Airbus and Boeing look to further increase production in 2025 /// Steel and aluminum tariffs raise concerns for production

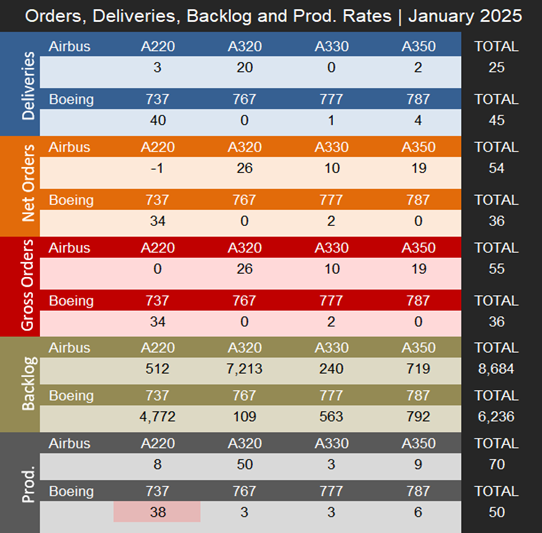

Note: Light red color means the program is temporarily producing at a lower rate than what is indicated in the table.

January 2025 Summary

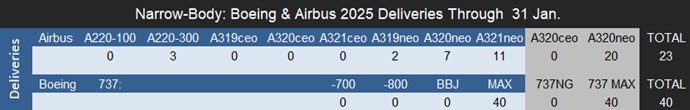

In January, ordering activity was relatively muted. Boeing deliveries increased, while Airbus saw a significant slowdown from its strong finish to 2024. Boeing handed over 45 commercial jets, up from 30 in December and 13 in November, whereas Airbus delivered only 25 units, a sharp decline from 123 the previous month. In comparison, Boeing delivered 27 aircraft and Airbus 30 in January of last year. With the major strike involving 33,000 unionized workers now over, Boeing is focused on ramping up production of MAX aircraft to an FAA-approved rate of 42 per month by March 2025. In January, the company delivered 40 MAX 8 aircraft, making up for its sluggish end to 2024 due to the strike. However, Boeing produced only 30 737 MAX jets that month.

Airbus has not yet released official guidance on its 2025 delivery targets, but Forecast International expects it to deliver just under 840 aircraft this year as it continues increasing production across all commercial aircraft programs and nears its pre-COVID production rates. Boeing, despite a strong start to the year in terms of deliveries, is still playing catch-up following the production slowdown at the end of 2024 caused by the machinists’ strike. January 2025 marked the first month since January 2022 in which Boeing delivered more aircraft than Airbus. While Boeing’s deliveries declined significantly in 2024, shipments are expected to surge in 2025. However, the company still has a long way to go before setting new all-time delivery records. In 2018, before the COVID-19 pandemic and the first 737 MAX grounding, Boeing delivered 806 jets—a level that Forecast International does not anticipate Boeing reaching until at least 2027. Airbus’ all-time high of 863 deliveries was set in 2019, a record that has the potential to be surpassed in 2025 if Airbus can increase production beyond our expectations. Additionally, Airbus is projected to maintain its lead in deliveries for the foreseeable future due to its strong backlog advantage over Boeing. Before 2019, Boeing had out-delivered Airbus every year since 2012.

Deliveries

The 45 Boeing jets delivered in January included 40 737 MAXs, one 777, and four 787s. Production significantly lagged in 2024 as Boeing struggled to meet its FAA-approved 737 MAX production rate of 38 aircraft per month. This shortfall was due to the recent strike, as well as increased quality checks and regulatory audits following the Alaska Airlines Flight 1282 incident. While Boeing is currently producing 737 MAXs at a lower rate than 38 per month, Forecast International expects the manufacturer to reach this target in 2025 and continue increasing MAX production in line with FAA-approved rates. Additionally, Boeing remains committed to its plan of ramping up 737 MAX production to approximately 50 aircraft per month in the 2026 timeframe, but whether this will be approved is in the hands of the FAA.

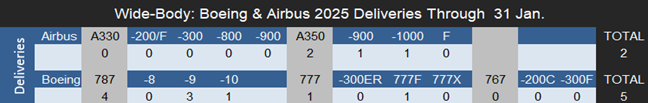

The 787 program is also expected to see a production increase in the coming years. As of January 2025, Boeing plans to produce seven 787 aircraft per month this year, with hopes of increasing output to ten per month by 2026. However, the company is currently producing only five to six 787s per month, raising questions about the feasibility of meeting its projected timeline. The long-term production outlook beyond 2026 remains uncertain, and Boeing has not provided guidance on its future plans.

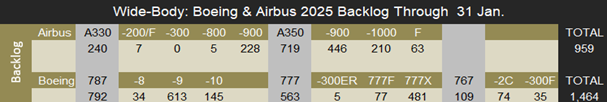

The 767 program is currently operating at a production rate of three aircraft per month, consisting of a mix of KC-46 tankers (based on the 767-2C) and 767-300F freighters. Boeing has announced plans to end production of the 767-300F in 2027, after which the KC-46 will be the sole remaining variant in production. At the end of January 2025, Boeing had unfilled orders for 35 767-300Fs, including 25 for UPS and 10 for FedEx.

The 777 program is currently producing aircraft at a rate of three per month, with most of the backlog consisting of 777 freighters. Only five 777-300ERs remain on order. By the 2025/26 timeframe, Boeing expects to increase production to four aircraft per month. The 777 program was originally set to expand in late 2023 with the delivery of the first 777X (777-9), but the aircraft’s entry into service has now been delayed to 2026. Boeing also plans to launch the 777X-based freighter (777-8F), with initial deliveries now scheduled for 2028—one year later than originally planned, mirroring the delay of the 777-9.

In January, Airbus delivered 25 jets, including three A220s, 20 A320neos, and two A350s. While production is increasing, Airbus no longer discloses specific production rate changes, instead opting to announce the year in which it expects to reach certain targets. At present, Forecast International estimates the unofficial A320 production rate to be around 50 aircraft per month, with further increases expected as Airbus works toward its goal of producing 75 per month by 2027. Initially, this target was set for 2026, but in June 2024, Airbus pushed it back by a year, citing supplier constraints that have made it difficult to keep pace with demand.

Meanwhile, A220 production has increased to an estimated eight aircraft per month, up from seven in the fourth quarter of 2024, with a target of 14 per month by 2026. Airbus was reportedly considering a stretched version of the A220, but recent reports suggest that those plans have been put on hold as the company focuses on scaling up production across its existing commercial aircraft programs.

The A330neo is currently being produced at a rate of approximately three to four aircraft per month, with no further increases planned. The A350 program, on the other hand, is ramping up, with the current production rate at six aircraft per month. Airbus aims to increase this to 10 per month by 2026 and 12 per month by 2028. The first A350F, the freighter variant of the A350, is scheduled for delivery in 2026.

For 2025, Forecast International projects that Boeing and Airbus will deliver approximately 569 and 837 commercial jets, respectively. These figures exclude militarized variants of commercial platforms, such as Boeing’s P-8 Poseidon maritime patrol aircraft and KC-46 Pegasus tanker, as well as Airbus’ A330 MRTT tanker.

Orders

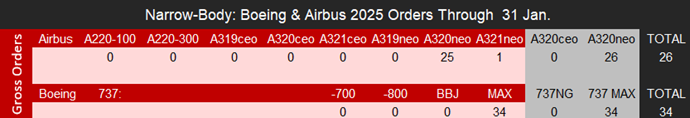

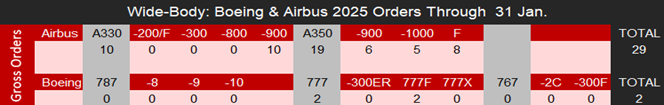

In terms of reported bookings, both Boeing and Airbus had a relatively soft month. Boeing recorded 36 gross orders, while Airbus reported 55. Boeing received no cancellations or conversions in January, resulting in 36 net new orders. These included 34 737 MAXs and two 777Fs, both ordered by unidentified customers. For consistency, this article does not include Boeing’s ASC 606 accounting adjustments in reported figures and considers net new orders as gross orders minus cancellations.

Airbus’ orders for the month were also moderate but exceeded Boeing’s, with a total of 55 gross orders. The manufacturer recorded one cancellation of an A220, bringing net orders to 54. The largest order by volume came from an undisclosed customer for 26 A320neos. Additionally, another undisclosed customer ordered 10 A330neos, while 19 A350s were booked—five for Lufthansa and another five for Taiwanese carrier STARLUX. The remaining nine orders are for an undisclosed customer.

Backlog

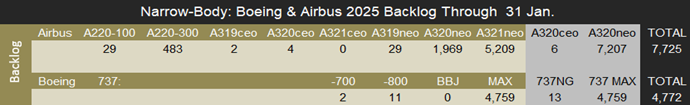

As of the end of January, Airbus reported a backlog of 8,684 jets, of which 7,725—representing 89.0% of the total backlog—were A220 and A320 family narrowbodies. Airbus’ all-time backlog record of 8,769 jets was set in October 2024. Meanwhile, Boeing’s total unfilled orders (before ASC 606 adjustments) stood at 6,236 aircraft, with 4,759, or 76.0% of the total backlog being 737 MAXs. Boeing’s highest recorded backlog of 6,268 aircraft was reached in November 2024. The volume of Airbus aircraft awaiting production and delivery represents 10.1 years of shipments at 2019 production levels (pre-pandemic) or 11.3 years based on 2024 deliveries. In comparison, Boeing’s backlog would last approximately 7.7 years at its 2018 production rate (the most recent “normal” year for Boeing) or 17.9 years based on its 2024 delivery total.

References:

- https://www.boeing.com/commercial#orders-deliveries

- https://aircraft.airbus.com/en/newsroom/press-release/2025-02-orders-deliveries-january-2025

- https://www.ainonline.com/aviation-news/general-aviation/2025-02-11/steel-and-aluminum-tariff-gives-aviation-industry-pause

- https://www.airbus.com/en/products-services/commercial-aircraft/the-life-cycle-of-an-aircraft/production

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.