by J. Kasper Oestergaard, European Correspondent, Forecast International.

Summary:

- Revenues, cash flow and liquidity greatly improved in fourth quarter

- Reported €1.6 billion net profit in Q4 – first quarterly profit since Q3 2019

- Sharp increase in deliveries in Q4 vs. Q1-Q3

- Cash flow surge: Q4 free cash flow of €6.7 billion

- On slow path to recovery – company expects flat commercial jet deliveries in 2021

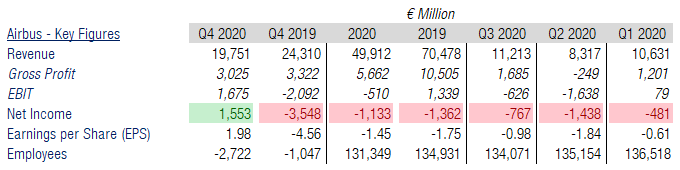

Airbus’ revenues, cash flow, and profits greatly improved in the final quarter of 2020 due to higher production and a surge in deliveries. Airbus reported Q4 2020 revenues of €19.8 billion, down 18.8 percent from €24.3 billion in the same quarter the year before. Compared to Q3 2020, revenues were up a whopping 77 percent. For the full year 2020, Airbus’ revenues were down 29.2 percent – from €70.5 billion in 2019 to €49.9 billion last year.

After losing €767 million in Q3, €1.4 billion in Q2, and €481 million in Q1, Airbus reported a net profit of €1.6 billion – the company’s first quarterly profit since Q3 2019. Airbus reported a major loss in Q4 2019 due to a €3.6 billion charge related to bribery case agreements with authorities and a €1.2 billion charge to the A400M program when export expectations were revised downward.

In Q4 2020, Airbus reported earnings per share (EPS) of €1.98, compared to € -0.98 in Q3 and € -1.84 in Q2. For the full year 2020, the company reported EPS of € -1.45, compared to € -1.75 in 2019. Airbus’ headcount declined by 2,722 employees in the fourth quarter to 131,349 by December 31.

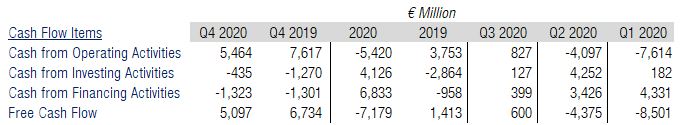

Airbus reported positive free cash flow (FCF) in the amount of €5.1 billion in the fourth quarter. This compares to FCF of € -12.3 billion for the first nine months of 2020 – a complete turnaround. The improvement in cash flow was mainly due to the sharp increase in deliveries. Airbus raised €8.2 billion from financing activities and €4.6 billion from investment activities in the first nine months of 2020, to ensure that the company had sufficient cash on hand to weather the pandemic. Airbus reduced its debt in Q4 as cash flow from operations greatly improved. For the full year 2020, FCF was € -7.2 billion, down from €1.4 billion in 2019.

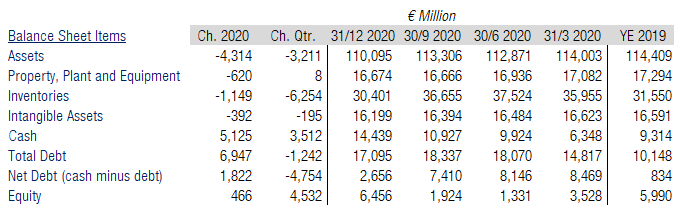

Looking at Airbus’ balance sheet figures, we see that the company entered 2020 with €9.3 billion in cash and cash equivalents and €10.1 billion in debt. When including securities held by the company, the company’s net cash position was an impressive €12.5 million.

Airbus was clearly in a strong financial position prior to the pandemic. As of September 30, the company’s net cash position was €-242 million meaning that the company had burned through €12.8 billion in cash. As the chart below shows, the majority of the cash burn was due to changes in working capital (paying employees while facilities were closed down, paying suppliers, and building up inventory). The second largest item was a €3.6 billion ($3.9 billion) penalty (from a settlement to resolve foreign bribery charges with authorities in the United States, France and the United Kingdom). Airbus ended the year 2020 with a net cash position of €4.3 billion thanks to increased business activity in Q4 2020 and a surge in deliveries.

Total debt by the end of 2020 was €17.1 billion, up €6.9 billion from year-end 2019. Leverage was reduced by €1.2 billion in Q4 2020. Shareholder’s equity declined from €6.0 billion by the end of 2019 to a low of €1.3 billion as of June 30, 2020, but has since made a strong comeback to finish the year at €6.5 billion as of December 31. This means that, despite the massive fallout from COVID-19, equity improved during 2020. By the end of 2020, Airbus held €14.4 billion in cash on its balance sheet. It is expected that the company will continue to reduce its leverage during 2021.

Looking at segment-level results, revenues from Airbus (commercial jets) were down from €19.2 billion in Q4 2019 to €14.0 billion in Q4 2020, a 27.2 percent decrease. In comparison, Airbus helicopters and Airbus Defence and Space have been much less impacted by the pandemic, and in fact reported an increase in revenues in the fourth quarter 2020. For the full year 2020, Airbus’ revenues were down a staggering 37.5 percent, from €54.8 billion in 2019 to €34.3 billion.

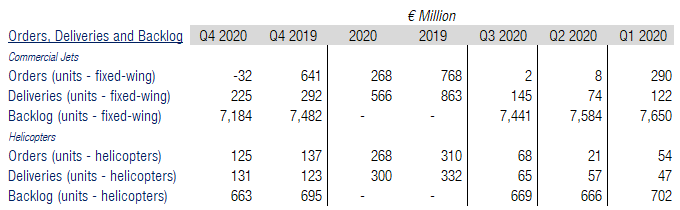

In the fourth quarter of 2020, Airbus removed 55 commercial jets from its backlog and finished the year with 268 net new orders. The company delivered 225 commercial jets in Q4 2020, down from 292 in Q4 2019 but up sharply from 145 in Q3 2020 and 74 in Q2 2020.

Airbus Helicopters booked 125 net new orders in Q4 2020 and 268 in all of 2020 – compared to 310 in 2019. The company delivered 131 helicopters in Q4 2020, compared to 123 in Q4 2019 and 65 in Q3 2020. As of December 31, Airbus’ commercial jet backlog totaled 7,184 aircraft, down from 7,482 at the same time last year. Airbus Helicopters’ backlog was 663 aircraft at the end of December, compared to 695 by the end of 2019. Airbus Defence and Space delivered a total of nine A400M military airlifters in 2020 – down from 14 in 2019.

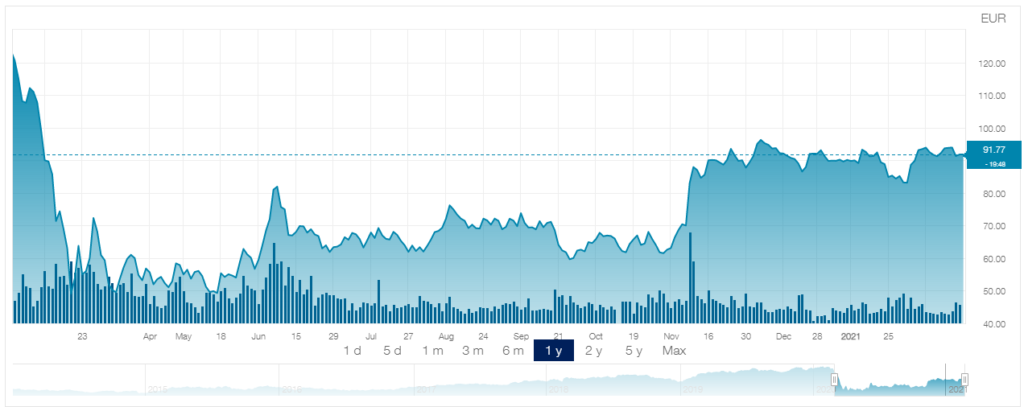

Share Price

Airbus’ shares traded at €91.77 when markets closed on Friday, February 19. Airbus started the year at €130.48 and traded as low as €48.12 on March 18. Shares are currently 29.7 percent down for the year. The company has decided to suspend its dividend for the second year in a row due to COVID-19. Airbus paid a dividend of €1.65 in 2019 (for the calendar year 2018).

Outlook

The worst of the financial damage caused by the pandemic is in all likelihood over and it is expected that Airbus’ financial figures will keep improving in 2021 and beyond as the company gradually ramps up commercial aircraft deliveries.

In 2021, Airbus expects to deliver the same number of commercial aircraft deliveries as in 2020 (566 units). The company expects to report an adjusted EBIT of €2 billion for 2021 and expects breakeven free cash flow. The 2021 guidance assumes no further disruptions to the world economy, air traffic, and Airbus’ internal operations and ability to deliver products and services. The author believes the guidance provided by the company is quite cautious.

Forecast International expects Airbus to deliver 577 commercial jets and 270 helicopters in 2021. These figures were provided by the company’s Platinum Forecast System service, which is the only source of market intelligence that provides 15-year production forecasts plus 10 years of historical data.

Note: Free cash flow (FCF) can be calculated in different ways. In this article, it is calculated as = operating cash flow minus capital expenditures (CAPEX).

References:

- https://www.airbus.com/newsroom/press-releases/en/2021/02/airbus-reports-full-year-2020-results.html

- https://www.airbus.com/content/dam/corporate-topics/financial-and-company-information/Airbus-FY2020-SN.pdf

- https://www.airbus.com/content/dam/corporate-topics/financial-and-company-information/Airbus-FY2020-Presentation.pdf

- https://www.airbus.com/investors/share-price-and-information.html

- https://www.forecastinternational.com/platinum.cfm

Forecast International’s Civil Aircraft Forecast covers the rivalry between Airbus and Boeing in the large airliner sector; the emergence of new players in the regional aircraft segment looking to compete with Bombardier, Embraer, and ATR; and the shifting dynamics within the business jet market as aircraft such as the Bombardier Global 7000, Cessna Hemisphere, and Gulfstream G600 enter service. Also detailed in this service are the various market factors propelling the general aviation/utility segment as Textron Aviation, Cirrus, Diamond, Piper, and a host of others battle for sales and market share. An annual subscription includes 75 individual reports, most with a 10-year unit production forecast. Click here to learn more.

Based in Denmark, Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

For more than 50 years, Forecast International intelligence reports have been the aerospace and defense industry standard for accurate research, analysis, and projections. Our experienced analysts compile, evaluate, and present accurate data for decision makers. FI's market research reports offer concise analysis of individual programs and identify market opportunities. Each report includes a program overview, detailed statistics, recent developments and a competitive analysis, culminating in production forecasts spanning 10 or 15 years. Let our market intelligence reports be a key part of reducing uncertainties and mastering your specific market and its growth potential. Find out more at www.forecastinternational.com