Deliveries Improve as Boeing and the FAA Complete Three Days of 737 MAX Certification Test Flights

by J. Kasper Oestergaard, European Correspondent, Forecast International.

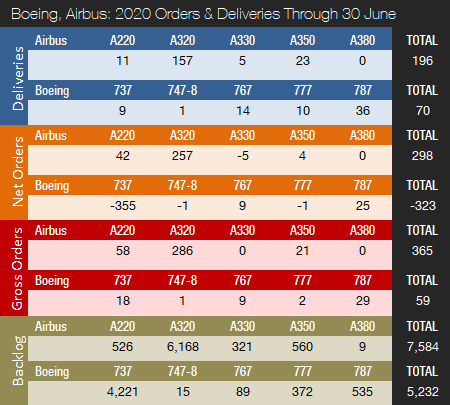

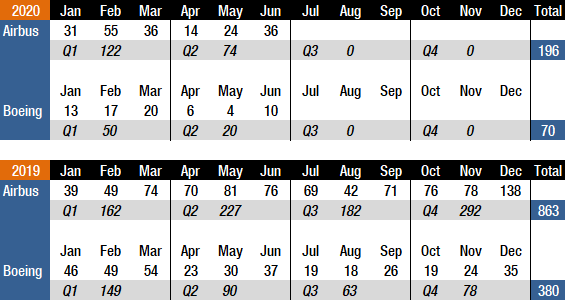

Boeing and Airbus delivered 10 and 36 commercial jets in June 2020 compared to 37 and 76 deliveries, respectively, in the same month last year. With just 70 deliveries this year to date, Boeing is 169 shipments behind last year’s total for the first half of the year. Airbus delivered a total of 196 jets from January to June, compared to 389 during the same period last year.

Boeing’s deliveries have suffered for many months in the aftermath of two 737 MAX crashes and the subsequent suspension of deliveries and grounding of the fleet. Deliveries of 737 MAX aircraft have been on hold since March 2019. Due to COVID-19, both manufacturers have been forced to temporarily close down production facilities and have announced significant production rate cuts. For the full year 2019, Boeing delivered 380 aircraft, while Airbus set a new all-time annual record, handing over 863 jets. Prior to this, Boeing had retained a deliveries lead over Airbus since 2012. In 2018, Boeing delivered 806 jets (763 in 2017), with Airbus handing over 800 (718 in 2017).

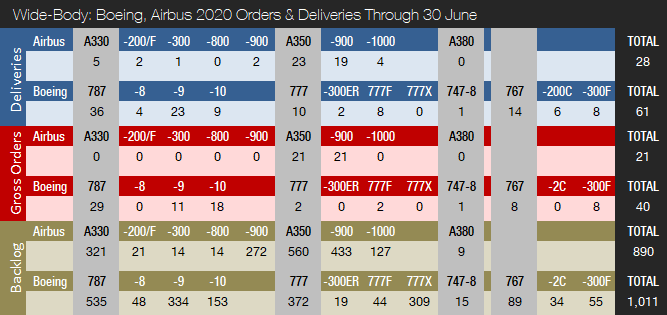

In June, Boeing delivered 10 aircraft, including two 737NGs, one 747-8F, three 767s, one 777, and three 787s. Production of the 737 MAX was suspended from January of this year until the end of May. On May 27, Boeing announced it had resumed production of the 737 MAX in Renton, Washington. Aircraft are being built at a low rate as more than a dozen initiatives focused on enhancing workplace safety and product quality are being implemented. When Boeing presented its first-quarter 2020 results in April, it was announced that the 737 MAX production rate will gradually increase to 31 per month during 2021, with further gradual increases as market demand allows. Boeing also announced that the 787 production rate will be reduced from 14 per month to 10 per month this year, and gradually reduced to seven per month by 2022. The combined 777/777X production rate will be reduced to three per month in 2021. Production rate assumptions were not changed on the 747 and 767 programs.

Prior to the recent 737 MAX production suspension, Boeing was manufacturing the jet at a reduced rate of 42 per month. The 737 MAX is expected to remain grounded until at least August. Boeing hopes to win regulatory approval in August for the jet’s return to service, although that could be pushed back until fall. In the meantime, test flights and software changes continue. Meanwhile, the Federal Aviation Administration (FAA) has repeatedly stated that it has no timetable for the aircraft’s return to service. In any case, it will be a few years before Boeing is able to hit the monthly production rate of 57 aircraft that was originally planned. Prior to the suspension of deliveries in March 2019, Boeing had produced and shipped 387 737 MAX jets. On June 17, FAA chief Steve Dickson testified at a Senate hearing on the 737 MAX. At the hearing, the FAA was heavily criticized and accused of stonewalling by senators pursuing changes to the agency’s safety role. Between June 29 and July 1, a number of 737 MAX certification flight tests were carried out by Boeing and the FAA to evaluate Boeing’s proposed changes to the automated flight control system. Following the flights, the FAA announced that, while this was an important milestone, a number of key tasks remain. These include a number of evaluation reviews and reports to be held and issued by the FAA and the Joint Operations Evaluation Board (JOEB), which includes international partners from Canada, Europe, and Brazil. Next, a Continued Airworthiness Notification to the International Community (CANIC) and an Airworthiness Directive (AD) will be issued, followed by the official ungrounding of the aircraft. The FAA will retain its authority to issue airworthiness certificates and export certificates for all new 737 MAX jets manufactured since the grounding and will perform in-person, individual reviews of these aircraft. In addition, the FAA will review and approve training programs for all part 121 operators.

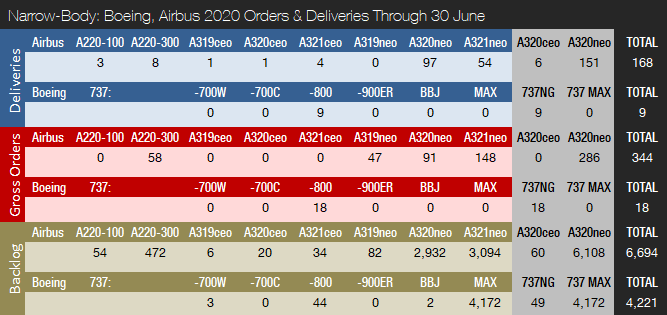

In June, Airbus delivered one A220, 31 A320s (all NEO), and four A350s. Prior to COVID-19, Airbus was targeting a 5 percent A320 rate increase to 63 jets per month from 2021, and was also discussing a further ramp-up with its supply chain that could have brought the production rate up to as high as 67 aircraft per month, or 804 per year, by 2023. This would have put the company within reach of a total of 1,000 jets deliveries per year. Those plans have now been shelved. For the full year 2019, Airbus handed over 642 A320 family aircraft, of which 551 were A320neos. This compares to a total of 386 A320neo family aircraft delivered in 2018, up from 181 and 68 in 2017 and 2016, respectively. Airbus delivered a record 112 A350s in 2019, up from 93 and 78 in 2018 and 2017, respectively.

Due to the COVID-19 pandemic, Airbus has cut production on several programs and is looking to hold underlying jet output at 40 percent below pre-pandemic plans for two years. The A320 production rate has been reduced to 40 aircraft per month, down from an average of over 53 aircraft per month in 2019. The A330 and A350 programs are reduced to a rate of two and six aircraft per month, respectively. No rate cut has been announced for the A220 or the A380. However, Airbus has delayed a planned A220 production ramp-up at its Mirabel facility near Montreal, where the company has been producing four A220s per month. On April 27, Airbus announced that it had begun the process of furloughing more than 6,000 employees in Europe, including 3,200 production workers at its wing manufacturing site in Broughton, Wales, and another 3,000 workers in France. In addition, Airbus is furloughing 3,163 workers in Spain. Airbus’ CEO Guillaume Faury has told the company’s 135,000 employees to brace for potentially deep job cuts and warned that Airbus’ survival was at stake without immediate action. On June 30, Airbus announced it plans to cut 14,000 jobs (5,000 in France, 5,100 in Germany, 900 in Spain, 1,700 in the U.K. and 1,300 elsewhere) as it deals with the effects of the coronavirus crisis. In the meantime, Boeing announced in May that it plans to cut 12,300 jobs, including nearly 10,000 in Washington. Recently, Boeing carried out a second round of layoffs involving an additional 1,030 employees companywide.

Turning to the orders race, in June, Boeing booked an order from FedEx for one 767-300F. The company also reported 60 737 MAX cancellations, for a total of -59 net new orders. Year-to-date, Boeing has accumulated 59 gross orders (382 cancellations => -323 net new orders). For the full year 2019, Boeing accumulated 243 gross orders (330 cancellations => -87 net new orders). For the full year 2018, Boeing booked 893 net new orders and 1,008 gross orders.

In June, Airbus received no new orders but reported one cancellation. For 2020 to date, Airbus has accumulated 365 gross orders (67 cancellations => net of 298). For the full year 2019, Airbus landed 1,131 gross orders (363 cancellations => net of 768), thereby retaking the orders crown from Boeing. In 2018, Airbus booked a total of 747 net new orders and 831 gross orders, thereby losing the 2018 orders race. Prior to this, Airbus had retained an orders lead over its rival every year since 2012.

At the end of June, Airbus’ reported a backlog of 7,584 jets, of which 6,694, or 88 percent, were A220 and A320ceo/neo family narrowbodies. This is 141 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020.

By the end of June 2020, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,232 aircraft, of which 4,221, or 81 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.8 years of shipments at the 2019 production level. In comparison, Boeing’s backlog would “only” last 6.5 years at the 2018 level, which we use as a proxy for 2019 due to the severe drop in 737 MAX deliveries. This year to date, Boeing’s book-to-bill ratio, calculated as net new orders divided by deliveries, is negative due to cancellations exceeding gross orders. Airbus’ book-to-bill ratio is 1.52, thanks mainly to very strong order bookings in January. In 2019, Boeing’s book-to-bill ratio was negative, while Airbus reported a book-to-bill of 0.89.

2020 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology which, among many other features, provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecasts and, for 2020, Forecast International’s analysts expect Boeing and Airbus to deliver 255 and 490 commercial jets, respectively.

Note: Boeing 777-300ER orders include one 777-200LR. The 777-300ER backlog includes two 777-200LRs.

References:

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://www.faa.gov/news/updates/?newsId=93206

- https://www.boeing.com/commercial/737max/737-max-update.page

- https://boeing.mediaroom.com/news-releases-statements?item=130685

- https://boeing.mediaroom.com/news-releases-statements?item=130673

- https://boeing.mediaroom.com/2020-04-29-Boeing-Reports-First-Quarter-Results

- https://www.washingtonpost.com/local/trafficandcommuting/faa-accused-of-stonewalling-by-senators-pursuing-changes-to-agencys-safety-role-after-boeing-737-max-crashes/2020/06/17/b5c44316-b0c6-11ea-856d-5054296735e5_story.html

- https://www.reuters.com/article/us-boeing-737max/u-s-faa-chief-to-testify-at-senate-hearing-on-boeing-737-max-idUSKBN2392YZ

- https://www.france24.com/en/20200630-airbus-to-cut-15-000-jobs-worldwide-a-third-of-them-in-france

- https://www.reuters.com/article/us-boeing-737max/boeing-737-max-expected-to-remain-grounded-until-at-least-august-sources-idUSKCN22A35G

- https://edition.cnn.com/2020/04/27/business/airbus-furloughs/index.html

- https://www.seattletimes.com/business/boeing-aerospace/boeing-to-cut-nearly-10000-jobs-in-washington-more-than-12000-overall/

Based in Denmark, Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.