Building on the concerns raised in our earlier analysis of the broader impact of tariffs on commercial aerospace, this follow-up dives deeper into how trade barriers may specifically threaten individual aircraft programs and reshape global manufacturing dynamics. From increased component costs to delivery disruptions and strategic production shifts, the ripple effects of rising tariffs are starting to become increasingly apparent for stakeholders within the commercial aviation industry.

Impact on Supply Chains and Costs

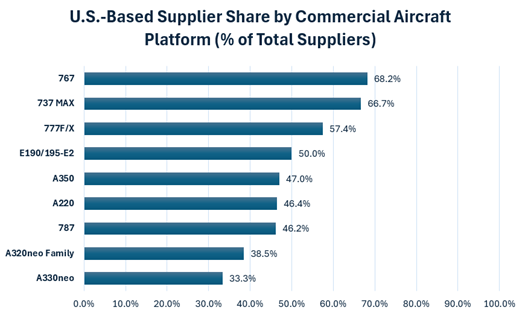

While many aircraft platforms rely heavily on U.S.-based suppliers, this domestic concentration does not fully insulate them from tariff-related cost pressures. For instance, approximately two-thirds of the suppliers for the 737 MAX and 767 are U.S.-based, and other platforms show varying levels of domestic supplier involvement. U.S.-based suppliers account for 57 percent of the supply chain for the 777F and 777X, 50 percent for the E2 regional jet, and just under 47 percent for the A350 and A220. The A320neo family and A330neo have even lower U.S. supplier shares, at around 38 percent and 33 percent, respectively. Even the 787, an aircraft with about 46 percent of its suppliers located in the U.S., will be highly sensitive to trade dynamics due to its deeply integrated global production network.

This shows that despite major OEMs heavily relying on U.S.-based suppliers for their programs, no aircraft program is immune to the effects of trade barriers, because all rely on global trade for key components and materials. For example, the introduction of 10 percent tariff on imported materials into the United States is still likely to raise baseline costs across the industry. Many of these U.S.-based suppliers depend on lower-tier foreign vendors to manufacture critical parts, and these vendors are likely to be impacted by the tariffs. Because many of these parts contribute to multiple components within an aircraft, they will cross international borders several times before becoming part of the larger components supplied by tier one suppliers such as engines and landing gear. This repeated cross-border movement could result in tariffs being applied multiple times throughout the supply chain, increasing costs even further. Suppliers are likely to pass these added costs along, leading to increased production expenses, longer assembly timelines, and higher aircraft prices over the long term. These disruptions could cause delivery delays, reduce profit margins, and ultimately increase costs for both airlines and consumers over the long term.

Impact on Deliveries

In addition to supply chain impacts, aircraft final assembly locations play a critical role in determining a manufacturer’s exposure to retaliatory tariffs. This matters especially when aircraft are delivered across borders, where political tensions and trade disputes come into play.

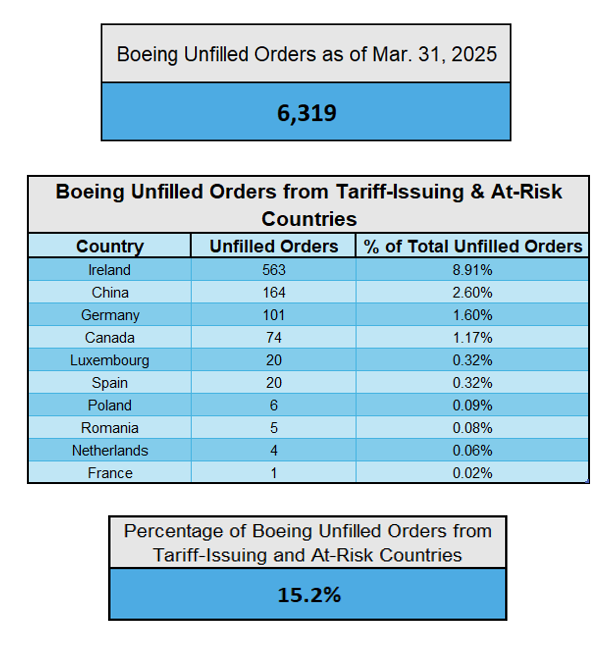

Since Boeing assembles its aircraft in the United States, the primary impact of tariffs on its exports is likely to come from retaliatory measures imposed by foreign governments. These tariffs may originate from large, economically influential regions such as China, the European Union, and Canada, which have the industrial capacity and political leverage to implement such actions without significantly disrupting their own industries. In contrast, smaller economies are more likely to pursue negotiated trade agreements to maintain access to aircraft and aerospace components. While the risk of retaliatory tariffs exists, the immediate effect on Boeing appears limited, as only about 15.2 percent of its unfilled orders are from countries that have imposed or are at risk of imposing such measures. Ireland represents the greatest exposure, accounting for 8.9 percent of unfilled Boeing orders, largely due to the presence of major aircraft lessors in the country and a substantial backlog of 737 MAX aircraft for Ryanair. Additionally, although China has enacted a 125 percent retaliatory tariff on the United States and is pressuring domestic carriers to delay Boeing deliveries, this currently represents just 2.6 percent of Boeing’s total unfilled orders, including those from Hong Kong-based airlines and lessors. This suggests that Boeing faces relatively low immediate risk from tariffs in terms of deliveries. However, if similar trade tensions extend to other key regions, the combined impact could significantly reduce Boeing’s delivery volumes.

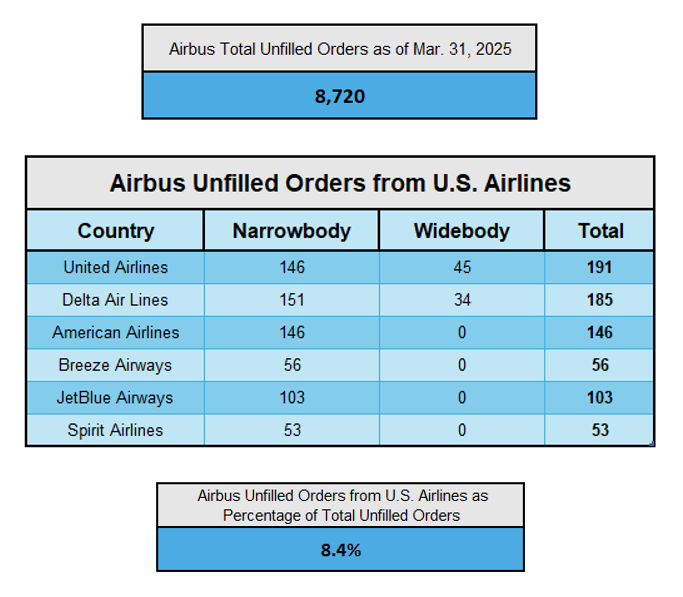

Airbus, on the other hand, operates a more international network of final assembly lines. For its narrowbody models, such as the A220 and A320neo family, the company benefits from U.S.-based assembly in Mobile, Alabama, as well as one in Mirabel, Canada for the A220. These sites reduce the Airbus’ exposure to trade-related delivery delays for those platforms. However, the situation is very different for Airbus’s widebody aircraft. The A330neo and A350 are only assembled in Europe, specifically in Toulouse, France, and Hamburg, Germany, and as a result are vulnerable to tariffs when sold to U.S. carriers. One of the most exposed programs is the A321XLR, which, despite being a part of the A320neo Family, lacks a U.S.-based final assembly line and is only produced in Toulouse and Hamburg.

As of March 31, 2025, unfilled orders from U.S. airlines account for 8.4 percent of Airbus’s total backlog, with only 0.9 percent of the 8.4 percent comprising widebody aircraft and 1.2 percent consisting of A321XLRs. Delta recently announced it would defer deliveries of any Airbus aircraft subject to tariffs, casting doubt on the future of its 50 A321XLR orders and remaining A350 and A330neo commitments. United Airlines, which also holds 50 A321XLR orders and additional unfilled orders for the A350-900, has not issued public statements regarding potential delivery deferrals. Given that U.S. carriers represent a relatively small share of Airbus’s total backlog, even widespread deferrals or cancellations would likely cause only minor disruptions and slightly lower delivery figures. However, if tariffs become long-term and deeply entrenched, Airbus may consider establishing additional final assembly lines for its widebody aircraft and the A321XLR within the United States. Considering that U.S. carriers might otherwise turn to Boeing to avoid tariff-related costs, doing so could help safeguard Airbus’ market share and long-standing relationships with U.S. airlines.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.