Year-End Narrowbody Output Drives December Production /// Widebody Recovery Remains Uneven /// Deliveries Accelerate Into Year-End

Airbus A220 FAL – Image – Airbus

For the purposes of this article, Forecast International considers an aircraft to be “produced” once it completes its first test flight, and “delivered” when it is contractually handed over to the customer.

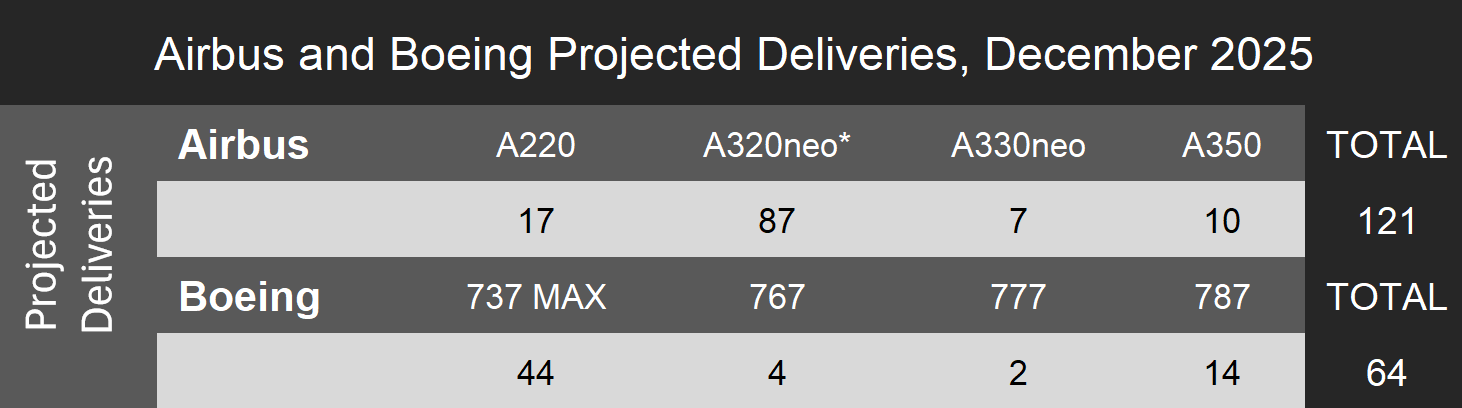

Production by Market Segment

Total commercial aircraft production in December reached 157 aircraft, driven overwhelmingly by narrowbody platforms. Narrowbodies accounted for 123 aircraft, highlighting their continued dominance in OEM output and their central role in year-end delivery performance. Widebody production totaled 18 aircraft, reflecting gradual improvement but still highlighting the sector’s structural constraints, including supply chain friction and ongoing certification or industrial bottlenecks, particularly for the A350 program. As expected, regional jets and turboprops each contributed eight aircraft, resulting in relatively limited influence on aggregate production totals.

- Production data represents the actual number of aircraft produced in December 2025. Forecast International considers an aircraft produced upon its first flight. This may differ from an OEM’s definition of produced.

Average Production-to-Delivery Lead Times

Average lead times from production to delivery continued to compress in December, particularly for narrowbody aircraft. Narrowbody lead times averaged 24.0 days from production to delivery, closely aligned with widebodies at 24.3 days, suggesting that year-end delivery efforts were supported by relatively efficient handover processes once aircraft exited final assembly. Turboprop aircraft recorded the shortest average lead time at 14.5 days, driven primarily by simpler production flows and fewer customer-specific customization requirements. Regional jets did not report a meaningful average for the month due to limited sample size.

Unofficial/Preliminary Deliveries

Forecast International estimates that Airbus and Boeing combined delivered approximately 185 aircraft in December 2025, with Airbus accounting for 121 deliveries and Boeing for 64 deliveries. Airbus deliveries were led by narrowbody aircraft, with an estimated 87 A320neo-family aircraft delivered alongside 17 A220s. Widebody deliveries included approximately seven A330neo aircraft and 10 A350s, supporting a solid year-end contribution from long-haul platforms despite their ongoing production challenges.

Boeing’s estimated December deliveries were again dominated by the 737 MAX, with 44 aircraft delivered during the month. Widebody activity included an estimated four 767s, two 777s, and 14 787s, reflecting steady Dreamliner handovers and limited movement across the remainder of the widebody portfolio. Taken together, December deliveries show the extent to which year-end performance continues to rely on narrowbody aircraft, while widebody deliveries remain constrained by industrial pacing rather than demand.

Notes:

- Delivery data is the expected number that Boeing and Airbus will report in their December 2025 Orders and Deliveries summary and is based on Forecast International’s internal research. Numbers are not official and are not provided by Airbus or Boeing.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

- 737 numbers include 737-800A and 737 MAX variants

For readers seeking program-level insight, including detailed production trajectories, delivery risks, and program-specific analysis, Forecast International offers a Monthly Commercial Aircraft OEM Analysis that provides granular breakdowns by aircraft program and variant. To learn more, please reach out to Forecast International for additional details.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.