WASHINGTON D.C. – U.K.-based eVTOL aircraft developer Vertical announced that it has raised $90 million in additional funding for the production of its VX4 eVTOL aircraft. Vertical previously secured an additional $50 million in new funding from Mudrick Capital in November 2024. The news follows significant developments in the manufacturer’s flight test progress, with Vertical becoming only the second company in the world to achieve piloted thrust-borne flight maneuvers with a full-scale vectored thrust eVTOL. The company currently plans to achieve certification of the VX4 by the end of 2026.

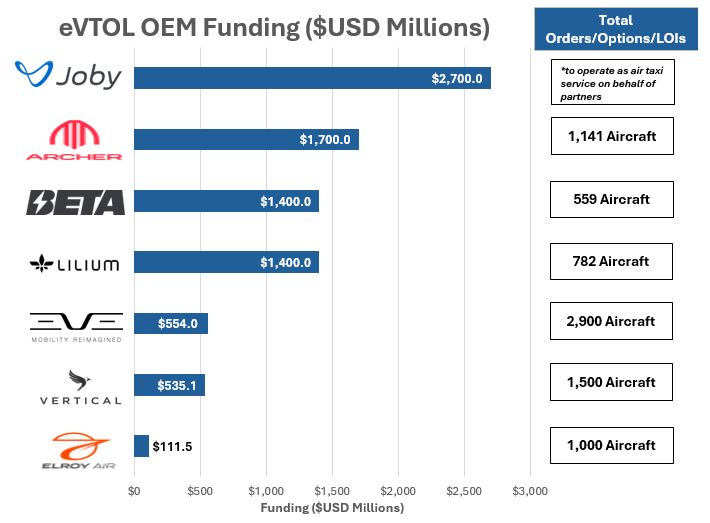

The two rounds of funding add further legitimacy to the VX4 program, which currently lags significantly behind its competitors, such as Joby, Archer, Beta, and Lilium, all of which have raised over $1 billion in capital. Substantial capital and strong funding are essential for the research, development, and successful production of eVTOLs.

In late 2023, the investment firm Hindenburg Research took a short position in the China-based eVTOL manufacturer EHang. The firm cited EHang’s weak funding of $97.4 million compared to Vertical’s funding of $535.1 million, even though EHang boasts an order book of over 1,300 aircraft compared to Vertical’s order book of 1,500 aircraft. Additionally, despite having raised $1.4 billion in funds, the Germany-based eVTOL manufacturer Lilium announced in November 2024 that it would be filing for bankruptcy after failed fundraising efforts, further demonstrating the capital hurdles eVTOL manufacturers face while developing and manufacturing a product.

Vertical’s funding remains a concern, considering that it lags well behind its competitors in capital raising yet holds an order book of 1,500 aircraft— larger than the size of those of Archer and Beta, which have order books of 1,141 and 559 aircraft, respectively, but have each raised over $1 billion in funding. To successfully develop and produce its VX4 eVTOL, Vertical must continue to raise additional funding and maintain a strong cash position amid a dry landscape of investment capital in comparison to the pandemic-induced flow of venture capital into UAM (Urban Air Mobility).

With diverse experience in the commercial aviation industry, Grant joins Forecast International as the Lead Analyst for Commercial Aerospace. He began his career at the Boeing Company, where he worked as a geospatial analyst, designing and building aeronautical navigation charts for Department of Defense flight operations.

Grant then joined a boutique global aviation consulting firm that focused on the aviation finance and leasing industry. In this role he conducted valuations and market analysis of commercial aircraft and engines for banks, private equity firms, lessors and airlines for the purposes of trading, collateralizing and securitizing commercial aviation assets.

Grant has a deep passion for the aviation industry and is also a pilot. He holds his Commercial Pilots License and Instrument Rating in addition to being a FAA Certified Flight Instructor.