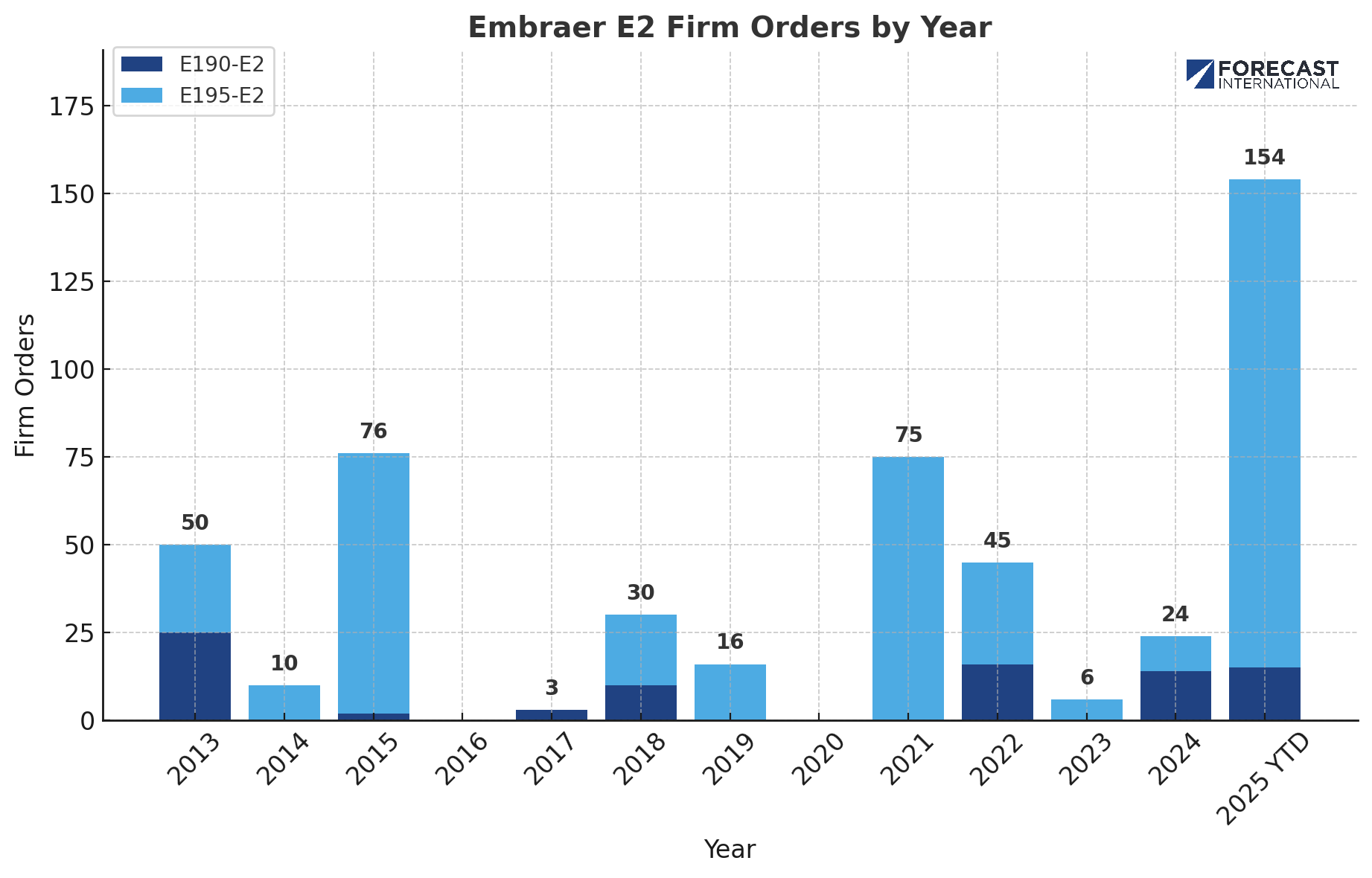

Everyone is talking about Embraer’s recent E2 order boom, and it’s easy to see why. The company has had a standout year in 2025, securing 154 firm orders for the E190-E2 and E195-E2 combined as of the end of October. The key question is, what does this surge really mean for the narrowbody segment overall?

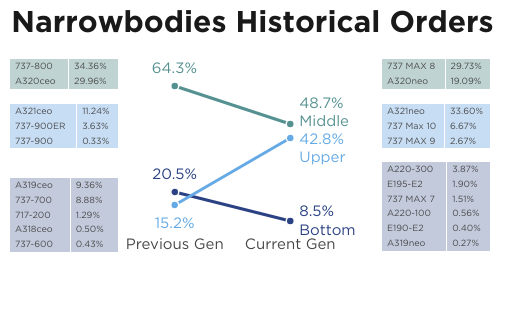

Embraer has in many ways stepped into a segment of the market that Airbus and Boeing have gradually moved away from, as operator demand for smaller narrowbodies has declined over the past two decades. In the previous generation, aircraft such as the 717-200, 737-600, A318ceo, and to some extent the 737-700 and A319ceo, occupied the same general capacity and range segment now served by the E2 and A220. As Airbus and Boeing shifted their focus toward larger, higher-margin models like the A321neo and 737 MAX 10, they widened the gap at the lower end of the market, where their smallest variants, the 737 MAX 7 and A319neo, now sit just above the A220-300 in both passenger capacity and range. This shift has created an opportunity for Embraer to fill the small gap at the very bottom of the narrowbody segment with the E2 family.

The lower end of the narrowbody market has also contracted significantly from the previous generation of aircraft to the current one, driven by a shift toward larger variants. Previously, the smallest narrowbody models accounted for about 20.5 percent of total narrowbody orders; today, they represent only 8.5 percent. Much of this decline stems from the drop in demand for the successors of the A319ceo and 737-700. In the current generation, the A319neo and 737 MAX 7, make up just 1.78 percent of all narrowbody orders, compared to 18.2 percent in the previous generation.

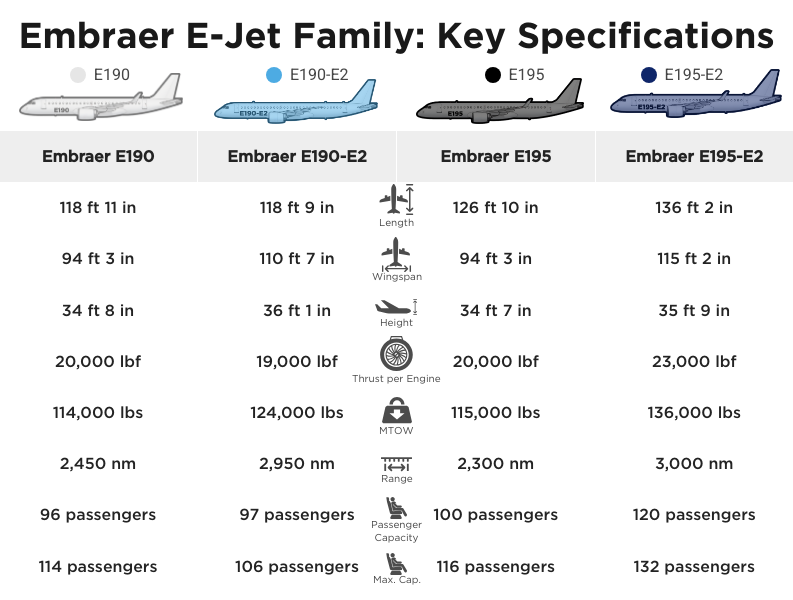

For that reason, I don’t believe Airbus and Boeing were wrong to move away from the lowest-capacity variants at the very bottom of the narrowbody market. Embraer, however, recognized the opportunity and built on the success of its earlier E190 and E195 models to fill this small gap in the market. The transition to the E2 generation introduced new Pratt & Whitney GTF engines, extended range, and higher seating capacity, enabling Embraer to position the E190-E2 and E195-E2 as strong replacements for the smallest variants in the previous generation of narrowbodies. Even as operators continue to shift toward larger narrowbody aircraft, the E2’s recent order momentum shows that there is still meaningful demand in this space and that Embraer has managed to bring new life to a category many thought had lost its relevance.

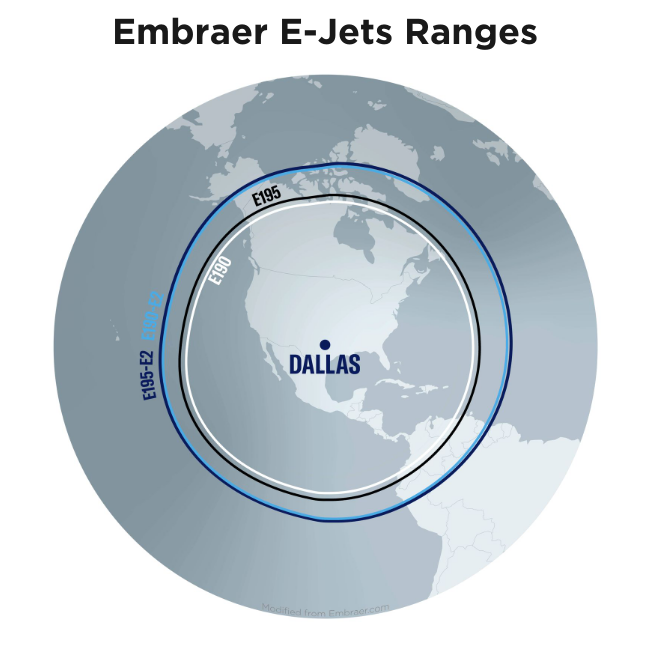

This shift also highlights Embraer’s success in repositioning the E2 as a small narrowbody jet rather than a regional aircraft. This rebranding was especially evident at the Paris Air Show this year, where Embraer promoted the aircraft as the “World’s Most Efficient Small Narrowbody Jet.” The technological and engineering advancements behind the program have played a key role in supporting that message by delivering greater range, improved fuel efficiency, and increased seating capacity. The E195-E2, for example, is ten feet longer than the original E195, seats up to 120 passengers compared to the E195’s 100 and offers extended range that pushes it in to the lower end of the narrowbody market.

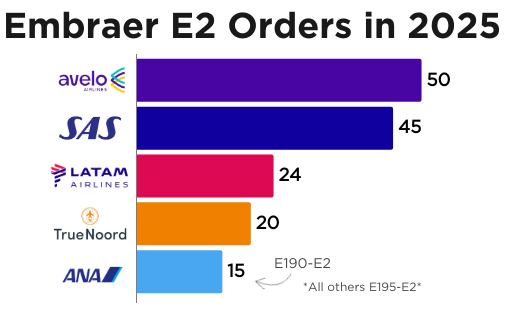

Some of the recent E2 orders have also come from nontraditional Embraer customers, including airlines that have historically operated A320ceos or 737NGs. LATAM is one example. The airline was seeking a replacement for its aging A319 fleet and needed an aircraft with the right balance of range and capacity. While the A319neo seems like the obvious choice, LATAM ultimately chose the E195-E2, ordering 24 aircraft with options for 50 more. The airline currently operates 38 A319ceos. Similarly, Avelo departed from the typical low-cost carrier model of maintaining a single fleet type, expanding beyond its all-737NG fleet with a firm order for 50 E195-E2s, including options for 50 more.

So why did these operators move away from their traditional fleet choices? Broader market dynamics are playing a major role.

Airbus and Boeing slots are booked well into the 2030s, and both OEMs continue to face ongoing production ramp-up challenges. As a result, the LATAM and Avelo orders are examples of airlines exploring alternatives that enable them to modernize fleets sooner and benefit from improved fuel efficiency. In this environment, Embraer’s more predictable production cadence and near-term delivery availability make the E2 family particularly such airlines.

All of this brings us back to the question of why the E2 is succeeding in a segment of the narrowbody that has traditionally weakened. In my view, it’s a story of technological progress, smart marketing by Embraer, and broader industry dynamics aligning in a way that has allowed the company to carve out a sustainable but limited niche at the very bottom of the narrowbody segment. This doesn’t mean that this part of the market is expected to grow or that operators’ appetite for smaller narrowbody variants will increase anytime soon. After all, the E2 family has received only 489 firm orders compared to nearly 20,000 combined orders for the 737 MAX and A320neo families. What it does show, however, is that success in the narrowbody market isn’t defined by size alone, and Embraer has proven that focus and smart execution can be just as powerful as scale when it comes to staying competitive

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.