from Airbus (commercial jets) are down from €11.5 billion in Q3 2019 to €7.7 billion in Q3 2020, a 32.9% decrease. In comparison, Airbus helicopters and Airbus Defence and Space have been much less impacted. For the first nine months of the year, Airbus’ revenues are down a staggering 43.0% from €35.6 billion in 2019 to €20.3 billion in 2020.

For the first nine months of the year, Airbus Group generated an EBIT loss of €2.2 billion compared to a €3.4 billion EBIT profit in 2019. Airbus (commercial jets) reported a €2.4 billion EBIT loss for the first nine months of the year, whereas Airbus Helicopters managed to grow its EBIT to €238 million, up from €203 million last year. The majority of the COVID-19 financial fallout occurred in Q2 2020 due to facility closures and other disruptions to the company’s operations.

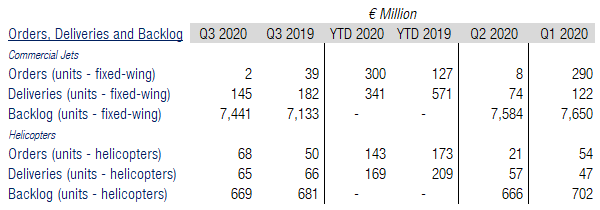

In the third quarter of 2020, Airbus booked two net new orders for commercial jets and has received 300 orders year-to-date compared to 127 last year. The company delivered 145 commercial jets in Q3 2020 down from 182 in Q3 2019, but up sharply from just 74 aircraft in Q2 2020.

Airbus Helicopters booked 68 net new orders in Q3 with total 2020 net new orders now at 143 compared to 173 for the first nine months of 2019. The company delivered 65 helicopters in Q3 2020, compared to 66 in Q3 2019 and 57 in Q2 2020. As of 30 September, Airbus’ commercial jet backlog totaled 7,441 aircraft, up from 7,133 at the same time last year. Airbus Helicopters’ backlog was 669 aircraft at the end of September compared to 681 in 2019.

Share Price

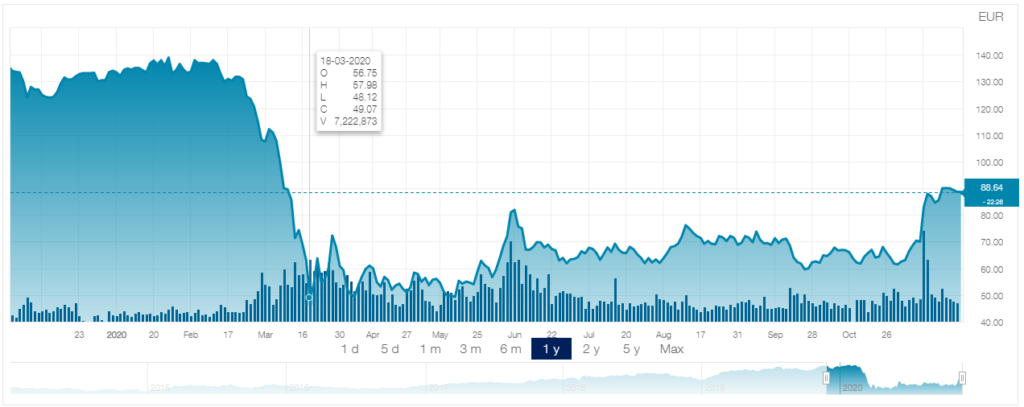

Airbus’ shares traded at €88.64 when markets closed on Friday 20 November. Airbus started the year at €130.48 and traded as low as €48.12 on 18 March. Shares are currently 32.1% down for the year. The company paid a dividend of €1.65 in 2019 (for the calendar year 2018) but decided to suspend its dividend this year due to COVID-19. It is unlikely that the company will pay a dividend next year.

Outlook

Airbus withdrew its full-year 2020 guidance in March. Given the continued impact of COVID-19 on the company’s business and the associated risks, Airbus has decided to issue no new guidance on commercial aircraft deliveries or EBIT.

Assuming no further disruptions to the world economy, air traffic, Airbus’ internal operations and ability to deliver products and services, the company targets at least breakeven free cash flow before M&A and customer financing in the fourth quarter of 2020.

The worst of the financial damage caused by the pandemic appears to be behind us and it is expected that Airbus’ financial figures will keep improving in Q4 2020 and beyond, as the company ramps up commercial aircraft deliveries.

Forecast International expects Airbus to deliver 513 commercial jets and 248 helicopters in 2020. These figures were provided by our Platinum Forecast System® service, which is the only source of market intelligence that provides 15-year production forecasts plus 10 years of historical data.

References:

- https://www.airbus.com/newsroom/press-releases/en/2020/10/airbus-reports-nine-month-9m-2020-results.html

- https://www.airbus.com/newsroom/press-releases/en/2020/07/airbus-reports-halfyear-h1-2020-results.html

- https://www.airbus.com/newsroom/press-releases/en/2020/04/airbus-reports-first-quarter-q1-2020-results.html

- https://www.airbus.com/content/dam/corporate-topics/financial-and-company-information/Airbus_SN_Q3-2020.pdf

- https://www.airbus.com/content/dam/corporate-topics/financial-and-company-information/Airbus_9m2020_Presentation.pdf

- https://www.airbus.com/investors/share-price-and-information.html

- https://www.justice.gov/opa/pr/airbus-agrees-pay-over-39-billion-global-penalties-resolve-foreign-bribery-and-itar-case

- https://www.forecastinternational.com/platinum.cfm

The Platinum Forecast System is a breakthrough in forecasting technology that enables you to select your own unique criteria to create distinct market segments. With Platinum, you can create customized assessments that quickly identify both risk and future opportunities. System types and platforms, currencies, world regions and more can all be input to collect the intelligence that you need, when you need it. Simply select your market, your specific criteria, your forecast period and your currency — and get your results. All results are displayed as bar graphs, pie charts and unit and value of production charts — presented as line items by manufacturer — for instant analysis. All forecast data are complemented by full market reports, Forecast Rationales, Excel spreadsheets, and more. Check out the demo video to see Platinum in action by clicking here.

Based in Denmark, Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

A military history enthusiast, Richard began his career at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet became central to defense research, he helped design the company’s Forecast Intelligence Center and now coordinates the FI Market Recap newsletters for clients. He also manages two blogs: Defense & Security Monitor, which covers defense systems and international security issues, and Flight Plan, focused on commercial aviation and space systems.

For more than 30 years, Richard has authored Defense & Aerospace Companies, Volume I (North America) and Volume II (International), providing detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database tracking all companies involved in programs covered by the FI library. Richard currently serves as Manager of the Information Services Group (ISG), which develops outbound content for both Forecast International and Military Periscope.