The 2025 Paris Air Show highlighted an industry amid transition, with attention shifting from headline-grabbing orders and long-term innovation toward the immediate challenges of aircraft delivery and production stability. Although Airbus and Embraer secured notable deals, much of the discussion centered on ongoing supply chain issues and the strain of meeting existing backlog commitments.

Orders: Steady Activity for Airbus and Embraer; Boeing Quiet at the Show

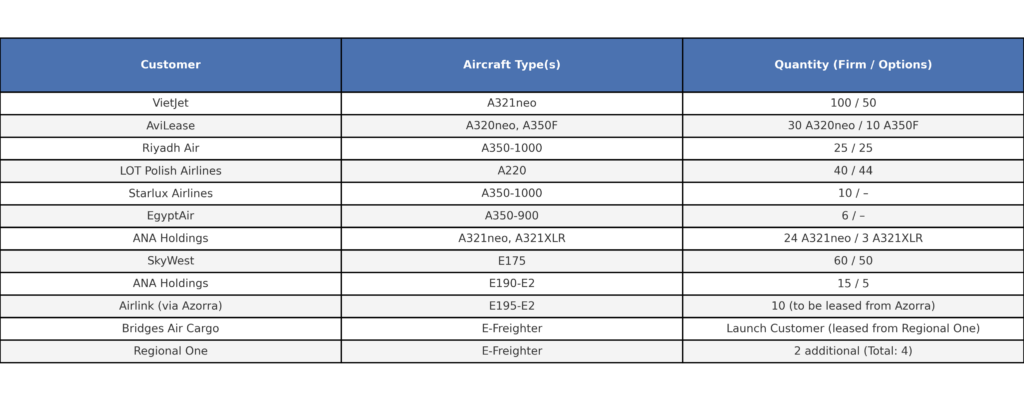

Airbus secured approximately 268 firm orders across its widebody and narrowbody aircraft families, signaling strong market confidence despite current production constraints. Embraer also received a total of 79 firm orders, with the largest coming from SkyWest, which ordered 60 E175s, with options for 50 more.

Boeing did not announce any new orders during the Paris Air Show; however, this absence should be viewed in context. In the month prior to the show, Boeing recorded 303 gross orders for the month of May, outpacing the orders that Airbus received at the Paris Air Show. Boeing also appears to be prioritizing internal challenges over new commitments, focusing on certification work, supplier alignment, and improving its delivery reliability, particularly on the 737 MAX program.

Supply Chain: Transparency, Labor, and Long-Term Planning

As expected, key discussions centered around persistent supply chain pressures and the evolving dynamics between OEMs and suppliers. There was a clear call for increased communication and forecasting between suppliers and OEMs. A knowledge gap in skilled workers remains a concern after many workers retired during the pandemic, though the influx of tech-savvy, less experienced workers is spurring opportunities for digital transformation and efficiency gains in manufacturing processes. The role of AI and data analytics drew attention as a potential tool for supply chain decision-making, contingent on improved data visibility and end-to-end transparency across the value chain. Meanwhile, the strong aftermarket is disrupting traditional dynamics, attracting new entrants and increasing tension between engine and airframe OEMs, as engine makers thrive on aftermarket profits, while aircraft OEMs are focused on delivering new aircraft.

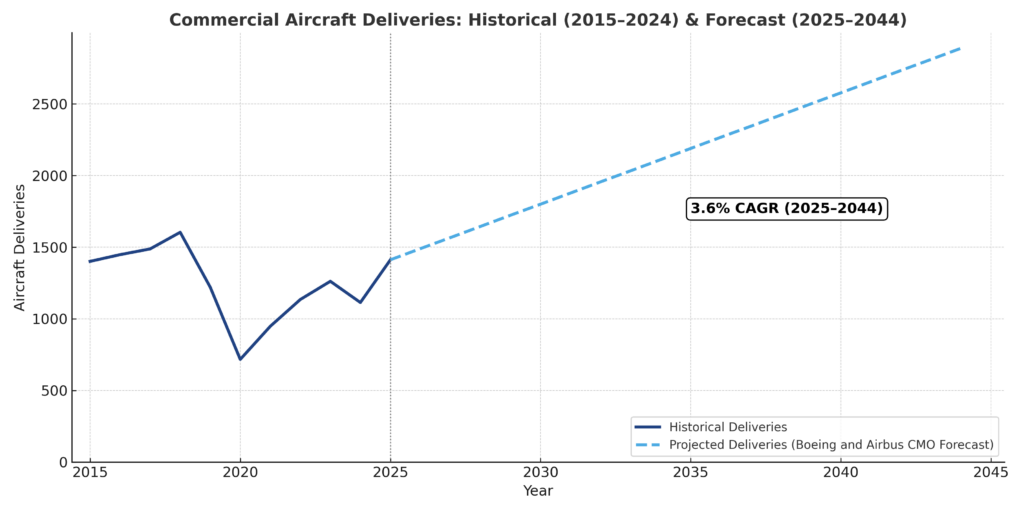

Layered atop these dynamics are the long-range commercial market outlooks recently issued by both Airbus and Boeing, which project sustained and significant demand for new aircraft deliveries through 2044. Boeing forecasts a global demand for over 43,600 new commercial jets, while Airbus anticipates 42,420, driven by rising air travel demand in emerging economies, fleet modernization goals, and a push for more fuel-efficient operations.

Nearly half of these new aircraft are expected to replace older, less efficient models. This reflects the urgent need to expand capacity across the commercial aviation supply chain and for OEMs to ramp up production over the next two decades. As both Airbus and Boeing aim to meet demand, effective collaboration and longer-term visibility of order books and delivery schedules will be essential to maintaining pace with the industry’s trajectory.

eVTOL Development: Focus Shifts to Operational Integration and Infrastructure

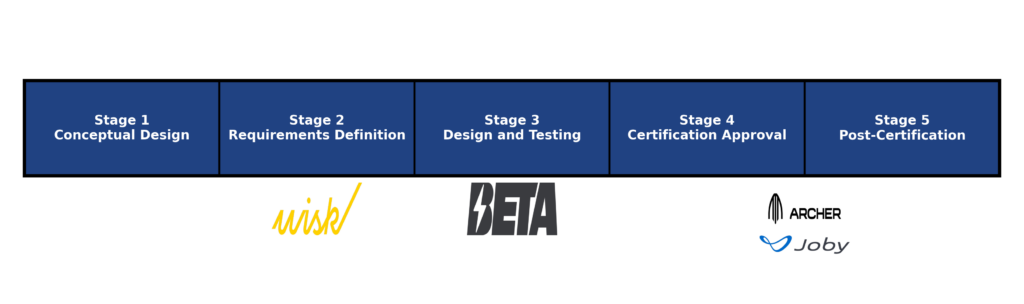

Advanced air mobility companies used the event to showcase their progress toward FAA certification and operational readiness. Joby and Archer Aviation are currently the most advanced, navigating through stages 4 and 5 of the FAA’s certification process. BETA Technologies revealed it has reached stage 3, following a methodical, phased approach. Meanwhile, Wisk Aero remains in stage 2 but continues to pursue certification for its fully autonomous eVTOL.

Archer also announced plans to begin operations in Abu Dhabi by 2026, with broader commercial service aimed for the 2028 Los Angeles Olympics. Much of the dialogue at the event centered on regulatory alignment and infrastructure development. Key challenges identified by companies include vertiport construction, modernization of air traffic management systems, and fostering public acceptance.

Other eVTOL manufacturers, including Vertical Aerospace and EVE, have not publicly disclosed specific milestones in their certification efforts.

Next-Generation Narrowbodies: Engine OEMs Set the Pace

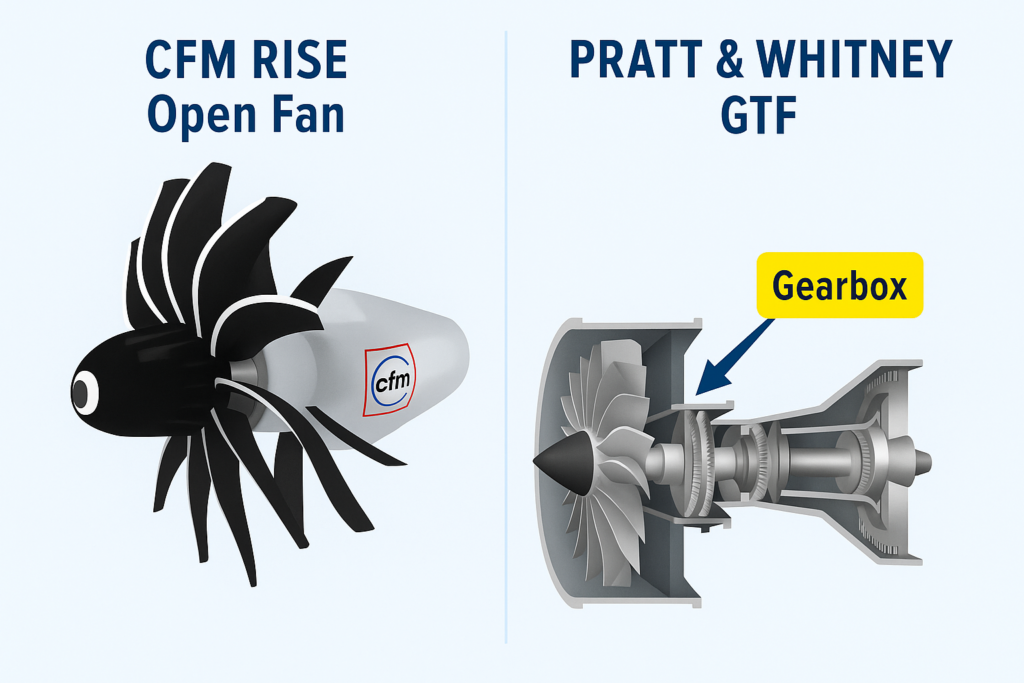

It was evident at the air show that the conversation around the next generation of narrowbody aircraft is being led by the development of new engine technology by engine manufacturers, with Airbus and Boeing largely in a wait-and-see mode. CFM has taken a firm position in favor of open-fan technology, emphasizing its potential to deliver double-digit fuel efficiency gains and meet long-term emissions targets. In contrast, Pratt & Whitney is advocating for continued evolution of its geared turbofan (GTF) platform, arguing that stepwise improvements offer a more practical and less disruptive path forward. Whichever path gains traction will directly shape how and when Boeing and Airbus move forward with clean-sheet designs. For now, engine development, not airframe development, is setting the timeline.

Aerospace OEMs and their suppliers are currently navigating a challenging environment marked by supply chain disruptions and fluctuating markets. These pressures are intensified by ongoing issues like tariffs on materials and components, which could drive up manufacturing costs and complicate international production. To help manage these complexities, Forecast International’s Platinum Forecast System offers customized assessments designed to quickly pinpoint both risks and future opportunities within this dynamic landscape. Click here to book a demo with a Forecast International expert today.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.