Impact of Tariffs on the Commercial Aviation Industry Becomes More Apparent /// Boeing and Airbus Orders Pick Up After a Slow Start to the Year

Source: Airbus

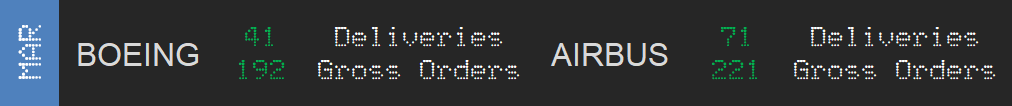

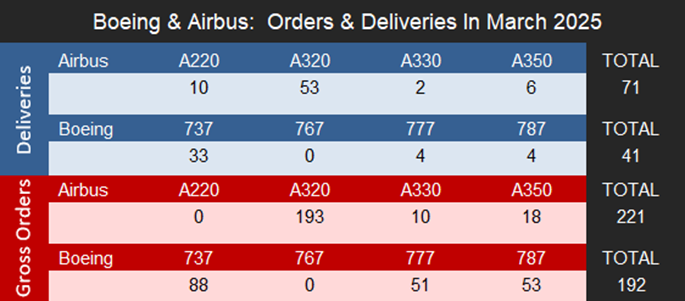

Source: AirbusOrder activity in March picked up rapidly, while Boeing deliveries remained flat compared to last month and Airbus deliveries saw a significant increase following a slowdown in the first two months of the year. Boeing delivered a total of 41 aircraft in March, slightly lower than its 44 deliveries in February, whereas Airbus delivered 71 aircraft, a sizable increase from the 25 and 40 aircraft delivered in January and February, respectively. Ambitious production goals by Boeing and Airbus for the year are seeming further out of reach as the impact of tariffs on the commercial aerospace supply chain comes further into view amid an already fragile and recovering global supply chain.

Though the full impact of the tariffs on the aerospace supply chain is not yet known, airlines are cutting revenue and profit forecasts for the year, and suppliers are expecting hits to their bottom lines and increased costs as a result of the tariffs. Airbus’ all-time high of 863 deliveries set in 2019 is unlikely to be surpassed in 2025 due to the ongoing headwinds the industry faces and their impact on production. Supply chain issues have not subsided to the degree previously anticipated, and the addition of tariffs further dims the outlook for the production ramp-up. Our current forecast for Airbus projects just under 840 deliveries in 2025, pushing a full recovery to pre-pandemic production levels into 2026. We consider this a best-case scenario, given Airbus’ guidance of 820 deliveries for the year, a 7.0% increase from the 766 aircraft delivered in 2024. These numbers could also be revised downward as the year progresses, especially considering that supply chain issues may worsen with tariffs being implemented. The outlook for Boeing production is similar. The company delivered a total of 350 commercial aircraft in 2024, a 33.7% decrease from the 528 aircraft delivered in 2023. We expect Boeing deliveries to return closer to 2023 levels this year, with around 570 aircraft being delivered in 2025. However, this estimate could also be revised downward if the state of the aerospace supply chain further deteriorates.

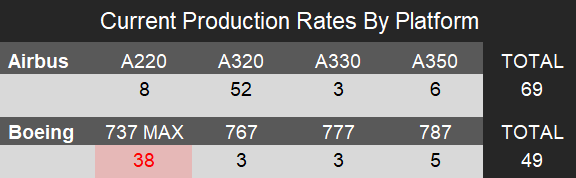

Notes:

- Production rates do not represent the actual number of aircraft produced in February 2025. Instead, they are generalized figures based on current monthly production estimates derived from OEM guidance and internal research conducted by Forecast International.

- Light red indicates the program is temporarily producing at a lower rate than what is displayed in the table.

Deliveries

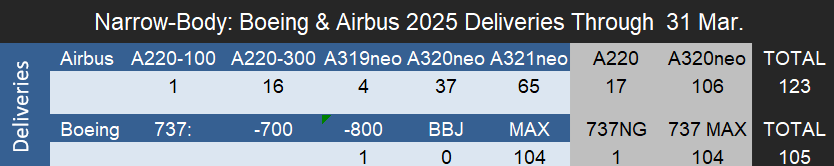

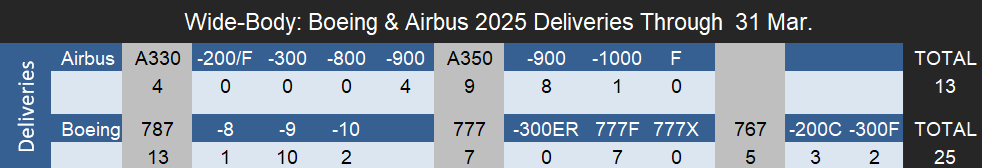

The 41 Boeing jets delivered in March included 33 737 MAXs, four 777s, and four 787s. Boeing’s month-to-month deliveries were consistent in the first quarter of the year— 45 in January, 44 in February, and 41 in March—totaling 130 aircraft in Q1. Boeing is still struggling to reach its FAA-approved production rate of 38 737 MAX aircraft per month, and the recent implementation of tariffs may further inhibit the manufacturer from doing so. However, it is possible that Boeing reaches a production rate of 38 MAX aircraft per month by late 2025 and continues increasing production in line with FAA-approved rates. The company also aims to ramp up 737 MAX production to approximately 50 aircraft per month by 2026, but this goal is contingent on FAA approval and improvements in the overall health of the commercial aerospace supply chain.

As for its remaining programs, Boeing delivered only 13 787s in the first quarter of 2025 but continues to aim for a production rate of seven per month by the end of the year and ten per month by 2026. While the 787 backlog of 836 aircraft supports these targets, persistent industry challenges—particularly tariffs and supply chain instability—are likely to delay progress toward those goals. The 767 program on the other hand remains steady at a rate of three aircraft per month, including a mix of KC-46 tankers and 767-300F freighters. Boeing is currently delivering the final 767-300Fs to FedEx and UPS ahead of the program’s scheduled conclusion in 2027, with five delivered in the first quarter and 33 unfilled orders remaining as of March 31, 2025. Meanwhile, the 777 program is producing three aircraft per month, with plans to increase to four per month by 2026. The first 777X delivery is still scheduled for 2026 to Lufthansa, though potential delays into 2027 remain possible due to production or regulatory setbacks. Although tariffs are not expected to significantly affect the timing of this initial delivery, since over 20 777X aircraft have already been built and are in inventory, any subsequent ramp-up in production could be hindered if supply chain conditions worsen. Boeing has also postponed the entry into service of the 777-8 freighter from 2027 to 2028.

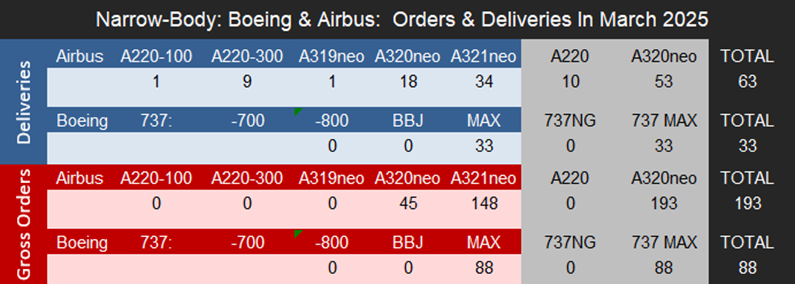

In March, Airbus delivered 71 jets, including ten A220s, 53 A320neo family aircraft, two A330neos, and six A350s. Like Boeing, Airbus entered 2025 with ambitious production plans, but ongoing supply chain headwinds are preventing rate increases, and tariffs could worsen the situation.

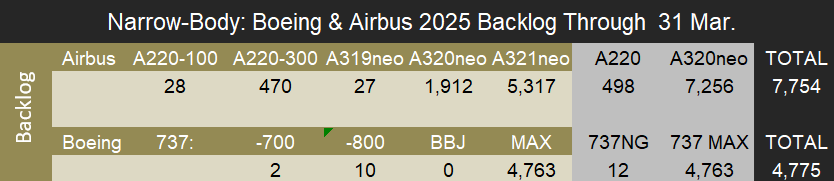

Forecast International currently estimates the unofficial A320 production rate to be around 50–55 aircraft per month, with incremental increases expected as Airbus works toward its goal of producing 75 per month by 2027. Airbus is currently producing between six and eight A220 aircraft per month, with a goal of reaching 14 per month by 2026. However, this target appears overly ambitious given the current backlog of just 498 aircraft and a historical average of only 95 gross orders per year since 2018. At this pace, the backlog would be exhausted in just over three years, making it difficult to justify such an aggressive ramp-up without a significant increase in new orders. The program also faces headwinds from ongoing supply chain issues, weak demand for the A220-100, and the indefinite delay of the A220-500, all of which limit its growth potential.

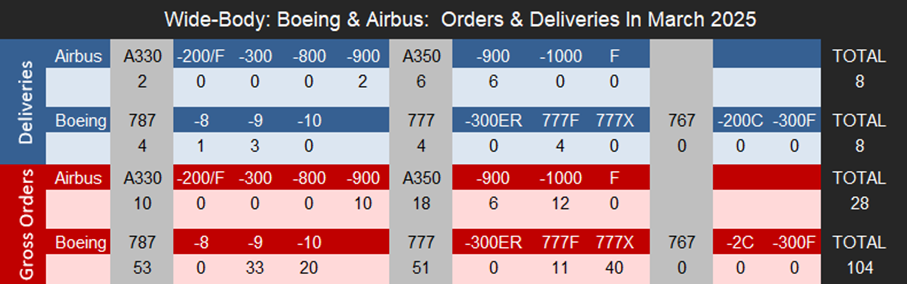

On the widebody side, Airbus began 2025 with plans to raise A350 production to nine aircraft per month, followed by increases to ten in 2026 and twelve by 2028. However, due to supply chain disruptions at Spirit AeroSystems, production is now capped at six per month for the remainder of 2025, with six A350s delivered in March in line with this limit. Airbus also postponed the first A350F delivery to 2027, a year later than initially planned. Meanwhile, A330neo production remains steady at around three to four aircraft per month, with no plans for near-term increases and two deliveries recorded in March.

Orders

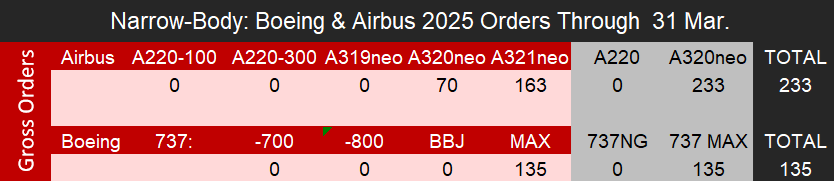

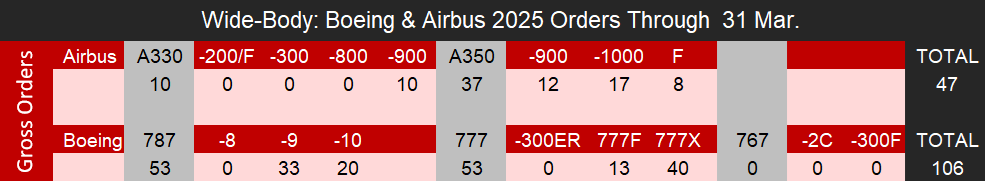

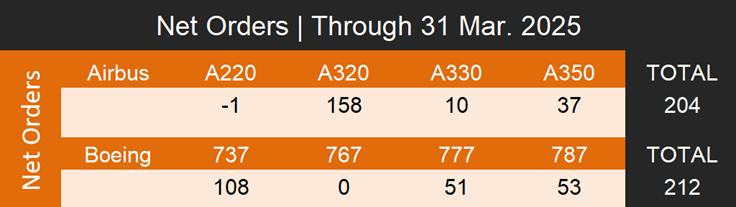

March saw a significant pickup in order activity for both Boeing and Airbus compared to the first two months of 2025. After receiving only 13 gross orders in February, Boeing recorded 192 gross orders in March, including 88 for the 737 MAX, 51 for the 777X and 777F, and 53 for the 787. Boeing also recorded 29 cancellations in March, resulting in 163 net new orders for the month. 27 of these cancellations were for the 737 MAX and the remaining two were for the 777F. For consistency, this article does not include Boeing’s ASC 606 accounting adjustments and considers net orders as gross orders minus cancellations.

Airbus also significantly outpaced its February order activity, receiving 221 gross orders in March. Of these, 193 were for A320neo family aircraft, 10 for the A330neo, and 18 for the A350. In the first quarter, Airbus recorded total cancellations of 75 A320neo aircraft and one A220-100. One of the largest March orders came from aircraft leasing company BOC Aviation, which ordered 70 A320neo aircraft. The A321neo continues to be the preferred variant within the A320neo family and received 148 orders in March compared to 45 for the A320neo.

Backlog

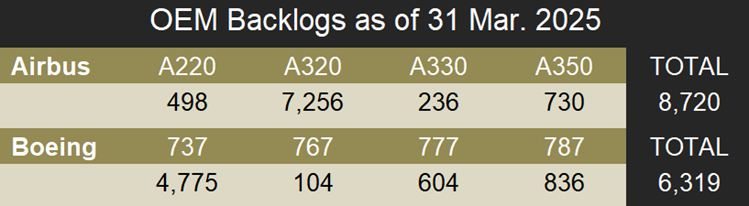

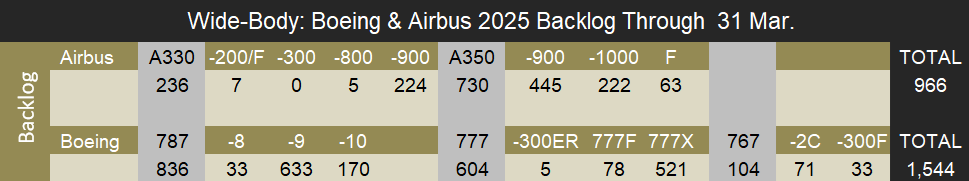

As of March 31, 2025, Airbus reported a backlog of 8,720 jets, of which 7,696—or 88.9%—were A220 and A320 family narrowbodies. Meanwhile, Boeing’s total unfilled orders (before ASC 606 adjustments) stood at 6,319 aircraft, with 4,763—or 75.4%—being 737 MAXs. Airbus’ backlog represents 10.4 years of production based on Forecast International’s 2025 production estimates, while Boeing’s backlog would last approximately 11.1 years. As both manufacturers ramp up production and supply chain constraints ease, these figures will decline as more aircraft are delivered annually. However, if tariffs further impact supply chains and limit production, the backlog for both OEMs will continue to represent at least over ten years of production until targets can be met.

As Airbus and Boeing navigate persistent supply chain challenges and unprecedented tariffs, their ability to ramp up production is now even more uncertain. Forecast International continues to monitor these developments closely and will provide an additional update at the beginning of May. For more detailed insights or to discuss how these developments might impact your business, reach out to our team today.

Navigating supply chain hurdles and shifting markets, both Airbus and Boeing face a complex landscape. Adding to these pressures, persistent tariffs on materials and components present a significant headwind for aerospace manufacturing, potentially increasing costs and complicating international production networks. Forecast International is tracking these developments and will provide updates as warranted. For deeper insights on how these factors could affect your business, contact our team to elevate your understanding of the global aerospace market.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.

image sources

- BOC Aviation A320neo: Airbus