The delivery of a Juneyao Air Boeing 787-9 is being delayed due to the escalating trade war between the United States and China, which has led to significant tariffs on imports from both countries. Reports have also emerged that the Chinese government has instructed domestic carriers to halt the acceptance of new Boeing aircraft. Furthermore, Chinese airlines have reportedly been directed to stop purchasing aircraft parts and components from U.S. companies.

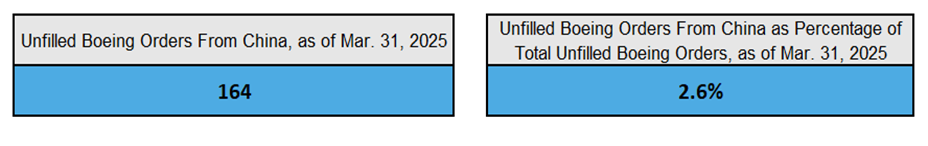

While Forecast International believes the short-term impact on Boeing will be minimal, given that only 2.6 percent of Boeing’s unfilled orders, or 164 aircraft, are from Chinese-based operators and lessors (including Hong Kong, as it is also subject to the tariffs), the delivery delay of the Juneyao Air 787-9 suggests that the effects of these tariffs are already being felt within the industry and could lead to longer-term consequences. Boeing also reported 762 unfilled orders for unidentified customers as of March 31st, 2025, some of which may be in China. The company has already begun flying 737 MAX aircraft, originally destined for Chinese carriers, from China back to the United States, signaling that more Chinese carriers have deferred or delayed their Boeing deliveries. As a result, unless trade tensions between the United States and China ease, the validity of the current Boeing backlog for Chinese operators and lessors may need to be reconsidered. Additionally, Boeing’s commercial orders and deliveries data does not show any unfilled orders for Juneyao Air and instead indicates that the 787-9 was delivered to Juneyao in February 2025. It is unknown why the aircraft is listed as delivered on Boeing’s website, considering the recent news of its delayed delivery.

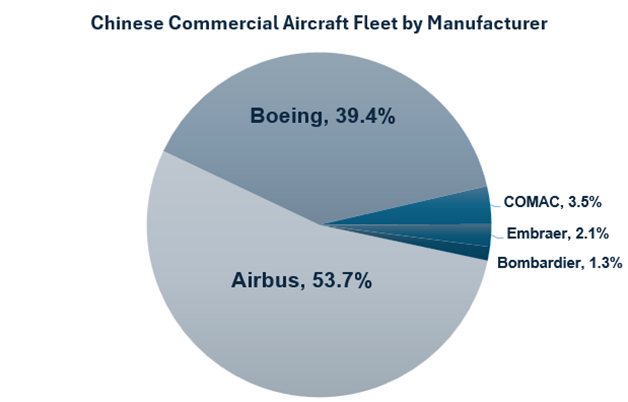

Given the current circumstances, the Chinese government may take the opportunity to encourage domestic carriers to prioritize orders from COMAC, particularly models such as the C909, C919, and C929. Currently, Boeing aircraft make up approximately 39.4 percent of the Chinese commercial fleet, while Airbus accounts for 53.7 percent, according to Forecast International’s inventory and fleet database. However, these percentages would decrease as the Chinese government urges airlines to reduce their reliance on U.S. and foreign-made jets. However, this shift has already been in progress over the past few years, with Chinese carriers gradually redirecting their orders from Boeing and Airbus to domestically produced aircraft, particularly following the launch of the C919 and C929 programs. COMAC’s share of the Chinese fleet currently stands at just 3.5 percent, and was already projected to grow significantly with the ramp-up of C919 production and other COMAC programs.

On the other hand, the trade conflict may hinder the production and development of COMAC aircraft, which still heavily rely on U.S.-made components. For instance, according to Forecast International’s internal data, 55 percent of the component suppliers for the COMAC C919 are U.S.-based companies, while only 25 percent are based in China. Key components on the C919 such as the LEAP-1C engines from CFM International are provided by U.S. suppliers, and having to re-engine an aircraft such as what Russia had to do with the Superjet and MC-21 would be extremely costly and time consuming. Additionally, establishing a fully domestic supply chain would be a lengthy and complex process for China, especially given the C919 program’s current reliance on foreign, particularly American, components. This suggests that, under the current circumstances, it is most likely that China will first attempt to negotiate continued access to critical foreign components, rather than attempt a full and immediate shift to domestic production.

Lastly, considering the Chinese government has reportedly instructed Chinese airlines to stop purchasing aircraft parts from U.S. suppliers, the more than 1,500 in service Boeing aircraft, which account for 39.4 percent of China’s total commercial aircraft fleet, would face significant challenges. Airlines will struggle to maintain and repair their fleets due to limited access to critical spare parts, leading to increased downtime and potential safety concerns if attempts are made to substitute parts. The situation would be akin to the ongoing part shortage in Russia, where sanctions imposed by Western countries have led to difficulties in sourcing Western components for both Airbus and Boeing aircraft. While alternatives may be sought from domestic or other foreign suppliers, these options are likely to come with higher costs and delays, and the inability to source U.S. parts would only hinder future growth in China’s aviation sector. Maintaining access to U.S.-manufactured parts would be the most practical and beneficial approach for China’s aviation sector in the near term, rather than attempting an immediate shift to domestic sourcing.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.