Ongoing supply chain challenges, labor strikes, and inflationary pressures have severely impacted production capacity, leaving manufacturers struggling to meet the strong demand for both narrowbody and widebody aircraft. This raises concerns about the future of aircraft production and the ability of Boeing and Airbus to achieve their short- and long-term production goals. The analysis below presents Forecast International’s outlook on the current state of the commercial aviation industry and its impact on future aircraft production and deliveries.

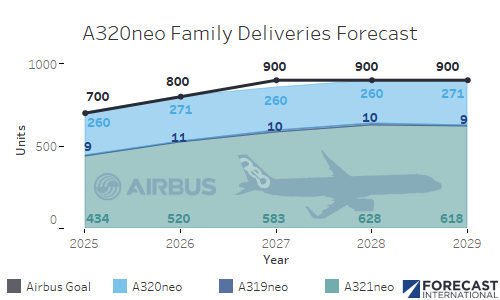

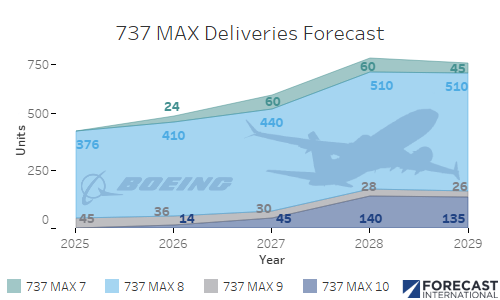

Demand for new technology narrowbody aircraft remains strong, driven by increasing domestic travel levels. However, Boeing and Airbus are struggling to produce enough aircraft to meet operators’ capacity needs. Airbus plans to ramp up production of its A320neo family from the current rate of approximately 45–50 aircraft per month to 75 per month by 2027. Meanwhile, increasing MAX 8 production remains a challenge, with output currently capped at 38 aircraft per month, though Boeing is seeking authorization to raise production to 42 units per month by March 2025.

Forecast International believes that the key question is not whether Boeing and Airbus can increase production to meet demand, but rather how soon they can achieve their targets. This will largely depend on the continued easing of supply chain constraints and, for Boeing, the pace at which the FAA allows production rate increases for the MAX. Even if approved, achieving the FAA-approved production targets within such a short timeframe would be difficult, especially since Boeing has yet to reach the current FAA-approved rate of 38 aircraft per month and only delivered 30 MAX 8s in January 2025. Additionally, we anticipate that MAX 7 and MAX 10 deliveries will begin in 2026, assuming both aircraft receive certification in 2025. Our long-term forecast for the A320neo family aligns with Airbus’ projections, though we expect the ramp-up to 75 aircraft per month to be slightly slower due to the aforementioned supply chain challenges. Airbus may further increase A320neo production above 75 aircraft per month beyond 2027, and we will continue to monitor the situation.

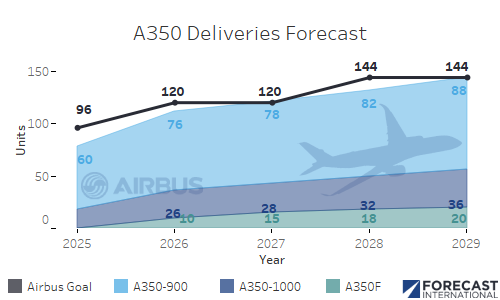

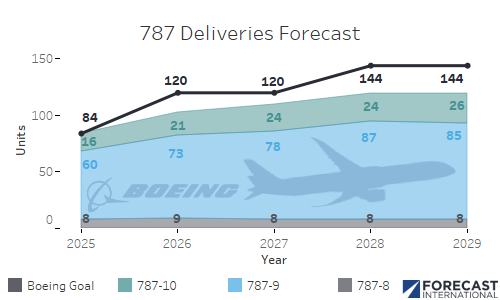

For widebody aircraft, Boeing and Airbus plan to more than double their 2024 production rates of 787s and A350s by 2026. However, this increase is from relatively low current levels on a per-unit basis, rising from approximately five aircraft per month to ten by 2026. Airbus also plans to increase A350 production to 12 aircraft per month by 2028. We expect the production ramp-up for both aircraft to progress slightly slower than Boeing and Airbus anticipate, primarily due to lingering supply chain constraints expected to persist through 2025. While Boeing aims to achieve a production rate of seven 787s per month in 2025 and ten per month by 2026, the timeline for further increases remains uncertain. The company plans to deliver 75–80 aircraft this year, but this total includes 25 previously built but undelivered aircraft from prior years, resulting in an estimated production of only 50–55 787s in 2025.

Additionally, though international travel demand has recovered, Forecast International questions whether Boeing and Airbus will reach their long-term production targets of approximately 12 widebody aircraft per month by 2028. Nevertheless, given the sustained demand for widebody aircraft, we believe they will eventually achieve these production levels over the long term.

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.