U.S. Manufacturers Deliver 380 Aircraft – Down 48 Units from Q2 2018

by J. Kasper Oestergaard, European Correspondent, Forecast International.

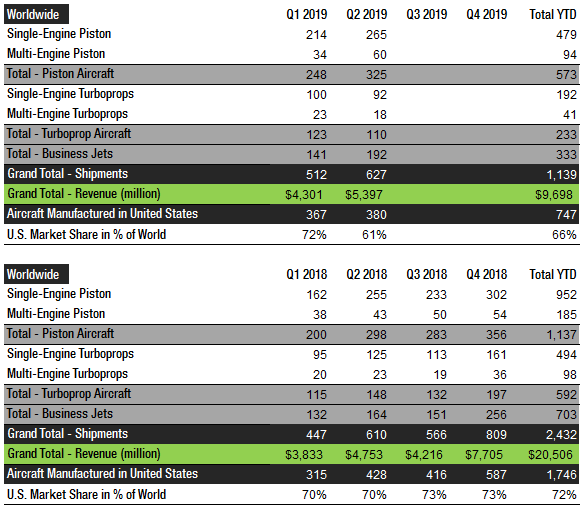

The General Aviation Manufacturers Association (GAMA) reports that manufacturers showed strong results in the second quarter of 2019. Fixed-wing general aviation aircraft manufacturers delivered 627 aircraft worldwide in Q2 2019, up 2.8 percent from 610 in Q2 2018. At the same time, revenues (billings) increased 13.6 percent to $5.4 billion, mainly due to a surge in Gulfstream revenues year-over-year, following the commencement of G500 deliveries in September 2018. The business jet market led the increase on deliveries of 192 units in Q2 2019, a 17.1 percent increase from the same period in 2018. Piston airplane shipments increased 9.1 percent year-over-year, while turboprop aircraft deliveries dropped as much as 25.7 percent.

U.S. manufacturers delivered 380 aircraft in Q2 2019, down from 428 in Q2 2018 – equal to a 16.5 percent decrease. U.S. manufacturers accounted for 61 percent of worldwide shipments in the second quarter, down from 70 percent in Q2 last year.

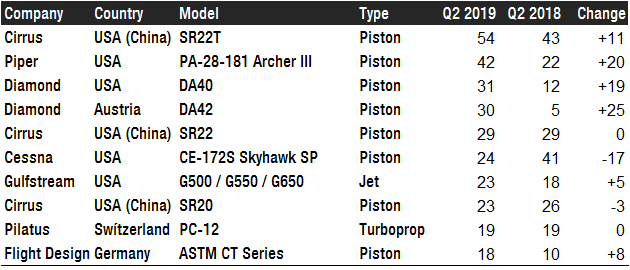

In Q2 2019, the Cirrus SR22T (piston) was the most popular fixed-wing general aviation aircraft with 54 units delivered (+11 from Q2 2018). The Piper PA-28-181 Archer III (piston) took second place with 42 shipments – up from 22 in Q2 2018, followed by the Diamond DA40 (piston) with 31 shipments, up 19 units from last year. In fourth place is the Diamond DA42 (piston), with 30 units delivered, putting it ahead of the Cirrus SR22 (piston), the Cessna CE-172S Skyhawk SP (piston), Gulfstream’s G500 / G550 / G650 large-cabin business jet variants, the Cirrus SR20 (piston), Pilatus’ PC-12 (turboprop), and Flight Design’s ASTM CT Series (piston).

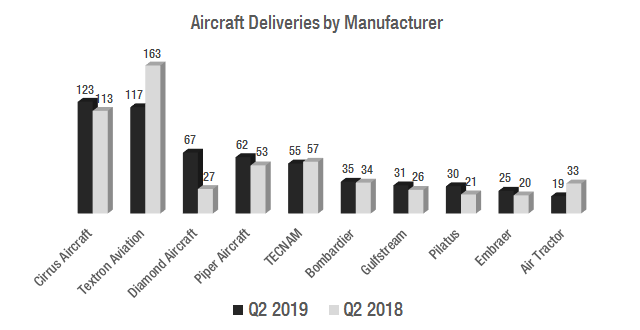

In the second quarter of 2019, Cirrus delivered more aircraft than any other general aviation aircraft manufacturer. The company shipped 123 aircraft, compared to 113 in Q2 2018. The 2018 leader, Textron Aviation (Cessna + Beechcraft), had a very disappointing quarter and delivered 46 fewer aircraft than in the second quarter of last year. In third place is Diamond Aircraft with 67 shipments, up from just 27 in Q2 2018, followed by Piper Aircraft, TECNAM, Bombardier, Gulfstream, Pilatus, Embraer and Air Tractor.

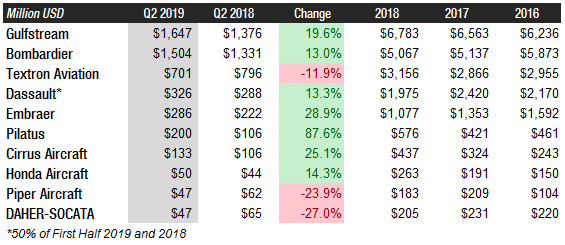

When general aviation aircraft manufacturers are ranked by revenues, the business jet manufacturers take the lead. Gulfstream boasted the highest revenues of all fixed-wing aircraft manufacturers in Q2 2019 with total sales of $1.6 billion, up 19.6 percent from the same period last year. The increase is mainly due to the market entry of the G500. Gulfstream has been the world’s largest general aviation aircraft manufacturer by revenues since 2013. In second place is Bombardier with Q2 2019 sales of $1.5 billion, up 13.0 percent from Q2 2018. Despite the fact that Textron Aviation (Cessna + Beechcraft) was the 2018 leader by units sold, it only ranks third by revenue in Q2 2019 with $701 million in earnings, down 11.9 percent from $796 million in the second quarter of last year. In fourth place is Dassault, which reported billings of $326 million, up 13.3 percent. It is worth mentioning that Pilatus Aircraft had a record quarter, with year-over-year billings up nearly 90 percent after the company delivered 11 units of its new PC-24 business jet (for a special company report on Pilatus, please click here). Embraer and Cirrus Aircraft also reported strong results with billings up 28.9 percent and 25.1 percent, respectively.

Forecast International’s 2019 General Aviation Forecast

Forecast International’s Platinum Forecast System® is a breakthrough in forecasting technology. Among many other features, Platinum provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest business jet and general aviation aircraft forecast data. Forecast International’s analysts expect aircraft manufacturers to deliver 724 business jets in 2019 as well as 1,742 other fixed-wing general aviation / utility aircraft.

Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

References:

- http://www.fi-aeroweb.com/General-Aviation.html

- https://gama.aero/facts-and-statistics/quarterly-shipments-and-billings/

- https://www.dassault-aviation.com/wp-content/blogs.dir/2/files/2019/09/Dassault-Aviation-Financial-Release-090419.pdf

- https://www.gulfstreamnews.com/news/gulfstream-delivers-first-g600

A military history enthusiast, Richard began his career at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet became central to defense research, he helped design the company’s Forecast Intelligence Center and now coordinates the FI Market Recap newsletters for clients. He also manages two blogs: Defense & Security Monitor, which covers defense systems and international security issues, and Flight Plan, focused on commercial aviation and space systems.

For more than 30 years, Richard has authored Defense & Aerospace Companies, Volume I (North America) and Volume II (International), providing detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database tracking all companies involved in programs covered by the FI library. Richard currently serves as Manager of the Information Services Group (ISG), which develops outbound content for both Forecast International and Military Periscope.