About two months after Ball Corp announced it was shopping its aerospace operation, Ball Aerospace & Technologies Corp, BAE Systems has swooped in with a $5.55 billion offer. Other interested companies included General Dynamics and Textron, as well as private equity firms.

“The proposed acquisition of Ball Aerospace is a unique opportunity to add a high quality, fast-growing technology-focused business with significant capabilities to our core business that is performing strongly and well positioned for sustained growth,” said BAE Systems CEO Charles Woodburn. “It’s rare that a business of this quality, scale and complementary capabilities, with strong growth prospects and a close fit to our strategy, becomes available.”

Under BAE Systems, Ball Aerospace will be a complementary acquisition thanks to its space, optical, and antenna products. As such, it will likely report to BAE Systems Electronic Systems business division.

For 2022, Ball Aerospace reported sales of $1.98 billion, compared to sales of $1.91 billion in 2021. Operating income for the division was $170 million for the year, compared to $169 million in 2021. The federal government accounted for 98 percent of the division sales for 2022. Backlog jumped 20 percent during 2022 to almost $3 billion from $2.5 billion in 2021. The unit’s success can be attributed to its position in key funding priorities for space systems hardware.

BAE Systems’ interest in the unit stems from its positions in the space, C4ISR, and missile and munition markets. All of these sectors are seen as strong growth areas for the U.S. Intelligence Community and the Department of Defense.

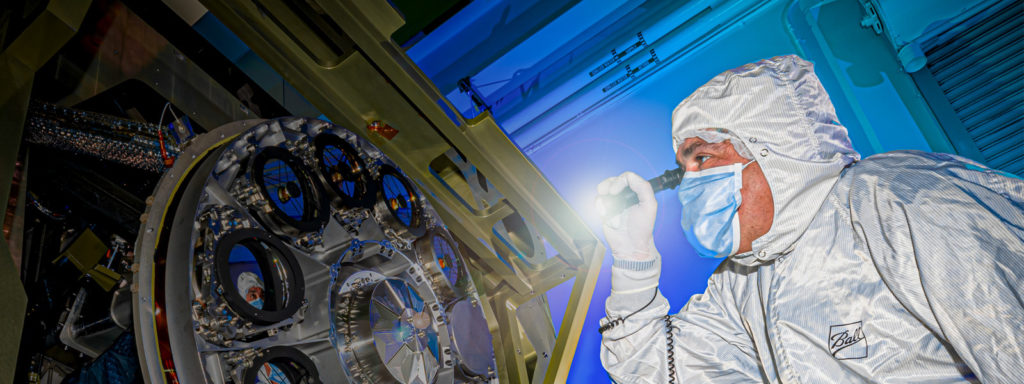

Ball Aerospace & Technologies designs, develops, and manufactures systems for intelligence surveillance and reconnaissance (ISR); civil and commercial; and national security aerospace markets. It produces spacecraft, instruments, and sensors; radio frequency systems and components; data exploitation solutions; and a variety of advanced technologies and products that enable weather prediction and climate change monitoring as well as deep space missions.

The operation is headquartered in Broomfield, Colorado, and employs about 5,200, of whom over 60 percent hold U.S. security clearances. Other facilities are located in Albuquerque, New Mexico, and Chantilly, Virginia.

The deal is expected to close in the first half of 2024 pending successful review by regulatory authorities.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.