Airbus Outpaces Boeing on November Deliveries // Widebody Orders Favor Boeing // Boeing Retains 2025 Order Lead

Emirates 777X. Image – Boeing

November 2025 Summary

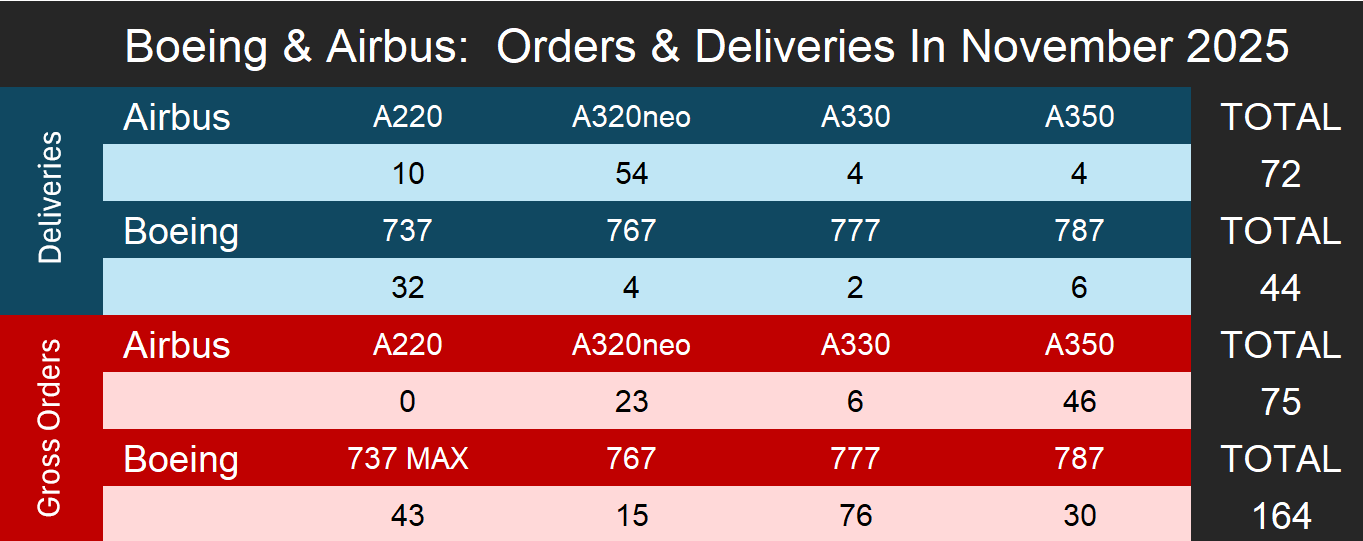

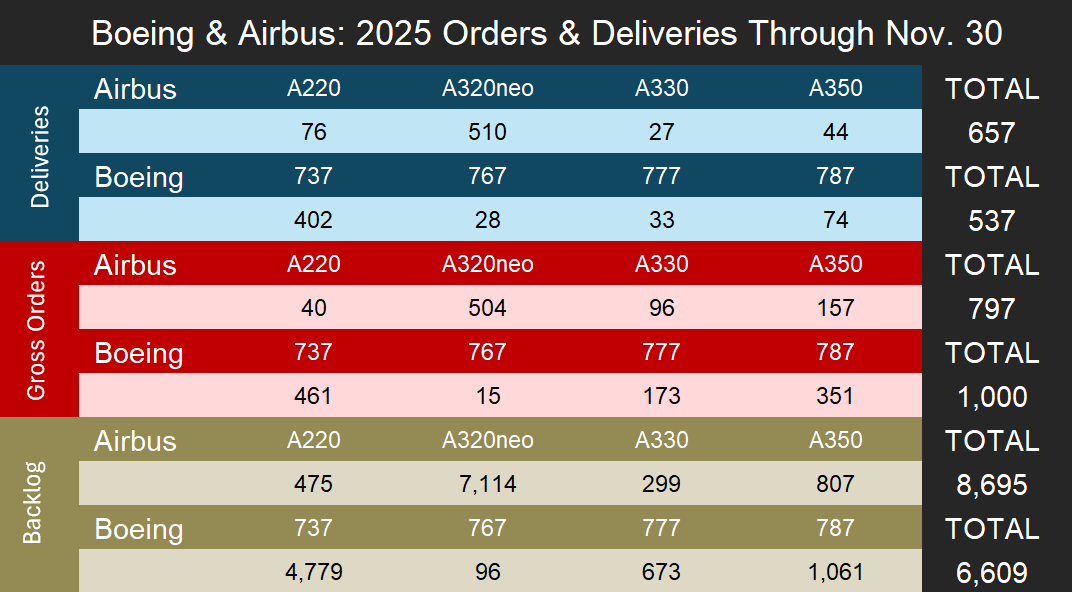

In November, Airbus delivered 72 aircraft, comprising 64 narrowbodies and eight widebodies. Boeing delivered 44 aircraft, including 32 narrowbodies and 12 widebodies. Airbus once again led Boeing on monthly deliveries, driven primarily by higher A320neo-family handovers, while Boeing’s month benefited from steady twin-aisle deliveries across multiple programs. From an orders perspective, Boeing recorded 164 gross orders in November, significantly outpacing Airbus, which logged 75 gross orders during the month. Boeing’s order intake was weighted toward widebodies, particularly the 777 family, while Airbus orders were dominated by the A320neo and A350 programs. Through November 30, 2025, Airbus has delivered 657 aircraft, compared with 537 deliveries for Boeing. On the order side year to date, Boeing has accumulated 1,000 gross orders, maintaining a clear lead over Airbus’s 797 gross orders.

Notes:

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo.

Boeing Deliveries

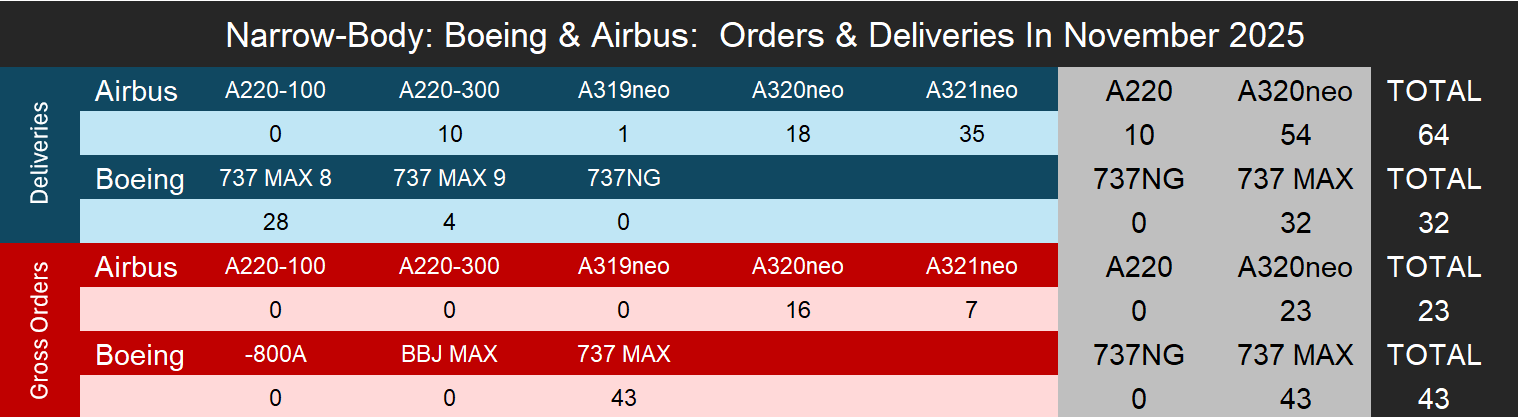

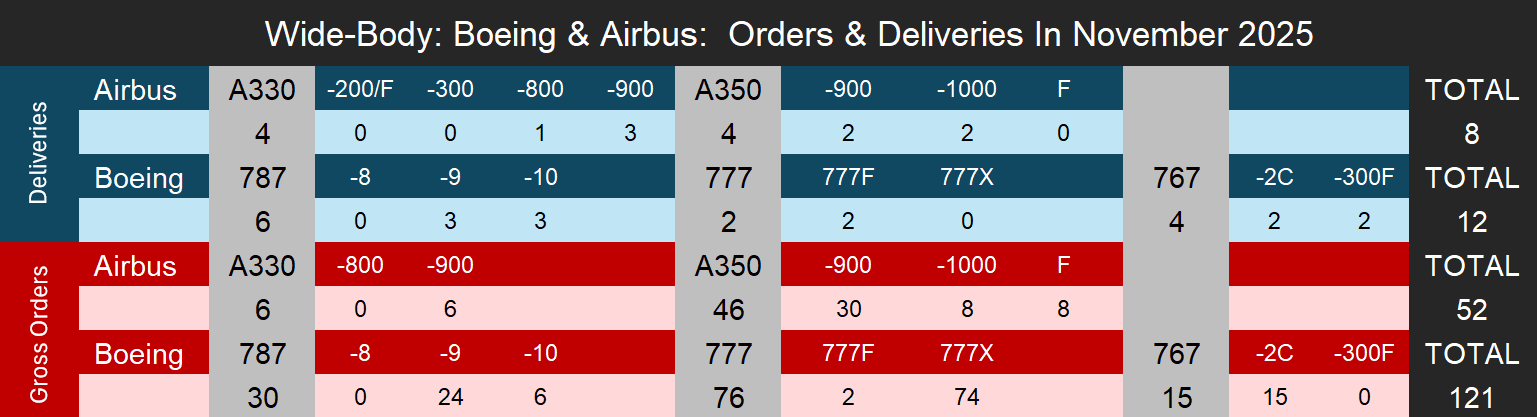

Boeing’s 44 deliveries in November consisted of 32 narrowbodies and 12 widebodies. All narrowbody deliveries came from the 737 program and were exclusively 737 MAX aircraft, with most deliveries attributed to the MAX 8 variant and a smaller number from the MAX 9. No 737NG aircraft were delivered during the month. Widebody deliveries included contributions from all active Boeing twin-aisle programs. Boeing delivered four 767s in November, continuing deliveries across both the 767-2C and 767-300F variants. The company also delivered two 777s during the month, along with six 787s spread across multiple variants. On a cumulative basis, Boeing has delivered 537 aircraft through the end of November. Of these, the 737 program accounts for the majority, with 402 deliveries year to date, followed by 74 787s, 33 777s, and 28 767s. Narrowbodies continue to form the core of Boeing’s delivery profile in 2025, though widebodies remain a consistent contributor to monthly totals.

Airbus Deliveries

Airbus delivered 72 aircraft in November, including 64 single-aisle jets and eight widebodies. Narrowbody deliveries were led by the A320neo family, which accounted for the bulk of the month’s handovers. Airbus delivered 54 A320neo-family aircraft in November, with the A321neo representing the largest share, alongside a smaller number of A319neo and A320neo variants. The A220 program contributed 10 deliveries during the month, all of which were A220-300s. On the widebody side, Airbus delivered four A330s and four A350s. A350 deliveries were evenly split between the A350-900 and A350-1000 variants. Through November 30, Airbus has delivered a total of 657 aircraft in 2025. This includes 510 A320neo-family aircraft, 76 A220s, 44 A350s, and 27 A330s. As with Boeing, Airbus’s delivery performance remains dominated by narrowbody aircraft, reflecting continued demand for single-aisle capacity.

Boeing Orders

Boeing recorded a strong order month in November, booking 164 gross orders. Widebody aircraft represented a large share of the month’s activity, led by a significant number of orders for the 777X program. The 737 MAX program also recorded meaningful order activity during the month, while the 787 added additional widebody demand. Boeing also logged a smaller number of orders for the 767. Through November, Boeing has recorded 1,000 gross orders in 2025. The 737 MAX and NG remain the largest contributor to year-to-date orders, with 461 aircraft booked, followed by 351 orders for the 787, 173 for the 777 program, and 15 for the 767. Boeing’s order performance in 2025 continues to be characterized by a relatively higher share of widebody demand compared with Airbus.

- For consistency, this article does not include Boeing’s ASC 606 accounting adjustments and considers net orders as gross orders minus cancellations.

Airbus Orders

Airbus recorded 75 gross orders in November, with activity centered on the A320neo and A350 programs. The A320neo family accounted for 23 orders during the month, while the A350 contributed 46 orders across both the -900 and -1000 variants. The A330 program added six orders in November. No A220 orders were recorded during the month. Year to date through November 30, Airbus has accumulated 797 gross orders in 2025. The A320neo family remains the largest component of Airbus’s order book with 504 orders, followed by 157 orders for the A350, 96 for the A330, and 40 for the A220. While Airbus trails Boeing in total gross orders for the year, demand across both narrowbody and widebody programs remains broadly diversified.

- Airbus backlog numbers do not include A320ceo ghost orders.

- Boeing backlog numbers do not include 737-700 or 777-300ER ghost orders.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

Backlog

As of November 30, 2025, Airbus reported a backlog of 8,695 aircraft, excluding A320ceo positions. Based on Forecast International’s 2025 delivery projection of 798 aircraft, Airbus’s current backlog represents approximately 11.0 years of deliveries at the forecasted pace. The backlog remains heavily concentrated in narrowbody aircraft, with the A220 and A320neo families accounting for the vast majority of outstanding orders. Boeing’s backlog stood at 6,609 aircraft at month-end, excluding legacy 777-300ER positions. Using Forecast International’s 2025 delivery forecast of 590 aircraft, Boeing’s backlog equates to approximately 11.2 years of deliveries at the current projected delivery rate. As with Airbus, Boeing’s backlog is dominated by next-generation narrowbodies, led by the 737 MAX, alongside a meaningful widebody component across the 787, 777, and 767 programs.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.