Boeing Stabilizes 737 MAX Production at 38 per Month /// Airbus Produces Only 38 A320neo Family Aircraft /// A350 Production Continues to Struggle

For the purposes of this article, Forecast International considers an aircraft to be “produced” once it completes its first test flight, and “delivered” when it is contractually handed over to the customer.

Overview

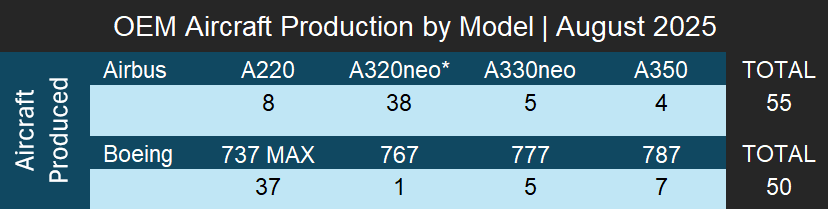

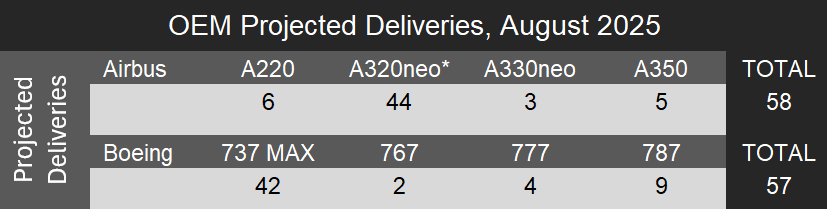

Airbus led the month in total production, completing 55 aircraft, followed by Boeing with 50, resulting in a combined total of 105 aircraft. Of these, 83 were narrowbody aircraft, while the remaining 22 were widebodies. On the delivery side, Forecast International expects Boeing to have delivered a total of 57 aircraft in August, including 42 737 MAXs with the remaining 15 to be widebodies. For Airbus, we estimate total deliveries of 58 aircraft, comprising 50 narrowbodies and eight widebodies. 44 of the narrowbodies are expected to be A320neo family aircraft, and the remaining six are expected to be of the A220 family.

- Production data represents the actual number of aircraft produced in August 2025. Forecast International considers an aircraft produced upon its first flight. This may differ from an OEM’s definition of produced.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

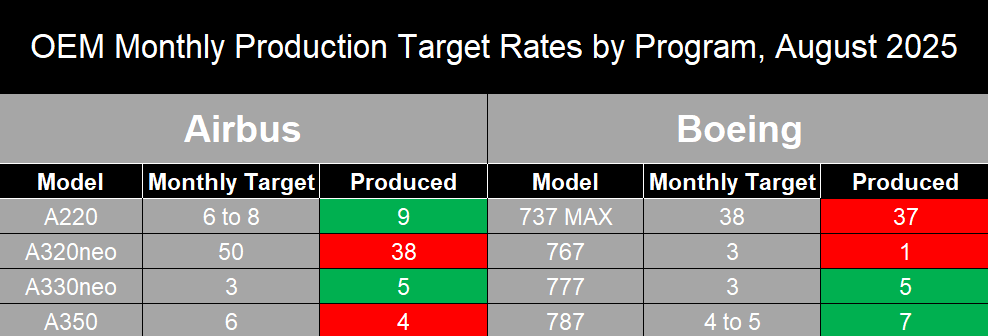

A320neo family production dipped to 38 aircraft in the month of August. This is well below the program’s 50 aircraft per month target, after it finally exceeded this target in the month of July. The company also produced eight A220s during the month. On the widebody front, Airbus completed five A330neos and four A350s. Boeing’s August production was dominated by the 737 MAX, with 37 units completed, along with one 767, five 777s, and seven 787 Dreamliners.

- Monthly production targets are generalized figures based on monthly production estimates derived from OEM guidance and internal research conducted by Forecast International.

We remained cautious after Airbus reported strong A320neo production in July, with 58 aircraft completed, as we expected it to be a short-term spike rather than a sustained increase. That view has proven correct, as output has generally fallen short of the 50-aircraft-per-month target throughout the year, and the July figure now appears to have been a one-off with only 38 A320neo family aircraft produced in August. As a result, we continue to remain skeptical that Airbus will meet its full-year delivery target of 820 aircraft, since the A320neo carries most of the burden as A350 production continues to lag below target and A220 output is unlikely to reach 14 per month by year-end.

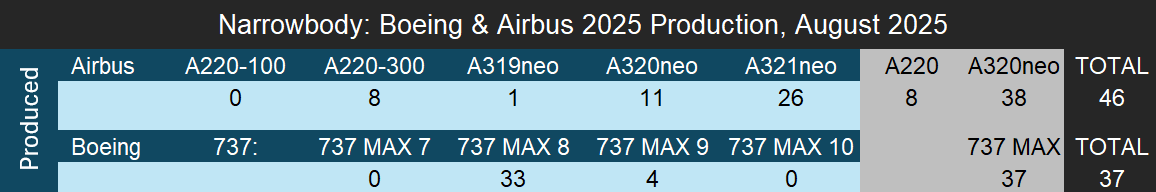

With A220 production now firmly stabilized at eight aircraft per month, gradual output increases are possible in the short term. In August, Airbus produced eight A220s, all of which were A220-300s. While stable production provides a foundation for future rate hikes, we remain firm in our view that Airbus’ goal of ramping up to 14 aircraft per month by 2026 is highly unlikely. Airbus may well attempt to reach that target, and it could be possible in the near term, but 14 per month is unsustainable over the long run given a backlog of just over 500 aircraft and weak order activity. Speculation continues around the potential launch of a stretched A220-500 variant, which could boost demand and help sustain higher production, but with no announcement to date, we maintain that the current order book does not justify a long-term output of 14 aircraft per month.

A350 production remains subdued, with Airbus producing four aircraft in August, below the current target of six per month. The program has struggled throughout the year, showing no signs of stabilizing even at the six-per-month rate, and Airbus has largely fallen short of expectations. Production has averaged just four aircraft per month through August, with a total of 35 A350s produced so far in 2025. This shortfall comes despite ambitious plans announced at the start of the year to ramp up output to 10 aircraft per month by 2026 and 12 per month by 2028. Forecast International maintains the view that to make meaningful progress toward those goals, Airbus must first achieve consistent production at the current six-per-month target.

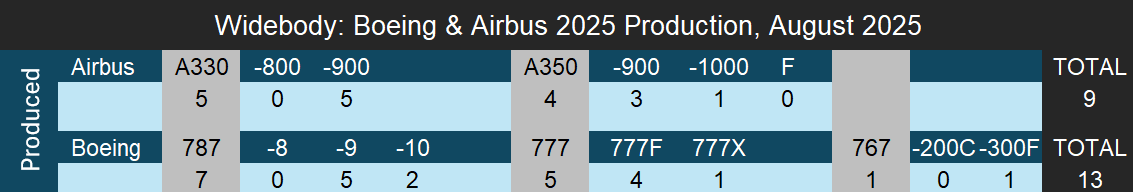

The A330neo, by contrast, had a strong month in August with five aircraft produced, all of them A330-900neos. Airbus recently announced plans to raise production from three aircraft per month to five per month by 2029, a target that Forecast International considers viable and sustainable given the aging A330ceo fleet and the approaching replacement window for many operators. We expect a significant number of current A330ceo operators to select the A330neo as their replacement, which will drive additional orders and support higher production volumes of the aircraft.

Boeing has finally stabilized 737 MAX production at its FAA-approved rate of 38 aircraft per month, a positive sign for the program after years of instability and volatility. In August, Boeing produced 37 MAXs, including 33 MAX 8s and four MAX 9s. This progress strengthens the case for FAA approval to raise output to 42 aircraft per month, though the timing of such approval remains uncertain. Boeing appears to be moving closer to that milestone, as the FAA recently announced plans to conduct scenario-based planning with the company before granting approval for a rate hike. Boeing has also reiterated its long-term goal of producing 52 MAX aircraft per month, a target that looks viable given the current backlog and the expected ramp-up of MAX 7 and MAX 10 production once certification is secured. However, this timeline also remains unclear, with Boeing providing no formal guidance on when it expects to achieve that rate. Complicating matters further, certification for the MAX 7 and MAX 10 has been pushed to 2026 as Boeing continues to address challenges with the LEAP-1B engine de-icing system.

Boeing’s widebody programs continue to show signs of stability, strengthening the case for production rate increases, particularly for the 787. In August, Boeing produced seven 787s, exceeding its current target of four to five aircraft per month. The company has stated its intention to raise output to seven aircraft per month by the end of the year and to ten per month by 2027. This goal appears achievable, as Boeing has already produced seven 787s in multiple months this year and now only needs to stabilize production at that level. The manufacturer has also announced plans for a long-term rate of 16 aircraft per month by the 2030s, an increase from its earlier target of 12 per month, driven by strong order activity. Forecast International maintains a positive outlook for the 787 in both the short and long term, supported by robust demand, improving production stability, and Boeing’s investment in expanded capacity at the Charleston plant.

As for the remaining widebody programs, Boeing produced one 767-300F and five 777s in the month of August. We do not anticipate any increases in production rates for either platform. Production of the 767-300 freighter is scheduled to end in 2027, and the 777-8 freighter is not expected to enter service until later in the decade. The 777X is still awaiting certification, which Boeing aims to secure this year, although a delay into 2026 remains a possibility.

Unofficial/Preliminary Deliveries

Forecast International expects Boeing to have delivered an estimated 57 aircraft in the month of August 2025. The 42 narrowbodies expected to be delivered account for 36 737 MAX 8s and six 737 MAX 9s. On the widebody side, Forecast International expects Boeing to deliver an estimated nine 787s; eight 787-9s and one 787-10. We also expect Boeing to have delivered four 777Fs and two 767-2Cs.

As for Airbus, we expect the manufacturer to have delivered a total of 58 aircraft in August 2025. As for the A220 specifically, Forecast International expects six A220-300 deliveries. The majority of narrowbody deliveries are expected to be from the A320neo Family, with three A319neos, nine A320neos and 32 A321neos deliveries, or a total of 44 for the A320neo family. For widebodies we expect a total of two A350-900s, three A350-1000s and three A330-900neos to have been delivered.

- Delivery data is the expected number that Boeing and Airbus will report in their August 2025 Orders and Deliveries summary and is based on Forecast International’s internal research. Numbers are not official and are not provided by Airbus or Boeing.

- A320neo numbers include all variants for the family; A319neo, A320neo and A321neo

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.