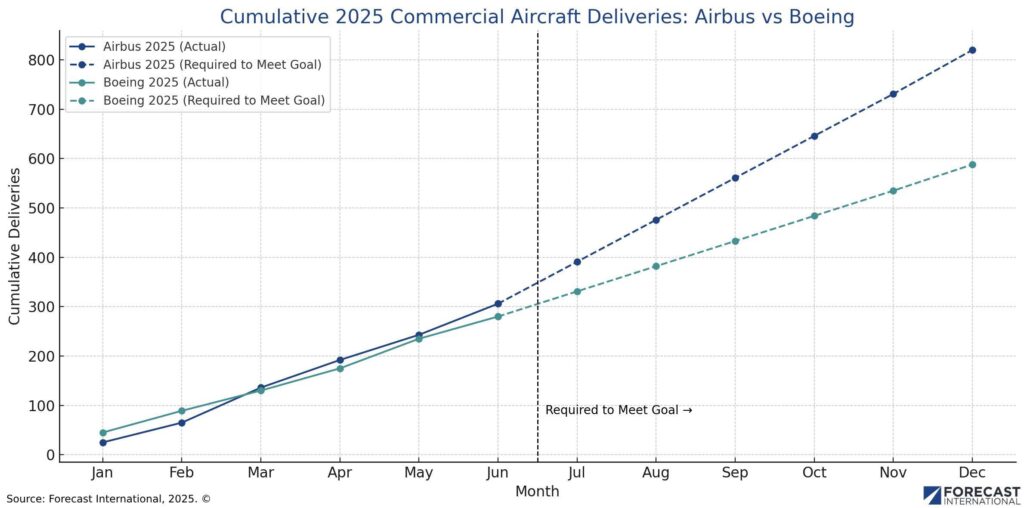

With June delivery figures available, we now have a clear view of where Airbus and Boeing stand at the halfway point of 2025. The delivery gap between the two OEMs is widening, and the second half of the year will determine whether either can meet its objectives.

Airbus: Ambition Meets Reality

Airbus is targeting 820 deliveries for 2025 but had completed only 306 units through June. This means the company must deliver 514 aircraft between July and December, or an average of 86 aircraft per month. That level of output will be difficult to reach and sustain, although Airbus will likely lean on a push in the final months to close the gap.

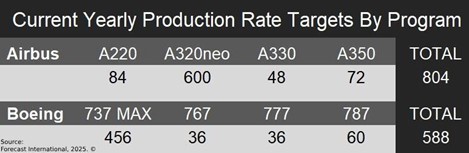

Interestingly, Airbus’s full year target of 820 deliveries is 16 units lower than the sum of its monthly production targets for each commercial aircraft program. This gap reflects the high expectations Airbus brought into the year. However, those expectations have been dampened by ongoing supply chain issues, particularly affecting the A320neo family and A350 programs.

Deliveries for the A320neo have been behind pace all year. Airbus delivered just 291 A320neo family aircraft through June, an average of 39 per month. That is well below the company’s stated goal of just producing 50 aircraft per month. Even if Airbus achieves that rate in the second half, it will not likely be enough to reach its full year delivery target.

Widebody deliveries have also disappointed. Airbus had plans to scale up A350 production from around six aircraft per month to ten by 2026. As of June 30, the company delivered only 33 widebodies; 12 A330s and 21 A350s. In comparison, Boeing had delivered 57 widebodies; 20 777s and 37 787s, benefiting from an inventory of about 25 previously built 787s.

The contrast in performance reflects a difference in strategy. Boeing is taking a measured approach, balancing output with quality. Airbus, on the other hand, started the year with overly optimistic assumptions about how quickly supply chain constraints would improve and how fast it could ramp up production. Our early analysis said Airbus’s plan to hit 10 A350s per month by 2026 was unlikely, and that view was confirmed when the company announced in the first quarter that it would be limited to around six per month due to ongoing supplier issues.

Boeing: Steady Performance, Limited Upside

Boeing has not issued a formal 2025 delivery goal, but based on its stated monthly production rate targets, a full year estimate of 588 aircraft is a reasonable baseline. Throughout the first half, Boeing delivered 280 aircraft. To reach 588, the company must deliver 308 more aircraft, or an average of 51 per month.

One of the most interesting shifts this year is in delivery stability. Historically, A320neo production has been consistent, with a standard deviation of only 14 percent from the mean since ramping up in 2018. Boeing’s 737 MAX program by contrast has seen high levels of volatility and uncertainty, with a standard deviation of 57.0 percent from the mean since its ramp up in 2018. This year that pattern has reversed as the FAA cap on MAX production has reduced volatility. Boeing’s upside is limited outside of its stored inventory and its production and delivery pace has become more stable. Airbus on the other hand is now facing greater variability due to ambitious goals and persistent supply chain constraints impacting the A320neo and A350. This does not mean Airbus production is inherently less stable, but rather that rising ambitions increase the potential gap between targeted and actual deliveries. This is a trend worth watching, both for the remainder of 2025 and the remainder of the decade as both manufacturers push for higher output to meet their growing backlogs.

Outlook: Who Gets There?

We continue to doubt Airbus’s ability to meet its original target. In early June, we revised our forecast from 820 to 798 deliveries. Though we do not expect Airbus to fall dramatically short of its goal, the path to 820 deliveries is increasingly narrowing as each month of the year passes.

Boeing on the other hand has shown more consistent performance. If it maintains its current pace, it will likely meet our full year estimate of 569 aircraft, with the potential to reach as high as 590 deliveries depending on how much stored MAX and 787 units are cleared up and delivered before the end of the year. Additionally, while Boeing is delivering fewer aircraft than Airbus, its deliveries are somewhat more predictable given the FAA’s oversight in production and its more stable production levels for the year compared to Airbus. As it stands now, Boeing appears more likely to deliver on its goals for 2025 than Airbus.

Aerospace OEMs and their suppliers are currently navigating a challenging environment marked by supply chain disruptions and fluctuating markets. These pressures are intensified by ongoing issues like tariffs on materials and components, which could drive up manufacturing costs and complicate international production. To help manage these complexities, Forecast International’s Platinum Forecast System offers customized assessments designed to quickly pinpoint both risks and future opportunities within this dynamic landscape. Click here to book a demo with a Forecast International expert today.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.