With Boeing showing a probable near-term loss, plants closing, and the FAA still sitting tight with its order on grounding the 737 MAX, the common belief of many investors is that Boeing is in real tough financial shape and that Airbus is leaping ahead. However, during the daily changing events of COVID-19, analysts at Forecast International, while working remotely, have been continually tweaking their near- and far-term forecasts to reflect the probable outlook for production of large commercial jets, the largest source of revenue for both Airbus and Boeing.

With the benefit of Forecast International’s Platinum Forecast System, the analysts have been able to quickly examine many near- and long-term scenarios and have come up with some surprising findings!

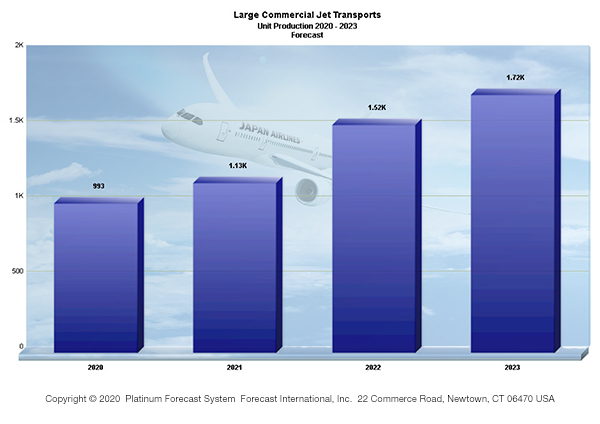

Airbus to Retain Lead in Unit Production – Looking first at a very short-term scenario, 2020-2023, combined output from the two major competitors is expected to slump to 993 total units in 2020, as compared with 1,562 units the year before, a projected drop of 36.4%. It is no surprise that Boeing has been the most severely impacted, as the company has taken multiple hits, not only with the grounding of its narrowbody 737 MAX and the COVID-19 virus, but also from additional FAA challenges to the safety of some of its widebody transports. Accordingly, based on what they consider the most probable scenario, the analysts project that Boeing’s production of large commercial jets for 2020 will total only 423 units, while Airbus, although also impacted by the virus, will build 570. Thereafter, the analysts see production from both competitors mounting steadily in 2021-2023 to address very substantial backlogs.

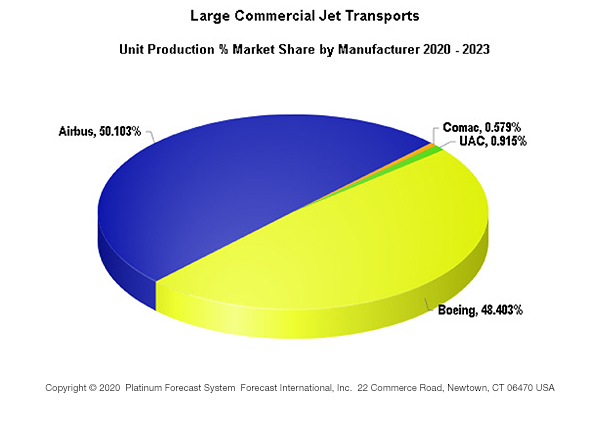

The unit bar graph below shows the projected buildup of production in units by the combined competitors, while the first pie chart shows the calculated manufacturer market shares by units for the period. As shown, in three full years of mounting production, Airbus is expected to build 2,682 large jet transports of all types for a 50.1% share, while Boeing will produce an estimated 2,592 for a 48.4% share. Several other manufacturers in China and Russia will account for a small share of the output, but it should be noted that China will become increasingly visible as a new manufacturer of large commercial transports as the decade ahead advances.

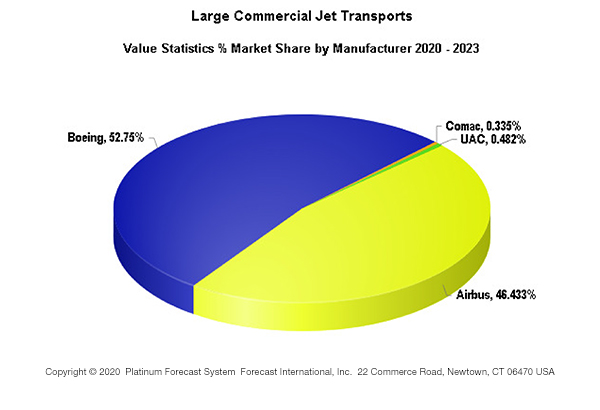

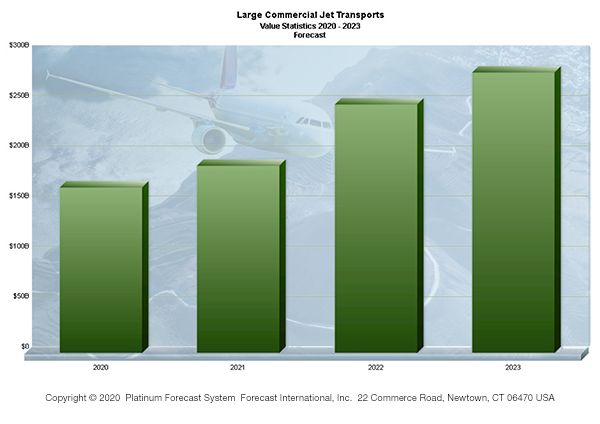

Boeing to Quickly Regain Lead in Value Share – Interestingly, while Boeing will temporarily lose value share in 2020, the analysts see the U.S. manufacturer quickly beginning to recover in 2021 and moving steadily into the value lead during the 2021-2023 period. As demonstrated in the second pie chart, Boeing is expected to accrue 52.75% of the value share, as compared to 46.3% for Airbus. The reason for this disparity is that while Airbus currently has an advantage in the narrowbody sector, where unit numbers are higher, Boeing is better positioned in the widebody market, where per-aircraft prices are higher.

Boeing to Increase Value Share Lead over Long Term – The data amassed by Forecast International’s Platinum System carries well into the future. Based upon current projections, during the 15-year 2020- 2034 period, Airbus will continue to hold a lead in units (13,633 to 13,491), but Boeing’s value lead is actually expected to increase significantly. Airbus will earn $2.096 trillion, while Boeing’s earnings will climb to $2.451 trillion, a difference of $355 billion. Again, this is due to Boeing’s lead in the higher-value widebody segment, led by the 787 and 777.

In the final analysis, this great competitive struggle is good for business worldwide. Despite the setbacks from the virus, demand for airline travel and for more efficient airliners is ever-increasing and the ongoing re-equipment cycle for such aircraft is one of the marvels of the century!

For further information, contact Forecast International at info@forecastinternational.com, or at 1-203-426-0800, where your inquiry will be further directed.

About Forecast International

Forecast International, Inc. is a leading provider of Market Intelligence and Consulting in the areas of aerospace, defense, power systems and military electronics. Based in Newtown, Conn., USA, the company specializes in long-range industry forecasts and market assessments used by strategic planners, marketing professionals, military organizations, and governments worldwide. Forecast International also maintains a high posture of situational awareness and geopolitical analysis.

A military history enthusiast, Richard began his career at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet became central to defense research, he helped design the company’s Forecast Intelligence Center and now coordinates the FI Market Recap newsletters for clients. He also manages two blogs: Defense & Security Monitor, which covers defense systems and international security issues, and Flight Plan, focused on commercial aviation and space systems.

For more than 30 years, Richard has authored Defense & Aerospace Companies, Volume I (North America) and Volume II (International), providing detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database tracking all companies involved in programs covered by the FI library. Richard currently serves as Manager of the Information Services Group (ISG), which develops outbound content for both Forecast International and Military Periscope.