by J. Kasper Oestergaard, European Correspondent, Forecast International.

According to Reuters, Airbus is contemplating a large A320 production cut due to the fallout of COVID-19. Airlines are currently scrambling to preserve cash amid a huge drop in global air traffic caused by travel restrictions and closed off borders. Many airlines have either suspended all flights or reduced their flight schedule by as much as 60-95 percent. Airbus is reportedly examining scenarios that include cutting the current monthly output of 60 A320 family jets by up to 50 percent for a period of three to six months. Reuters also reports that A320 suppliers have been asked to reduce deliveries by 40 percent, a reduction that is compatible with the production of 36 jets per month.

Editor Note: Shortly after this article was published, Airbus announced that it would suspend production at its German sites in Bremen and Stade as well as at its US-based A220/A320 manufacturing facility in Mobile, Alabama. Commercial Aircraft production and assembly activities in Bremen will be paused until April 27. Airbus in Stade will pause production and assembly through April 11 , with some additional pause days in the weeks that follow in selected production departments. In Mobile, the pause in production is expected to last until April 29.

On April 9, Airbus detailed the production cuts.

Prior to COVID-19, Airbus was targeting a 5 percent rate increase to 63 jets per month from 2021 and was also discussing a further ramp-up with its supply chain that could have brought the production rate up to as high as 67 aircraft per month, or 804 per year, by 2023, putting the company within reach of a total of 1,000 jets delivered per year. Those plans have now been shelved.

According to an analysis published by IATA, revenues are expected to fall by 68 percent and airlines may burn through $61 billion of cash reserves during Q2 2020, while posting a quarterly net loss of $39 billion. On top of unavoidable fixed costs, many airlines have to refund sold tickets. Among nations providing aid packages to the industry are the United States, Australia, China, Colombia, New Zealand, Norway, and Singapore. Recently, Brazil, Canada, Colombia, and the Netherlands have relaxed regulations and are allowing airlines to offer passengers travel vouchers instead of refunds.

A final decision on an A320 production cut is expected at the company’s annual shareholder meeting on April 16. It is expected that Airbus will seek to avoid mandatory layoffs and instead make use of short-time working schemes at facilities in France and Germany.

Airbus is also studying major cuts in the production of A330 and A350 widebody jets. Suppliers on the A350 program are being instructed to run at half speed, equivalent to five aircraft per month. The monthly A330 production rate could be reduced to two down from 3.5.

By the end of February 2020, Airbus reported a backlog of 7,670 jets, of which 6,756, or 88 percent, were A220 and A320ceo/neo family narrowbodies. This represents 8.9 years of deliveries at the 2019 production level. While a slew of airline bankruptcies could certainly put a dent into Airbus’ order book, most of the damage will likely be caused by the ongoing uncertainty and reduction in near-term business activity. Even in bankruptcy, airlines will often choose to retain their orders as they may need the capacity in the future, but would cancel or seek to postpone near-term deliveries until air traffic volumes normalize. As for U.S. airlines, carriers emerging from Chapter 11 reorganization have cleaner balance sheets and thus, while not obligated to, are more likely to make good on their orders assuming they need the capacity.

2020 Forecast

Forecast International’s Platinum Forecast System® is a breakthrough in forecasting technology which, among many other features, provides 15-year production forecasts. The author has used the Platinum Forecast System to retrieve the latest delivery forecast figures and, for 2020, Forecast International’s analysts expect Airbus to deliver 692 commercial jets. Currently, there is much uncertainty surrounding this figure. When Airbus officially announces its production plans for the coming months, there will be more clarity.

Update on COVID-19 in Europe

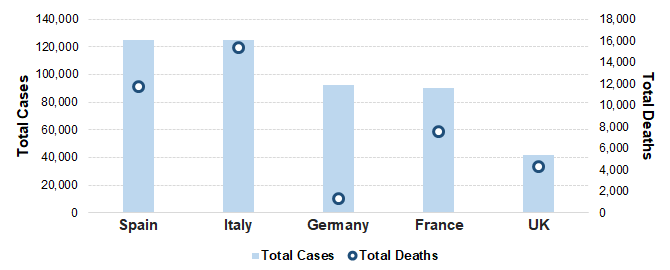

As of Saturday April 4, Spain overtook Italy and is now the country in Europe with the most reported COVID-19 cases to date, with Italy coming in as a close second. The two nations account for a combined 38 percent (45% one week ago) of Europe’s 643,263 reported COVID-19 cases and 58 percent (73%) of the continent’s 46,407 deaths. In Italy alone, the number of fatalities last week surpassed the 15,000 mark. Germany has reported 92,150 cases, or 14 percent, of total European cases, but “only” accounts for 1,330 fatalities, or 3 percent, which is certainly a figure that stands out. Worldwide, Europe Accounts for 54 percent of total COVID-19 cases and 73 percent of fatalities. With key manufacturing operations in France, Germany, Spain and the U.K. and, to a lesser extent, Italy, Airbus and its employees are significantly impacted by the war on COVID-19.

While deaths are still high, it appears that the worst could soon be over in Spain and Italy. Daily new cases seem to have peaked in Italy on March 21 at 6,557 and have been coming in well below 5,000 for five days in a row. In Spain, the highest number of daily new cases so far was on March 26.

Top Nations by Total Reported COVID-19 Cases: Spain and Italy most affected

Source: Forecast International chart based on data from Worldometer.

Based in Denmark, Joakim Kasper Oestergaard is Forecast International’s AeroWeb and PowerWeb Webmaster and European Editor. In 2008, he came up with the idea for what would eventually evolve into AeroWeb. Mr. Oestergaard is an expert in aerospace & defense market intelligence, fuel efficiency in civil aviation, defense spending and defense programs. He has an affiliation with Terma Aerostructures A/S in Denmark – a leading manufacturer of composite and metal aerostructures for the F-35 Lightning II. Mr. Oestergaard has a Master’s Degree in Finance and International Business from the Aarhus School of Business – Aarhus University in Denmark.

- https://www.reuters.com/article/us-health-coronavirus-airbus-production/exclusive-airbus-weighs-sharp-cut-in-single-aisle-jet-output-sources-idUSKBN21L161

- https://www.airbus.com/investors/annual-general-meetings.html

- https://www.airlines.iata.org/news/airlines-facing-rapid-cash-burn

- https://www.worldometers.info/coronavirus/

A military history enthusiast, Richard began at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet grew in importance as a research tool, he helped design the company's Forecast Intelligence Center and currently coordinates the EMarket Alert newsletters for clients. Richard also manages social media efforts, including two new blogs: Defense & Security Monitor, covering defense systems and international issues, and Flight Plan, which focuses on commercial aviation and space systems. For over 30 years, Richard has authored the Defense & Aerospace Companies, Volume I (North America) and Volume II (International) services. The two books provide detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database that tracks all the contractors involved in the programs covered in the FI library. More recently he was appointed Manager, Information Services Group (ISG), a new unit that encompasses developing outbound content for both Forecast International and Military Periscope.