Strong Deliveries Ahead of Paris. Massive Airline Orders on the Drawing Board.

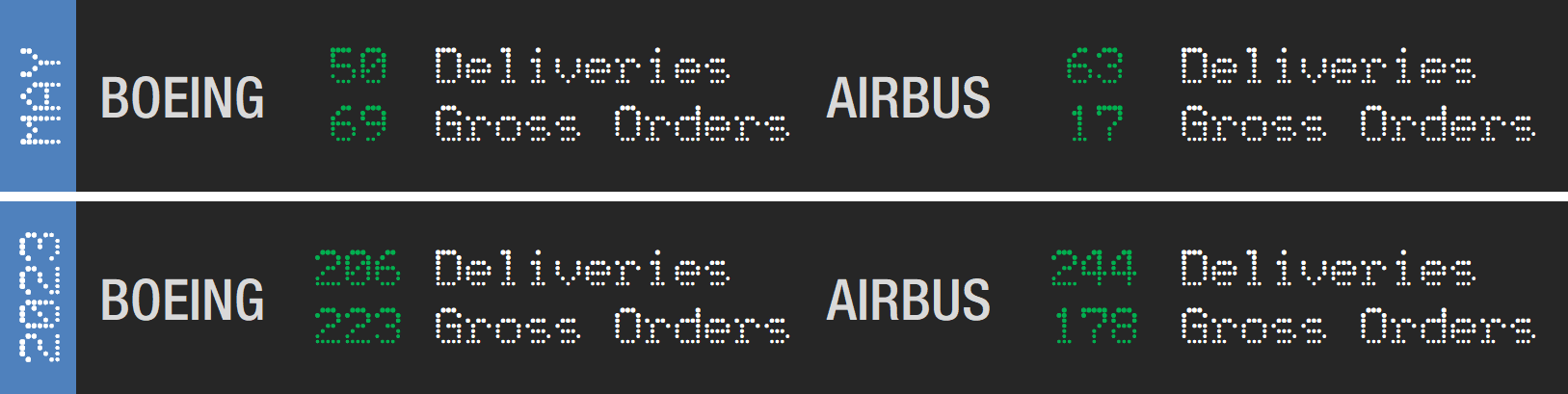

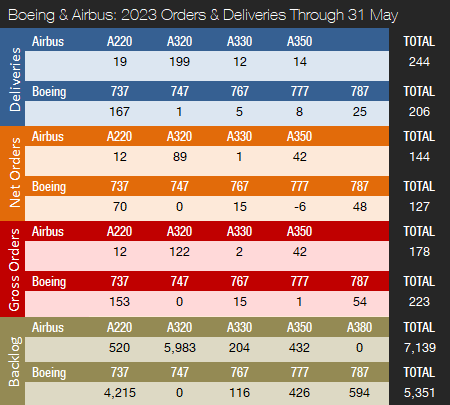

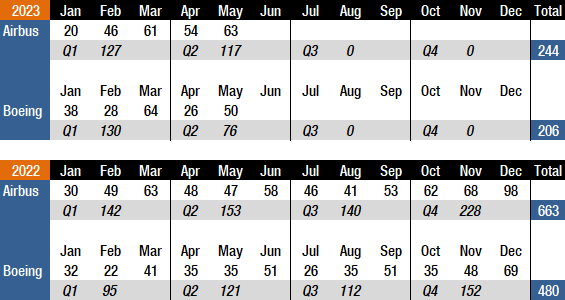

Boeing and Airbus delivered 50 and 63 commercial jets in May 2023, compared to 35 and 47 deliveries, respectively, in the same month last year. Boeing’s deliveries roared back in May after the company’s April shipments were significantly impacted by a 737 MAX manufacturing issue. Year-to-date, Boeing and Airbus have delivered 206 and 244 aircraft compared to 165 and 237, respectively, for the first five months of 2022. After the first five months of the year, Boeing and Airbus are 41 and seven deliveries ahead of last year’s totals to date. In 2022, Airbus won the deliveries crown for the fourth year in a row by delivering 663 aircraft, compared to Boeing’s 480 shipments. In 2021, Boeing and Airbus delivered 340 and 611 aircraft.

Following a more than challenging 2020 due to the COVID-19 pandemic, 2021 and 2022 were recovery years for the two largest commercial plane makers. Another year of recovery for the commercial aircraft manufacturing industry can be expected in 2023 despite ongoing supply chain challenges, inflation and higher interest rates, labor shortages, and the war in Ukraine. However, Boeing and Airbus still have quite a way to go before deliveries are back to pre-pandemic levels. In 2018, before COVID-19 and the 737 MAX grounding, Boeing delivered 806 jets, a level that will likely not be recaptured before the 2025-26 timeframe. Airbus’ all-time record high of 863 shipments was set in 2019, a level that could be surpassed in 2024 if supply chain challenges ease, but likely will not be exceeded until 2025 at the earliest. Also, Airbus is expected to retain the deliveries lead for the foreseeable future due to the company’s comfortable backlog lead over its American rival. Prior to 2019, Boeing had out-delivered Airbus every year since 2012.

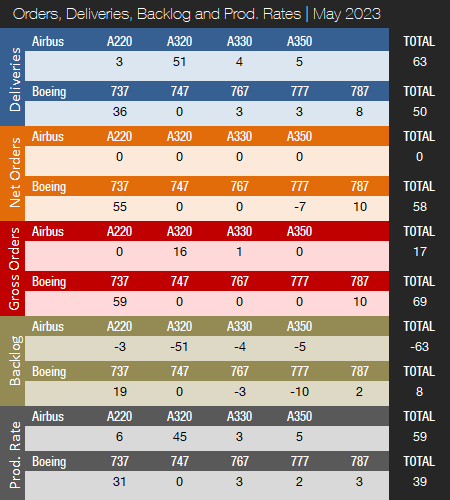

As indicated above, in May 2023, Boeing delivered 50 jets, including 36 737s (35 MAXs and one NG), three 767s, three 777s, and eight 787s. Since June of last year, the 737 program has been producing aircraft at an official rate of 31 per month. The monthly production trend is expected to remain in the low 30s for now, but will be increased as soon as the supply chain allows. For 2023, Boeing targets an average rate of between 33 and 38 737s per month, or 400-450 for the year. Year-to-date, Boeing has delivered 33 737s per month, on average; however, this figure includes aircraft from inventory. Longer term, Boeing expects to increase production to approximately 50 jets per month in the 2025/26 timeframe. This compares to the pre-crash/pre-pandemic rate of 52 737s per month in 2018. Recently, it was reported that the company is planning to boost production to 52 jets per month by January 2025. The company plans to open a fourth 737 MAX production line in Renton in the second half of 2024. Boeing ended the first quarter with 225 737 MAX jets in inventory, down 25 from Q4 2022. Customers in China account for 138 of these aircraft. Boeing expects most of the inventoried jets will be delivered by the end of 2024. Boeing believes that supply chain constraints will remain a significant challenge in 2023. The company is still producing 737 NGs, but only has 21 737-800s remaining in backlog.

On April 14, Boeing announced that a manufacturing issue affecting a significant number of undelivered 737 MAX airplanes, both in production and in storage, had been discovered. Spirit AeroSystems, which produces the 737’s fuselage, reportedly used a non-standard manufacturing process during the installation of two fittings in the rear fuselage. Inspection and rework are currently ongoing and will impact deliveries in the near future. However, Boeing still expects to deliver 450 737 airplanes this year. Of the 225 inventoried 737 MAX airplanes, roughly 75 percent will require fuselage rework. In May, 737 MAX deliveries came roaring back and it would appear the situation is improving.

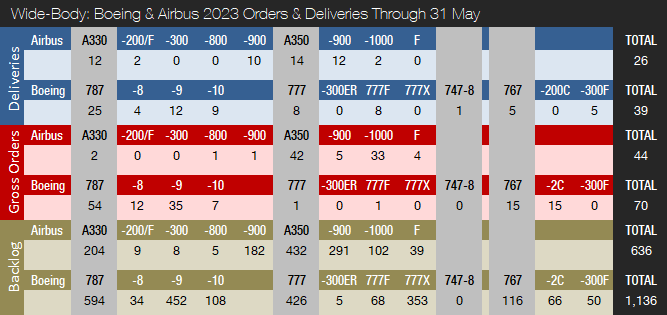

In August of last year, deliveries of the Boeing 787 Dreamliner were resumed following a suspension of shipments that lasted nearly 16 months. Boeing had suspended Dreamliner deliveries in May 2021 for the second time in less than a year. The 787 production rate was recently raised to three aircraft per month, up from two. The 787 rate will return to five per month by the end of 2023 (for a total of 70-80 deliveries for the year), followed by further increases before reaching 10 aircraft per month by 2025/26. Boeing ended the first quarter with 95 Dreamliners in inventory, down five from Q4 2022. Most of these aircraft will be delivered during 2023 and 2024. However, Dreamliner deliveries could decline in the near future, as a new production glitch has been disclosed. The problem involves miniscule gaps in a fitting on the horizontal stabilizer and must be fixed before Boeing can resume deliveries. The fitting was installed by a Boeing production facility in Salt Lake City, Utah. Boeing will have to inspect the 90 Dreamliners in its inventory. Also, while the issue does not immediately affect in-service 787s, Boeing is investigating whether Dreamliners currently operated by airlines will need a fix.

The 747 program closed down production when the last aircraft was delivered to Atlas Air on January 31. The 767 program is currently producing at a rate of three units per month, a mix of KC-46 tankers (based on the 767-2C) and 767-300 freighters. The 777 program is currently pushing out aircraft at a rate of two per month. Most aircraft in backlog are 777 freighters, with only five 777-300ERs left. The 777 program was expected to get a new addition in late 2023 with the first delivery of the 777X, but in April of last year Boeing announced this will now not happen before 2025. This reflects an updated assessment of the time required to meet certification requirements. Last year, Boeing launched a new 777X-based freighter, thereby expanding its 777X and cargo portfolio. By the 2025/26 timeframe, Boeing expects to be delivering four 777s per month.

In May 2023, Airbus delivered 63 jets, including three A220s, 51 A320s (all NEO), four A330s, and five A350s. The official A320 production rate is 45 aircraft per month and has remained at this level since the end of 2021. On average, the company delivered 43 A320s per month in 2022 but has only delivered 40 per month during the first five months of this year. Production is currently being increased and is expected to reach a monthly rate of 65 by late 2024 (pushed back twice now due to supply chain challenges). Also, Airbus is working with its supply chain to increase A320 production to 75 aircraft per month in 2026. It was recently announced that Airbus plans to add a second A320 final assembly line in Tianjin, China. The A321XLR flight test program is reportedly progressing well, and entry into service is expected to take place in the second quarter of 2024.

The A220, meanwhile, is being produced at a rate of six aircraft per month, with a monthly production rate of 14 expected by 2025. The A350 production rate currently averages five per month and was expected to be increased to six by early 2023. However, the rate increase is likely to be pushed back to late 2023. Airbus expects to produce nine A350s per month by 2025. The A330 production rate was increased from two aircraft per month to three at the end of 2022, with an increase to four per month expected in 2024.

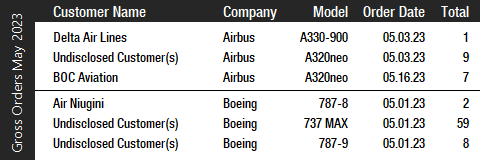

Turning to the May orders review, Boeing had a good month and booked orders from three customers for a total of 69 jets (gross orders). However, the company also reported 11 cancellations (four 737 MAXs and seven 777 freighters), resulting in 58 net new orders. The May orders haul included 59 737 MAXs for undisclosed customers. The 787 was in demand in March and April (37 orders) and again in May with 10 aircraft added to Boeing’s books, including eight 787-9s for undisclosed customers and two 787-8s for Air Niugini, the national airline of Papua New Guinea. Year-to-date, Boeing has accumulated 127 net new orders (223 gross orders), compared to 171 net new orders (236 gross orders) in the first five months of last year. In 2022, Boeing booked 774 net new orders (935 gross orders), up from 479 net new orders (909 gross orders) in 2021 (before ASC 606 changes). Please note that for comparison reasons, we do not include Boeing’s so-called ASC 606 accounting adjustments in the numbers reported in this article and regard net new orders as gross orders minus cancellations.

In May, Airbus had a very quiet month and booked orders for just 17 aircraft from three different customers and reported 17 cancellations (16 A320neos and one A330-900), for a total of zero net new orders. BOC Aviation and undisclosed customers ordered a total of 16 A320neos. Also, Delta Air Lines ordered a single A330-900. Year-to-date, Airbus has accumulated 144 net new orders (178 gross orders), compared to 191 net new orders (364 gross orders) in the five months of last year. In 2022, Airbus booked 820 net new orders (1,078 gross orders), surpassing both 2021 gross orders and net new orders. In 2022, Airbus won the orders crown for the fourth consecutive year by a fairly slim margin of just 46 aircraft compared to Boeing. In 2021, Airbus booked a total of 771 gross orders and received 264 cancellations, for a total of 507 net new orders.

At the end of May, Airbus reported a backlog of 7,139 jets, of which 6,503, or 91 percent, were A220 and A320ceo/neo family narrowbodies. This is 586 aircraft below the company’s all-time backlog record of 7,725 aircraft set in January 2020. By the end of last month, Boeing’s backlog (total unfilled orders before ASC 606 adjustment) was 5,351 aircraft, of which 4,215, or 79 percent, were 737 NG/MAX narrowbody jets. Boeing’s all-time backlog high of 5,964 aircraft was set in August 2018. The number of Airbus aircraft to be built and delivered represents 8.3 years of shipments at the 2019 production level (the pre-pandemic level), or 10.8 years based on the 2022 total. In comparison, Boeing’s backlog would “only” last 6.6 years at the 2018 level (the most recent “normal” year for Boeing), or 11.1 years based on 2022 deliveries. As of May 31, Boeing’s book-to-bill ratio this year, calculated as net new orders divided by deliveries, is 0.62, compared to Airbus at 0.59. This means that both companies are currently tapping into their backlog. In 2022, Boeing’s book-to-bill ratio was a very strong 1.61. Meanwhile, Airbus’ book-to-bill ratio was a solid 1.24.

Paris Air Show

The 2023 Paris International Air Show will be held from June 19-25 – the first edition since the COVID-19 pandemic. There is uncertainty about how many commercial aircraft orders will be placed in Paris; however, all forecasts call for stronger-than-ever aircraft demand and air traffic figures from this decade and onward. A total of 2,453 exhibitors from 49 countries will participate, and 316,470 visitors are expected – including 139,840 trade visitors and 176,630 visitors from the general public. Also, 2,700 accredited journalists from 87 countries will cover the event.

What we do know is that Ryanair is getting ready to place a massive order for up to 300 Boeing 737 MAX jets. The deal includes 150 firm orders and 150 options for the 737-10 model, the largest in the 737 MAX family. It would seem like a no-brainer for both parties to finalize this deal in Paris and make a big splash. Furthermore, Turkish Airlines has a massive order for 600 jets on the drawing board, including 400 narrowbody and 200 long-haul aircraft. The order would be split between Airbus and Boeing; however, the airline may not be ready to place it just yet. Turkish Airlines plans to double its fleet to 814 jets, carrying 171 million passengers, as part of a major strategic push over the next decade. Also, in February Air India announced it plans to add 470 aircraft to its fleet. Of this total, 220 aircraft would be ordered from Boeing, with the remaining 250 going to Airbus. Also, IndiGO is planning a massive order for 500 Airbus A320neo Family jets which, if placed, would be the largest aircraft order in the history of commercial aviation. It will be very interesting to see if any of these orders will be signed in Paris.

In terms of aircraft on display and/or in the air, Airbus is showcasing the A321LR and XLR, the A330 MRTT (a military tanker variant), and the A350-900. Boeing is bringing the 737-10, the 787-9 and the 777-9. Other participants, such as airlines, will also be showcasing Airbus and Boeing aircraft.

2023 Forecast

Forecast International’s Platinum Forecast System is a breakthrough in forecasting technology that provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast data from the Civil Aircraft Forecast product. For 2023, Forecast International’s analysts currently expect Boeing and Airbus to deliver 521 and 710 commercial jets, respectively. Please note that these figures exclude militarized variants of commercial platforms such as Boeing’s P-8 Poseidon maritime patrol aircraft and KC-46 Pegasus tanker and Airbus’ A330 MRTT tanker.

Boeing released its Q1 2023 results on April 26 and reaffirmed its 2023 737 MAX and 787 guidance from November of last year. On the investor earnings call, CEO David Calhoun stated, “We still expect to deliver 450 737 airplanes this year.” In November of last year, Boeing announced that it expects to deliver 400-450 737s and 70-80 787s in 2023, which equates to a monthly average of 33-38 for the 737. Meanwhile, Airbus is targeting 720 commercial jet deliveries in 2023. The company reported its first quarter 2023 results on May 3 and reaffirmed its guidance.

References:

- https://www.forecastinternational.com/platinum.cfm

- http://www.boeing.com/commercial/#/orders-deliveries

- https://www.airbus.com/aircraft/market/orders-deliveries.html

- https://boeing.mediaroom.com/2023-05-09-Ryanair-Places-Its-Biggest-Boeing-Order-for-up-to-300-737-MAX-Jets

- https://www.bloomberg.com/news/articles/2023-06-01/turkish-airlines-mega-plane-order-taking-more-time-to-wrap-up

- https://www.reuters.com/business/aerospace-defense/turkish-airlines-set-order-600-aircraft-june-chairman-2023-05-11/

- https://timesofindia.indiatimes.com/business/india-business/470-planes-80-billion-largest-ever-deal-air-india-to-revamp-fleet-with-huge-boeing-airbus-orders/articleshow/97925918.cms

- https://www.ajot.com/news/ibas-predictions-for-paris-air-show-2023

- https://www.reuters.com/business/aerospace-defense/new-787-dreamliner-production-issue-could-slow-delivery-90-jets-boeings-2023-06-06/

- https://www.siae.fr/en/presentation.htm

- https://www.aerotime.aero/articles/indias-indigo-eyes-order-for-500-airbus-aircraft

Kasper Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. Mr. Oestergaard has a Master's Degree in Finance and International Business from the Aarhus School of Business - Aarhus University in Denmark. He has written four aerospace & defense market intelligence books as well as numerous articles and white papers about European aerospace & defense topics.